Trump Tax Policies

Re-Examining 529 Plans: Stopping State Subsidies to Private Schools After New Trump Tax Law

November 20, 2025 • By Miles Trinidad, Nick Johnson

The 2025 federal tax law risks making 529 plans more costly for states by increasing tax avoidance and allowing wealthy families to use these funds for private and religious K-12 schools.

State Tax Dollars Shouldn’t Subsidize Federal Opportunity Zones

November 12, 2025 • By Eli Byerly-Duke

The Opportunity Zones program benefits wealthy investors more than it benefits disadvantaged communities.

The move was expected, given heavy lobbying from tax prep companies like Intuit and H&R Block to put a halt to the IRS’s popular Direct File program.

Biden Tax Reforms Take a $16 Billion Bite Out of Trump’s Big Tax Giveaway to Meta

October 30, 2025 • By Matthew Gardner

Meta’s earnings setback is entirely attributable to an important tax reform championed by the Biden administration in 2022.

Why States Shouldn’t Go Along With OBBBA’s Corporate Tax Breaks: A Practical Guide

October 27, 2025 • By Nick Johnson, Michael Mazerov

States should immediately decouple from four costly corporate tax provisions in the new federal tax law.

Well, That Was Fast: Trump Tax Law’s New Corporate Breaks are Already Worsening the Deficit

October 9, 2025 • By ITEP Staff

Corporate income taxes for the fiscal year that ended in September are $77 billion lower than in the previous year, a 15 percent drop.

Many lawmakers who were vocal supporters of this bill will see direct personal benefits while most of their constituents benefit little or will be worse off.

Trump Tax Law Erases Economic, Racial Progress in the Tax Code

October 6, 2025 • By Brakeyshia Samms

President Trump’s massive tax-and-spending bill continues the administration’s assault on racial and economic justice by prioritizing tax breaks for the top 1% while neglecting the economic well-being of poor and working families of all races, especially people of color.

The Trump Megabill Hands the Rich a Gift — and Sends the Bill to Young Americans

August 21, 2025 • By ITEP Staff

Trump's megabill directs most benefits to the wealthy, while leaving younger generations with higher taxes, more debt, and fewer opportunities. For Millennials and Gen Z, it means reduced public investment and an economy less likely to work in their favor.

How Will the Trump Megabill Change Americans’ Taxes in 2026?

July 22, 2025 • By Steve Wamhoff, Michael Ettlinger, Carl Davis, Jon Whiten

The megabill will raise taxes on the poorest 40 percent of Americans, barely cut them for the middle 20 percent, and cut them tremendously for the wealthiest Americans next year.

Nobody should be too excited and think this means our country is headed toward lower deficits - especially when the administration recently signed one of the most expensive budget reconciliation bills in history.

10 Crazy Comparisons Showing How Much Trump and Congress Just Cut Taxes for the Rich

July 10, 2025 • By ITEP Staff

$117 billion is a big number, so we thought it could use a little context.

There Were Far Cheaper and Fairer Options Than the Trump Megabill

July 8, 2025 • By Steve Wamhoff, Joe Hughes, Jessica Vela

Congress and the president could have spent less than half that much money on a tax bill that does more for working-class and middle-class households.

Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates

July 7, 2025 • By Steve Wamhoff, Carl Davis, Joe Hughes, Jessica Vela

President Trump has signed into law the tax and spending “megabill” that largely favors the richest taxpayers and provides working-class Americans with relatively small tax cuts that will in many cases be more than offset by Trump's tariffs.

Top 1% to Receive $1 Trillion Tax Cut from Trump Megabill Over the Next Decade

July 3, 2025 • By Carl Davis

The Trump megabill will give the top 1 percent tax cuts totaling $1.02 trillion over the next decade. For comparison, the bill’s cuts to the Medicaid health care program will total $930 billion over the same period.

Megabill Takes Cap Off Unprecedented Private School Voucher Tax Credit, Potentially Raising Cost by Tens of Billions Relative to Earlier Version

July 2, 2025 • By Carl Davis

It is clear that this tax credit has the potential to come with an enormous cost if private school groups are successful in convincing their supporters to participate. In these times of very high debt and deficits, this is reason for all of us to be uneasy.

As federal aid ends and economic uncertainty grows, local governments face tough budget choices. Now is the time for localities to protect vulnerable residents and build stronger, more equitable fiscal foundations.

Trump Megabill Will Give $117 Billion in Tax Cuts to the Top 1% in 2026. How Much In Your State?

June 30, 2025 • By Michael Ettlinger

The predominant feature of the tax and spending bill working its way through Congress is a massive tax cut for the richest 1 percent — a $114 billion benefit to the wealthiest people in the country in 2026 alone.

How Much Do the Top 1% in Each State Get from the Trump Megabill?

June 30, 2025 • By Carl Davis

The Senate tax bill under debate right now would bring very large tax cuts to very high-income people. In total, the richest 1 percent would receive $114 billion in tax cuts next year alone. That would amount to nearly $61,000 for each of these affluent households.

Analysis of Tax Provisions in the Senate Reconciliation Bill: National and State Level Estimates

June 25, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

Compared to its House counterpart, the Senate bill makes certain tax provisions more generous, including corporate tax breaks that it makes permanent rather than temporary. But the bottom line for both is the same. Both bills give more tax cuts to the richest 1 percent than to the entire bottom 60 percent of Americans, and both bills particularly favor high-income people living in more conservative states.

Trump Megabill’s Deduction for Car Loan Interest Would Not Offset Tariff-Related Auto Price Increases for Most Buyers

June 12, 2025 • By Carl Davis, Sarah Austin

The auto loan interest deduction that recently passed the House is designed, at least in part, to mitigate the impact of tariff-induced price increases on vehicles assembled in America. But the deduction is incapable of offsetting even small-scale price increases, especially for working-class families and others with moderate incomes.

Our tax policies enable people like Elon Musk and Donald Trump to accumulate more wealth than anyone could ever use in a lifetime. They then use it to steer elections and shape public policy to further enrich themselves and others like them. We should defeat the enormously destructive tax bill in Congress and instead craft tax policy that taxes the rich, makes our democracy more fair, and returns resources to the rest of the country.

Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

May 22, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

The poorest fifth of Americans would receive 1 percent of the House reconciliation bill's net tax cuts in 2026 while the richest fifth of Americans would receive two-thirds of the tax cuts. The richest 5 percent alone would receive a little less than half of the net tax cuts that year.

The House of Representatives unveiled a sprawling piece of tax legislation earlier this week that would extend temporary tax changes enacted in 2017 and layer various kinds of tax cuts and increases on top. The JCT analysis makes clear that the House tax plan would be regressive, meaning it would offer larger tax cuts as a share of income to high-income taxpayers than to either middle-class or working-class families. It also makes clear that most of the tax cuts would go to families with above-average incomes.

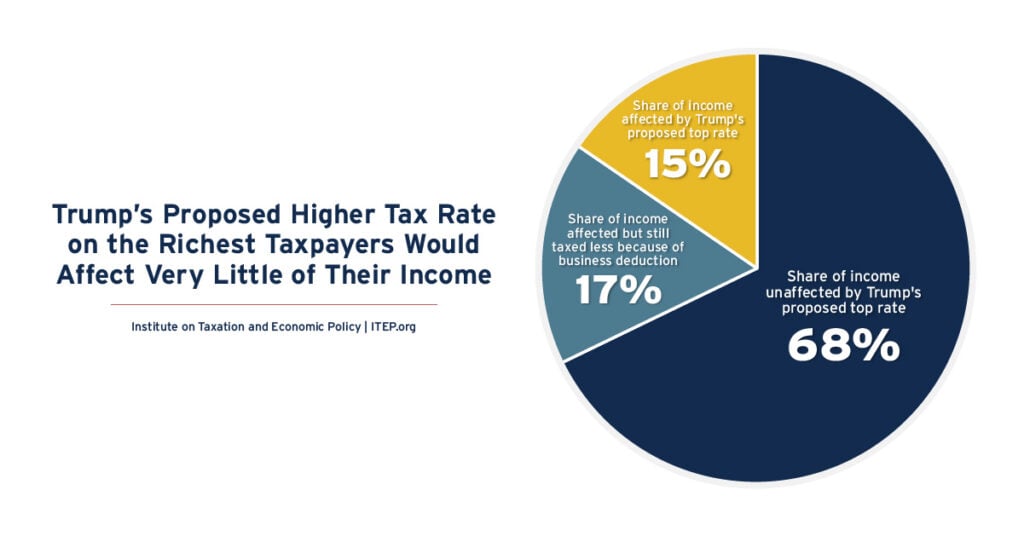

Trump’s Proposed Higher Tax Rate on the Richest Taxpayers Would Affect Very Little of Their Income

May 10, 2025 • By Carl Davis, Steve Wamhoff

President Donald Trump has proposed allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers. But many other special breaks in the tax code would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.