Washington

Real Change: Fishing for Equity in a Regressive Tax System

October 16, 2019

“It’s always about race, and it’s always about taxes,” said Misha Hill, a policy analyst with the Institute on Taxation and Economic Policy (ITEP). ITEP is the source of the frequently cited statistic that Washington has the most regressive tax system in the country. In fact, Hill said, there are no states in the union […]

POLITICO: Cannabis was supposed to be a tax windfall for states. The reality has been different.

October 14, 2019

In all, five of the nine states that have set up tax systems for legalized marijuana employ cultivation levies on growers, while all but Alaska charge an excise tax specifically on cannabis sales. Five states also charge the general sales tax, though not the same exact group that has a cultivator tax. The actual effective […]

POLITICO: Cannabis Was Supposed to Be a Tax Windfall for States. The Reality Has Been Different.

October 14, 2019

In all, five of the nine states that have set up tax systems for legalized marijuana employ cultivation levies on growers, while all but Alaska charge an excise tax specifically on cannabis sales. Five states also charge the general sales tax, though not the same exact group that has a cultivator tax. The actual effective […]

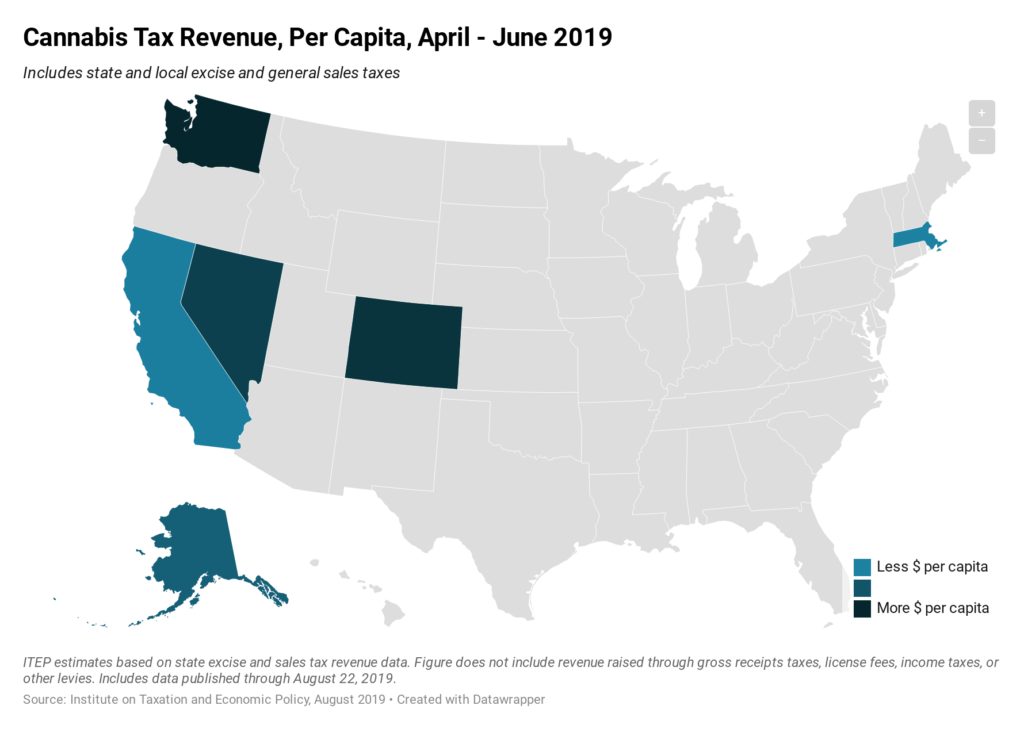

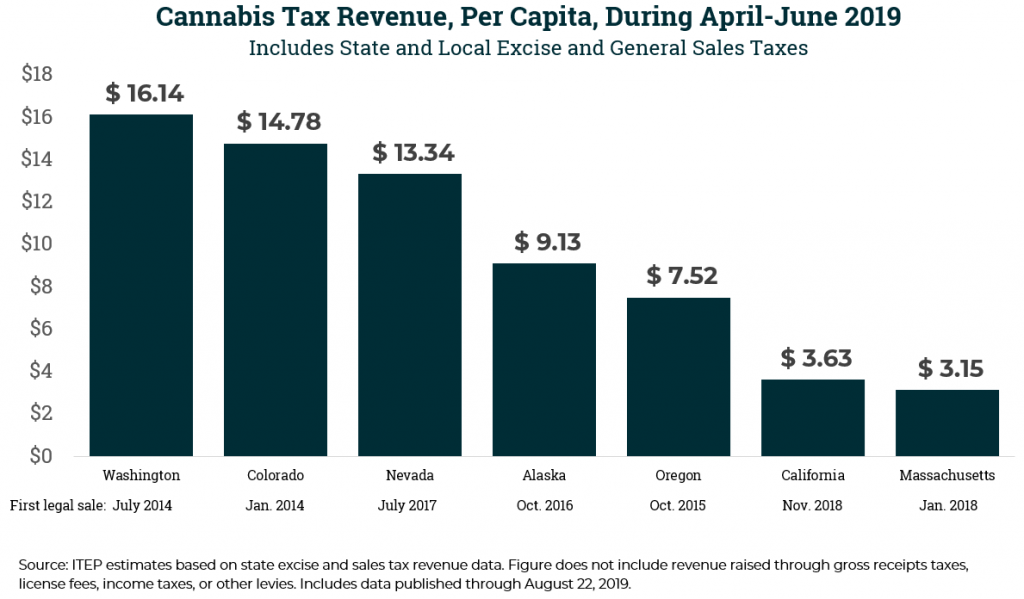

Seven states currently allow for the legal, taxable sale of recreational cannabis. The above map shows per capita revenue collections from excise and sales taxes on cannabis during the second quarter of 2019, the most recent period for which data are available in every state. The most lucrative cannabis market in the country, from a tax revenue perspective, is in Washington State where the 46 percent combined tax rate applied to cannabis is the highest in the country. Collections in California and Massachusetts, by contrast, remain low as these states are still in the early stages of establishing their legal…

The hottest, stickiest month of the year has left a grimy feeling on several state tax debates, as Idaho lawmakers find themselves unable to fund the state’s priorities after years of cutting taxes, Alaskans express their support for public investments to their governor’s polling office and then watch the governor slash them anyway, New Jersey lawmakers go to bat for ineffective and corrupt business tax subsidies, and residents of North Carolina watch their representatives pursue cheap political points over sound investments and thoughtful policy. Nonetheless, residents and advocates on the other side of these and other debates have fought long…

Washington Post: Why the U.S. Economy Is Worse Than It Seems

August 27, 2019

The situation looks very different at the high end of the economic scale. Over the past decade, the nation’s highest earners (the 95th percentile) saw their wages grow at almost four times the rate of those whose earnings put them in the middle of the pack (the 50th percentile). Even more remarkably, the top 1 […]

NPR: California Says Its Cannabis Revenue Has Fallen Short Of Estimates, Despite Gains

August 23, 2019

“After adjusting for population, the Golden State raised the second-least amount of revenue from cannabis taxes during the second quarter among states with legal sales, ahead of only Massachusetts,” according to the Institute on Taxation and Economic Policy. The result was a departure from the spikes seen in states such as Colorado, Washington and Oregon […]

Why California’s Cannabis Market May Not Tell You Much about Legalization in Your State

August 22, 2019 • By Carl Davis

New tax data out of California, the world’s largest market for legal cannabis, tell a complicated story about the cannabis industry and its tax revenue potential. Legal cannabis markets take time to establish, and depending on local market conditions, the revenue states raise can vary significantly.

Washington Times: Trump Says He’s Considering Cut in Payroll Taxes, Calls on Fed to Cut Rates

August 20, 2019

Cutting payroll taxes that fund Social Security programs “should not be cut except in extreme situations,” said Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy. In 2011 and 2012, Congress and President Obama reduced the part of the payroll tax paid directly by employees from 6.2% to 4.2%. […]

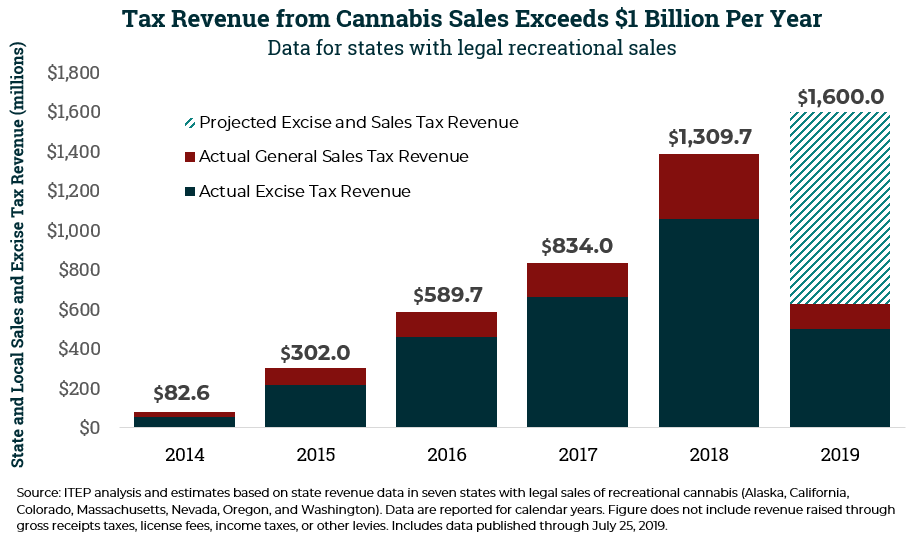

State and Local Cannabis Tax Revenue on Pace for $1.6 Billion in 2019

August 7, 2019 • By Carl Davis

Cannabis tax revenue is becoming more significant as legal sales grow. The tax is far from a budgetary panacea, but an ITEP analysis of revenue data reported by the seven states with legal cannabis sales underway suggests that excise and sales tax revenues from the sale of the drug could reach $1.6 billion this year.

CNN: Fact Check Democratic debate, night 2

August 1, 2019

Bennet: “Since 2001, we have cut $5 trillion worth of taxes. Almost all of it has gone to the wealthiest people in America.” THE FACTS: This is exaggerated. Bennet’s claim is based on a 2018 report from the liberal Institute on Taxation and Economic Policy in Washington. It finds tax cuts under Presidents Donald Trump, […]

New York Times: Debate Fact Check: What Were They Talking About, and What Was True?

August 1, 2019

What Mr. Bennet said: “Since 2001, we have cut $5 trillion worth of taxes. Almost all of it has gone to the wealthiest people in America.” This is exaggerated. Mr. Bennet’s claim is based on a 2018 report from the liberal Institute on Taxation and Economic Policy in Washington. It finds tax cuts under Presidents […]

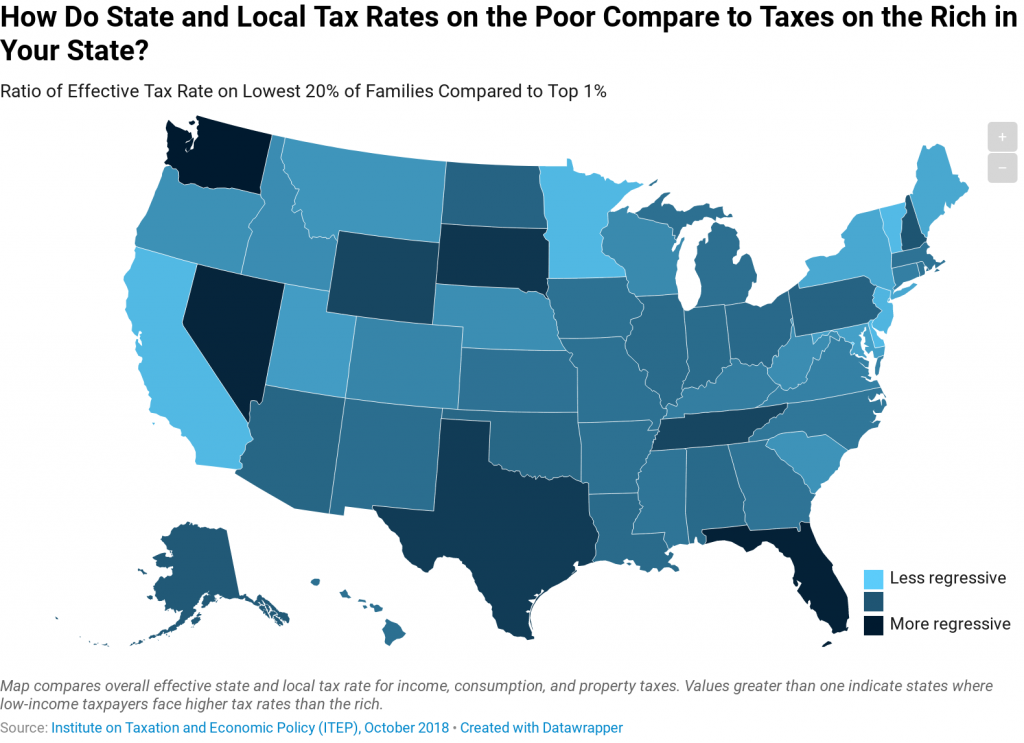

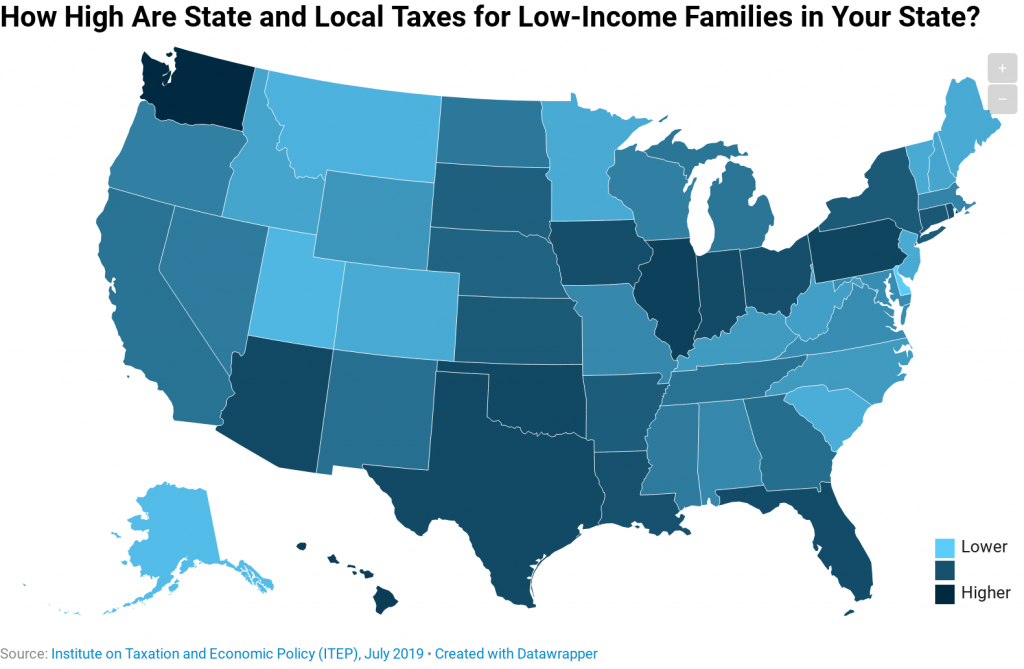

How Do Tax Rates on the Poor Compare to Taxes on the Rich in Your State?

August 1, 2019 • By ITEP Staff

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. Effective tax rates for the lowest 20 percent of families range from a high of 17.8 percent in Washington State to a low of 5.5 percent in Delaware.

Washington Times: 2020 Democratic Candidates Put Trump’s Corporate Tax Rate Cut in Crosshairs

July 31, 2019

Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy, agreed that the rate alone isn’t enough. “If we raise the corporate income tax rate but we leave in place some of the rules right now that seem to be encouraging American corporations to have more tangible assets offshore, more […]

OHIO legislators passed a budget with unfortunate income tax cuts for high-income households. Other states turned their attention to unconventional ideas during their legislative off-seasons, for better and for worse. And there are many gems to be found in our “What We’re Reading” section below, including new research on the racial inequities that continue to pervade our communities and schools.

We shouldn’t wait for Washington to tax the rich. We can begin at the state level. Examining the federal policy landscape is a logical place to start, but state policymakers are missing a key opportunity if they don’t join this national conversation and take a hard look at how their tax codes are affecting individuals […]

New York Times: State and Local Taxes Are Worsening Inequality

July 21, 2019

Low-income households in Illinois pay about 14 cents in state and local taxes from every dollar of income, while the state’s most affluent households pay about 7 cents per dollar. That gap between the poor and the wealthy in Illinois is one of the largest in any state, but the poor pay taxes at higher […]

Washington Post: Trump Aides to Look for Big Spending Cuts in Second Term

July 20, 2019

… with 2018, with 60 Fortune 500 companies paying no federal taxes at all, according to a 2018 study by the Institute on Taxation and Economic Policy. Read more

We've said it before, and we'll say it again: states don't have to wait for federal lawmakers to make moves toward progressive tax policy. And so far, 2019 has been a good year for equitable and sustainable tax policy in the states. With July 1 marking the start of a new fiscal year for most states, this special edition of the Rundown looks at how discussions in 2019 have been dominated by plans to raise revenue for vital investments, tax the rich and corporations fairly, use the tax code to help workers and families and advance racial equity, and shore…

The Washington Post: States Are Doing It. So Why Hasn’t Congress Increased the Federal Gas Tax?

July 6, 2019

All told, 31 of the 50 states have raised or reformed their motor fuel taxes during the past decade, according to the Institute on Taxation and Economic Policy. What’s more, 22 states now have variable-rate policies in place to make sure that inflation does not erode this crucial revenue stream. In so doing, they are […]

Public News Service: Deadline Today for WA Initiative Requiring Voter Approval for Tax Increases

July 5, 2019

Taxes took center stage because of a finding that Washington has the most regressive tax code in the country. According to the Institute on Taxation and Economic Policy, people in the top 1% pay 3% or less of their income in taxes, while those in the bottom 20% pay nearly 18%. Read more

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. This map shows the effective tax rates for the lowest-income 20 percent in each state--ranging from a high of 17.8 percent in Washington to a low of 5.5 percent in Delaware.

Washington Post: Democratic presidential candidates engage in ‘arms race to the left’ in first debate

June 27, 2019

On taxes, many of the candidates also emphasized their more left-leaning ideas to raise rates on corporations and make the tax system more progressive, while none touted plans to keep taxes low for businesses, noted Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy. Wamhoff noted that Delaney did […]

Washington Post: Amazon Was the Only Tech Company Called Out

June 27, 2019

Income inequality has emerged as one of the top issues for Democrats in 2020, and few examples illustrate the uneven playing field in the U.S. more aptly than profitable companies avoiding paying corporate taxes. Amazon emerged as the symbol of that issue after the company received a federal tax rebate of $129 million on income […]

New House Bill Sponsored by Rep. Tlaib

June 27, 2019

Tlaib said in recent weeks that she was working on a bill that was like the EITC “on steroids.” The liberal Institute on Taxation and Economic Policy called the measure, dubbed the BOOST Act and which offers a $3,000 credit to single filers and $6,000 to married couples, the “most expansive to date” in that […]