West Virginia

State Rundown 8/10: Pump the ‘Breaks’ on Sales Tax Holiday Celebrations

August 10, 2023 • By ITEP Staff

August is here, school is starting, and with that comes back to school shopping...

Gimmicky Sales Tax Holidays to Cost States & Localities $1.6 Billion This Year

August 3, 2023 • By ITEP Staff

Sales tax holidays are bad policies that have too often been used as a substitute for more meaningful, permanent reform.

The Dog Days of summer are upon us, and with most states out of session and extreme heat waves making their way across the country, it’s a perfect time to sit back and catch up on all your favorite state tax happenings (ideally with a cool drink in hand)...

Most state legislatures have adjourned for 2023, and that means it’s a perfect time to look at the tax policy trends that have formed thus far...

We can make modest reforms to better tax those who are taking a larger share of our wealth and income in order to reinforce a major pillar of our promise to Americans.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

Mountain State Spotlight: Tax Cuts, Low-Balled Estimates and Volatile Revenues: Inside West Virginia’s $1.8 Billion Budget Surplus

July 1, 2023

Gov. Jim Justice has used the state’s budget surplus as proof of his business skills as he runs for the U.S. Senate. But the surplus is built on unpredictable revenue streams and will likely be temporary. Read more.

This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe. There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and […]

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

The Lever: Joe Manchin’s Tax Hike On The Working Class

April 25, 2023

Despite representing one of America’s poorest states, West Virginia Sen. Joe Manchin (D) decided in 2021 to kill legislation to extend expanded child and antipoverty tax credits that were helping the working class. The expiration of the expanded tax credits resulted in more than three million kids being thrown into poverty. New data shows it also resulted in a massive regressive tax increase […]

Deep Public Investment Changes Lives, Yet Too Many States Continue to Seek Tax Cuts

April 12, 2023 • By Aidan Davis

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

State Rundown 3/9: The Whirlwind 2023 Legislative Session Continues

March 9, 2023 • By ITEP Staff

State 2023 legislative sessions are proving to be eventful ones. With many states eager to make use of their budget surpluses, major tax changes are still being proposed and others signed into law. Michigan residents will soon see an increase to their state Earned Income Tax Credit (from 6 percent to 30 percent) after the […]

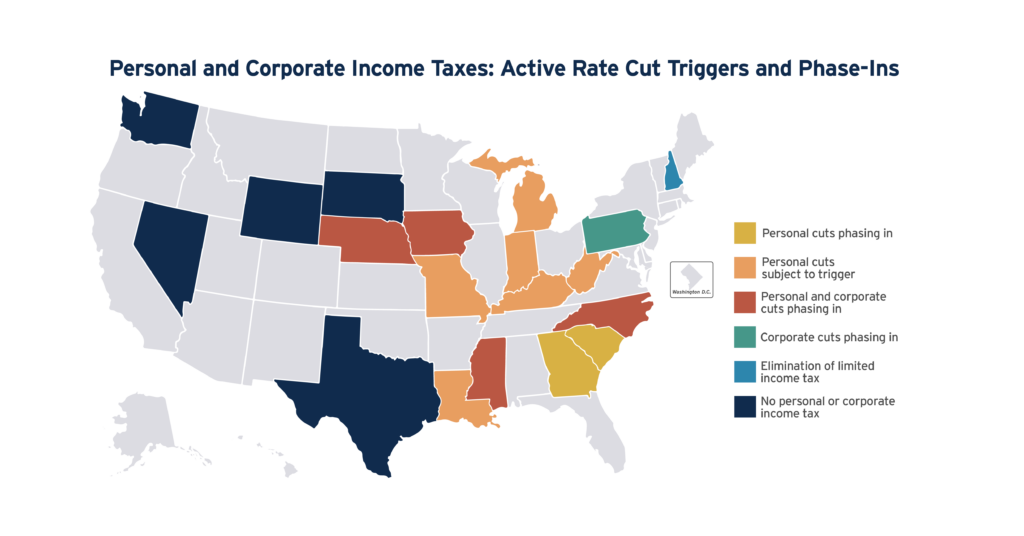

In recent years, lawmakers have been quick to push for phased-in tax cuts or cuts attached to trigger mechanisms. These policy tools push the implementation of tax cuts outside of the current budget window with a predetermined phase-in schedule or a mathematical formula tied to state revenue trends.

This week, several big tax proposals took strides on the march toward becoming law...

This week, a fresh bouquet of tax proposals was delivered by state lawmakers, but not all of them have left us with that warm, fuzzy feeling in our stomachs...

The great women’s philosopher, Pat Benatar, once said “love is a battlefield,” and there’s no greater test of our love for state tax policy than following the ups and downs of state legislative sessions...

State Rundown 1/26: Tax Season Brings With it Reminder of EITC’s Impact

January 26, 2023 • By ITEP Staff

Tax season has officially kicked off and with Earned Income Tax Credit (EITC) Awareness Day right around the corner, it serves as another reminder for how important the EITC is...

State Rundown 1/19: ITEP Provides a Roadmap for Equitable Tax Goals in 2023

January 19, 2023 • By ITEP Staff

State legislatures are buzzing as leaders and lawmakers jockey to advance their 2023 goals...

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

As states continue to tally the remaining votes and the news stories roll out at a breakneck pace, the unofficial results of the 2022 midterm elections have brought with it significant changes across the state tax policy landscape...

Election Day in the States: Voters Deliver Important Victories for Tax Justice

November 10, 2022 • By Jon Whiten

Voters in Massachusetts and Colorado raised taxes on their wealthiest residents to fund schools, public transportation and school lunches for kids while making their tax codes more equitable. And voters in West Virginia defeated a proposal to deeply cut taxes, mostly for businesses, and drain the coffers of county and local governments.

Measures on the November Ballot Could Improve or Worsen State Tax Codes

October 26, 2022 • By Jon Whiten

In a couple of weeks, voters in a handful of states will weigh in on several tax-related ballot measures that could make state tax codes more equitable and raise money for public services, or take states in the opposite direction, making tax systems less fair and draining state coffers of dollars needed to maintain critical […]