Vermont

Download PDF

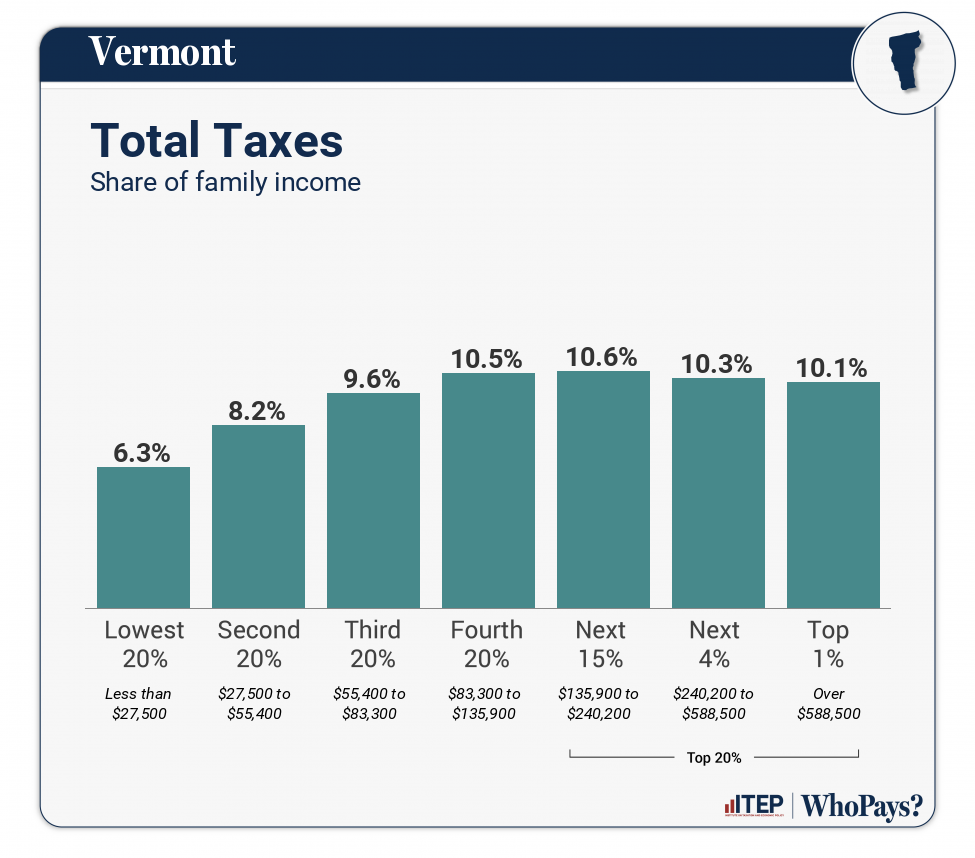

State and local tax shares of family income

| Top 20% | |||||||

| Income Group | Lowest 20% | Second 20% | Middle 20% | Fourth 20% | Next 15% | Next 4% | Top 1% |

| Income Range | Less than $27,500 | $27,500 to $55,400 | $55,400 to $83,300 | $83,300 to $135,900 | $135,900 to $240,200 | $240,200 to $588,500 | Over $588,500 |

| Average Income in Group | $13,100 | $40,600 | $68,200 | $109,000 | $167,400 | $352,600 | $1,096,200 |

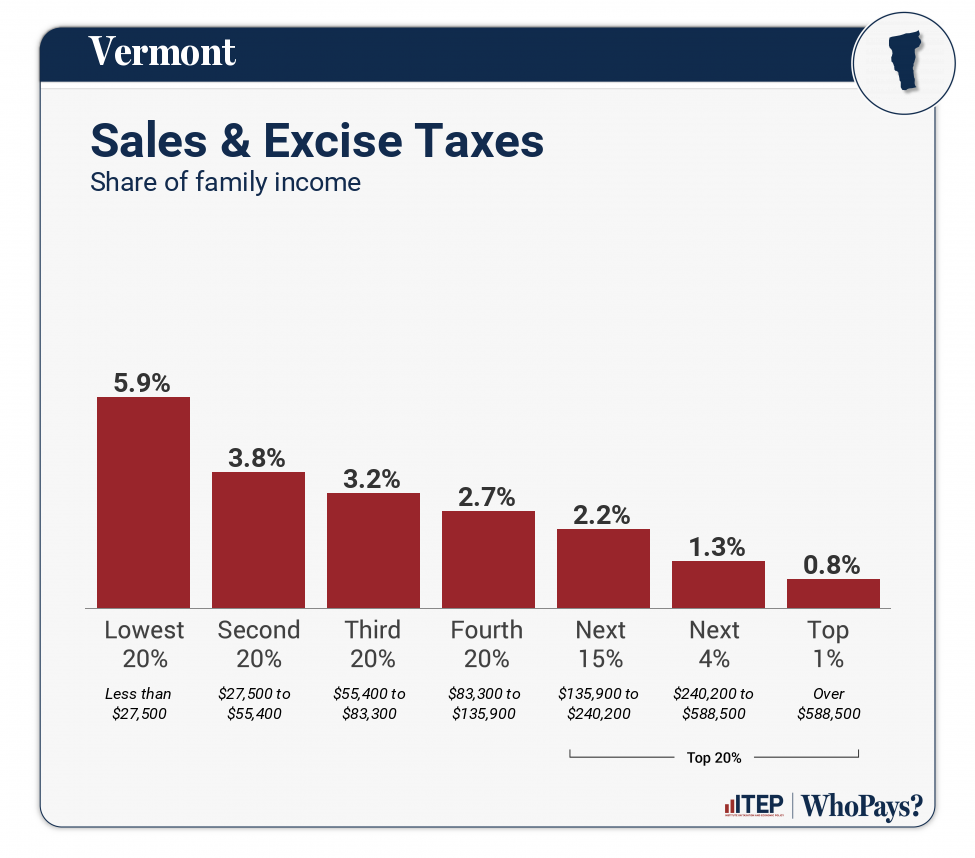

| Sales & Excise Taxes | 5.9% | 3.8% | 3.2% | 2.7% | 2.2% | 1.3% | 0.8% |

| General Sales–Individuals | 1.4% | 1.4% | 1.3% | 1.1% | 0.9% | 0.5% | 0.2% |

| Other Sales & Excise–Ind | 3.6% | 1.6% | 1.2% | 0.9% | 0.7% | 0.3% | 0.1% |

| Sales & Excise–Business | 0.9% | 0.8% | 0.7% | 0.7% | 0.6% | 0.5% | 0.4% |

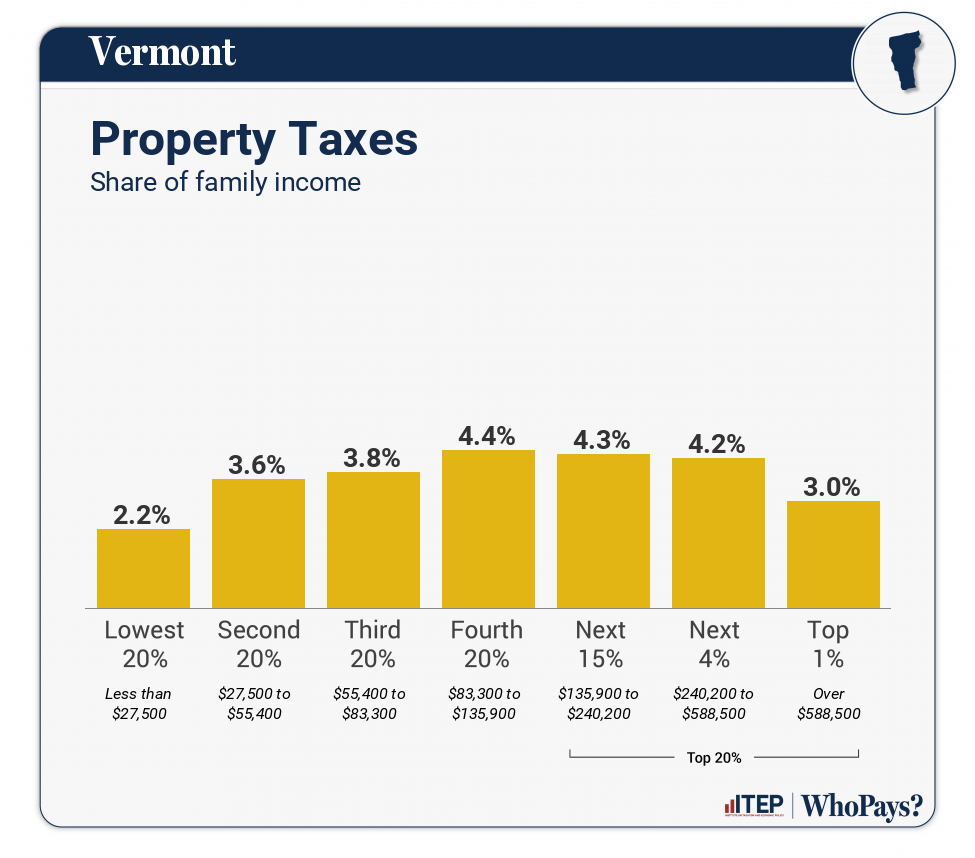

| Property Taxes | 2.2% | 3.6% | 3.8% | 4.4% | 4.3% | 4.2% | 3% |

| Home, Rent, Car–Individuals | 1.3% | 2.9% | 3.1% | 3.7% | 3.6% | 3.2% | 1.5% |

| Other Property Taxes | 0.9% | 0.8% | 0.7% | 0.7% | 0.7% | 0.9% | 1.5% |

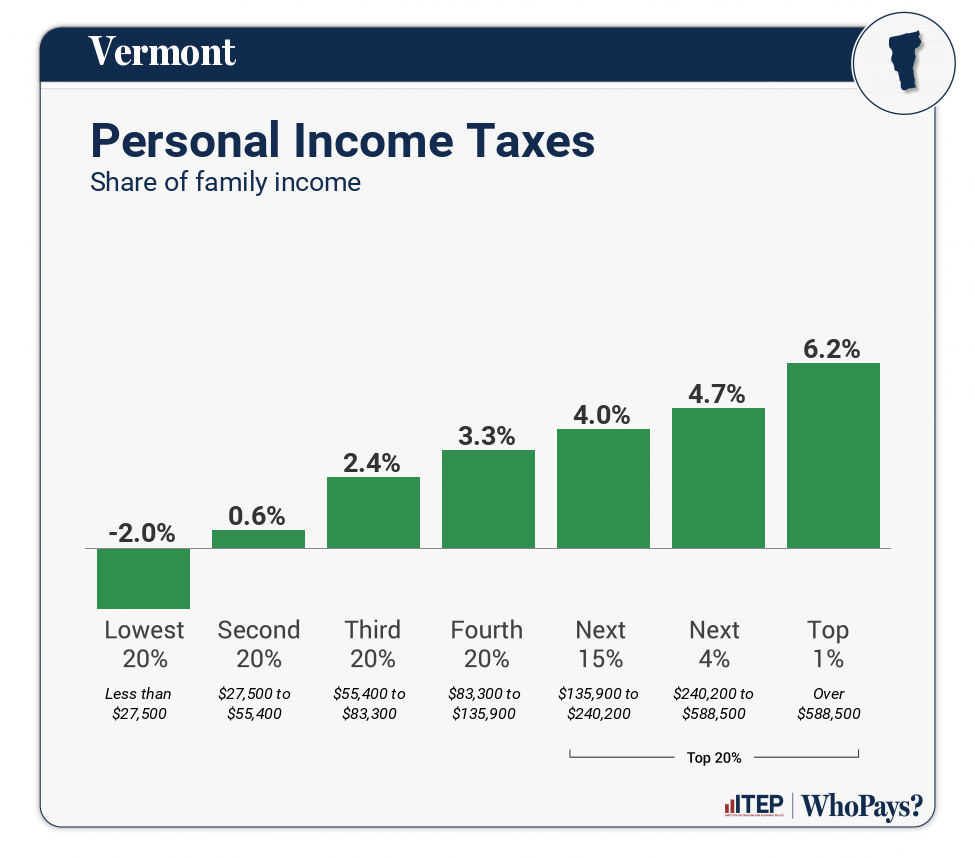

| Income Taxes | -2% | 0.6% | 2.4% | 3.3% | 4% | 4.7% | 6.2% |

| Personal Income Taxes | -2% | 0.6% | 2.4% | 3.3% | 4% | 4.7% | 6.2% |

| Corporate Income Taxes | 0% | 0% | 0% | 0% | 0% | 0% | 0.1% |

| Other Taxes | 0.2% | 0.2% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% |

| TOTAL TAXES | 6.3% | 8.2% | 9.6% | 10.5% | 10.6% | 10.3% | 10.1% |

| Individual figures may not sum to totals due to rounding. | |||||||

ITEP Tax Inequality Index

Vermont has a hybrid system that is progressive through the bottom part of the income distribution and regressive through the top part. On balance, the overall system tilts slightly progressive according to ITEP’s Tax Inequality Index, which measures the overall effect of each state’s tax system on income inequality. Vermont ranks 49th on the Index, meaning that only Minnesota and the District of Columbia have more progressive systems. (See Appendix B for state-by-state rankings and the report methodology for additional detail.)

Tax features driving the data in Vermont

|

Requires combined reporting for the corporate income tax; some foreign tax haven income is partially taxed through GILTI inclusion

Many resident homeowners pay school taxes based on income rather than property value

Refundable property tax “circuit breaker” credit (all ages)

Graduated rate structure for the real estate transfer tax

Refundable Earned Income Tax Credit (EITC)

Graduated personal income tax structure

Refundable dependent care tax credit

Refundable Child Tax Credit (CTC)

Sales tax base excludes groceries

Levies a state estate tax

Refundable renter credit

|

|

|

Provides a capital gains tax preference

|