Wisconsin

Deep Public Investment Changes Lives, Yet Too Many States Continue to Seek Tax Cuts

April 12, 2023 • By Aidan Davis

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

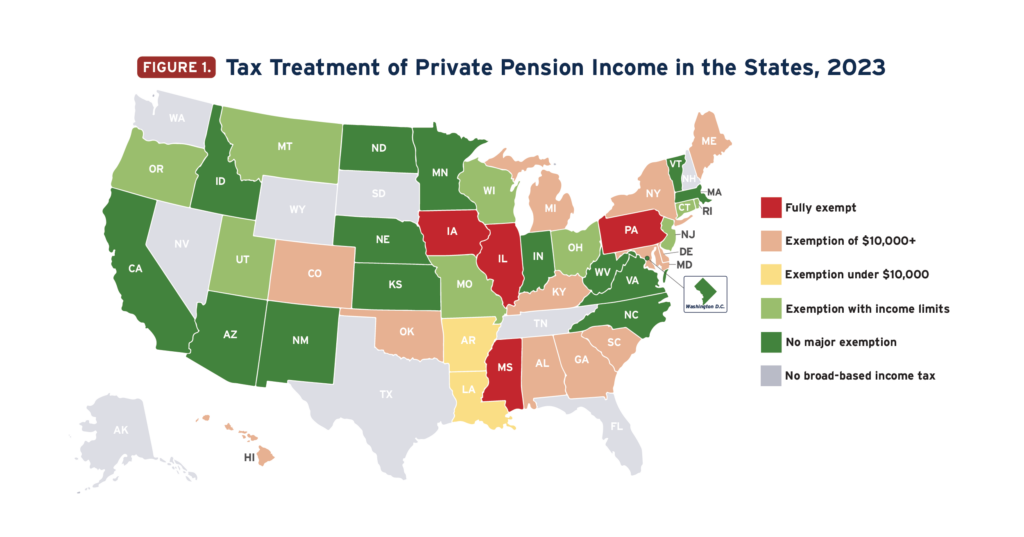

Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities

March 22, 2023 • By ITEP Staff

Contact: Jon Whiten – [email protected] Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities State lawmakers should focus on improving overall tax fairness, not creating special carveouts based on age Lawmakers in several states are currently considering tax subsidies for senior citizens, even though these breaks are costly and poorly targeted. […]

It’s March and state lawmakers are showing why the Madness isn’t only reserved for the basketball court...

State Rundown 3/9: The Whirlwind 2023 Legislative Session Continues

March 9, 2023 • By ITEP Staff

State 2023 legislative sessions are proving to be eventful ones. With many states eager to make use of their budget surpluses, major tax changes are still being proposed and others signed into law. Michigan residents will soon see an increase to their state Earned Income Tax Credit (from 6 percent to 30 percent) after the […]

This week, several big tax proposals took strides on the march toward becoming law...

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.

This week, a fresh bouquet of tax proposals was delivered by state lawmakers, but not all of them have left us with that warm, fuzzy feeling in our stomachs...

The great women’s philosopher, Pat Benatar, once said “love is a battlefield,” and there’s no greater test of our love for state tax policy than following the ups and downs of state legislative sessions...

State Rundown 1/26: Tax Season Brings With it Reminder of EITC’s Impact

January 26, 2023 • By ITEP Staff

Tax season has officially kicked off and with Earned Income Tax Credit (EITC) Awareness Day right around the corner, it serves as another reminder for how important the EITC is...

Wisconsin Examiner: Tax Analyst Says Flat-Rate System Will Benefit Wealthy at the Expense of the Majority

January 26, 2023

The wealthiest Wisconsin residents already pay a smaller share of their incomes in state taxes than the rest of the population, and replacing the state’s current graduated-rate income tax structure with a flat tax would increase that disparity, a national tax expert says. Read more.

Yahoo News: Flat Income Taxes: Who Are the Biggest Winners and Losers?

January 25, 2023

From Kansas to Wisconsin to Nebraska, the conversation surrounding a flat tax has picked up as of late, with more state legislators pushing for as much. Read more.

State Rundown 1/19: ITEP Provides a Roadmap for Equitable Tax Goals in 2023

January 19, 2023 • By ITEP Staff

State legislatures are buzzing as leaders and lawmakers jockey to advance their 2023 goals...

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.

The new year often brings with it new goals and a desire to take on complex problems with a fresh perspective. Unfortunately, that doesn’t always apply to state lawmakers when considering tax policy...

State Rundown 12/15: State Priorities for 2023 Begin to Take Shape

December 15, 2022 • By ITEP Staff

State leaders have begun to release budget projections for 2023 and a familiar theme has emerged once again: big revenue surpluses, which have many state lawmakers pushing for another round of tax cuts despite the monumental challenges that we as a country face that call for sustainable revenues...

State Rundown 11/30: ‘Lame Duck’ December Could Have Major Tax Implications

November 30, 2022 • By ITEP Staff

As federal lawmakers begin their lame duck deliberations, the revival of the expanded child tax credit remains a strong possibility...

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

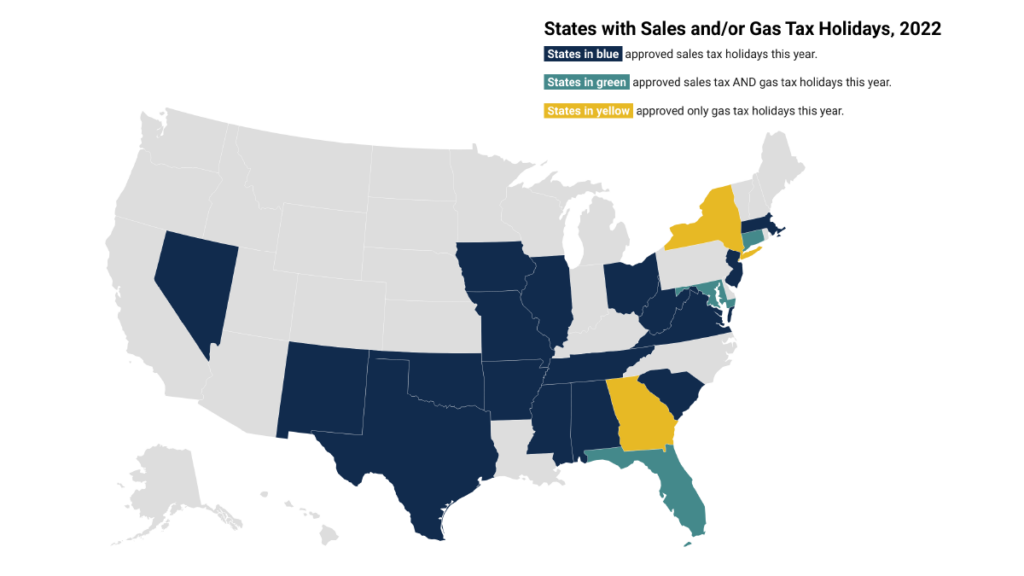

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

State Rundown 3/9: One State Stands Out Amid the Avalanche of Tax Cuts

March 9, 2022 • By ITEP Staff

The avalanche of regressive tax-cut proposals coming out of state legislatures has not slowed over the course of the winter months, but one state has provided a shot of hope to advocates of tax equity...

Several state legislatures are continuing to push ahead this year with significant tax cut packages that are regressive and would dramatically reduce revenues and leave states in a bad position should they experience another unexpected economic shock...

State Rundown 2/16: Spending Priorities Emerge as the Votes Are Counted

February 16, 2022 • By ITEP Staff

State lawmakers have been busy working out deals and negotiating how best to use excess revenues, and as the votes are beginning to come in, spending priorities are becoming clearer...

While record state revenue surpluses have led to big pushes in red states to make unnecessary permanent income and corporate tax cuts, Democrats are also getting in on the tax-cut mania...

Wisconsin Budget Project: Tax Shift Would Hike Taxes for People with Low Incomes and Give a Big Tax Cut to the Top 1%

February 7, 2022

Last month, an influential group of lobbyists released a proposal to raise Wisconsin’s sales tax to 8%, making it the highest state sales tax in the country, and eliminate the state individual income tax, Wisconsin’s biggest source of revenue. The plan would result in the largest tax cuts going to white households, with households of color […]

One-time payments have become a common theme around the country, as Idaho is one of roughly eleven states with plans to provide tax relief in a similar fashion...