Abstract

Proposals to adopt mandatory worldwide combined reporting (WWCR) in state corporate income taxes are receiving increased attention as lawmakers seek to protect their tax bases from avoidance maneuvers centered around international profit-shifting. This analysis uses publicly available data on the worldwide activities of multinational enterprises, among other sources, to calculate the estimated revenue effects of adopting this reform in states with corporate income taxes. In total, universal adoption of mandatory WWCR would boost state corporate income tax revenues by 14 percent, or $18.7 billion per year. The revenue effects would vary considerably across states due to differences in the starting points for reform afforded by their current corporate income tax structures.

Overview

This report quantifies the revenue implications of reforming state corporate income tax laws to mandate a filing methodology known as worldwide combined reporting (WWCR). It begins with an overview of the basic features of state corporate taxes necessary to understand WWCR and then goes on to describe WWCR and its potential revenue impact in the states. The report concludes with a description of the method underlying those calculations.

Revenue considerations aside, it bears noting that the debate over mandatory WWCR is multifaceted and concerned primarily with whether WWCR offers a more accurate, principled, and administrable alternative to the current patchwork of state laws governing state corporate taxation and corporate tax avoidance.[1] While this report focuses on the revenue implications of WWCR, revenue alone does not determine the wisdom of mandatory WWCR.

Key findings of the report include:

- In total, universal adoption of mandatory WWCR would boost state corporate income tax revenues by roughly 14 percent, or $18.7 billion per year. The revenue effects would vary across states.

- Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion. States with corporate income tax bases more subject to taxpayer manipulation, such as those following the separate filing method or lacking meaningful taxes on suspected internationally shifted profits, would tend to see particularly large revenue increases.

- Our estimates show that five states would see revenue declines totaling $400 million. There is evidence to suggest, however, that our methodology is understating the revenue potential of WWCR in these states, as well as in other states that have conformed to federal Global Intangible Low-Taxed Income (GILTI) provisions. This underestimation is likely driven by the fact that we generously assume taxpayers’ full compliance with current state GILTI inclusions despite the insistence of legal advisors to the business community that such inclusions, as currently structured, are impermissible under the U.S. Constitution.

- The short-term revenue impact of WWCR would likely be smaller than forecast in this report because of residual effects from the old system. In states where large companies have been paying zero corporate income taxes for many years, those companies have likely stockpiled tax breaks they can use under WWCR to keep their tax bills extraordinarily low for some period of time. Lawmakers frustrated with this reality could speed up this process by tightening the rules that govern how, and when, companies can use net operating losses and credit carryforwards gained under the previous, flawed, tax regime.

Background on State Corporate Income Taxes

The purpose of state corporate income taxes is to tax the profit, or net income, an incorporated business earns in each state. Ascertaining the state where profits are earned is, however, complicated for companies that conduct business in multiple jurisdictions. All states address the problem of taxing multi-state corporations by measuring the in-state share of a company’s total income using a method known as formula apportionment.

Under formula apportionment, the in-state share of a company’s income is assigned using one or more of several proxies for the company’s economic activity in the state. Today, nearly all states use the value of sales made into a state as that proxy—an approach known as single sales factor (SSF) apportionment.[2] In SSF states, if the in-state share of a corporation’s sales is 5 percent, for example, then 5 percent of the company’s apportionable income will be deemed in-state income for tax purposes. The use of an objectively measurable factor such as sales helps states to stay on the right side of U.S. Supreme Court precedent that taxes must be fairly apportioned by states.[3]

There is, however, a key first step in ascertaining how much of a company’s income is potentially taxed in a state before the apportionment factor is applied. A state must decide what constitutes a taxable business entity, and whether that entity has a meaningful economic connection, or “nexus,” with the state. Most larger corporations are made up of a parent company and an array of subsidiary entities which makes this complicated. Is the entire corporation effectively a single entity with all its income subject to apportionment, or does the state only look at some parts of the corporation and apportion the income of those parts operating in the state?

In the early days of state corporate income taxes, when the complex multi-entity structure of the modern corporation was only beginning to develop, most states chose the latter. That is, they taxed large, multi-entity companies on a separate entity basis—one entity at a time. A vertically integrated petroleum company with a subsidiary that extracted oil in Colorado, and another that refined it in Montana, for example, would file a state tax return in Colorado that only reflected its Colorado subsidiary, and a parallel return in Montana for its Montana subsidiary. In other words, for state tax purposes, this single petroleum corporation would be seen as two unrelated companies under a separate entity system.

But corporate accountants quickly learned that they could structure transactions between these subsidiary businesses in ways that artificially shifted income from higher-tax to lower-tax jurisdictions. If Montana’s corporate tax rate was higher, the company could arrange for its Colorado affiliate to “sell” its petroleum to the Montana affiliate at an artificially high price, thus reducing the corporation’s Montana income and increasing its Colorado income. (Of course, this sort of “sale” would not be a real-world market transaction, but rather a corporation doing business with itself.) The primary limit on the ability of companies to do this under these separate-entity regimes was the ability of state tax departments to monitor these prices and to require that subsidiary transactions be made using “transfer prices” that reflected real-world prices arranged by truly independent entities. This standard for fair pricing is known as the “arm’s-length” standard.

The arm’s-length standard can be a sensible benchmark in some circumstances, but in practice it offers substantial opportunities for tax avoidance. Many corporations quickly learned that state tax administrators lacked the capacity to adequately police the transfer prices set by these companies. One type of transfer pricing problem arises in the case of goods for which there is no single market price. For example, the price of petroleum varies by the day and even by the hour; the vertically integrated petroleum company in the example above has almost endless leeway in timing its intra-company transactions to funnel its income into lower-rate jurisdictions.

An especially problematic challenge for transfer pricing is the valuation of assets such as patents or copyrights which are typically so unusual, or even unique, that no market value can be ascertained. Companies with intangible assets that cannot be valued by analogs in the outside market have huge latitude in the internal “sales price” (e.g., royalties, license fees) they charge for the use of these assets. They can and do have their subsidiaries in low-tax tax haven jurisdictions charge an above-market price to other parts of the corporation for their use. California-based film production companies pioneered the use of this strategy almost as soon as the film industry came of age, before World War II—housing film rights in subsidiaries located in low-tax jurisdictions and charging their parent companies or other subsidiaries extravagant rights fees.

Description of Combined Reporting

The obvious and analytically correct way to prevent companies from reducing their taxes by shifting income from one subsidiary to another is to treat the company, including all its subsidiaries, as one entity for tax purposes. This is the hallmark of the “unitary combined reporting” method. Under combined reporting, the income and losses of all “unitary” entities associated with a corporation—basically, those with common ownership and engaged in a shared economic enterprise—are combined into one taxable entity. Entities are excluded from the combined report only if they are not part of the “unitary business.”[4]

Unitary combined reporting was identified as a sensible solution for income-shifting in the mid-20th century and is now used in most states that levy broad-based corporate income taxes. Combined reporting eliminates the tax incentive for companies to shift income between jurisdictions. Under a comprehensive approach to combined reporting, it does not matter whether a company chooses to house its income-generating activities in its headquarters state or in a post-office box in Delaware or the Cayman Islands. Either way, the income of all the corporation’s unitary U.S. entities will be included in a single tally of the corporation’s apportionable income.[5]

This is why combined reporting is generally regarded as the single most important corporate tax reform state lawmakers can contemplate: it nullifies the potential tax savings from artificially shifting income to a subsidiary in a lower-tax jurisdiction by bringing that income back into the tax base. As long as any part of the unitary corporation has a sufficient connection with a given state, that state can make the necessary calculations to apportion a fraction of its income as in-state taxable income.

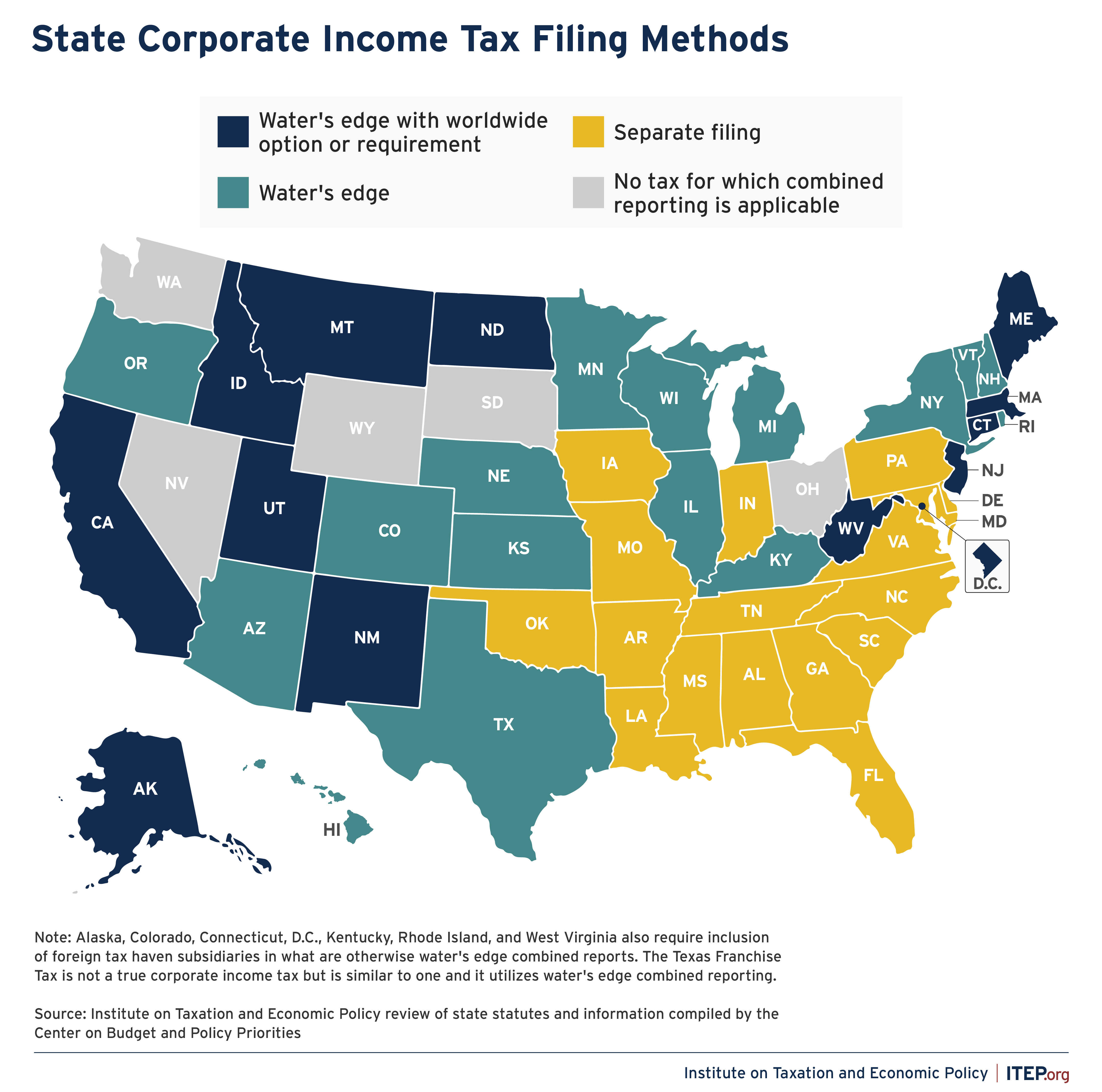

Seeing the revenue potential and the chance to prevent larger corporations from off-loading some of their tax responsibilities onto smaller one-state businesses, 28 states plus D.C. now require a limited version of combined reporting called “water’s edge” combined reporting.[6] The other 17 states with corporate income taxes offer corporations far greater latitude to shift profits to other states.

Under these water’s edge combined reporting laws, the subsidiaries included in the combined report are only those located in the U.S. While this approach is effective in neutralizing domestic profit-shifting strategies, it does little to prevent the well-documented problem of multinational corporations shifting their income to offshore tax havens.[7] Water’s edge—that is, wholly domestic—combined reporting is not well-suited to address this problem for the same reasons that the single entity approach does not work to address it between states.

Worldwide combined reporting (WWCR), on the other hand, eliminates the ability to shift corporate income offshore, and it does so using the same tools that water’s edge combined reporting uses to eliminate income shifting between states. Under worldwide combined reporting, the unitary business for which a state tax administrator determines an in-state share generally includes the parent company, its majority-owned subsidiaries within the U.S., and its majority-owned affiliates in foreign countries.

When combined reporting was first widely implemented by states starting in the early 1970s, most states with a combined reporting regime properly taxed the entire unitary business, wherever the corporate group operates. That is, they enacted the complete reporting approach of worldwide combined reporting, rather than stopping with the incomplete reporting allowed under the water’s edge method.[8] It was only after sustained lobbying of the Reagan administration by large multinational companies seeking a federal ban on mandatory WWCR that the combined reporting states scaled back their combined reports to the water’s edge. As seen in Figure 1, however, remnants of WWCR remain in place in many state tax codes today. These take the form of voluntary elections to file on a worldwide combined basis or, in Alaska, the requirement to do so for the oil and gas companies responsible for most of the state’s corporate income tax revenue.[9]

FIGURE 1

Reactivating mandatory WWCR would close a yawning gap in the water’s edge combined report that is now the norm. Doing so would reduce economically wasteful practices by companies that engage in activities solely to reduce tax liability and, as we estimate in this report, raise additional tax revenue as well.

Revenue Implications of Mandatory Worldwide Combined Reporting

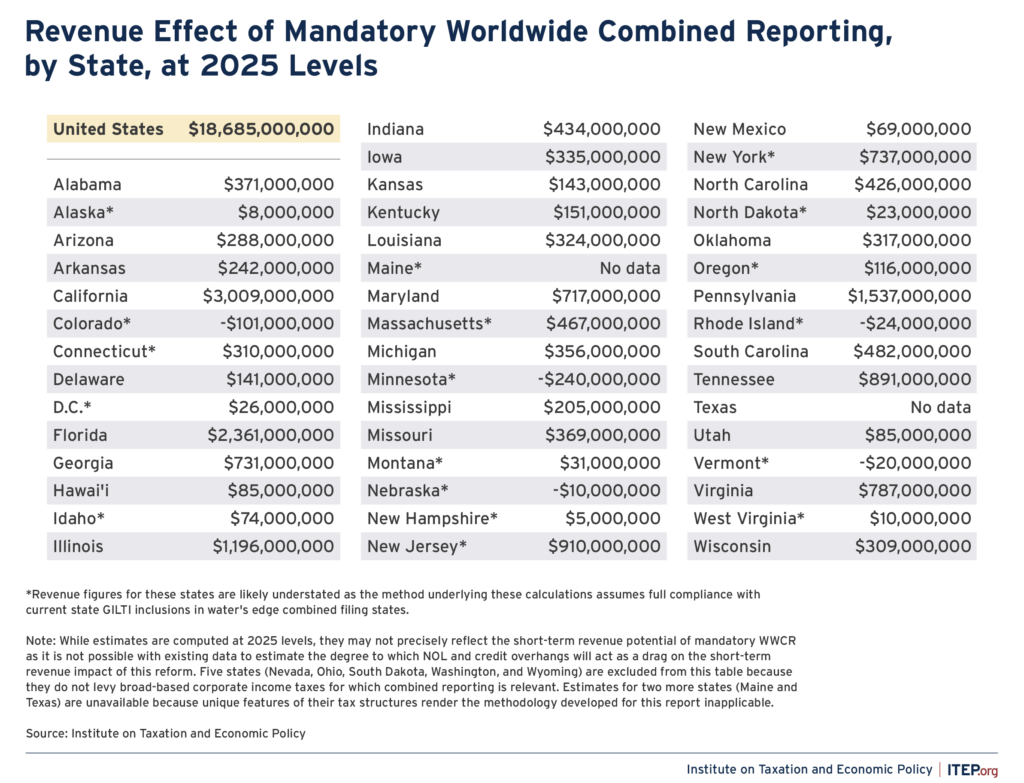

We find that universal adoption of mandatory WWCR in states with corporate income taxes would boost state tax revenue by $18.7 billion per year.

The estimates in this report are calibrated to 2025 corporate profit and tax levels. The actual, short-term revenue impact in 2025 would, however, likely be smaller because there would be residual effects from the old system that would make realizing the full revenue potential of mandatory WWCR a multiyear process. In states where large companies have been paying zero corporate income taxes for many years, for example, those companies have likely stockpiled net operating losses and tax credit carryforwards they will be able to use once implementation of WWCR leaves them with pre-credit tax liability.

Publicly available data do not allow for accurate estimates of this phenomenon on the revenue trajectory of WWCR in the early years, and thus it is not included in the figures in this report. It is clear, however, that it would take time to turn some corporate non-payers into corporate taxpayers. Lawmakers frustrated with this reality could speed up this process by tightening the rules that govern how, and when, companies can use net operating losses and credit carryforwards gained under the previous, flawed, tax regime.

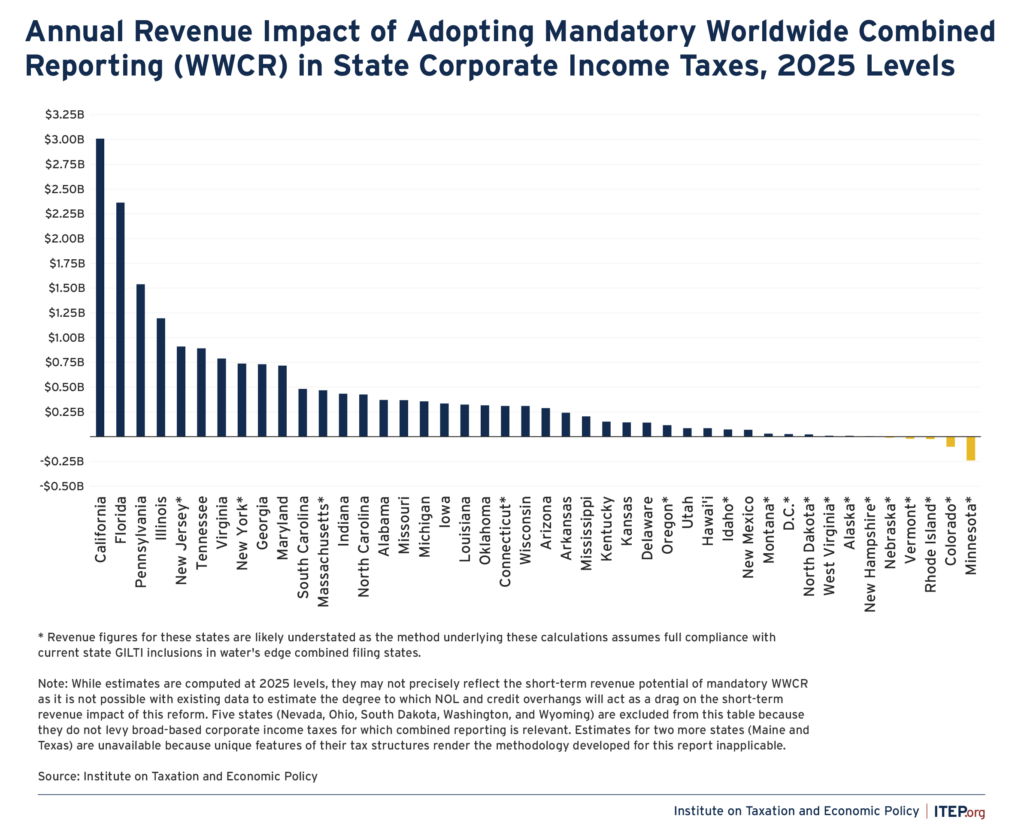

Initial timing effects aside, the revenue effects of mandatory WWCR would vary across states. We estimate that 38 states and the District of Columbia would experience revenue increases totaling $19.1 billion. The top 10 states by revenue potential are: California ($3 billion), Florida ($2.4 billion), Pennsylvania ($1.5 billion), Illinois ($1.2 billion), New Jersey ($910 million), Tennessee ($891 million), Virginia ($787 million), New York ($737 million), Georgia ($731 million), and Maryland ($717 million).

FIGURE 2

Among states experiencing revenue gains, those with especially narrow or porous corporate income tax bases—such as those following the separate filing method or lacking even modest protections against foreign profit-shifting—would see among the largest revenue increases. This makes intuitive sense as these states are currently the most vulnerable to tax avoidance and are thus positioned to see the most dramatic changes from adopting the broader and less gameable tax base afforded by WWCR. Many of the states with the largest potential revenue gains are among this group. Florida, for example, would see corporate tax revenues rise by more than 41 percent per year. Other notable percentage increases include Virginia (37 percent), Georgia (35 percent), Maryland (32 percent), Pennsylvania (31 percent), and Tennessee (26 percent).

On the other hand, states with broader, more robust corporate income tax structures would see comparatively smaller revenue increases. This is to be expected, as there is less room for growth under comparatively robust tax structures that already curb some—though certainly not all—of the same forms of corporate tax avoidance that mandatory WWCR would prevent.

Just five states would see revenue declines from adopting mandatory WWCR, and those declines are estimated to total $400 million. The states in this group are Minnesota (-$240 million), Colorado (-$101 million), Rhode Island (-$24 million), Vermont (-$20 million), and Nebraska (-$10 million). All these states have tax bases of above-average breadth that include substantial amounts of Global Intangible Low-Taxed Income (GILTI). As explained in the next section, however, GILTI estimation poses a challenge and we have reason to suspect that our technique—which generously assumes full compliance with GILTI by taxpayers despite evidence to the contrary—may overstate the revenue currently raised by GILTI, and therefore understate the revenue to be gained from replacing GILTI inclusions with mandatory WWCR.

FIGURE 3

Finally, two states are excluded from our estimates as unique features of their tax structures render the methodology developed for this report inapplicable. Texas levies a “margins tax,” called the Franchise Tax, that resembles a corporate income tax and that makes use of water’s edge combined reporting. Its definition of taxable income, however, differs substantially from the definition of profits used in true corporate income taxes and from the one captured by the data we use in this analysis. Maine levies a more traditional corporate income tax, but one that employs a unique mechanism for determining tax liability, called the Augusta Formula, that we cannot analyze using available data.[10]

Untangling the Revenue Effects of GILTI and WWCR

Analyzing the revenue impact of mandatory WWCR in states that include a meaningful amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases presents particular challenges. GILTI is a subcategory of foreign profit that is deemed to represent an extraordinary return on foreign assets (above 10 percent). The federal government includes only half of GILTI in federal taxable income (potentially rising to 62.5 percent in 2026, if current law remains in effect), meaning that in practice it is subject to a substantially reduced effective tax rate at the federal level.

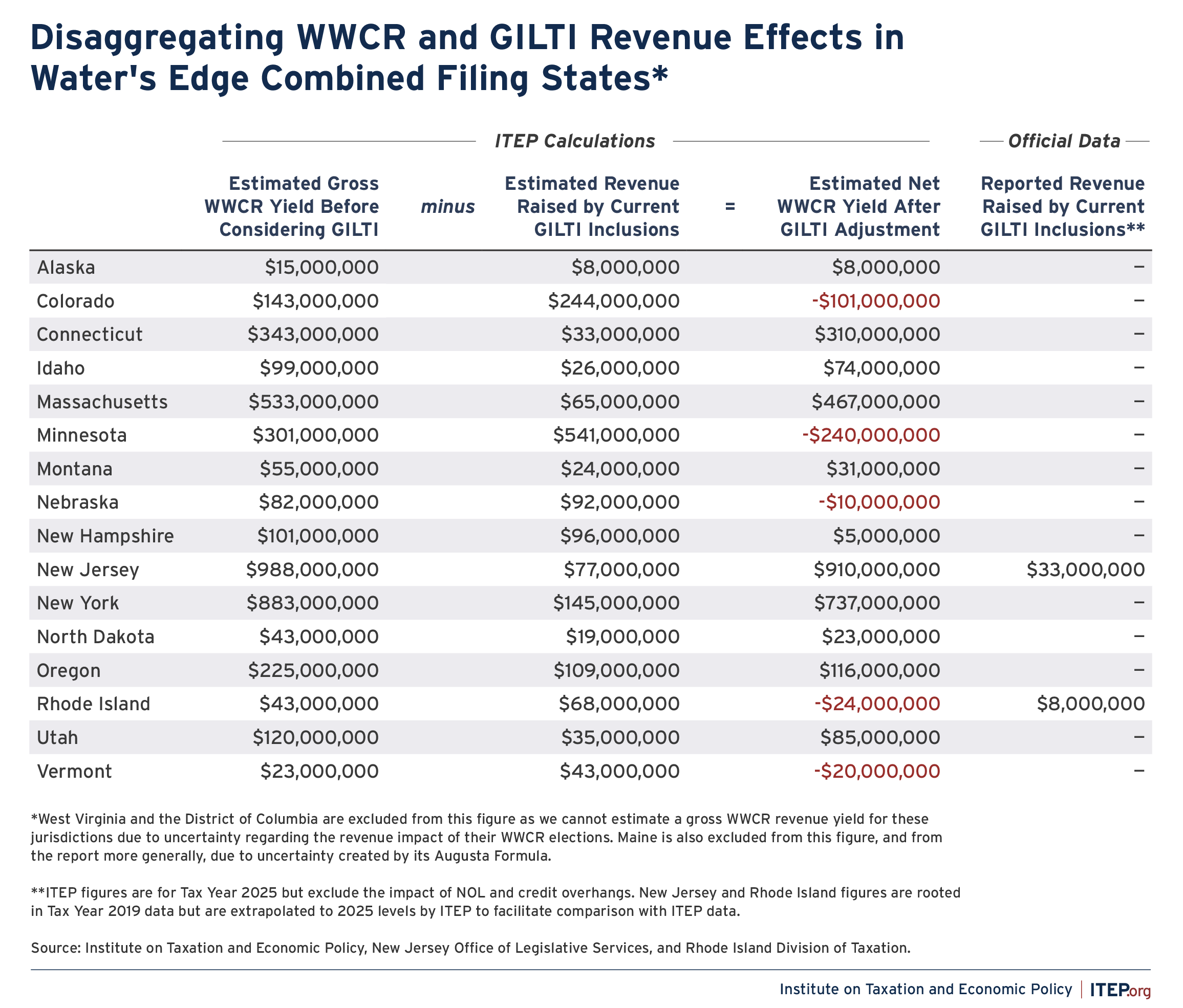

Mandatory WWCR overlaps with GILTI as both bring into state tax calculations income that is earned domestically but has been reported by companies as foreign source to minimize their tax liability. As seen in Figure 4, 18 states plus D.C. with water’s edge combined filing systems include some amount of GILTI in their tax calculations, though many of these inclusions are exceedingly modest.[11] Nine of these states follow the federal government in including 50 percent of GILTI in their tax bases while D.C. goes further by including 100 percent of GILTI.

Comparing Internal Revenue Service data on GILTI to U.S. Commerce Department data on the profits of the subsidiaries of U.S. parent corporations suggests that a large share of the ostensibly foreign profits that would be brought into the tax calculation process through implementation of mandatory WWCR is already being categorized as taxable GILTI under current federal rules.[12] Because of this, states that already include meaningful amounts of GILTI in their tax bases have less to gain by moving to mandatory WWCR relative to states that do not.[13]

All five states estimated in this report to see revenue declines from mandatory WWCR include 50 percent of GILTI in their tax calculations. While the reasons that current GILTI inclusion rules could potentially be raising more revenue than WWCR are complex, two issues in particular stand out.

First, including GILTI in state tax calculations raises revenue from companies with large overseas profits while leaving unchanged the tax bills of companies with foreign operations that are unprofitable or only moderately profitable. Under WWCR, by contrast, this latter group of companies could see a reduction in their tax bills—a fact that explains why some (though far from most) companies voluntarily choose to file on a worldwide combined basis in states that allow for that option.[14]

Second, apart from Utah, state GILTI inclusions do not come with traditional foreign “apportionment factor representation”—meaning that an estimate of the activity that gave rise to this income is not formally included in the calculation of the share of profits that will be apportioned to a given state. Instead, as envisioned at least in part by some of its first proponents, states deal with factor representation by only including a portion of GILTI in their tax bases.[15] Under WWCR, by contrast, all the profits of unitary foreign subsidiaries are included in the tax base, but so too are all the apportionment factors (typically sales) of those subsidiaries. This difference in approach is one reason that GILTI inclusions, at least under our assumption of full compliance, often appear to have revenue-raising potential compared to WWCR.

Primarily for these two reasons, we estimate that switching to mandatory WWCR would reduce corporate tax revenues in five of the 10 jurisdictions that include 50 percent or more of GILTI in their tax calculations.[16]

As seen in Figure 4, states where this is not the case—that is, where mandatory WWCR actually would raise revenue despite comparatively high GILTI inclusion rates—include two with optional WWCR already in place (West Virginia and D.C.), one with a particularly generous approach to GILTI apportionment (Utah), and one with a relatively porous version of water’s edge combined reporting (New Hampshire).[17] These policy choices negatively impact current corporate income tax revenue collections, thereby leaving more room for revenue growth under WWCR.

FIGURE 4

Caveats on Revenue Loss Estimates in Some States

As noted above, this report conservatively forecasts revenue declines from adopting mandatory WWCR in five of the 10 water’s edge filing jurisdictions that include at least 50 percent of GILTI in the tax calculation (Colorado, Minnesota, Nebraska, Rhode Island, and Vermont). It is important to emphasize, however, that there are factors that may prevent these revenue losses from occurring at all, or from being as large as estimated.

First, Colorado allows for the exclusion of so-called 80/20 companies from the water’s edge combined filing group. These are domestic companies that typically have 80 percent or more of their property and payroll overseas.[18] Credible sources note that “the amount of otherwise taxable GILTI income flowing into these 80/20 companies is simply unknown. Many combined filing states may accordingly be missing out on GILTI income.”[19] Unfortunately, the data available to account for the impact of 80/20 rules are rooted in tax years that predate adoption of GILTI and that are therefore not well suited to identifying the extent to which 80/20 exclusions are siphoning GILTI out of state tax bases.[20] If we are overstating the revenue yield of GILTI inclusion in Colorado for this reason, then we are understating the revenue benefit of replacing that inclusion with WWCR and we may be incorrect in scoring this policy reform as a revenue reduction for Colorado. Similarly, we may also be understating the revenue gain from mandatory WWCR in the other six water’s edge combined filing states that pair 80/20 exclusions with GILTI inclusions: Alaska, Connecticut, Montana, New Hampshire, New Jersey, and North Dakota.

Second, Rhode Island has not issued guidance on its approach to GILTI apportionment, and in the face of this uncertainty we conservatively assume the state uses an approach that results in the highest revenue yield from the GILTI inclusion: indirect factor representation through taxing 50 percent of GILTI, with no further dilution. If this assumption is incorrect and Rhode Island includes either net GILTI or GILTI factors in the apportionment denominator, then we are overstating the amount of tax revenue currently being raised by GILTI inclusion and are understating the revenue potential of replacing it with mandatory WWCR.

Notably, if it turns out that Rhode Island provides factor representation of the type available in Utah, then enacting mandatory WWCR would actually raise substantial new revenue for Rhode Island. This issue also applies in Idaho and West Virginia, where the approach to GILTI apportionment is similarly unclear.

Third and finally, our calculations hinge crucially on the conservative assumption of full compliance by taxpayers with statutory GILTI inclusion in water’s edge combined filing states. Our review of the available state tax collections data associated with GILTI—as reported by agencies in New Jersey and Rhode Island—offers compelling new evidence that this is not the case and that state GILTI inclusions are not living up to their full revenue potential in practice.[21] In these states, official tallies of the revenue implications of GILTI fall substantially below the revenue amounts implied in our calculations, which is a puzzling result as our math begins from a known amount of overall GILTI reported on federal tax forms that is then apportioned across states.

The underwhelming GILTI revenues being collected in the states may be partly a result of apportionment games that companies sometimes use to shift apportioned profits into zero-tax and low-tax states and countries.[22]

There is also very good reason to believe, however, that some corporations are simply choosing not to comply with GILTI. Corporate legal advisors have been telling corporate tax managers from the advent of GILTI that most states’ approach to factor representation is unconstitutional.[23] It is therefore reasonable to expect that some corporations are not including GILTI in their state tax calculations and are instead waiting for states to issue assessments of additional tax following an audit—at which point constitutional challenges to any assessments will be brought.

Mandatory WWCR, by contrast, has not sparked the same degree of constitutional second guessing from corporations and is therefore less prone to the nonpayment problems that our data suggest are plaguing current state GILTI inclusions.[24] In fact, the U.S. Supreme Court has upheld the constitutionality of WWCR on two separate occasions.[25]

Conclusion

Universal adoption of mandatory worldwide combined reporting (WWCR) would be a substantial revenue-raiser in most states, boosting overall corporate tax revenues by 14 percent, or $18.7 billion per year. Those revenue effects would vary across states. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion. Five states would see revenue declines totaling $400 million, though there is evidence to suggest that we are understating the potential revenue yield of WWCR in these states.

Ultimately, revenue considerations alone do not dictate the wisdom of WWCR and the debate over this policy will, and should, remain focused on the question of whether WWCR offers a more accurate, principled, and administrable alternative to the current patchwork of state laws governing state corporate taxation.

Appendix: Methodology

The reform analyzed in this report is a “Finnigan”-style, mandatory WWCR regime, implemented in each state with a corporate income tax using the same apportionment formula and same tax rates written into current law.[26]

The foundation of the estimates underlying this report is U.S. Commerce Department, Bureau of Economic Analysis (BEA) data on the worldwide activities of U.S. multinational enterprises (MNEs). As described below, this information is combined with a variety of other data from the BEA and from the Internal Revenue Service (IRS), Congressional Joint Committee on Taxation (JCT), Congressional Budget Office (CBO), and various state revenue offices—including some unpublished data provided to the authors upon request—to produce the most detailed calculations to date of the revenue implications of mandatory WWCR for state governments.

Broadly speaking, the analysis involves calculating the change in a national measure of corporate profit apportioned to the United States by U.S. parent companies under universal adoption of mandatory WWCR, weighting-up those estimates to account for the profit of foreign corporations with U.S. operations, apportioning those profits to each state, applying the appropriate tax rates, adding to the resulting revenue figure in separate filing states where WWCR would negate not just international profit-shifting but domestic profit-shifting as well, and subtracting from these figures any revenue already being raised from states’ inclusion in their tax calculations of income booked abroad—most notably income associated with GILTI, Subpart F, foreign dividends, tax haven reporting requirements, and “addback” provisions.

The method bears similarities to analytic approaches employed in Avi-Yonah and Clausing (2007), De Mooij et al. (2021), and Titterton (2024). It builds upon that field of work in the level of detail accounted for in the calculations and in its calculation of separate revenue estimates for each of the states that levy a corporate income tax.

Nationwide Calculation of Change in Apportioned Profit Under WWCR

The first step in the calculation is to determine the change in the aggregate level of corporate profit apportioned to the United States if every state were to mandate WWCR. We undertake this work using post-TCJA data for the 2018-2022 period. Using multiple years of base data allows us to avoid some of the year-to-year volatility apparent in the BEA dataset and to produce estimates that will be more representative of what states could expect, moving forward, in a typical year. The average result for these five years is adjusted to 2025 profit levels using CBO’s forecast for profit subject to federal corporate income tax, plus state and local corporate income taxes paid.

To calculate the change in pre-apportionment profit, we essentially replicate for all multinational corporations with majority-owned foreign subsidiaries, taken together, the calculation that an individual multinational corporation would perform to calculate its tax liability under both worldwide and water’s edge combined reporting.[27] We start from the BEA’s “profit-type return”[28] figure for U.S. parents,[29] which is not subject to the same potential double-counting issues as some other BEA series (Tørsløv et al. 2023). This profit measure includes profits earned by parent companies both with and without majority-owned foreign affiliates (MOFAs). Parents without MOFAs are not affected by the international portion of WWCR being estimated at this stage and thus are not relevant to the calculation at hand. Accordingly, we remove a small fraction of profit-type return from our calculations equal to the proportion of U.S. parent assets held by parents without MOFAs. The resulting value serves as the baseline, pre-apportionment profit level that would be reported if all states levied corporate income taxes with mandatory water’s edge combined reporting. (The marginal revenue gain from moving to water’s edge combined reporting in current separate filing states is estimated separately at a later stage of the estimating process.) Adding the profit-type return of MOFAs to that figure provides us with the comparable, pre-apportionment profit level to be expected under mandatory WWCR.

The next step in the calculation requires measuring how WWCR would impact the apportionment of those profits. To account for this, we use BEA data to estimate pre- and post-WWCR apportionment factors for the sales, payroll, and property factors and blend them together using the various formulae employed in the states to arrive at unique national starting points for each state’s calculation. The sales factor calculations are the most important part of this work as most states use single sales factor apportionment (SSF) and even non-SSF states tend to weight the sales factor more heavily than either the payroll or property factors.

Under state apportionment rules, only sales by parents and majority-owned subsidiaries to unrelated parties outside the combined reporting group affect the apportionment calculation, and they are almost always assigned to the jurisdiction in which the customer receives them. Fortunately, the BEA multinational corporation dataset provides these data for parents and majority-owned subsidiaries and further disaggregates them by both country of destination and related/unrelated customer. For the sales factor, therefore, we tabulate U.S. and non-U.S. destination sales of goods, services, and other minor income items to unrelated parties for U.S. parents with MOFAs to allow for calculation of the U.S. sales factor for the pre-WWCR baseline. The equivalent values for the MOFAs themselves are then added to the parents’ sales in arriving at the U.S. sales factor under WWCR.

Baseline and WWCR payroll factors are derived using broadly the same technique with the BEA’s employee compensation data, and property factors are computed using BEA data on the value of MNEs’ property, plant, and equipment.

Multiplying pre-apportionment profits by the apportionment factors described above allows us to calculate the amount of profit apportioned to the U.S. under the baseline and WWCR scenarios. The difference between these two values is the increase in profit apportioned to the U.S. under WWCR. It bears noting that while these profit values are book income values, we do not expect that tax values would be dramatically different in ways that would negatively impact our revenue estimates. In fact, there is evidence that book income may understate tax income appearing in tax havens as some shifting techniques move taxable income without moving book income (Bilicka 2019; Garcia-Bernardo et al. 2023).

The final step in calculating the change in profit apportioned to the U.S. is to bring in the additional profits that would be reported by foreign parent companies, which are not included in the BEA data described above. To accomplish this, we add to our apportioned profit measure an amount based on the scale of intercompany transactions (both purchases and sales), in the IRS data, for foreign headquartered companies relative to US headquartered companies. These transactions are the primary vehicle through which profit-shifting occurs and thus they give us a good sense of the size of the foreign MNE effect relative to the U.S. MNE effect that was calculated in the manner described above.

Ultimately, we find that universal state adoption of mandatory WWCR would increase the amount of nationwide apportioned profit by $217 billion under SSF apportionment and by $284 billion under equal weighted, 3-factor apportionment. Mandatory WWCR using heavily weighted sales factor apportionment that falls short of full SSF yields results between those two extremes.

To the extent that mandatory WWCR is envisioned largely as a means of negating opportunities for international profit-shifting, the scale of these values is heartening. Research by Tørsløv et al. (2023) finds that U.S. MNEs shifted $143 billion in profit out of the U.S. in 2015—a figure that would be well in excess of $200 billion today if it were updated to 2025 profit levels. This suggests that mandatory WWCR has effects on roughly the scale one would expect given the size of the profit-shifting problem at hand.

State-Specific Estimation

While the analysis of BEA data described above affords us various measures of potentially apportioned profit under universal adoption of WWCR by the states, additional work is needed to translate those figures into state-specific estimates.

Each state’s calculation starts with the applicable nationwide figure for apportioned profit that was calculated using the apportionment formula in effect in that state. Most states employ SSF apportionment and thus their calculations begin from the $217 billion figure described above.

We then distribute those profit amounts down to states using state distribution percentages derived from a methodology that closely follows one developed by the Advisory Commission on Intergovernmental Relations for the estimation of state-specific apportionment factors (ACIR 1993; Dubin 2010). The sales factor, which is by far the most important component given its heavy weighting in state apportionment formulae, is derived using the BEA’s input-output, GDP, and personal consumption expenditure data. The payroll factor is estimated using salary and wage data from the ITEP Microsimulation Tax Model (ITEP 2025), which in turn was constructed primarily with data from the IRS and the U.S. Census Bureau’s American Community Survey. The property factor estimates are obtained using BEA data for fixed assets and GDP to arrive at business fixed asset values by state.

At this stage we have developed the basis of an estimate, for every state, of the growth in apportioned profit associated with adopting mandatory WWCR. Multiplying this profit amount by each state’s top corporate tax rate in 2025 (including zero rates for states not levying the tax), adjusted to account for state deductibility of federal corporate income taxes where applicable, converts that profit value into a revenue figure. As explained elsewhere in this report, this calculation does not account for the effects of possible net operating loss and tax credit overhangs that a WWCR system would unlock, as publicly available data do not allow for estimation of these transition effects.

Additional Calculations to Capture the Upper-Bound Effect of WWCR

Two adjustments must then be made to account for ways in which the method described above understates the actual ceiling on the revenue potential of mandatory WWCR in certain states.

First, a dozen states already allow companies to file on a worldwide combined basis if they elect to do so, which means that the minority of companies for whom WWCR offers a meaningful tax cut can already access those tax cuts in these states. Put another way, these states have already adopted the revenue-losing aspects of WWCR and switching to mandatory WWCR will therefore bring with it more revenue upside than the comprehensive analysis described above shows. To account for this, we use data on corporate profits and sales among WWCR-electing companies in Massachusetts, provided to us upon request by the state’s Department of Revenue, to develop an adjustment factor that reflects the expected degree to which state corporate income tax revenues are being depressed by WWCR elections. This amount is then expressed as a positive value and added to the starting point estimate of WWCR revenue effects because adoption of mandatory WWCR would not bring with it these embedded tax cuts in these states—that is, these tax cuts have already been enacted.

Second, in states using separate filing systems, WWCR would neutralize not just international profit-shifting but domestic profit-shifting as well. The effects occurring within the confines of the water’s edge must be added separately to our calculations as the BEA data described above do not speak to this issue.[30]

The revenue impact of combined reporting up to the water’s edge has been the subject of considerable study. But as Cline (2008) notes, “the central problem [of revenue estimation] is that corporate tax returns in separate filing states do not contain sufficient information to estimate reliably the revenue impacts of adopting mandatory combined reporting.” To overcome this obstacle in the context of water’s edge combined reporting estimation, we use data on information returns filed in Maryland, Rhode Island, and Virginia that were mandated with the specific goal of allowing officials in these states to accurately analyze the revenue implications of this reform.

The Rhode Island data are particularly helpful for this purpose because, at the time the data were collected, the state corporate income tax operated on a separate filing basis without meaningful addback statutes,[31] providing a comparatively blank slate against which to measure the upper-bound revenue implications of water’s edge filing under both the Joyce and Finnigan variations thereof. The Maryland and Virginia data play secondary, though still important, roles in our analysis as well. Ultimately, we find that all three data sources are in close agreement when expressed as a percentage of baseline state corporate tax revenues, adjusted for differences in the points of the business cycle captured by these data, and factoring in the expected impact of addback statutes that slightly undercut the revenue potential of water’s edge combined reporting in the Maryland and Virginia data.

In the course of our research, we also reviewed high-quality studies of the impacts of water’s edge combined filing in the District of Columbia (Fahimullah et al. 2018) and Pennsylvania (Gill 2019) that found revenue-raising potential of a similar magnitude from the adoption of this policy. We ultimately decided, however, to rely solely on the pro forma data mentioned above in assembling our analysis, with the expectation that they are the most reliable and authoritative.

Finally, we account for the fact that many states with water’s edge combined reporting are forgoing a portion of the revenue potential of this reform through the exclusion of so-called 80/20 companies from the water’s edge combined filing group. These are domestic companies that, typically, have 80 percent or more of their property and payroll overseas (Fort 2021; Fort 2024). To account for the fact that mandatory WWCR would eliminate the revenue leakage created by 80/20 exclusions, we use an estimate produced by the Vermont Joint Fiscal Office (JFO) for repeal of its 80/20 exclusion and express it as a percentage of corporate tax revenues to allow for application to other states. Conversations with analysts at JFO suggest that the Vermont figure was heavily informed by data from Minnesota, which removed its 80/20 exclusion in 2013.

We use the data from Rhode Island, Maryland, Vermont, and Virginia to estimate the domestic portion of the overall, Finnigan-style combined reporting effect. States using separate filing without addback statutes have the most to gain, from a revenue perspective, from the domestic portion of this reform. States that fall short of full Finnigan-style combined reporting, but that take some partial steps in this direction by using addbacks or Joyce-style water’s edge combined reporting, would also see revenue gains—though of a somewhat smaller magnitude.[32]

Accounting for Provisions Superseded by WWCR

The final stage of the estimation process requires identifying the extent to which states are already bringing profit booked abroad into their tax calculations through various mechanisms. These effects must be netted against the WWCR revenue effects derived from the calculations described above to avoid double counting taxation of these profits. We make four adjustments of this type, comprised of taxes on ostensibly foreign income picked up through conformity to federal law (GILTI, Subpart F, and foreign dividends), profits associated with subsidiaries based in tax haven countries, addback statutes, and mandatory WWCR in Alaska.

Inclusion of foreign income through federal conformity. Many states include a variety of kinds of income booked abroad in their tax calculations through conformity to the federal definitions of GILTI, Subpart F income, and foreign dividends (Frieden and Nicely 2023; Fort 2024). Estimation of the effect of these provisions on states is aided by the fact that the IRS reports definitive data on the nationwide amounts of these income sources. Among these three items, GILTI is the largest by far. We take the 2021 IRS data (the most recent available as of this writing) and extrapolate them to 2025 levels using forecasts from the Congressional Joint Committee on Taxation (JCT) for the GILTI tax expenditure. The resulting national figures are shared down to states using the same general approach to apportionment discussed above in the context of WWCR.

At this point, a few additional refinements are needed to translate the IRS-based figures into amounts relevant for purposes of state taxation. First, we use BEA data to remove a small share of GILTI flowing from minority-owned foreign affiliates, with the expectation that companies are being advised these affiliates are non-unitary and outside the reach of state tax authorities. Second, we apply each state’s statutory inclusion rates for GILTI, Subpart F, and foreign dividends to the calculations. And finally, we apply one of three different approaches to the apportionment formula denominator (inclusion of foreign factors, inclusion of net GILTI, or no inclusion) based on the approach taken in each state. From there, apportionment of GILTI is calculated using generally the same technique described above for WWCR, but at a slightly greater level of detail as IRS data on net GILTI by industry allows us to use the more detailed BEA data by industry for this portion of the calculation.

States with separate filing regimes are very unlikely to see meaningful GILTI inclusions. Parent corporations owning foreign subsidiaries generating GILTI are unlikely to have nexus in those states. Even in cases where there is nexus, it is straightforward to transfer ownership of GILTI-generating subsidiaries to holding companies in states where the tax can be avoided. On top of that, legal advisors to multinational corporations have also argued that GILTI inclusion in separate filing states is constitutionally prohibited (Donovan et al. 2018). With all that in mind, we adopt the conclusion of Fort (2024) that “separate filing states are unlikely to see any GILTI income.”

In water’s edge combined filing states, on the other hand, GILTI inclusions and other federal conformity provisions could potentially raise substantial tax revenue. For the reasons described below, however, we expect that our approach overstates the current revenue yield of GILTI and other federal conformity measures. Thus, for states that have adopted these features of federal law, we expect that the approach understates the revenue potential of moving to a robust mandatory WWCR regime.

In particular, states with 80/20 provisions, which allow for the exclusion of domestic companies with significant overseas assets from the water’s edge combined report, are especially vulnerable to tax planning strategies that siphon GILTI from their tax bases (Fort 2021; Fort 2024). Unfortunately, the estimates we use to account for the effect of 80/20 exclusions (discussed in the previous section) are rooted in data from years prior to the enactment of GILTI and thus do not allow us to account for this form of tax avoidance, likely leading to an overestimate of GILTI revenue.

But even in water’s edge combined filing states without 80/20 exclusions—that is, in the states where GILTI inclusions should theoretically have the largest revenue impact—the best available evidence suggests that those inclusions are failing to live up to their full revenue potential.

Figure 5 provides a partial disaggregation of our WWCR revenue estimates, showing the impact of GILTI inclusions on our estimates of the net revenue potential of mandatory WWCR. In Nebraska, for instance, we estimate that mandatory WWCR would raise $82 million annually if measured relative to a hypothetical tax system with no GILTI inclusion. We also estimate that the state’s 50 percent GILTI inclusion is currently raising $92 million per year. Therefore, under a tax reform package replacing GILTI inclusion with comprehensive, mandatory WWCR, the net revenue effect to the state would be a loss of $10 million annually.

FIGURE 5

Whether this result would hold in practice depends crucially on whether Nebraska’s GILTI inclusion is living up to its full potential, which in turn depends largely on taxpayer compliance. Gauging this is made difficult by the fact that Nebraska does not report current GILTI-related revenues. But evidence from New Jersey and Rhode Island—the only states that we are aware of that have reported actual, real world revenue totals associated with GILTI inclusions—suggests that our assumption of full compliance is overly optimistic.

In both New Jersey and Rhode Island, Figure 5 shows that GILTI-related revenues are just a fraction of the amount that our analysis of IRS and BEA data suggests these states could raise. This discrepancy offers new, suggestive evidence that companies are aggressively planning around GILTI and are likely acting on legal advice that state GILTI inclusions, as currently structured, are impermissible under the U.S. Constitution.[33]

New Jersey, for instance, reported $216 million in actual revenue collections attributable to GILTI in 2019 under the 50 percent inclusion it used at the time. Furthermore, it stated that it would have collected $21.6 million under the 5 percent inclusion in effect today. Extrapolating those figures to 2025 levels using IRS and JCT data suggests that the state’s 5 percent inclusion is currently raising $33 million per year—less than half the $77 million calculated in our analysis. If we had used the state’s $33 million GILTI figure in our calculations in lieu of our own figure, we would have scored mandatory WWCR in New Jersey as raising $955 million rather than $910 million.

Similarly, in Rhode Island, official data indicate that the state’s 50 percent GILTI inclusion raised a meager $5.3 million in 2019. Growing that figure to 2025 levels suggests a revenue yield of $8 million today. If we had used that $8 million figure in place of our $68 million GILTI estimate, we would have scored mandatory WWCR as raising $35 million in Rhode Island—not losing $24 million as predicted in the core estimates presented in this report.

Given the uncertainty in the precise mix of forces responsible for anemic GILTI revenues in these two states, we do not adjust our GILTI estimates based on these findings. Instead, we caution readers that our revenue estimates for mandatory WWCR are likely understated in water’s edge combined filing states with GILTI inclusions—potentially to a significant degree—and we humbly suggest that states may want to take a closer look at how administration of their GILTI inclusions is functioning in practice.

Tax haven reporting. A handful of states require companies to include income from subsidiaries based in certain tax haven countries in their pre-apportionment income. We sort these states into two categories: those employing specific lists of countries and those that use more subjective criteria and empower companies to determine whether the countries in which their subsidiaries operate are tax havens. We develop separate estimates for the share of corporate income tax revenue attributable to each kind of reporting law based on fiscal notes, policy reports, and public statements made by tax department staff and subtract the resulting dollar figures from our estimates of the maximum revenue potential of mandatory WWCR. Available evidence suggests that states employing specific lists raise more revenue from tax haven reporting laws than states using subjective criteria. We then make a final adjustment to prevent double counting of income under both GILTI and tax haven reporting laws in states with statutes designed to safeguard against such an outcome.

Addback statutes. Slightly fewer than half the states have statutes in effect that disallow deductions for interest and royalty payments to related companies, which are common mechanisms for abusive interstate and international profit-shifting. (They are called “addback” laws because these payments are first allowed to be subtracted due to states’ conformity with federal law, and are then added back to federal taxable income to achieve the disallowance.) The most robust estimate of the revenue effects of addback statutes that we were able to identify comes from Maryland. We express that estimate as a percentage of corporate tax revenues to allow for a generalizable calculation of the dollar impact of addback statutes. We categorize the bulk of the addback effect as a curb on domestic profit-shifting while the remaining international amount is netted against our maximum WWCR estimates. We expect that we are overstating the impact of addback statutes, and therefore understating the revenue potential of WWCR. The Maryland figure we rely on was calculated in the immediate wake of enactment of a new addback statute and companies tend to become increasingly adept at planning around these kinds of narrow provisions as time passes.

Mandatory WWCR for oil and gas companies in Alaska. Alaska is unique in mandating WWCR for a subset of corporate taxpayers. Davis and Gardner (2023) analyzed the full history of revenue data under this system and found that almost three quarters (74 percent) of Alaska’s corporate income tax collections since implementation of this system have come from the oil and gas sectors. Furthermore, data provided upon request by the Alaska Department of Revenue reveal that, in Fiscal Year 2023, every dollar of corporate income tax revenue paid by this sector came from companies with at least one foreign subsidiary—meaning from companies that filed worldwide combined returns. In other words, Alaska’s corporate income tax primarily functions as a worldwide combined system. Our analysis of a comprehensive WWCR reform in Alaska, therefore, is adjusted to examine only the portion of the tax that does not already operate in this manner.

Applying a Floor in States with WWCR Elections

The method described so far suggests that two jurisdictions (D.C. and West Virginia) with elections allowing for WWCR filing would face tax revenue losses from adoption of mandatory WWCR. This is because mandatory WWCR would supersede their current GILTI inclusion practices, which we estimate to be generating significant revenue. This result is implausible, however, because companies operating in D.C. and West Virginia already have access to WWCR as an election and it can be reasonably expected that any company for whom WWCR would offer a meaningful tax cut is already making use of that election.

This anomaly in our calculations suggests that our approach to analyzing the impact of WWCR elections, described above, may underestimate the revenue loss from these elections, at least in some states. One potential source of this inaccuracy is that we use data from a state with relatively light GILTI inclusion rules (Massachusetts) to develop our revenue estimates. If higher GILTI inclusion rates steer more companies into using elective WWCR, then the revenue loss associated with these elections could be higher in these states. This suggests that we may be understating the revenue potential of mandatory WWCR not just in D.C. and West Virginia, but also in other states with moderately robust GILTI inclusion rules such as Idaho, Montana, and North Dakota.

We remedy the apparent contradiction in this component of our results by setting a floor on the international component of WWCR such that mandatory adoption of this filing technique cannot be scored as a revenue reduction in states that already offer this filing method as an election.[34] We expect that this approach is leading us to understate the revenue potential of mandatory WWCR as the international component of this reform should actually yield a non-zero, positive revenue gain—but one of a magnitude that we cannot predict with available data.

Omitted Transition Effects

Data limitations prevent us from quantifying the short- and medium-run effects that carryforwards of net operating losses and unused tax credits have on the revenue yield of mandatory WWCR. In short, some companies have been able to stockpile a large volume of tax subsidies over the years that they can potentially use to continue paying zero corporate income tax for some amount of time even if the tax base is meaningfully broadened. This issue will be far more impactful in some states than others, but in those states it will take time to exhaust these accumulated tax preferences under a broader, reformed corporate income tax. States wishing to realize the revenue potential of WWCR more quickly can place limitations on the amounts, or timing rules, that govern how companies can use net operating losses and tax credit carryforwards.

References

• ACIR (1993). “State Revenue Capacity and Effort.” Advisory Commission on Intergovernmental Relations, Information Report M-187.

• Avi-Yonah, Reuven S. and Kimberly A. Clausing (2007). “Reforming Corporate Taxation in a Global Economy: A Proposal to Adopt Formulary Apportionment.” The Brookings Institution, Hamilton Project Discussion Paper 2007-08.

• Bilicka, Katarzyna Anna (2019). “Comparing UK Tax Returns of Foreign Multinationals to Matched Domestic Firms.” American Economic Review 109 (8), 2921-2953.

• Clausing, Kimberly A. (2020). “5 Lessons on Profit Shifting From U.S. Country-by-Country Data.” Tax Notes Federal 169 (6), 925-940.

• Cline, Robert (2008). “Combined Reporting: Understanding the Revenue and Competitive Effects of Combined Reporting.” Ernst & Young LLP for Council on State Taxation. May 2008.

• Davis, Carl and Matthew Gardner (2023). “Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge.” Institute on Taxation and Economic Policy.

• De Mooij, Ruud, Li Liu, and Dinar Prihardini (2021). “As Assessment of Global Formula Apportionment.” National Tax Journal 74 (2), 431-465.

• Donovan, Joseph X., Karl A. Frieden, Ferdinand S. Hogroian, and Chelsea A. Wood (2018). “State Taxation of GILTI: Policy and Constitutional Ramifications.” State Tax Notes 90, 315-335.

• Dubin, Elliott (2010). “Changes in State Corporate Tax Apportionment Formulas and Tax Bases.” Tax Analysts Special Report, 563-572.

• Fahimullah, Fahad, Yi Geng, and Uranbileg Enkhtuvshin (2018). “Combined Reporting: The Effect on the District’s Tax Revenue.” Presentation by DC Office of Revenue Analysis staff at the 2018 Federation of Tax Administrators Revenue Estimation Conference.

• Fort, Bruce J. (2021). “Anatomy of a Domestic Tax Shelter.” Tax Notes State 100 (7), 689-702.

• Fort, Bruce J. (2024). “State Taxation of MNEs Under the TCJA: It’s Time for a Policy Reassessment.” Tax Notes State 112, 845-857.

• Frieden, Karl A. and Erica S. Kenney (2021). “Eureka Not! California CIT Reform is Ill-Conceived, Punitive, and Mistimed.” Tax Notes State 100, 795-815.

• Frieden, Karl A. and Fredrick J. Nicely (2023). “Minnesota’s New Approach to Taxing Foreign Income is Unfair and Unwise.” Tax Notes State 109, 577-588.

• Garcia-Bernardo, Javier, Petr Janský, and Gabriel Zucman (2023). “Did the Tax Cuts and Jobs Act Reduce Profit Shifting by US Multinational Companies?” SSRN.

• Gill, Amy (2019). “Corporate Net Income Tax Combined Reporting Methodology.” Presentation by Pennsylvania Department of Revenue staff at the 2019 Federation of Tax Administrators Revenue Estimation Conference.

• Grubert, Harry and Rosanne Altshuler (2013). “Fixing the System: An Analysis of Alternative Proposals for the Reform of International Tax.” National Tax Journal 66 (3), 671-712.

• Hellerstein, Jerome R. (1993). “Federal Income Taxation of Multinationals: Replacement of Separate Accounting with Formulary Apportionment.” Tax Notes 10, 1131-1145.

• ITEP (2025). “ITEP Tax Microsimulation Model Overview.” Institute on Taxation and Economic Policy website, accessed January 2025.

• Kranz, Stephen P., Diann L. Smith, and Michael J. Hilkin (2024). “Nebraska Court Embraces ‘Gotcha’ Argument in Factor Representation Case.” Tax Notes State 114, 623-625.

• Lindholm, Douglas L. and Marilyn A. Wethekam (2024). “Mandatory Worldwide Combined Reporting: Elegant in Theory but Harmful in Implementation.” Council on State Taxation, State Tax Research Institute.

• Mazerov, Michael (2024). “States Can Fight Corporate Tax Avoidance by Requiring Worldwide Combined Reporting.” Center on Budget and Policy Priorities.

• McLoughlin, Alysse and Kathleen M. Quinn (2024). “Moore Gives Taxpayers a ‘Gotcha’ Argument in Factor Representation Cases.” Tax Notes State 113, 709-712.

• Shanske, Darien (2024). “The Future of SALT (?): Using and Improving Formulas for Apportioning Income, Residence and Intangibles.” Tax Lawyer (forthcoming).

• Sullivan, Martin A (2018). “GILTI and That Disappointing Deemed Tangible Return.” Tax Notes, 773-776.

• Titterton, Patrick (2024). “Worldwide Combined Reporting.” Testimony by Legislative Joint Fiscal Office Staff before the Vermont House Committee on Ways and Means.

• Tørsløv, Thomas, Ludvig Wier, and Gabriel Zucman (2023). “The Missing Profits of Nations.” The Review of Economic Studies 90 (3), 1499-1534.

• Wamhoff, Steve (2024). “Ongoing Use of Offshore Tax Havens Demonstrates the Need for the Global Minimum Tax.” Institute on Taxation and Economic Policy.

Endnotes

[1] Some of the more notable academic work on this topic includes Hellerstein (1993) and Avi-Yonah and Clausing (2007). For a more recent overview of the case in favor of WWCR, see Mazerov (2024). The most recent response from the trade association representing multinational corporations can be found in Lindholm and Wethekam (2024).

[2] The Federation of Tax Administrators has long maintained a list of state approaches to the apportionment of corporate income. That list is accessible at the following link as of this writing: https://taxadmin.org/wp-content/uploads/resources/tax_rates/apport.pdf.

[3] See, for example, Complete Auto Transit, Inc. v. Brady, 430 U.S. 274 (1977) and Container Corp v. Franchise Tax Bd., 463 U.S. 159 (1983).

[4] Combined reporting requires combined tax filings by corporations that have common ownership and that are engaging in a shared economic enterprise or “unitary business.” For instance, a vertically integrated company with members engaged throughout the supply chain for a line of products (e.g., raw materials collection, product manufacturing, and sales) would very likely be taxable on a combined basis whereas a conglomerate with members engaged in entirely unrelated lines of business would be less likely to be deemed a unitary business, though that determination could depend on the extent to which their finances and other operations were intertwined.

[5] This is only true of legal entities that are part of a unitary business, which generally means that the entities share ownership, operation, and use. A subsidiary operating in a way that is completely unrelated to the parent company or other subsidiaries would not be considered part of a unitary business with these other entities.

[6] Note that Texas uses combined reporting for its Franchise Tax, though this is not a traditional corporate income tax. See, Center on Budget and Policy Priorities, “28 States Plus D.C. Require Combined Reporting for the State Corporate Income Tax,” Accessed February 2025. https://www.cbpp.org/charts/28-states-plus-dc-require-combined-reporting-for-the-state-corporate-income-tax-0.

[7] Clausing (2020); Tørsløv et al (2023); Wamhoff (2024).

[8] Mazerov (2024).

[9] Davis and Gardner (2023).

[10] Maine’s Augusta Formula essentially steers taxpayers into an outcome consistent with one of three filing methods: the statutory water’s edge filing method with international income items, a pared back water’s edge filing method without such items, or worldwide combined reporting. The formula bears some similarities to elective worldwide combined reporting and Maine Revenue Services notes that the Augusta Formula has the same effect as elective WWCR “in most instances.” Unlike traditional WWCR elections, however, the intricacies of the Augusta Formula create ambiguity as to whether switching to mandatory WWCR would raise or lower tax revenue collections. Companies paying under the statutory filing method today would experience WWCR as a tax increase, while companies paying under the pared back water’s edge filing method would experience WWCR as a tax cut. We cannot observe the current sorting of companies at this level of detail in the data we have available and thus we cannot forecast the direction, much less the magnitude, of revenue change associated with enacting mandatory WWCR in Maine. Helpful descriptions of the Augusta Formula can be found at: Maine Revenue Services. “Maine Tax Alert Volume 9, No. 4.” September/October 1999. Maine Revenue Services. “Worldwide Combined Reporting of Certain Corporations for Income Tax Purposes.” Report Prepared for the Joint Standing Committee on Taxation. February 2023.

[11] As discussed in the methodology, while some separate filing states also nominally include GILTI in their tax calculations, it is highly doubtful that GILTI inclusions can raise meaningful revenue under this form of corporate income structure (Fort 2024).

[12] In 2021, for instance, GILTI amounted to $607.7 billion according to the IRS while majority-owned affiliates’ profit-type return amounted to $614.6 billion according to BEA. Fully reconciling these figures would require several adjustments, such as to the treatment of foreign parents and minority-owned affiliates, but even so it is clear that the GILTI definition encompasses a substantial share of ostensibly foreign profits. Note that Martin Sullivan discussed the expansive nature of the GILTI definition not long after its enactment (Sullivan 2018).

[13] If a state switched from water’s edge combined reporting to worldwide combined reporting but continued to include GILTI in the tax base without any further adjustments, the result would be a double counting of income in some instances that would be vulnerable to legal challenge as unconstitutional discrimination against foreign commerce. It is unlikely that any state would attempt to implement such a structure.

[14] Mazerov (2024).

[15] Grubert and Altshuler (2013).

[16] As discussed in note 10, the revenue impact in a sixth jurisdiction (Maine) is indeterminate.

[17] West Virginia and D.C. already offer companies the option to sidestep the GILTI inclusion system by voluntarily electing to file on a WWCR basis. Companies for which WWCR would represent a meaningful tax cut are, therefore, already making use of that option in these places. Put another way, these two jurisdictions have already adopted the revenue-losing aspects of WWCR by making the option available to companies, and switching to mandatory WWCR will therefore bring with it more revenue upside. As for Utah, we estimate that it is raising far less revenue from GILTI inclusion than the other states with comparable statutory inclusion rate because it stands alone in reportedly allowing inclusion of all foreign subsidiaries’ sales in the apportionment calculation, not the inherently much smaller amount of GILTI associated with those sales (Frieden and Nicely 2023). Finally, New Hampshire’s corporate income tax collections are being suppressed by the decision to administer water’s edge combined reporting using the Joyce method, and by the exclusion of domestic 80/20 companies from the combined report. Adopting mandatory, Finnigan-style WWCR in New Hampshire would resolve these issues and therefore comes with more revenue upside than is the case for some of the other states identified in Figure 4 (Fort 2021; Fort 2024).

[18] Fort (2021); Fort (2024).

[19] Fort (2024).

[20] As discussed in the methodology, we use data from a Vermont revenue estimate that was produced in the runup to repeal of the state’s 80/20 exclusion. That estimate was heavily informed by data from Minnesota’s experience repealing its 80/20 exclusion in 2013, as the Minnesota data offered the best available basis for estimation at the time.

[21] See Figure 5 and the accompanying discussion in the methodology section of this report.

[22] See Shanske (2024) for one discussion of how to improve the apportionment of corporate income.

[23] In October 2018, two lawyers with a trade association representing multinational corporations on state tax matters (COST) teamed up with two more lawyers at Sullivan & Worcester LLP to publish a detailed article making this case (Donovan et al. 2018). COST followed that up with an article in 2021 arguing that excluding GILTI factors from the apportionment formula denominator is “blatantly unfair and unconstitutional” and then, in 2023, reiterated that doing so “likely violates the commerce clause under U.S. Supreme Court precedents related to discrimination, fair apportionment, and foreign commerce” (Frieden and Kenney 2021; Frieden and Nicely 2023). More recently, legal advisors to corporate clients have cited the U.S. Supreme Court’s ruling in Moore v. United States as providing additional backing for these claims, with two lawyers at Jones Walker LLP arguing that the dominant approach to GILTI apportionment in the states is “patently unconstitutional” (McLoughlin and Quinn 2024). Their arguments were echoed not long after by a trio of lawyers with McDermot Will & Emery in the context of a Nebraska Supreme Court decision (Kranz et al. 2024).

[24] Despite their misgivings about mandatory WWCR as a policy matter, COST concedes that it is “permissible under the U.S. Constitution” (Lindholm and Wethekam 2024).

[25] Container Corp v. Franchise Tax Bd., 463 U.S. 159 (1983). Barclays Bank PLC v. Franchise Tax Bd. of Cal., 512 U.S. 298 (1994)

[26] The Joyce and Finnigan methods, named for California court cases that most systematically explored the issues, address the question of how combined reporting is to be applied when some members of a combined group are subject to a corporate income tax in a combined reporting state and others are not. The Finnigan method, which is most consistent with the underlying theory of combined reporting, for apportionment purposes essentially treats all members of a combined group as taxable in a state if at least one member clearly is taxable. Most recent adoptions of water’s edge combined reporting have incorporated the Finnigan method.

[27] By law, only majority-owned subsidiaries can be included in a combined report.

[28] BEA’s measure of “profit-type return” is akin to operational income. It does not include profit attributable to one company’s equity ownership interest in other companies—which is what could lead to double-counting of profits if the profits of U.S parents and their foreign subsidiaries are combined (as they are under WWCR and, accordingly, in a later step in the estimation process).

[29] Although this report refers to “U.S. parents” in keeping with BEA terminology, the data are actually for ultimate U.S. parent companies combined with their majority-owned U.S. subsidiaries—analogous to a water’s edge combined group. See: BEA, “U.S. International Economic Accounts: Concepts and Methods.” June 2023, p. 58.

[30] As described in note 29, the BEA data for “profit-type return” of the “U.S. parent” are actually for the ultimate parent and its majority-owned U.S. subsidiaries. In other words, the profit figure being used in the calculation already combines these profits, netting out the effects of intra-group transactions.

[31] Addback provisions disallow the deductibility of certain sales to majority-owned subsidiaries, recouping some of the revenue from interstate profit shifting that water’s edge combined reporting would also recoup. As discussed in the methodology, we make an adjustment for existing addback statutes to avoid overestimating the marginal revenue gain from the adoption of both water’s edge and worldwide combined reporting.

[32] In Connecticut, these calculations also require accounting for the added wrinkle that the current combined reporting system is limited to only allow for a maximum tax increase on any given company of $2.5 million. Full implementation of the mandatory WWCR reform analyzed in this report would require eliminating this tax cap. We account for this by adding recent estimates of the revenue loss attributable to this provision, published by the Connecticut Office of Policy and Management, into our calculations.

[33] See note 23.

[34] The positive revenue effects for D.C. and West Virginia shown in Figures 2 and 3 are attributable to the domestic effects of moving from the Joyce to Finnigan method of combined reporting.