A Chart Book on the U.S. Tax System

Read the Chart Book in PDF

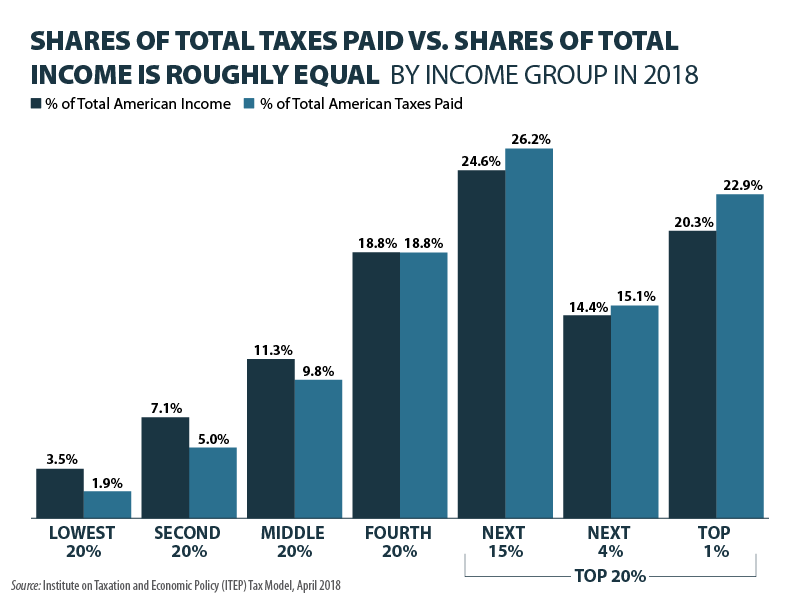

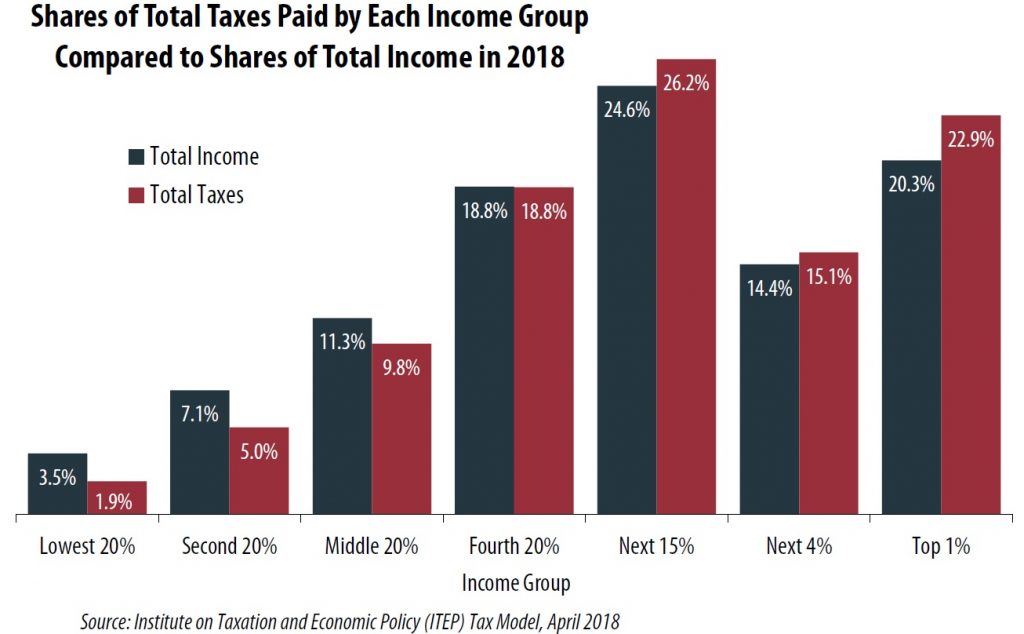

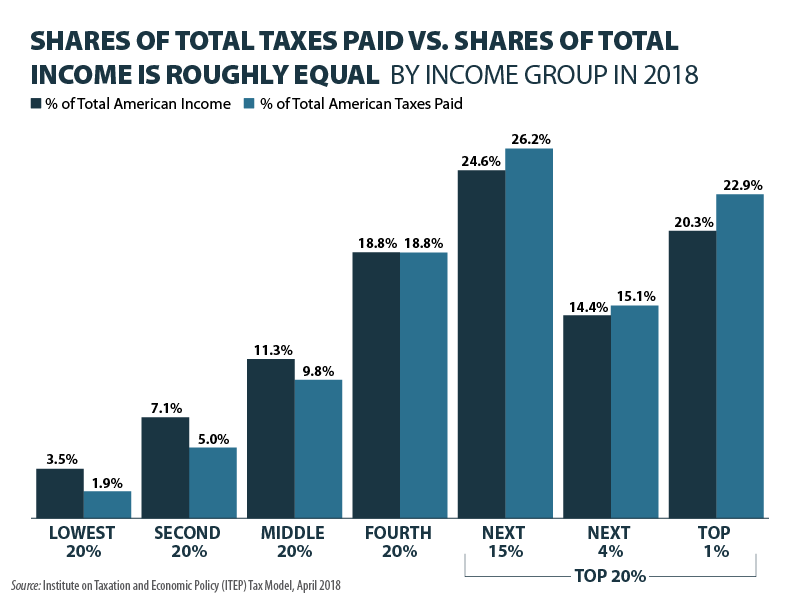

1.) Everyone pays taxes, including those who earn the least.

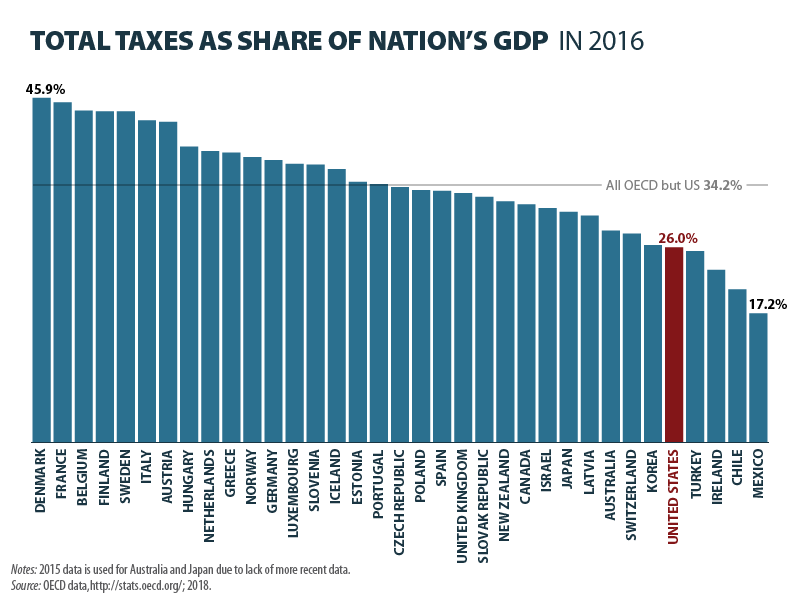

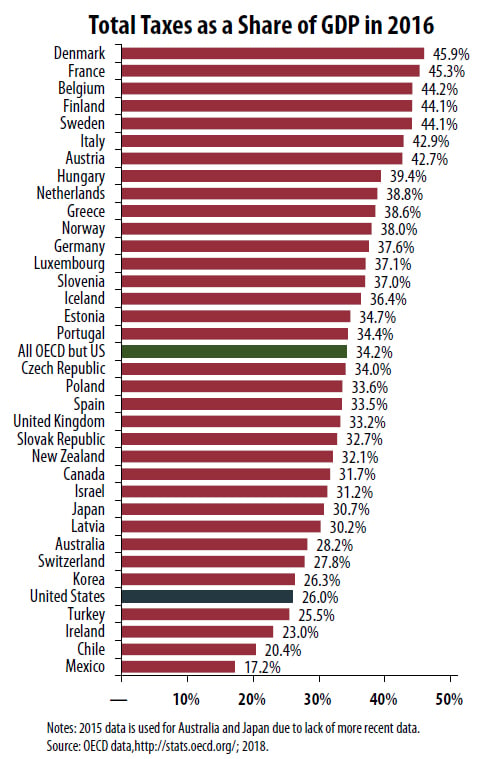

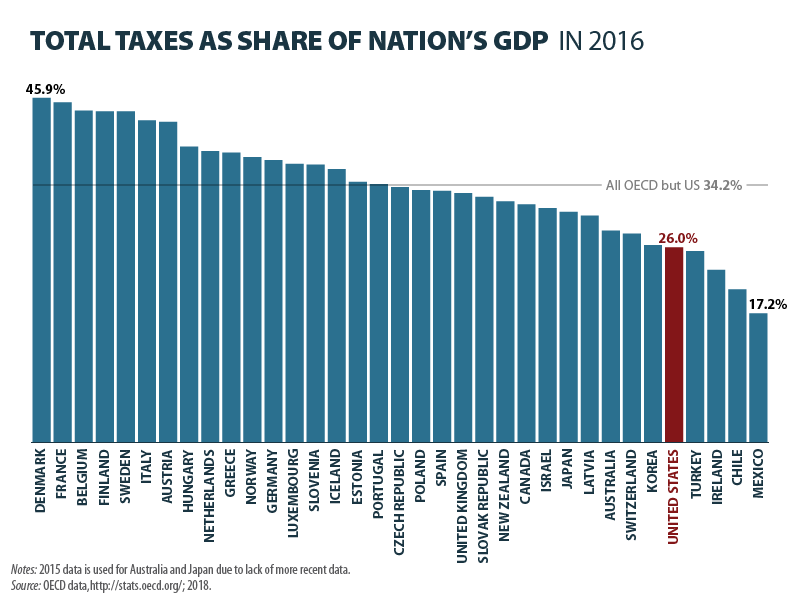

2.) Taxes in the United States are much lower than in most other developed nations.

- Taxes accounted for 26 percent of the nation’s GDP in 2016, well below the OECD average and lower than all but four other OECD member nations. The countries collecting more in taxes as a share of their economy than the United States includes many of our most prominent trade partners and competitors, such as France, Germany, the United Kingdom and Canada.

- The United States could increase its tax revenue by 30 percent across the board and still be below the OECD average.

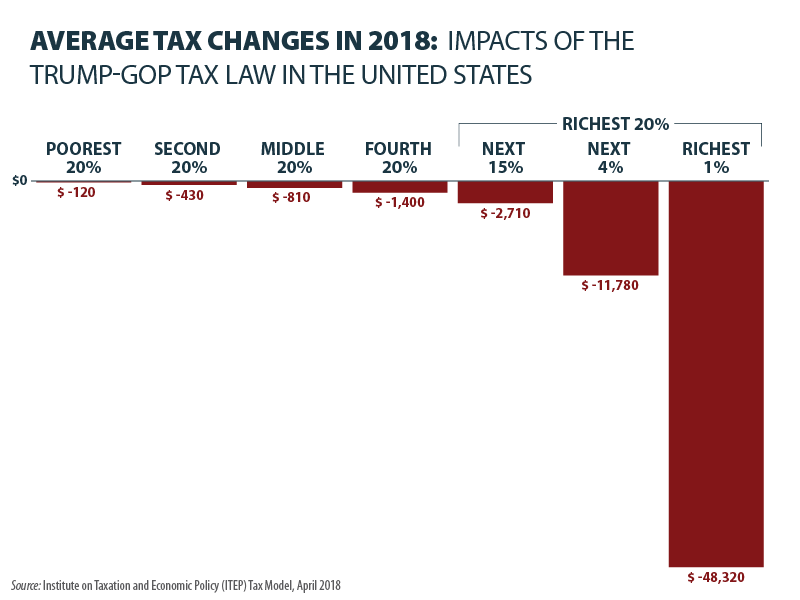

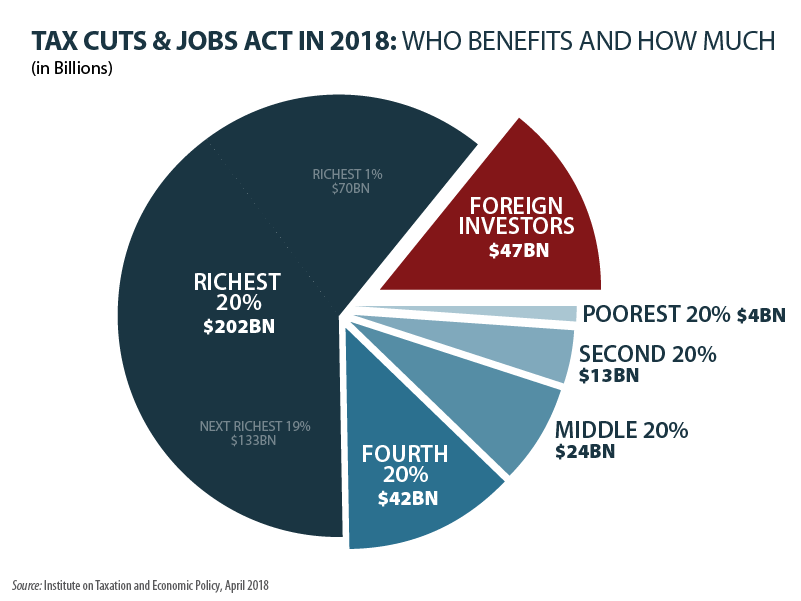

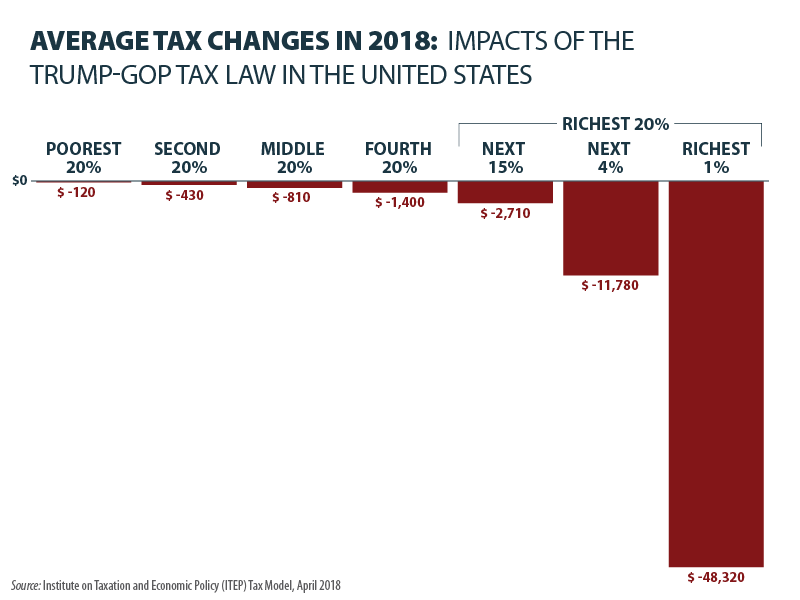

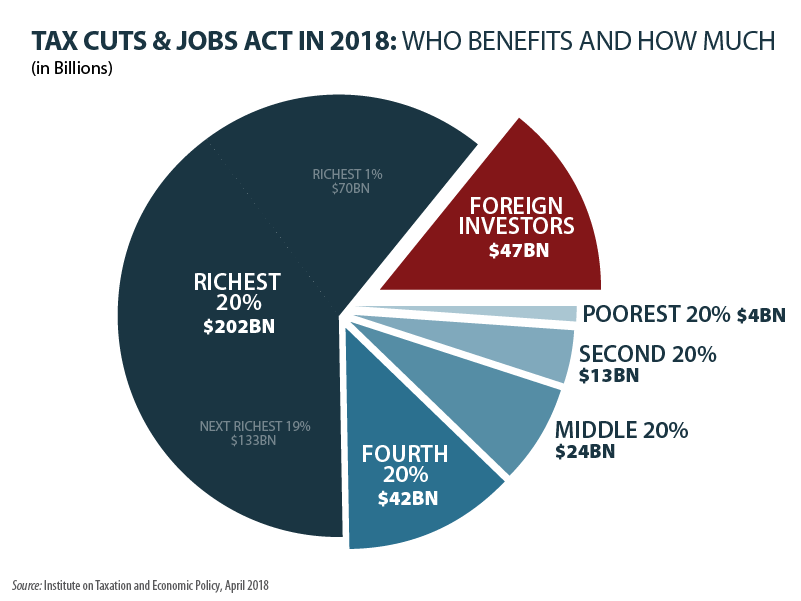

3.) The majority of the Trump-GOP tax cuts go to the wealthy.

4.) Foreign investors collectively will benefit more from the Trump-GOP tax law than the bottom 60 percent of tax payers.

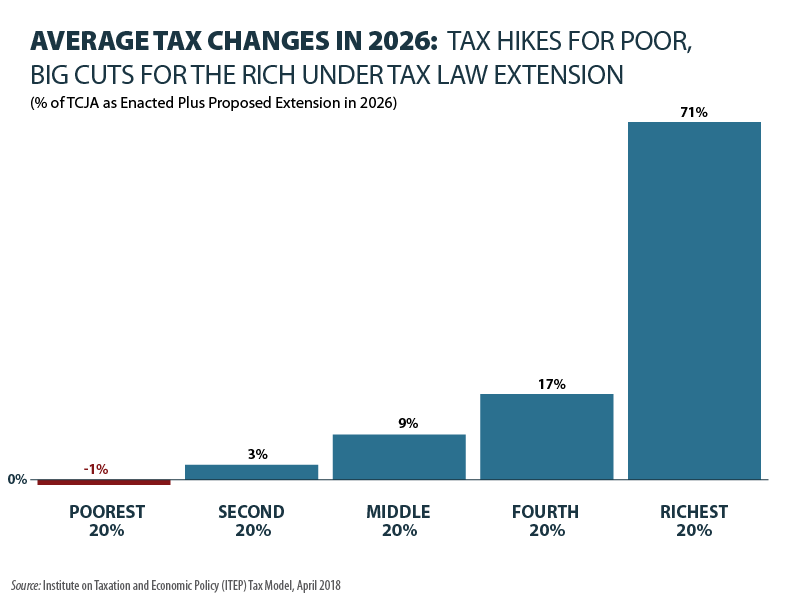

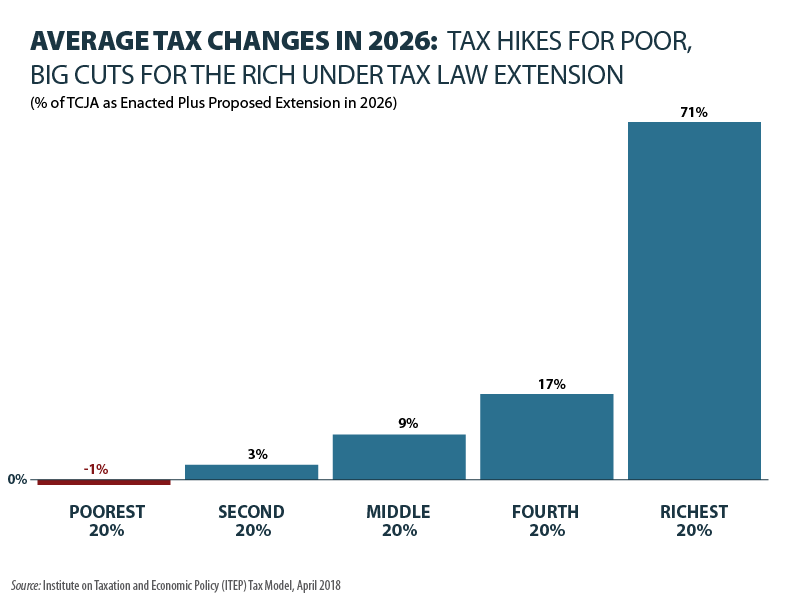

5.) If Congress extends the Trump-GOP tax cuts, the top 1 percent would get an annual tax break of more than $29,000.

- Making permanent all of the Trump-GOP tax law would maintain the law’s regressive tax cuts, with 71 percent going to the richest fifth of taxpayers, providing the richest one percent an average annual tax break of $29,910 dollars.

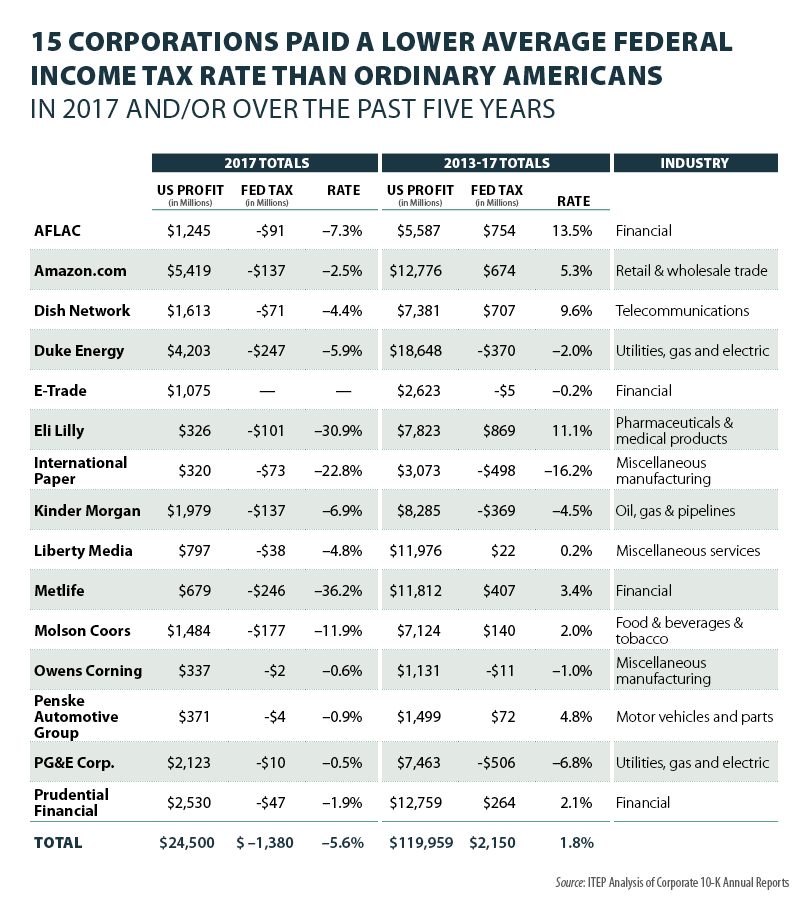

6.) Corporate tax rates were already low before the Trump-GOP tax law cut them further.

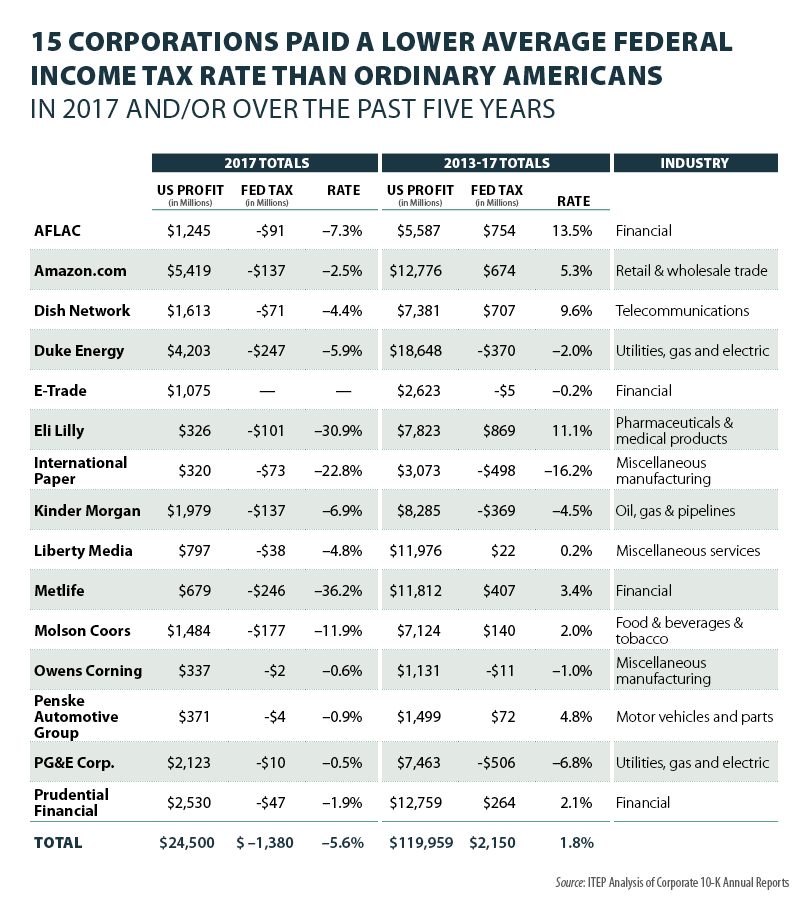

- Many major profitable corporations from diverse sectors, including Amazon, Dish Network, Molson Coors, Metlife, and Prudential Financial, paid nothing in federal income taxes in 2017.

- Corporate tax collections in 2016 were below the OECD average as a share of GDP and could become the lowest of any developed country moving forward, thanks to the Trump-GOP tax cuts.

- Many companies, such as AT&T, Boeing, Bank of American, and AFLAC, that have announced one-time worker bonuses in light of the Trump-GOP tax law have been paying tax rates of 21 percent or below for years. The fact that they were already paying low rates undermines the suggestion that the tax law drove these one-time bonuses.

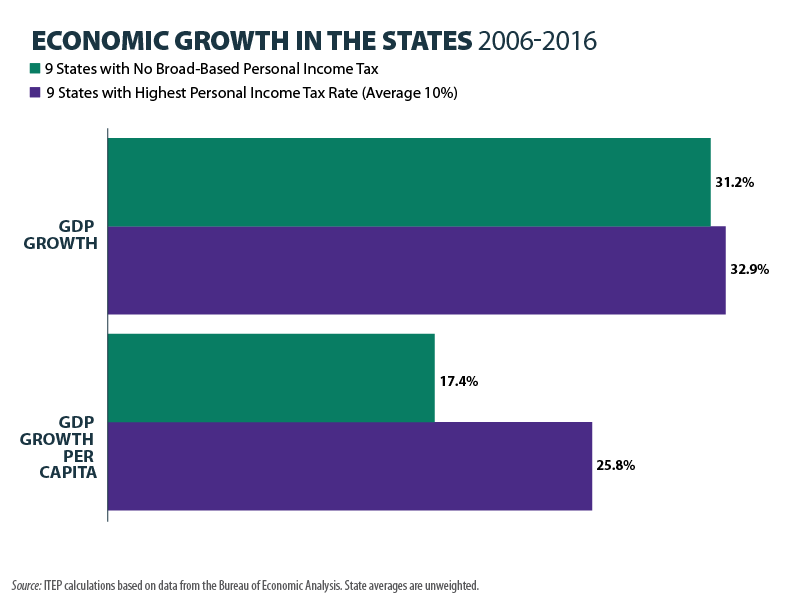

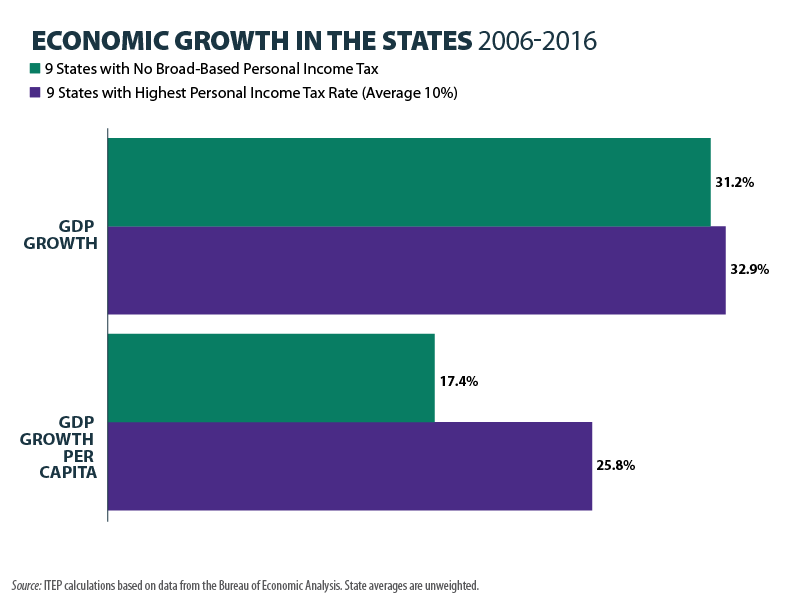

7.) Tax cuts for the rich and corporations do not trickle down or spur economic growth.

- Using data from the past 65 years, the Congressional Research Service (CRS) has found that there is no correlation between top tax rates and economic growth. This conclusion holds true at the state level, where research from ITEP and academic economists has shown lowering or eliminating state income taxes has little if any impact on state economies.

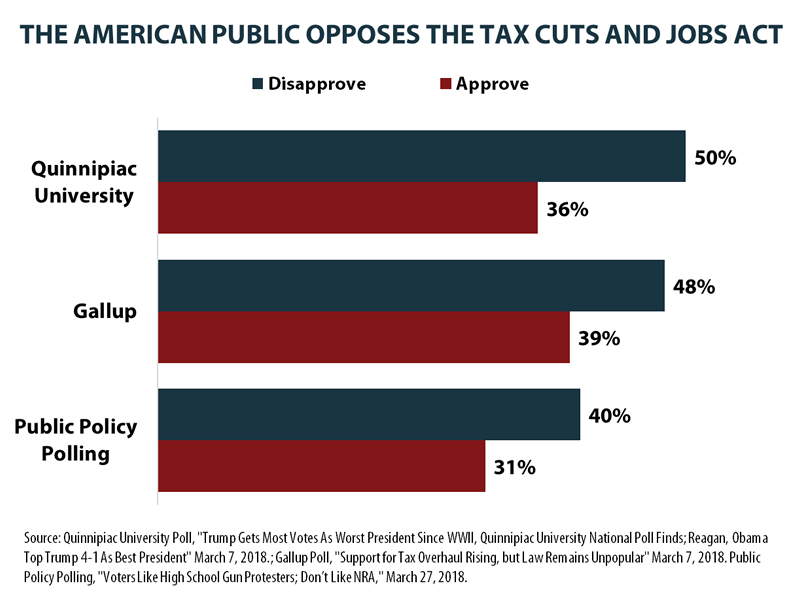

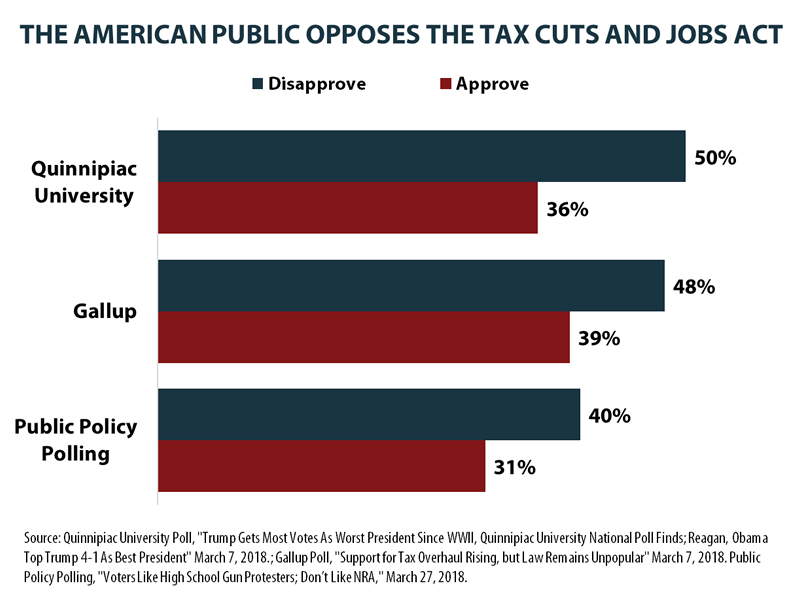

8.) The American public opposes the Trump-GOP tax law and believes the wealthy and corporations should pay more.

- Three recent polls about the Trump-GOP tax law all reveal that more Americans oppose the law than support it. A recent Quinnipiac University Poll found that 50 percent of voters disapprove of the Trump-GOP tax law versus 36 percent who approve. Similarly, a recent Gallup survey found that 48 percent of Americans disapprove of the Trump-GOP tax law, while 39 percent approve of it. In addition, a recent Public Policy Polling national poll found that only 31 percent of voters support the Trump-GOP tax law, while 40 percent oppose it.

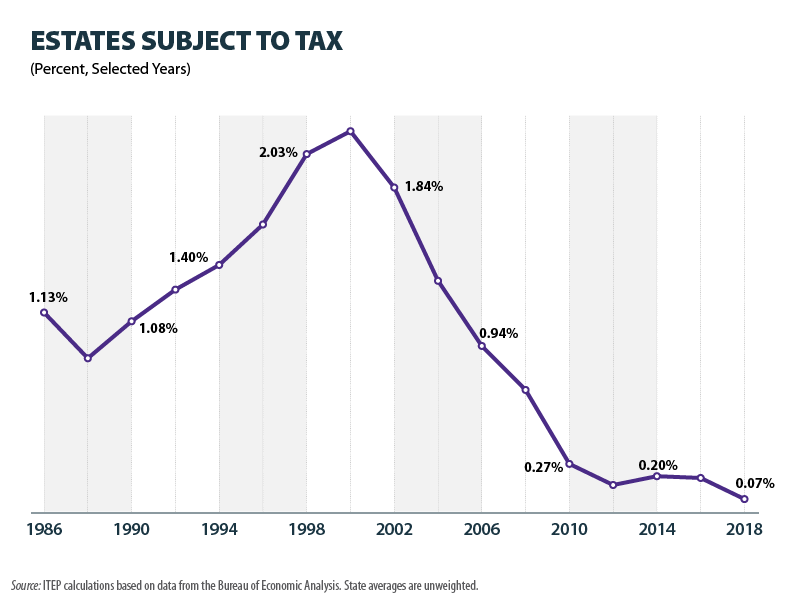

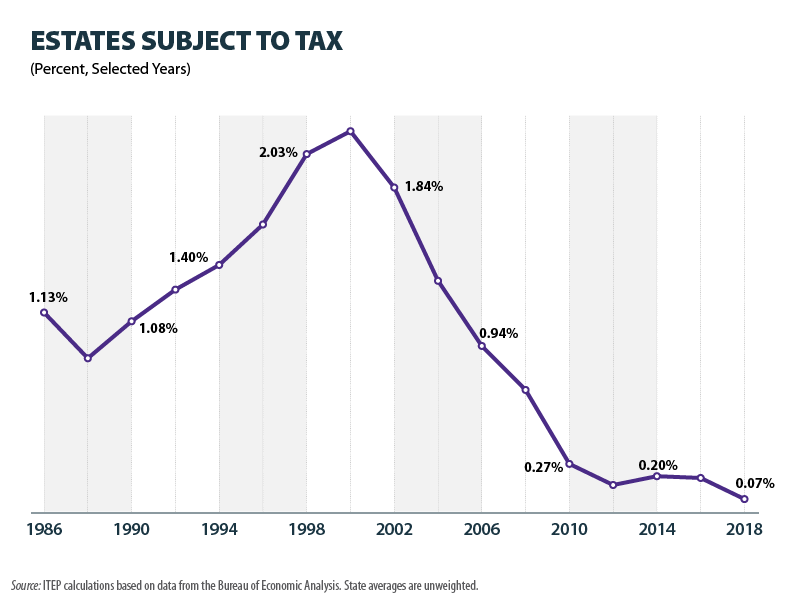

9.) Only a fraction of 1 percent of all estates (0.07) pay the estate tax

- Due to the doubling of the estate tax exemption in the Trump-GOP tax law, the vast majority of wealthy estates will not pay any estate tax. In fact, only 0.07 percent ( 7 out of every 10,000 estates) will owe anything in the federal estate tax going forward.

- The amount of an estate that is exempt from taxation increased to $11.2 million from $5.6 million. For married couples, the exemption is now $22.4 million.

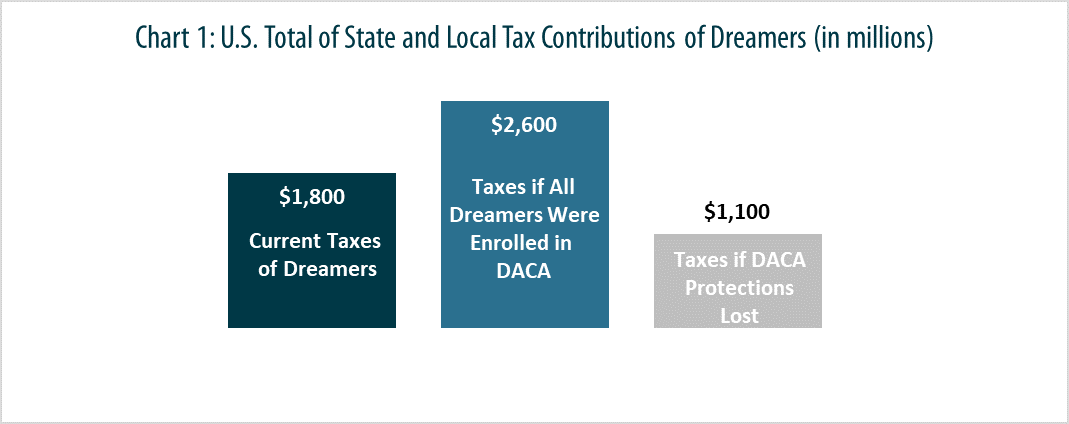

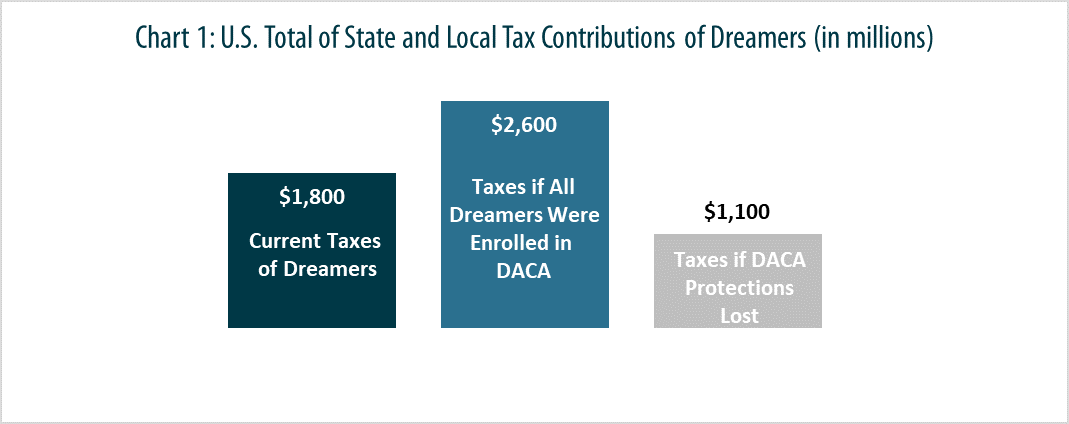

10.) Undocumented immigrants pay taxes.

- Undocumented immigrants who are receiving or are eligible for Deferred Action for Childhood Arrivals (DACA), also known as Dreamers, pay $1.7 billion in state and local taxes each year. If their DACA protections are lost, state and local governments could lose $696 million in needed revenue.

- Undocumented immigrants contribute 8 percent of their incomes in state and local taxes on average, which is on par with the rate paid by other working people and higher than the average 5.4 percent average tax rate paid by the richest 1 percent of taxpayers.