ITEP's Research Priorities

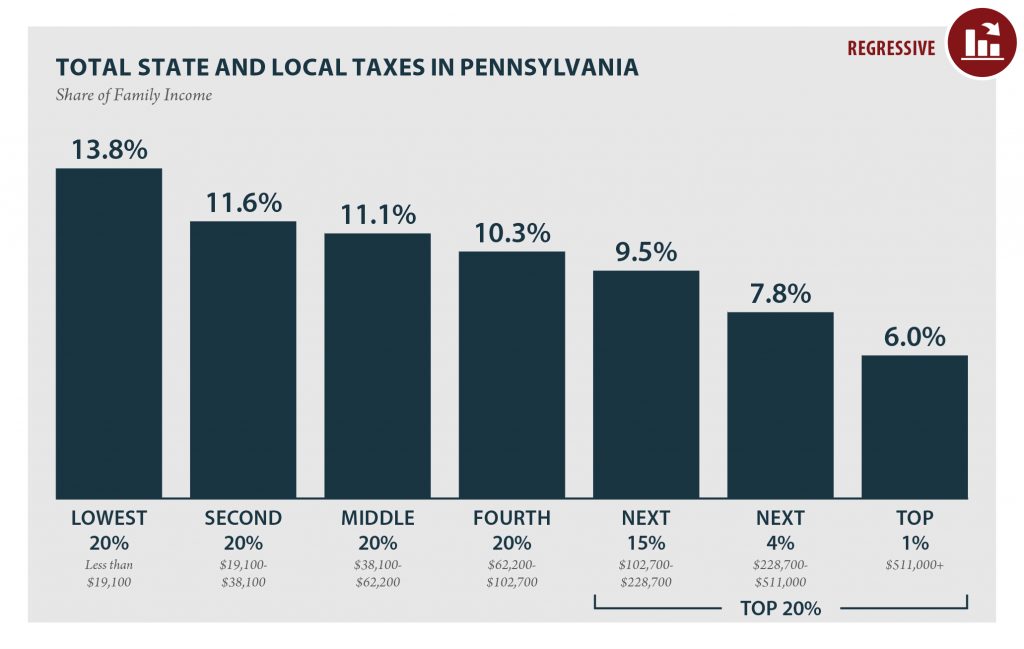

Pennsylvania: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

PENNSYLVANIA Read as PDF PENNSYLVANIA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,100 $19,100 to $38,100 $38,100 to $62,200 $62,200 to $102,700 $102,700 to $228,700 $228,700 to $511,000 over $511,000 […]

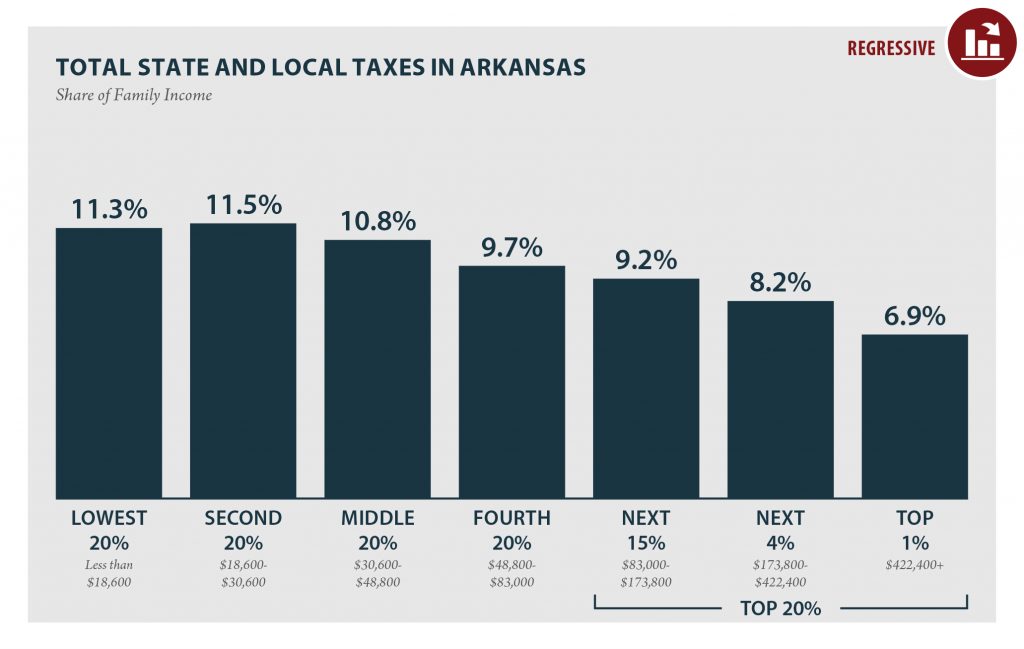

Arkansas: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

ARKANSAS Read as PDF ARKANSAS STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,600 $18,600 to $30,600 $30,600 to $48,800 $48,800 to $83,000 $83,000 to $173,800 $173,800 to $422,400 over $422,400 […]

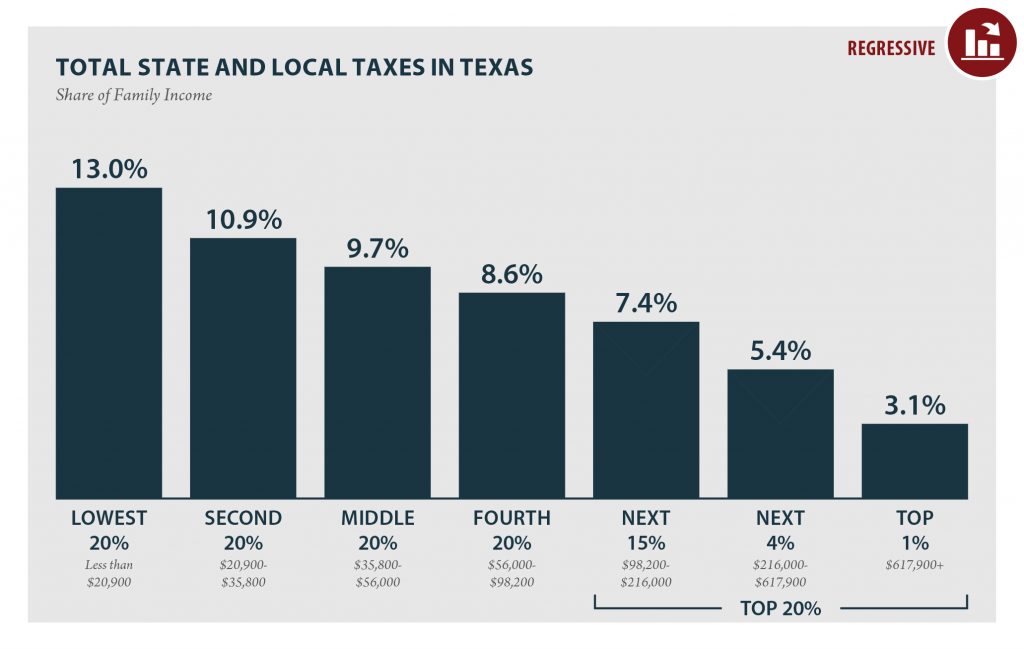

Texas: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

TEXAS Read as PDF TEXAS STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $20,900 $20,900 to $35,800 $35,800 to $56,000 $56,000 to $98,200 $98,200 to $216,000 $216,000 to $617,900 over $617,900 […]

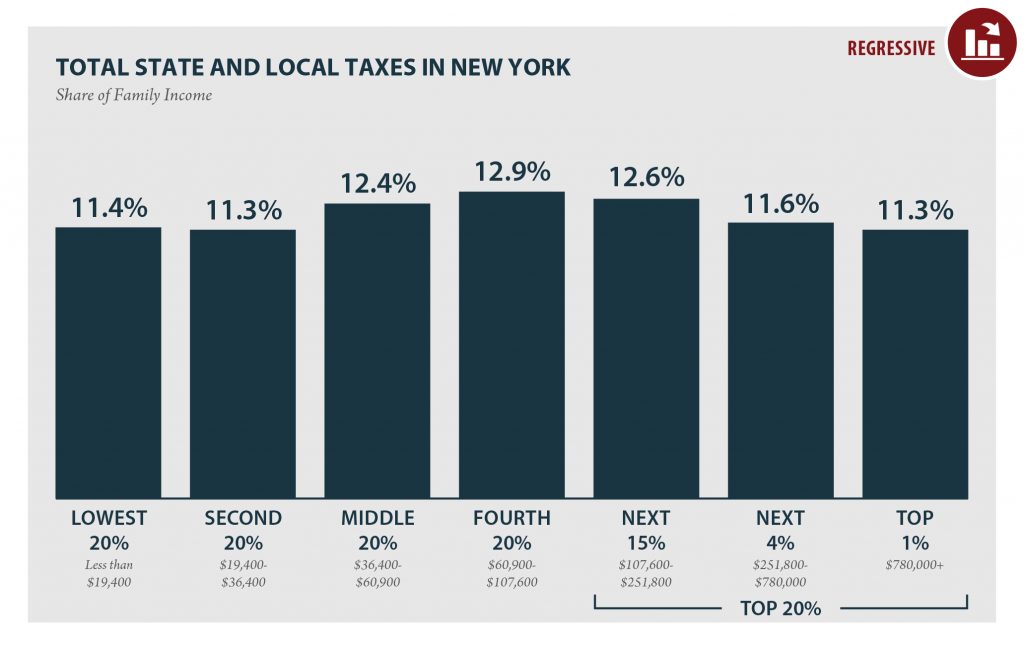

New York: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

NEW YORK Read as PDF NEW YORK STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,400 $19,400 to $36,400 $36,400 to $60,900 $60,900 to $107,600 $107,600 to $251,800 $251,800 to $780,000 […]

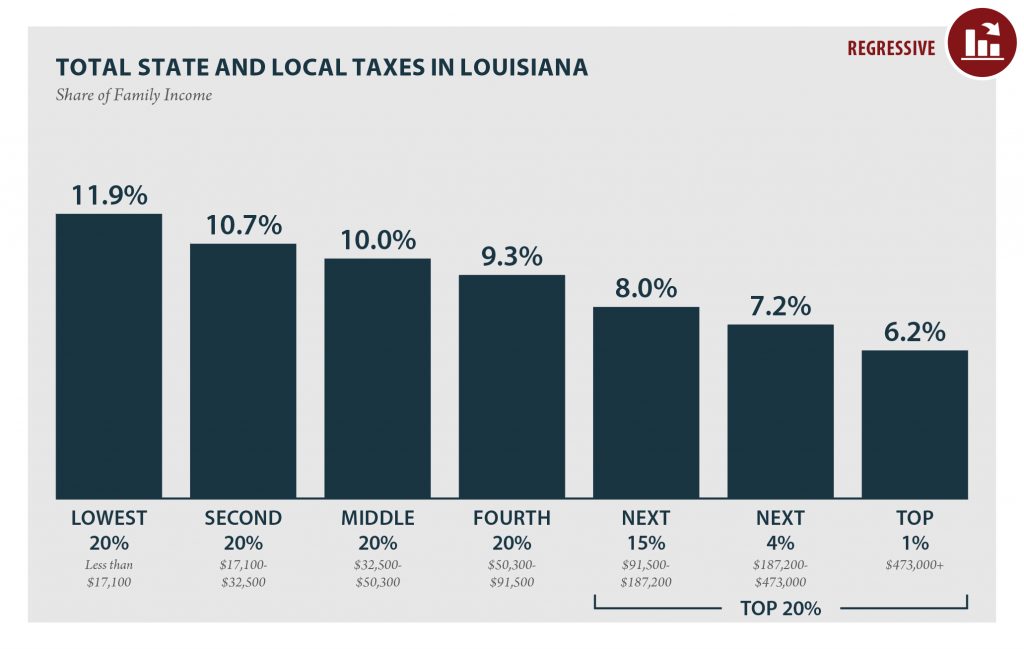

Louisiana: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

LOUISIANA Read as PDF LOUISIANA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,100 $17,100 to $32,500 $32,500 to $50,300 $50,300 to $91,500 $91,500 to $187,200 $187,200 to $473,000 over $473,000 […]

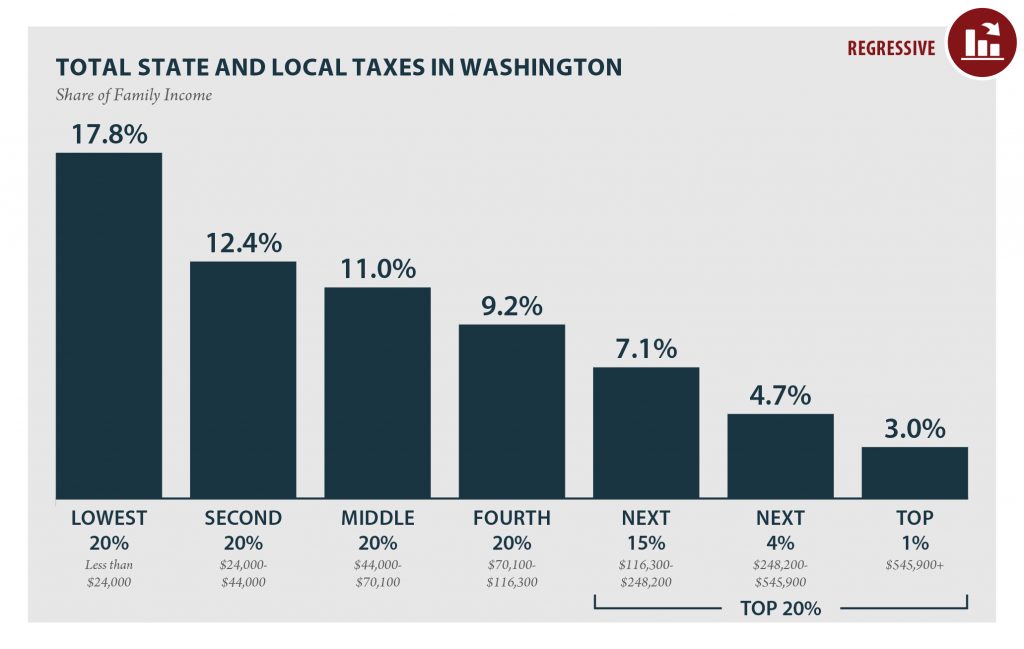

Washington: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

WASHINGTON Read as PDF WASHINGTON STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $24,000 $24,000 to $44,000 $44,000 to $70,100 $70,100 to $116,300 $116,300 to $248,200 $248,200 to $545,900 over $545,900 […]

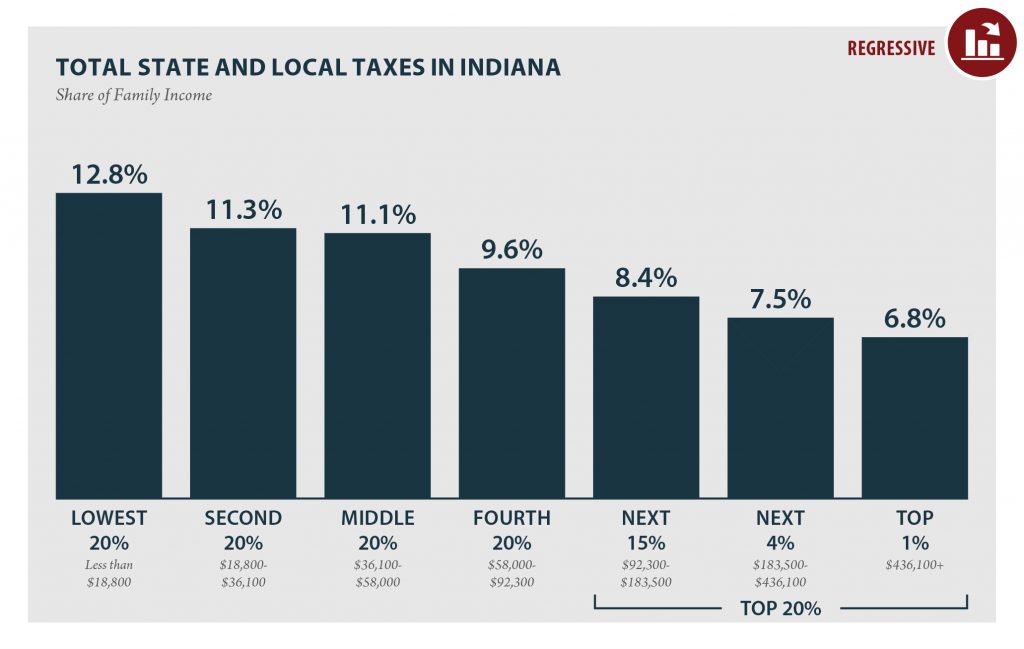

Indiana: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

INDIANA Read as PDF INDIANA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,800 $18,800 to $36,100 $36,100 to $58,000 $58,000 to $92,300 $92,300 to $183,500 $183,500 to $436,100 over $436,100 […]

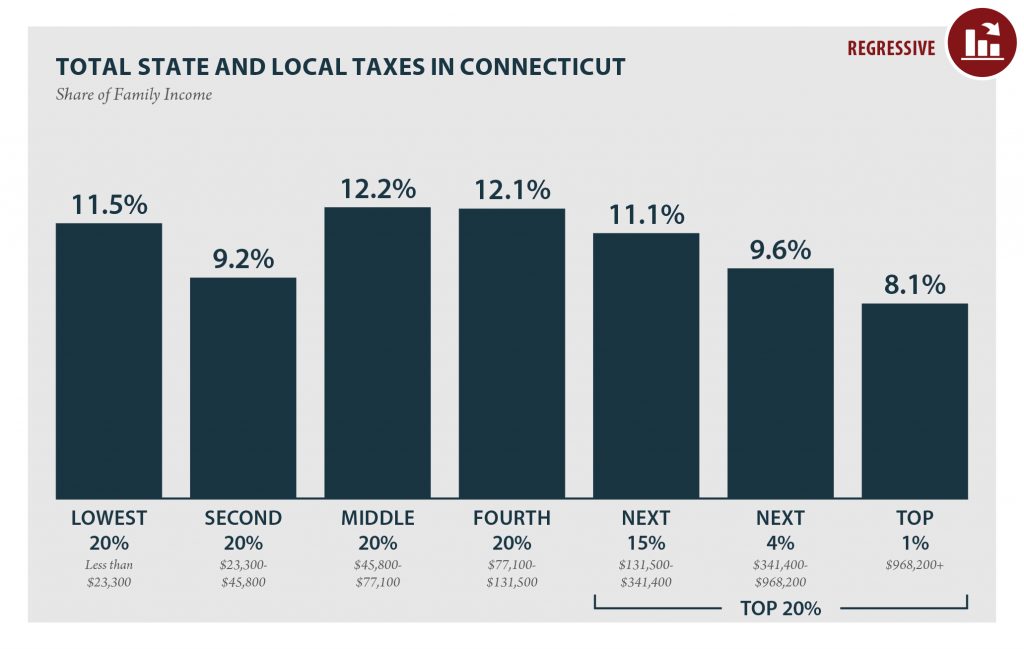

Connecticut: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

CONNECTICUT Read as PDF CONNECTICUT STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $23,300 $23,300 to $45,800 $45,800 to $77,100 $77,100 to $131,500 $131,500 to $341,400 $341,400 to $968,200 over $968,200 […]

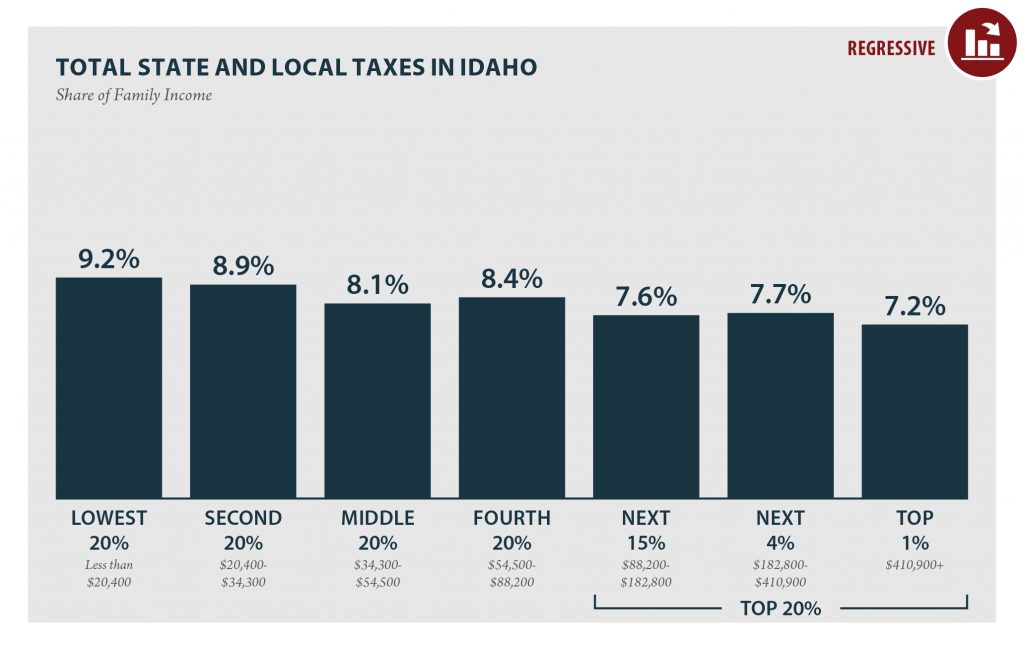

Idaho: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, which measures the impact of each state’s tax system on income inequality, Idaho has the 38th most unfair state and local tax system in the country. Incomes are more unequal in Idaho after state and local taxes are collected than before.

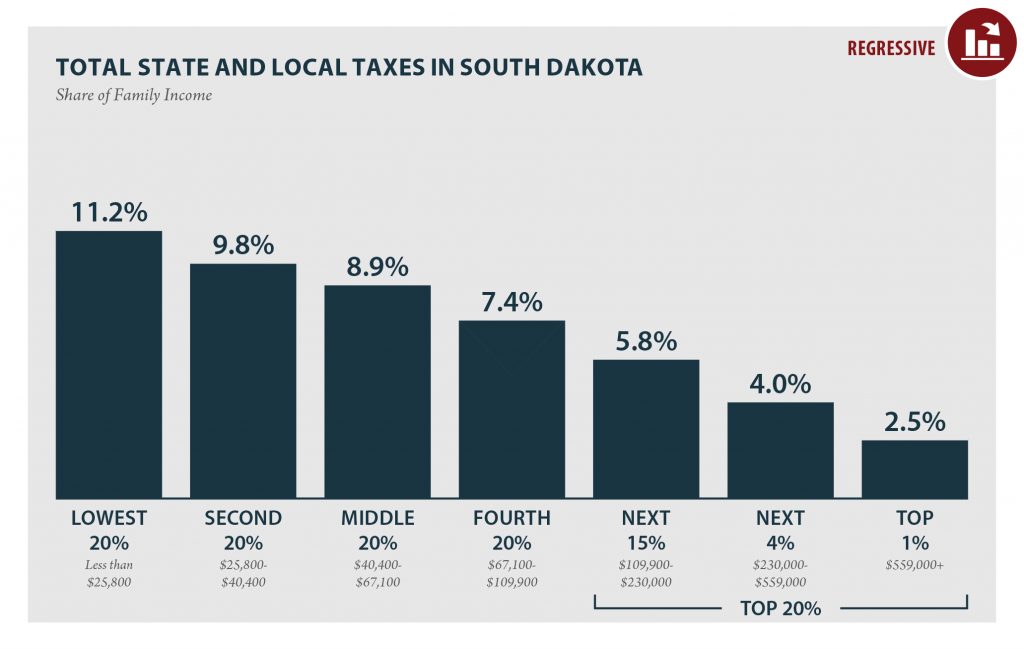

South Dakota: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

SOUTH DAKOTA Read as PDF SOUTH DAKOTA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $25,800 $25,800 to $40,400 $40,400 to $67,100 $67,100 to $109,900 $109,900 to $230,000 $230,000 to $559,000 […]

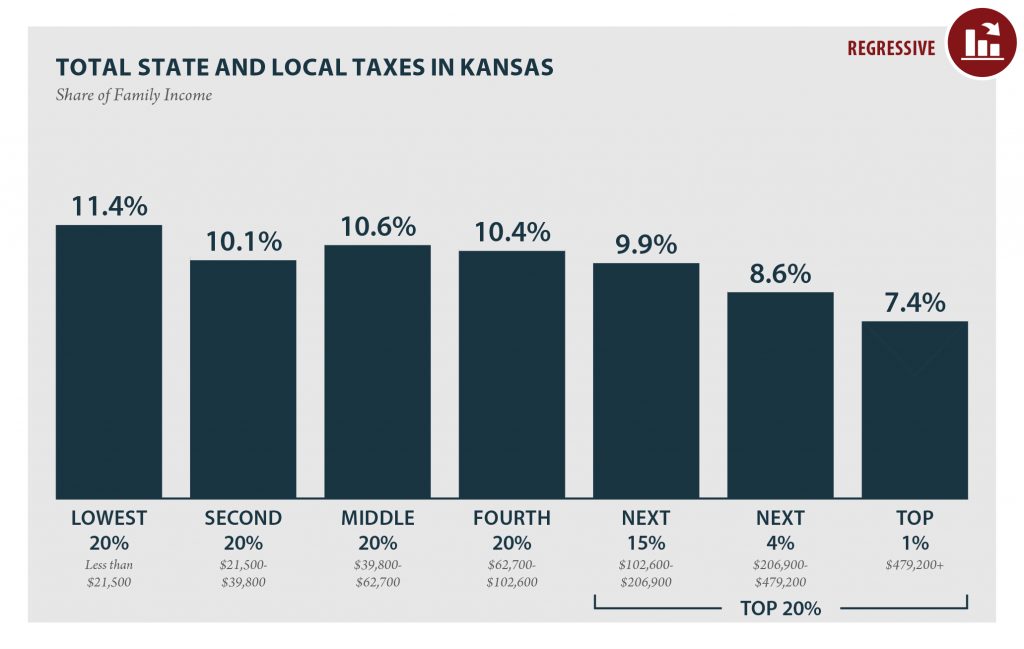

Kansas: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

KANSAS Read as PDF KANSAS STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $21,500 $21,500 to $39,800 $39,800 to $62,700 $62,700 to $102,600 $102,600 to $206,900 $206,900 to $479,200 over $479,200 […]

The American Prospect: Think the GOP Tax Cut Was for the Rich? Actually, It Was for the White and Rich.

October 16, 2018

The $1.5 trillion tax cut signed into law last December by President Trump is not only widening the economic gap between the rich and everyone else, but also between white Americans and people of color. That’s according to a new, first-of-its-kind analysis of the 2017 Republican Tax Act by the Institute on Taxation and Economic Policy (ITEP) and Prosperity Now, a nonprofit advocacy group for low-income households. Using an economic model created by ITEP, the report drills down on the racial implications of the Republicans’ handiwork. The report’s authors found that racial inequities are a feature of the tax law, not a…

Truthout: North Carolina Ballot Initiative Would Enshrine Tax Cuts for the Rich

October 16, 2018

“Since 2012, when Republicans took full control of the legislature and governorship for the first time in modern history, they’ve been on a tax cutting rampage,” said Meg Wiehe, a North Carolina native and deputy director of the Institute on Taxation and Economic Policy. “The state will be about $3.6 billion shorter in revenue than it would have been otherwise, which is a pretty significant difference in a state with a general fund of just around $21 billion.”

Pod Save the People: Flint: Lead & Beyond

October 16, 2018

DeRay, Brittany, Sam and Clint discuss the overlooked news, including the decline of U.S. prison populations, how American abortion policies affect women around the world, the death penalty, and who benefits from President Trump's tax cuts. (Podcast)

Law360: State Tax Codes Can Help Mitigate Poverty

October 15, 2018

State lawmakers have a tremendous opportunity to combat poverty with smart tax policies that can improve the lives of millions. Specifically, refundable tax credits for low-income workers and their families can play a role in positioning the nation’s most vulnerable families for success. Tax credits are also a vital tool for mitigating the upside-down nature of most state and local tax systems, which take a greater share of income from low- and middle-income families than from wealthy families. They are also especially important at a time when many federal lawmakers are determined to dismantle the safety net creating even more…

Mother Jones: A New Study Shows White Families Getting Four-Fifths of Trump’s Tax Cut

October 13, 2018

“Households of color have less income and have less wealth than white households, in large part due to centuries of systemic racism,” says Meg Wiehe, ITEP’s deputy director and one of the report’s authors. “So inevitably a tax cut that’s so expensive and so tilted to the top is furthering not just income inequality—it’s also furthering racial inequity in income and in wealth.”

Orlando Sentinel: Commentary: Vote No On Amendment 5: Allows a Few to Thwart the Needs of Many

October 12, 2018

This amendment would lock in tax breaks and loopholes for the wealthy and large corporations, making our tax system even more unfair than it is now. The nonpartisan Institute on Taxation and Economic Policy reports that only one state ranks lower in terms of the fairness of its tax system. Floridians who make $17,000 pay nearly 13 percent of their income in state and local taxes, and those who make more than $489,000 pay less than 2 percent. Amendment 5 would permanently enshrine this discrimination in our Constitution.

PolitiFact: Do Trump Tariffs Cost More Than Affordable Care Act Taxes?

October 12, 2018

Matt Gardner, a senior fellow at the Institute on Taxation and Economic Policy, added that regardless of imports volume, we don’t know how they will get passed through by the companies paying them, either. And not everyone has to pay them -- consumers could simply redirect their demand.

WBOC16: Incorporating in Delaware: The Perks and Pitfalls

October 12, 2018

Some critics of Delaware LLCs say until Delaware's corporate code is adjusted, criminal activity will continue to exist in Delaware's corporations. Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, authored a report entitled "Delaware: An Onshore Tax Haven."

Louisiana Budget Project: Federal Tax Cut Worsening Racial Wealth Divide

October 12, 2018

While President Trump and Republicans in Congress heralded the Tax Cut and Jobs Act of 2017 as a major tax cut for the middle class, the numbers don’t bear that out. A new analysis by researchers at Prosperity Now and the Institute on Taxation and Economic Policy reveals just how much of the federal tax cut benefits went to the highest income earners, and the crumbs that were left over for low and middle-class households.

State Rundown 10/12: Local Jurisdictions Fighting for Revenues, Independence

October 12, 2018 • By ITEP Staff

Voters all around the country are educating themselves for the upcoming elections, notably this week around ballot initiatives in Arizona and Colorado and competing gubernatorial tax proposals in Georgia and Illinois. But not all eyes are on the elections, as the relationship between state and local policy made news in Delaware, Idaho, North Dakota, and Ohio.

The Guardian: I’m Undocumented. It’s Time to Reveal What That Actually Means

October 12, 2018

Nationwide, the amount of taxes that the Internal Revenue Service collects from undocumented workers ranges from almost $2.2m in Montana, which has an estimated undocumented population of 4,000, to more than $3.1bn in California, which is home to more than 3 million undocumented immigrants. According to the non-partisan Institute on Taxation and Economic Policy, undocumented immigrants nationwide pay an estimated 8% of their incomes in state and local taxes on average. To put that in perspective, the top 1% of taxpayers pay an average nationwide effective tax rate of just 5.4%.

TalkPoverty: North Carolina Legislators Want to Add Tax Breaks for the Rich to the State Constitution

October 11, 2018

“Since 2012, when Republicans took full control of the legislature and governorship for the first time in modern history, they’ve been on a tax cutting rampage,” said Meg Wiehe, a North Carolina native and deputy director of the Institute on Taxation and Economic Policy. “The state will be about $3.6 billion shorter in revenue than it would have been otherwise, which is a pretty significant difference in a state with a general fund of just around $21 billion.”

Law360: TCJA Increases Racial, Economic Tax Divides, Report Says

October 11, 2018

The recent federal tax overhaul disproportionately benefits white households over households of color, increasing the wealth gap not just along income lines but along racial lines as well, according to a...

New York Times: White Americans Gain the Most From Trump’s Tax Cuts, a Report Finds

October 11, 2018

The tax cuts that President Trump signed into law last year are disproportionately helping white Americans over African-Americans and Latinos, a disparity that reflects longstanding racial economic inequality in the United States and the choices that Republicans made in crafting the law.