2025 tax debate

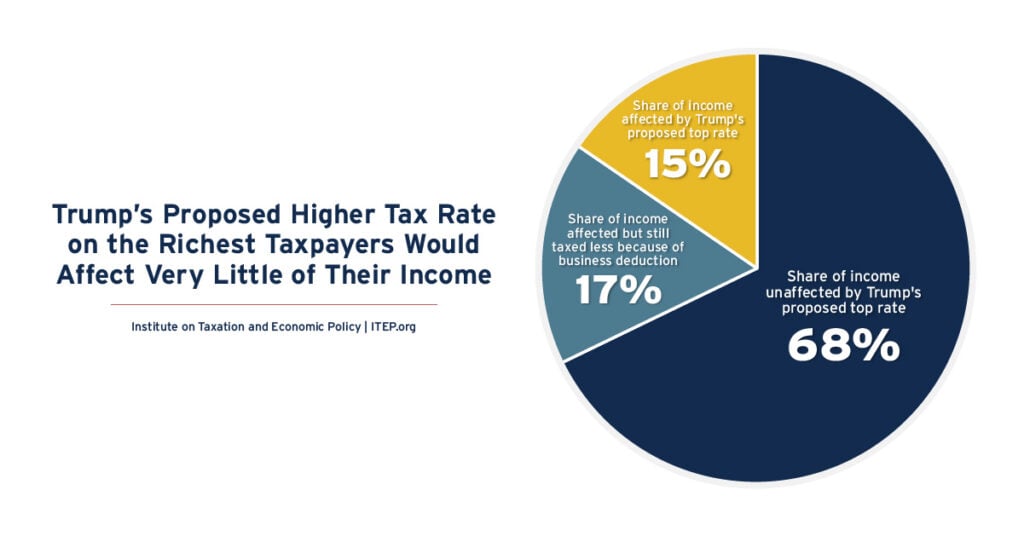

Trump’s Proposed Higher Tax Rate on the Richest Taxpayers Would Affect Very Little of Their Income

May 10, 2025 • By Carl Davis, Steve Wamhoff

President Donald Trump has proposed allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers. But many other special breaks in the tax code would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

The tariffs proposed by Donald Trump, which are far larger than any on the books today, would significantly raise the prices faced by American consumers across the income scale.

It’s Tax Day. You’ve Paid Your Share, but the Billionaires Haven’t.

April 15, 2025 • By Amy Hanauer

You likely had most of your federal taxes deducted from your paychecks throughout the year. This is not true, however, for mega-millionaires and billionaires, some of whom are practically running our government right now.

Senate Republicans Rig Congressional Rules to Make Their Tax Cuts Appear Cost-Free

April 4, 2025 • By Steve Wamhoff

This week, members of Congress are arguing about whether extending Trump’s 2017 tax cuts would cost trillions of dollars over a decade or cost nothing.

Two Ways a 2025 Federal Tax Bill Could Worsen Income and Racial Inequality

March 26, 2025 • By Joe Hughes

Two parts of Trump’s 2017 tax law that are particularly expensive and beneficial to the richest individuals are the changes in income tax rates and brackets and the special deduction for “pass-through” business owners. Lawmakers should not extend these provisions for high-income households past the end of this year, when they are scheduled to expire.

Trump and Congress’ Tax Package Likely to Worsen Racial Inequities

January 29, 2025 • By Brakeyshia Samms

While the country transitions to a new, yet familiar, presidential administration, lawmakers must keep in mind: fighting racial injustice should still be one of the focal points of this year’s tax debates. In theory, the debate over extending much of 2017’s Trump tax law represents an opportunity to advance racial equity. In practice, the tax package is likely to do the opposite, worsening racial inequities that already exist.

Different Approaches to the Trump Tax Law’s Cap on Deductions for State and Local Taxes (SALT)

January 17, 2025 • By Steve Wamhoff

President Trump and the Republican majorities in the House and Senate may not extend the $10,000 cap on federal income tax deductions for state and local taxes (SALT), the one part of the 2017 law that significantly limits tax breaks for the rich. And, depending on which proposal they settle on, leaving out the existing cap on SALT deductions could add between $10 billion and over $100 billion each year to the total cost of their tax plan.

Congress Could — But Won’t — Pass a Tax Package That Pays for Itself

January 17, 2025 • By Joe Hughes

If Republican lawmakers were serious about deficit-neutral tax reform, they would focus on increasing taxes for the ultra-wealthy and large corporations. The absence of such proposals in their plan reveals their true priority: delivering enormous tax cuts to the wealthiest Americans while average working families receive crumbs.

Trump’s Plan to Extend His 2017 Tax Provisions: Updated National and State-by-State Estimates

January 8, 2025 • By Steve Wamhoff

Trump’s plan to make most of the temporary provisions of his 2017 tax law permanent would disproportionately benefit the richest Americans. This includes all major provisions except the $10,000 cap on deductions for state and local taxes (SALT) paid.

Billionaires and businesses have too much power in Washington. Tax revenue is needed to pay for things we all need. If we want economic justice, racial justice and climate justice, we must have tax justice.

How Tax Decisions in 2025 Can Advance Racial Justice

October 30, 2024 • By Brakeyshia Samms, Jon Whiten

In the coming 14 months, federal lawmakers should address longstanding issues of racism in the tax code. With a presidential election this fall and many provisions of 2017’s Trump tax law expiring at the end of 2025, the debate over tax policy and economic fairness is in full swing.

Fifteen Companies Each Avoided More than $1 Billion in Taxes from a Single Trump Tax Cut

October 10, 2024 • By Joe Hughes, Spandan Marasini

The deduction for Foreign-Derived Intangible Income (FDII), one of the tax cuts included in former President Trump’s signature 2017 tax law, provides a lower effective tax rate on income earned from intangible assets, such as patents, trademarks, and other forms of intellectual property. Since the law went into effect in 2018, 15 corporations have separately reported more than $1 billion in tax benefits. Alphabet (the parent company of Google) reported the most, at more than $11 billion in tax breaks from 2018 to 2023. Other beneficiaries include large tech firms such as Meta, Microsoft, Intel, and Qualcomm.

Extending Temporary Provisions of the 2017 Trump Tax Law: Updated National and State-by-State Estimates

September 13, 2024 • By Steve Wamhoff

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans. Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s […]

After the dust settles on this year’s election, one of the most pressing issues confronting the next Congress and President will be how to deal with the expiration of the 2017 Trump tax cuts and, more specifically, who will pay for the cost of extending some or all of those cuts. Among the more widely accepted ideas circulating on the right is to raise income taxes on single parents, more than four in five of whom are women and a disproportionate share of whom are people of color.

Corporate Tax Breaks Contribute to Income and Racial Inequality and Shift Resources to Foreign Investors

July 16, 2024 • By Emma Sifre, Steve Wamhoff

Corporate tax cuts and corporate tax avoidance worsen income and racial inequality in our country. Most of the benefits flow to foreign investors and the richest 20% of Americans.

Corporate Taxes Before and After the Trump Tax Law

May 2, 2024 • By Matthew Gardner, Michael Ettlinger, Spandan Marasini, Steve Wamhoff

The Trump tax law slashed taxes for America’s largest, consistently profitable corporations. These companies saw their effective tax rates fall from an average of 22.0 percent to an average of 12.8 percent after the Trump tax law went into effect in 2018.

Corporate Tax Avoidance in the First Five Years of the Trump Tax Law

February 29, 2024 • By Matthew Gardner, Spandan Marasini, Steve Wamhoff

The Trump tax law overhaul cut the federal corporate income tax rate from 35 percent to 21 percent, but during the first five years it has been in effect, most profitable corporations paid considerably less than that.