The Institute on Taxation and Economic Policy

What's New

D.C.’s Fiscal Autonomy is at Stake, District’s Conformity Decisions Should Stand

February 6, 2026 • By Kamolika Das

Federal lawmakers passed a bill along party lines that would force the District of Columbia to override the decision of local elected officials and implement all of the costly and inequitable federal tax cuts passed under the “One Big Beautiful Bill Act” (OBBBA).

Four Big Tech Companies Avoid $51 Billion in Taxes in Wake of One Big Beautiful Bill Act

February 6, 2026 • By Matthew Gardner

Four of the corporations whose CEOs flanked President Trump at his 2025 inauguration ceremony have now disclosed that they collectively received $51 billion in federal tax breaks in 2025, much of that likely from the One Big Beautiful Bill Act (OBBBA).

State Rundown 2/5: Icy Roads Do Not Slow Tax Policy Debates

February 5, 2026 • By ITEP Staff

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

Meta’s Federal Tax Rate Hits an All-Time Low Due to Breaks Expanded by Trump Tax Law

February 4, 2026 • By Matthew Gardner

The company paid an effective federal income tax rate of just over 3.5% in 2025, the lowest it has recorded since the company went public as Facebook in 2012.

Trust Reform is Needed to Protect States, Especially in the Wake of IRS Enforcement Cuts

February 3, 2026 • By Sarah Austin

Trust use is widespread among the wealthiest households, with reports showing that roughly half of the nation’s wealthiest people rely on trusts for tax avoidance reasons

ITEP in the News

Newsweek: Major Tax Disruption Faces Over 300,000 Taxpayers—’Sabotage’

Associated Press: Trump's $10 Billion Lawsuit Against the IRS Raises Conflict of Interest Concerns

The American Prospect: Tesla's Wile E. Coyote Moment Is Here

Wall Street Journal: Companies Reveal Big Mystery: Where They Pay Taxes and How Much

Washington Post: How to Claim Tax Breaks on Overtime, Tips, and More This Filing Season

ITEP Work in Action

Reason Foundation: A Cigarette Tax Increase Would Undermine Nebraska's Fiscal Stability and Harm Consumers

FACT Coalition: New Transparency Requirements Reveal Low U.S. Taxes, Continued Use of Tax Havens by Major American Corporations

Economic Progress Institute: Hundreds of Millions in Lost Revenue: The Cost of Rhode Island’s Personal Income Tax Changes

Testimony: ITEP's Carl Davis on Federal/State Tax Conformity at Pair of Vermont Committee Hearings

Cato Institute: Immigrants’ Recent Effects on Government Budgets: 1994–2023

Across the States

Tax Watch

State Tax Watch 2026

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

Get weekly updates by signing up for our State Rundown newsletter.

Learn more about state taxes across the country, read Who Pays?

State Rundown & On the Map

On the Map

State Rundown 2/5: Icy Roads Do Not Slow Tax Policy Debates

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

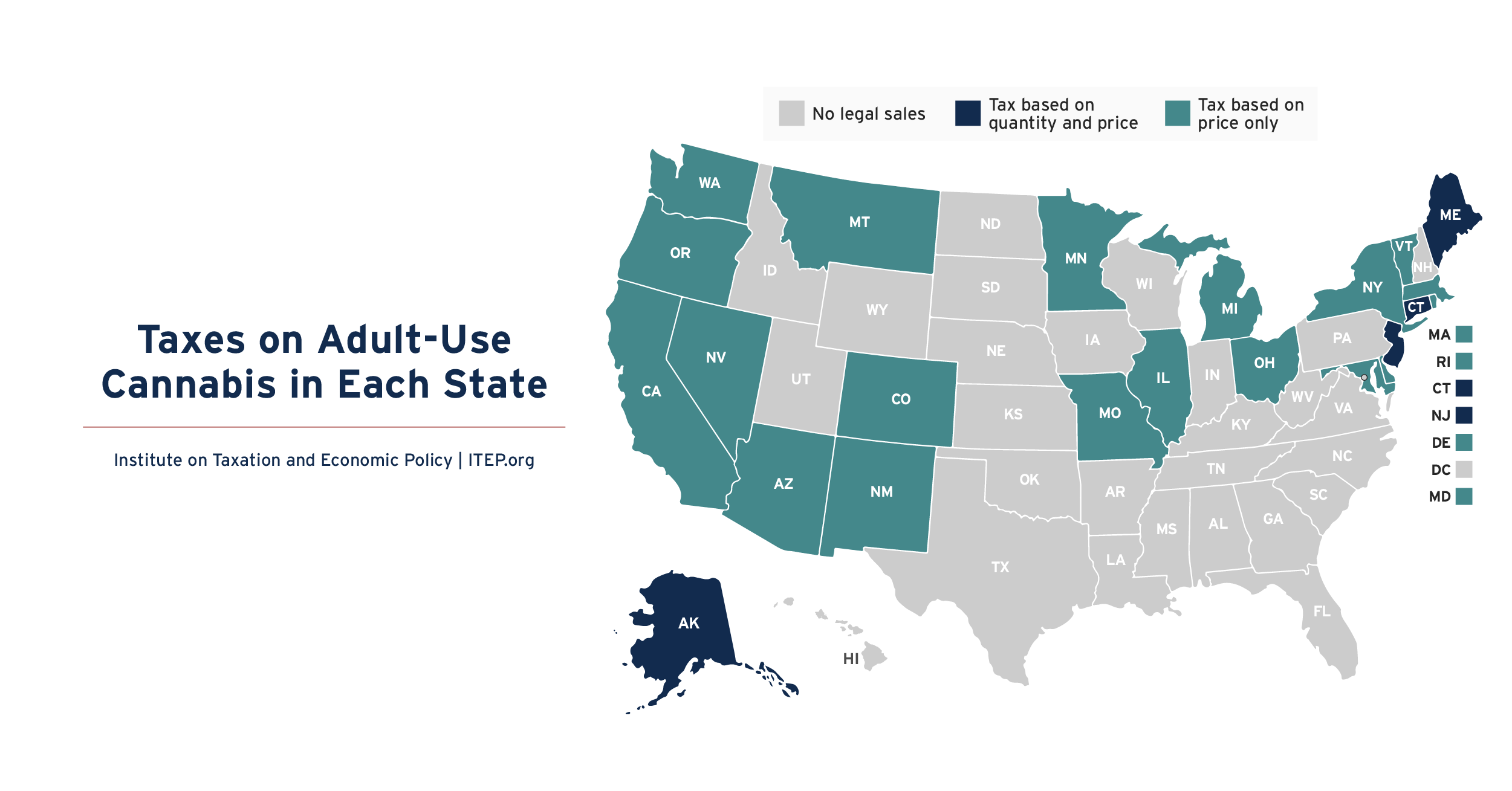

Taxes on Adult-Use Cannabis in Each State

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on…

State & Local Tax Policy

D.C.'s Fiscal Autonomy is at Stake, District's Conformity Decisions Should Stand

February 6, 2026 • By Kamolika Das

Trust Reform is Needed to Protect States, Especially in the Wake of IRS Enforcement Cuts

February 3, 2026 • By Sarah Austin

State Tax Watch 2026

February 2, 2026 • By ITEP Staff

An Anti-Affordability Agenda: Trump’s Advisors Call on States to Raise Taxes on the Working Class and Drastically Cut Taxes for the Rich

January 29, 2026 • By Carl Davis