The Institute on Taxation and Economic Policy stands with activists who are guiding the movement to transform America, dismantle systemic racism in policing, and envision a better justice system. Committed protestors in big cities, small towns, and suburban enclaves have spurred a sea change in public opinion and policy possibility on policing and incarceration. Their work and activism builds on years of action by Black Lives Matter and other leaders.

Racism in our criminal justice system intertwines with other policies, including tax policy. Protestors are raising needed, critical questions on how local and state government budgets are crafted and which investments are prioritized. ITEP supports this struggle, and we will work to build a more racially just tax code. Some past work we’ve done to explore connections between racism and taxes has found:

- The U.S. underinvests in most public essentials when compared to other wealthy democracies, and has for many years. This disproportionately hurts Black communities.

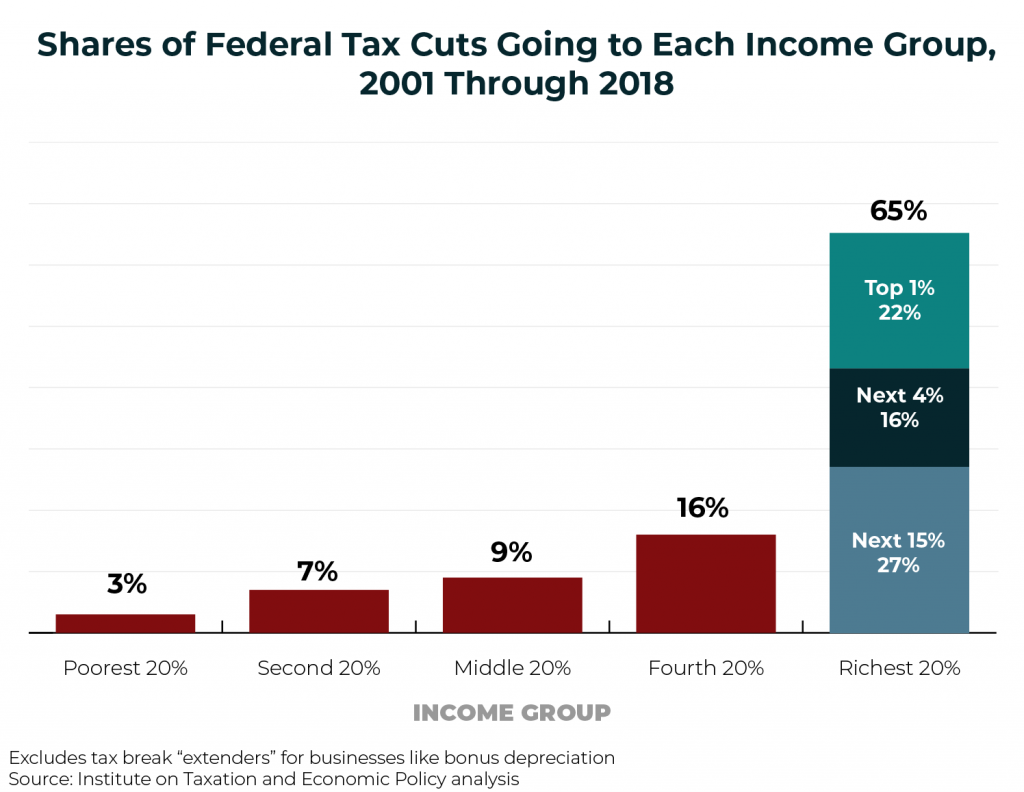

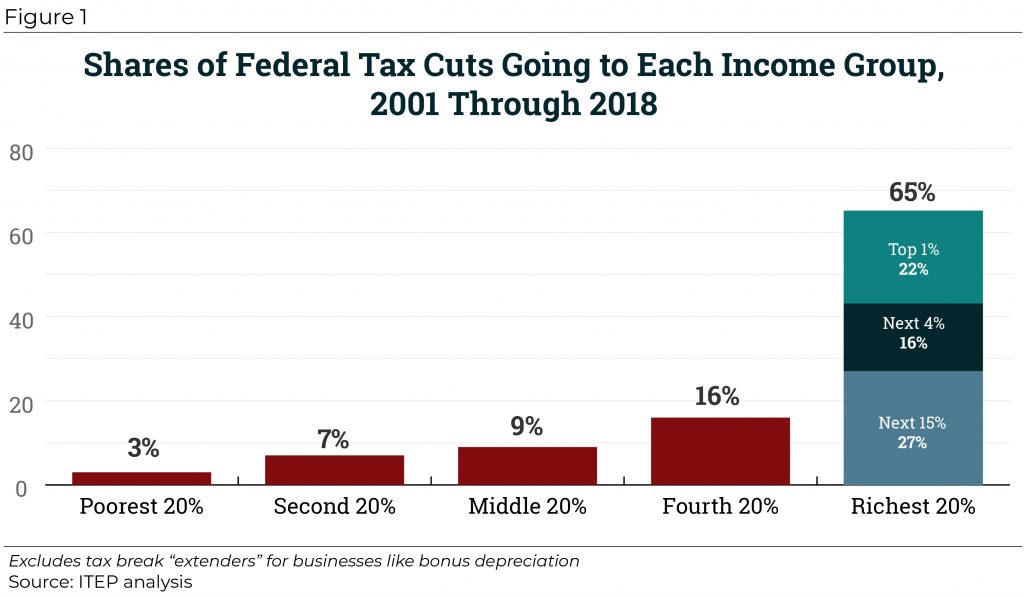

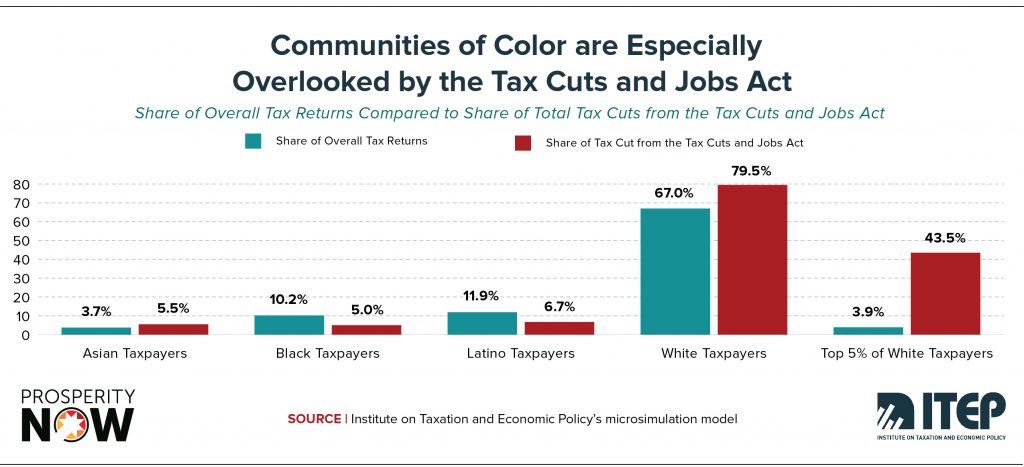

- The 2017 Trump-GOP tax law exacerbated the wealth gap between white and Black and brown communities while it also helped wealthy taxpayers more and deprived the nation of about $2 trillion that could be spent on public needs. Nearly 80% of the bill’s benefits flow to white households and the act supercharges the racial wealth divide. The provisions meant to be directed at struggling neighborhoods have not helped, according to new research, and as we also have previously described.

- Almost all state and local tax codes are already upside down, asking more as a share of income of low- and middle-income than of wealthy families, and more of Black and Hispanic families than of white households. Raising taxes on those most able to pay will advance both racial and economic equity.

- Many local governments rely on fines and fees not to protect public safety but to raise revenue to fund government–this increases negative interactions between police and communities, criminalizes poverty, and makes it more likely that Black people will be pulled over, harassed, arrested, and hurt by police.

- Anti-tax advocates and their political allies have pushed an agenda focused on tax cuts for the rich and corporations, largely benefitting the wealthiest white families and diverting resources from critical investments in people and communities. Tax policy is not race neutral.

- The interconnections between racism and tax policy are clear to activists, like those in the Movement for Black Lives who call for restructuring tax codes as part of their economic platform.

At ITEP, we will build on our past work to understand the connections between racism and tax policy. We have incorporated race and ethnicity into our microsimulation model and are using this capacity to illuminate racial inequities embedded in tax codes at all levels. We are also deepening our understanding of how relying on revenue from fines and fees jeopardizes Black lives. With gratitude toward the activists who are advancing our collective understanding of racism, we commit to work toward tax and economic policy that takes on racism and creates an America that lives up to its stated ideals.