While the results of the 2020 presidential election are all but set in stone—and a sign of life for progressive policy—the results of state tax ballot initiatives are more of a mixed bag. However, the overall fight for tax equity and raising more revenue to invest in people and communities is trending in the right direction.

Though ballots are still trickling in from across the country, President-elect Joe Biden and Vice President-elect Kamala Harris have already made history by being the first ticket to ever get over 80 million votes and are currently winning by a 51 percent to 47 percent margin. It’s hard to overlook the fact that many Americans also voted for a Biden administration that has vowed to raise taxes and limit certain tax breaks and deductions for those with taxable income over $400,000, as ITEP’s analysis of the plan finds. Increasing taxes on wealthy Americans, many of whom aren’t experiencing the same financial effects of the pandemic, is a popular idea. This was borne out in the election results in states like Oregon and Arizona, and similarly, recent polling showed that a majority of respondents support options like a wealth tax on the richest 5 percent of Americans to support those facing pandemic-induced medical and economic hardships.

In Oregon, voters in Multnomah County, home to Portland, approved a measure that will provide free preschool for children ages 3 to 4 and increase salaries for teachers and teaching assistants, which will be funded by a 2.3 percent tax that will begin on taxable income over $125,000 for single filers and $200,000 joint filers. The tax will then increase to 3.8 percent for individuals making more than $250,000 and households making over $400,000.

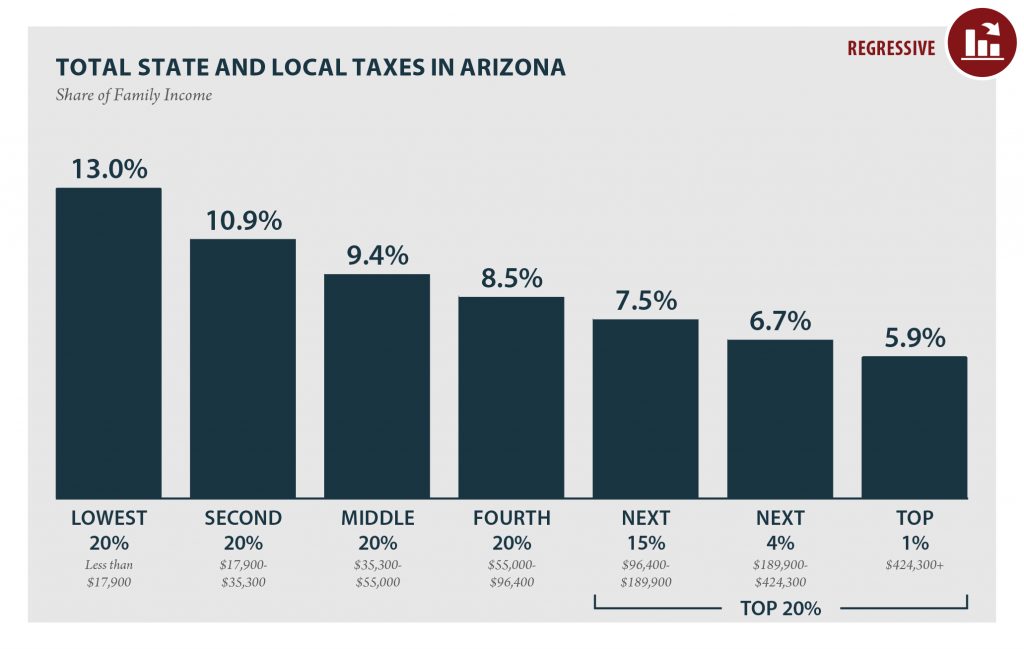

It wasn’t just blue states that made headway on the tax front, though. Taxpayers in Arizona voted in favor of Proposition 208 by a margin of 52 percent to 41 percent. The measure—which imposes a 3.5 percent surcharge on high-income earners making over $250,000 for single filers and $500,000 for joint filers—is estimated to raise between $827 million and $940 million annually. As mentioned in our earlier post endorsing the proposition, the revenue will go toward much needed education spending for teacher salaries and training and retention programs. The plan will also introduce additional progressivity to the state’s tax code. According to ITEP’s Who Pays? report, Arizonans making less than $17,900 pay 13 percent of their income in total state and local taxes whereas the top 4 percent of all earners (where the income thresholds for the new surcharge kick in) before the proposition paid only 6.7 percent of their income in state and local taxes. Under this plan, the new effective tax rate for the top 4 percent would be 9.5 percent and closer to the effective tax rate of those in the middle 20th quintile who pay a 9.4 percent effective tax rate.

Coloradans voted to repeal the Gallagher Amendment—a constitutional measure approved by voters in 1982 that set homeowner and commercial property tax rates at an arbitrary level. The change will allow the state to raise revenue for education in a more responsible manner and help the state’s fiscal health as it copes with the coronavirus pandemic.

Several other states also saw positive signs:

- Every state—Arizona, New Jersey, Montana, and South Dakota—that had the opportunity to legalize and tax the sale of recreational cannabis, did so, joining 34 states and the District of Columbia that tax cannabis for recreational or medical use. (Mississippi also legalized the sale of medical cannabis, which will be taxed at the state’s 7 percent sales tax rate.) While not all the states have specified where the revenue will go, Arizona will split its revenue between a range of public services, including police, fire departments and community colleges.

- A sales tax of 0.5 percent will continue to help fund transportation expenses in Arkansas.

- Residents of Colorado approved an increase on the cigarette and tobacco products tax and imposed a new tax on certain nicotine products used for e-cigarettes, which will help fund education and health programs.

- Income and property tax revenues in Utah—which were previously earmarked only to fund education—can now also be used to support children and disabled residents.

There is still work to do. Despite successes across the country, there were also several setbacks:

- California residents voted down Proposition 15, a measure that would have updated the state’s method for assessing the value of commercial property and taxes owed. Commercial and industrial properties will continue to be assessed based on purchase price instead of market value, and the state will remain dependent on regressive fees and fines to make up revenue needs;

- Illinois voters missed a significant opportunity after deciding not to move from the flat tax to a fairer graduated income tax. The state has the eighth-most regressive tax system in the nation, and if the measure had passed, the graduated structure would have raised taxes on those earning more than $250,000 while cutting taxes for all other filers. The governor has already signaled that due to the coronavirus and the state’s impending budget deficit, major spending cuts to public services will be needed. Increasing the flat tax is also on the table, which will disproportionately impact low-income taxpayers since they already pay a greater share of their income in state and local taxes than wealthier taxpayers;

- Alaskans opted not to increase taxes on certain oil production fields;

- and Colorado voters approved a measure that will reduce the flat income tax from 4.63 percent to 4.55 percent, which will, according to the state, reduce revenues by $154 million in 2021-22 (a time when the budget will still be healing from the fiscal effects of COVID-19).

Elections are complicated and making sense of steps forward and steps back in the aftermath is never easy, but it’s impossible to not recognize the record turnout for a presidential candidate that openly ran on a plan to raise taxes on Americans who have largely been insulated from the economic effects of the downturn.