The Earned Income Tax Credit (EITC) boosts low-paid workers’ incomes and offsets some of the taxes they pay, providing the opportunity for lower-income families to move toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been amplified as many states have enacted and expanded their own credits.

The EITC benefits low-income people of all races and ethnicities. It is particularly beneficial in historically excluded Black and Hispanic communities where discrimination in the labor market, inequitable educational systems and countless other inequities have relegated a disproportionate share of people to low-paid jobs.

The effects of the EITC have been studied for decades, and research consistently shows that children whose families received the credit are more likely to graduate from high school, go to college and be employed as adults.[1] In addition to boosting financial security for working families with children, the EITC also improves health outcomes and is connected to a reduction in babies born with low birthweights.[2] The positive effects of these credits are undeniable.

As our country continues to face economic uncertainty, proven and effective income supports like the EITC remain more important than ever. Even during periods of economic growth, too many workers face low and slow-growing wages, while simultaneously feeling the squeeze of the growing costs of food, housing, childcare and other basic household expenses. To make matters worse, in 46 states low-income households pay a higher share of their incomes in state and local taxes than the richest households.[3] This leaves working families with even fewer resources to make ends meet and contributes to ever-growing income and wealth inequality. Creating or expanding a state EITC can counteract this inequity in most state tax codes.

The Federal Earned Income Tax Credit Provides Critical Income Boost to Millions

The federal EITC has been boosting the income of low-paid workers since 1975. Lawmakers have improved the credit over time so more working families can put food on the table, pay their bills and be better positioned to secure meaningful economic stability.

Last year, the American Rescue Plan Act temporarily increased the federal EITC for low-paid workers without children in the home and made it more widely available by expanding both age and income limits. These critical expansions expired on January 1, 2022, though some members of Congress would like to see those enhancements revived.

The federal EITC delivered about $60 billion to 25 million working families and individuals in 2021, through claims on their 2020 tax returns.[4] Used mostly as a source of temporary support, the EITC helps millions of families each year. The expanded federal EITC, together with the enhanced federal Child Tax Credit (CTC), lifted an estimated 5.3 million people out of poverty in 2021.[5]

The EITC is based on earned income like salaries and wages. For example, for each dollar earned up to $15,410 in 2022, families with three or more children will receive a tax credit equal to 45 percent of those earnings, up to a maximum credit of $6,935. Because the credit is designed to boost incomes for low- and moderate-income workers, income limits restrict eligibility for the credit. Families continue to be eligible for the maximum credit until income reaches $20,140 for single heads of household. Above this level, the value of the credit is gradually reduced to zero and is unavailable when family income exceeds the maximum eligibility level. Single-parent households with three or more children earning $53,070 or more a year are ineligible, as are married couples earning $59,200 or more. Absent federal action to revive recent EITC enhancements, the credit will remain much less generous and available to fewer workers without children in the home: the maximum credit for such workers is just $560, roughly a third of what was made available to this population as a result of the 2021 enhancement.

State Earned Income Tax Credits Help Low-Paid Workers and Improve State Tax Codes

In addition to helping working families afford childcare, health care, housing, food and other necessities, state EITCs help improve the equity of upside-down state and local tax systems. Unlike federal taxes, state and local taxes as a whole are regressive, requiring low- and moderate-income families to pay a greater share of their income in taxes than wealthier taxpayers. The poorest 20 percent of Americans pay 11.4 percent of their incomes in state and local taxes. By contrast, middle-income taxpayers pay 9.9 percent and the wealthiest 1 percent of taxpayers pay just 7.4 percent of their incomes in state and local taxes.[6]

Heavy use of regressive sales and property taxes (which all working families pay) drive the high state and local tax rates faced by the poorest households. A refundable state EITC is among the most effective and targeted tax reduction strategies to help offset these regressive taxes and is one of several policy options states can use to add progressivity to their tax system.

Refundability is a vital component of state EITCs because it ensures that workers and their families get the full benefit of the credit. Refundable credits do not depend on the amount of income taxes paid; rather, if the credit exceeds income tax liability, the taxpayer receives the excess as a refund. Thus, refundable credits usefully offset regressive sales and property taxes and can provide a much-needed income boost to help families pay for basic needs. This is essential because, for lower-income families, it is sales and property taxes—not income taxes—that make up the bulk of state and local taxes paid.

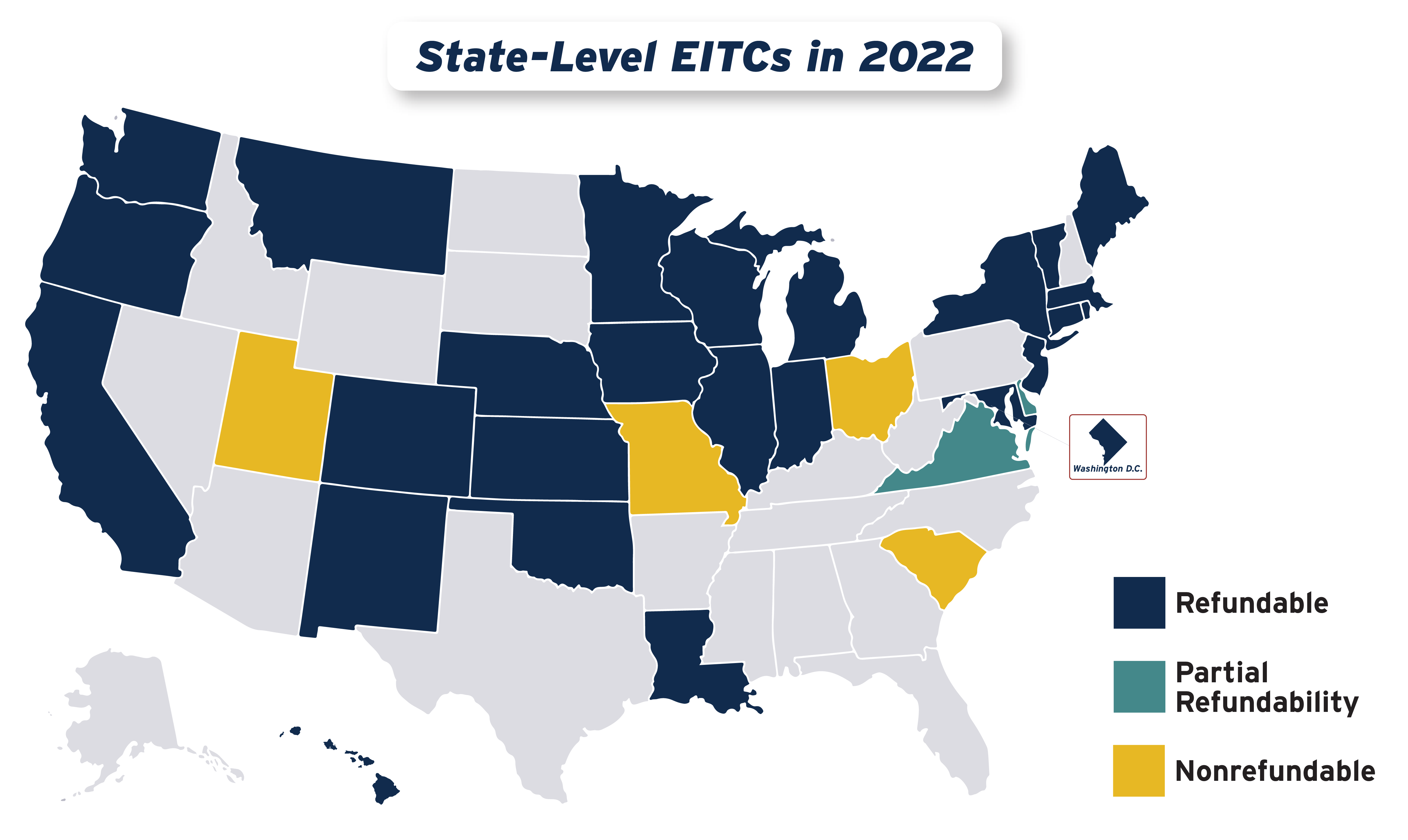

To date, nearly two-thirds of states (31 states plus the District of Columbia and Puerto Rico) offer EITCs based on the federal credit (see Appendix). With a few exceptions (California, Minnesota and Washington), most taxpayers calculate their state EITC as a percentage of the federal credit. This approach of linking state credits to the federal amount makes it easy for taxpayers to claim the credit (since they have already calculated the amount of their federal credit) and straightforward for state tax administrators. However, there are also benefits to decoupling from aspects of the federal credit to help strengthen the benefits available to workers without children in the home, immigrants filing with Individual Taxpayers Identification Numbers (ITINs) and extremely low-income families.

States vary dramatically in the generosity of their credits. The EITC provided by the District of Columbia, for example, is 70 percent of the federal credit this year for most eligible families, and will increase to 100 percent of the federal amount by tax year 2026 (matching their existing 100 percent credit for workers without dependents in the home). Part of D.C.’s EITC will be available to recipients in monthly payments.

Meanwhile, six states (Delaware, Louisiana, Michigan, Montana, Oklahoma and Oregon) have refundable credits that are worth less than 10 percent of the federal credit. Four states (Missouri, Ohio, South Carolina and Utah) allow only a nonrefundable credit, which limits the ability of the credit to offset regressive state and local taxes. Both Delaware and Virginia offer partial refundability which allows taxpayers to choose between a refundable or nonrefundable credit.

Improving Tax Equity with State Earned Income Tax Credits

There are several best practices that states can explore to increase the impact of their EITCs: full refundability, large matching percentages, extending eligibility to ITIN filers, loosening restrictions on the age of eligible claimants, boosting the credit for extremely low-income families and considering monthly payment options. These actions can chip away at racial and wealth inequality, blunt some of the regressivity of state and local tax systems and help families meet their basic needs. Whether enacting an EITC in states that do not yet have one or expanding an existing credit to more workers trying to get by on low wages, lawmakers should continue to enact and strengthen state EITCs.

Enacting New EITCs and Increasing the Size of Existing Credits

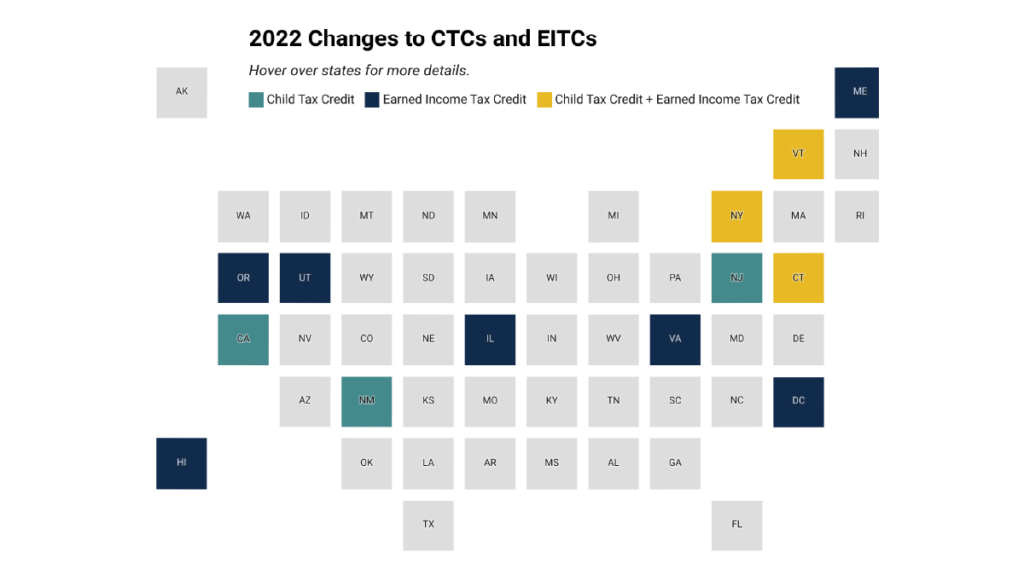

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.[7]

In 2021, the District of Columbia and Washington state exemplified EITC best practices. D.C. is setting the standard for boosting and expanding state credits to surpass the federal EITC (a move to 100 percent of the federal credit with ITIN and expanded income eligibility). Washington state, which lacks a state income tax, modeled its Working Families Tax Credit after the federal EITC and enhanced it through added improvements: including immigrant families and effectively eliminating the phase-in so that all families with any amount of earned income can qualify for the full value of the state’s credit. The state has had an EITC on the books since 2008 but it was not until this year that lawmakers took steps to improve its structure and fully fund its implementation.

Expanding Eligibility to Immigrant Workers

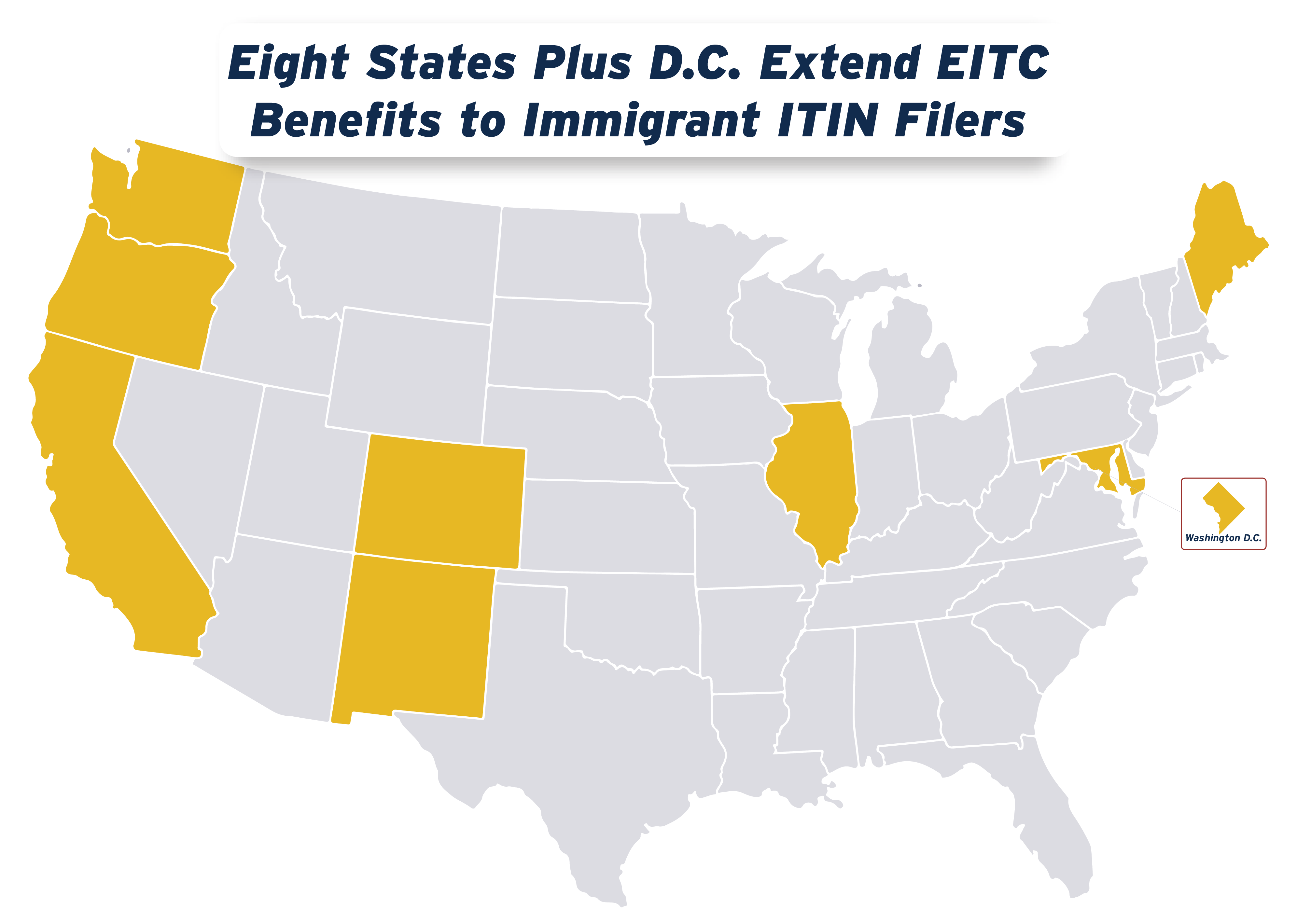

Individual Taxpayer Identification Numbers (ITINs) are tax processing numbers made available to certain immigrants, their spouses and their dependents who do not have Social Security numbers. This allows these noncitizens who live, work or invest in the United States to pay local, state and federal taxes—and yet they remain left out of public benefits, including the federal EITC. In response to this inequity, lawmakers in eight states and the District of Columbia have taken steps to ensure that their EITCs are inclusive of all families and children. Immigrant populations, in particular, have been historically excluded from key federal policies and relief packages, even when meeting other eligibility requirements. States should extend the reach and impact of their state EITCs by expanding eligibility to include ITIN filers.[8]

In 2020, Colorado and California became the first states to expand their EITCs to include immigrant families who work and pay taxes with ITINs but are excluded from the federal credit. In 2021, five additional states – Maine, Maryland, New Mexico, Oregon and Washington state – followed their lead. That momentum continued into 2022 as the District of Columbia and Illinois joined the list of jurisdictions that allow ITIN filers to receive the EITC.

Expanding Age Eligibility and Increasing the Credit for Childless Workers

More states are permanently expanding the EITC for workers without children in the home. While the federal EITC provides a great deal of support to families with children, its impact is limited for those without children: the maximum credit is much smaller and the income limits are more restrictive. For instance, a worker without dependent children in the home who is working full-time at the federal minimum wage is ineligible for the EITC. Yet if the same worker had children they would receive the maximum EITC. Under the current system, these low-paid workers continue to be taxed deeper into poverty.

If the American Rescue Plan Act’s EITC expansions are not reinstated by Congress, the federal EITC will continue to exclude low-income workers under 25 or over 64 years of age unless they have children in the home. And since so many states are linked to the federal EITC, the same will be true in most states with EITCs as well. These workers include noncustodial parents, young workers who are just getting a foothold in the job market and older workers who need to keep working well past the traditional retirement age and who often struggle to make ends meet.[9]

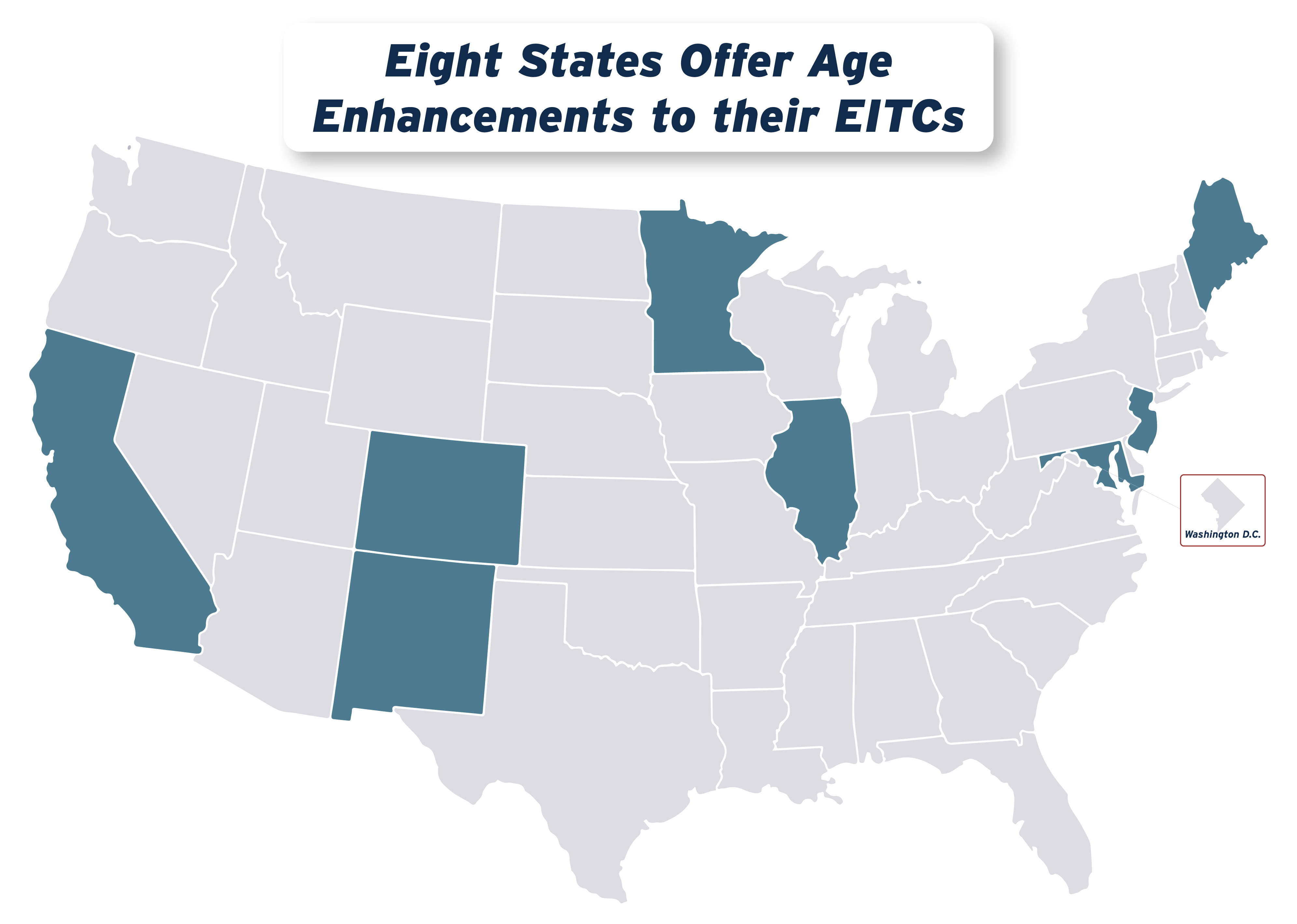

Eight states have now recognized the need to allow more young workers to enjoy the benefits of the EITC. And three states have taken steps to include older workers (65+) without dependent children in the home.

This year, Illinois and Maine enhanced their credits to benefit workers without children in the home. Lawmakers in Illinois lowered the state’s minimum age of eligibility to 18 and expanded the credit to those 65 and older. Maine lawmakers doubled the credit size for their childless population from 25 to 50 percent of the federal level.

In 2021, Maryland, New Jersey and New Mexico permanently lowered the age of their existing credits to include 18- to 24-year-old workers without dependents. These states join California and Maine, both of which include 18- to 24-year-old workers without children in the home, and Colorado and Minnesota, with age eligibility beginning at 21 and 19, respectively.

At the state level, the District of Columbia has led the way in expanding eligibility for workers without children in the home. Since 2015, more of these workers qualify for D.C.’s EITC (and receive a larger credit) thanks to higher income eligibility thresholds and a credit expanded to 100 percent of the federal amount. California, Maryland and Minnesota joined the District of Columbia in their 2018 expansions to younger workers, with California eliminating the EITC age requirement for workers without dependents in the home. California also adjusted its EITC income limits to reflect the state’s minimum wage increase to ensure that those working full-time for minimum wage are eligible to receive the credit. Maryland and Minnesota legislators also removed the state EITC’s minimum age requirement by using some of the revenue gained from conformity to federal tax changes enacted in 2017. In 2019, Maine lawmakers lowered the minimum age to 18 and increased the share of the federal credit workers without dependents in the home receive to 25 percent.

While the federal EITC offers a strong starting point for state EITCs, state lawmakers should build on the credit’s success by enacting reforms that expand age eligibility and increase the credit for this population who have historically been left behind.

Local EITCs

A few localities also have their own version of an EITC, most notably New York City and Montgomery County, Maryland. Chicago’s EITC moved toward advanced payments to help workers make ends meet throughout the year with a pilot project. The District of Columbia, similarly, has a newly enacted temporary monthly payment. State lawmakers should ensure that localities aren’t barred from creating their own EITCs, and local lawmakers should pursue these credits to bolster the economic security of residents working low-paid jobs.

Endnotes

[1] Bastian, Jacob, and Katherine Michelmore. The Long-Term Impact of the Earned Income Tax Credit on Children’s Education and Employment Outcomes. Journal of Labor Economics, Volume 36, Number 4. October 2018. https://www.journals.uchicago.edu/doi/abs/10.1086/697477?journalCode

[2] “Earned Income Tax Credits: Interventions Addressing the Social Determinants of Health.” Centers for Disease Control and Prevention, Accessed September 9, 2022. https://www.cdc.gov/policy/hst/hi5/taxcredits/index.html

[3] Wiehe, Meg, et al. “Who Pays? A Distributional Analysis of the Tax System in All Fifty States, 6th Edition,” Institute on Taxation and Economic Policy, October 2018. https://itep.org/whopays/

[4] Internal Revenue Service. “Statistics for Tax Returns with EITC,” Last updated March 2022. https://www.eitc.irs.gov/eitc-central/statistics-for-tax-returns-with-eitc/statistics-for-tax-returns-with-eitc

[5] Poverty in the United States: 2021. United States Census Bureau, September 13, 2022. https://www.census.gov/data/tables/2022/demo/income-poverty/p60-277.html

[6] Wiehe, Meg, et. al., Who Pays? A Distributional Analysis of the Tax System in All 50 States (Sixth Edition). Institute on Taxation and Economic Development, October 2018. https://itep.org/whopays/

[7] Butkus, Neva. “Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs. Institute on Taxation and Economic Policy, July 22, 2022. https://itep.org/legislative-momentum-2022-child-tax-credit-eitc/

[8] Community Change. “ITIN-EITC Fact Sheet,” April 14, 2020. https://communitychange.org/resource/itin-eitc-fact-sheet/ and Sifre, Emma. ITIN Filer Data Gap: How Changing Laws, Lack of Data Disaggregation Limit Inclusive Tax Policy. Institute on Taxation and Economic Policy, June 17, 2021. https://itep.org/itin-filer-data-gap-how-changing-laws-lack-of-data-disaggregation-limit-inclusive-tax-policy/

[9] See the following reports and posts by Aidan Davis at the Institute on Taxation and Economic Policy: