California

New 50-State Analysis of Biden Revenue-Raising Tax Proposals

October 7, 2020 • By ITEP Staff

A state-by-state analysis of President-elect Joe Biden’s proposal to raise taxes for filers with income of more than $400,000 finds that in 2022, just 1.9 percent of all taxpayers would face a direct tax increase. This would vary only slightly by state. For example, in West Virginia, 0.6 percent of taxpayers would see an increase, and in Connecticut, 3.7 percent of taxpayers’ taxes would increase.

State Rundown 9/23: Tax Justice Advanced in New Jersey, On the Ballot in Illinois

September 23, 2020 • By ITEP Staff

New Jersey leaders grabbed the biggest headlines of the week by finally agreeing to implement a much-needed and long-discussed millionaires tax to shore up the budget and improve tax fairness. And Illinois residents can begin voting tomorrow to enact a graduated income tax there. Relatedly, ITEP Research Director Carl Davis updated our research debunking the myth that progressive taxes interfere with economic growth. Cannabis legalization and taxation was a hot topic as well, as lawmakers in Vermont reached an agreement to move forward on the matter and others in Connecticut, Kansas, and New Hampshire worked toward the same.

Another Reason to Tax the Rich? States with High Top Tax Rates Doing as Well, if Not Better, than States Without Income Taxes

September 23, 2020 • By Carl Davis

ITEP updated a 2017 study that examined the economic performance of the nine states with the highest top marginal tax rates compared to the nine states with no state income tax. Economies in states with the highest top marginal rates grew faster. States facing budget shortfalls should first look at raising taxes on those most able to pay (incomes at the top have grown during this economic crisis) before considering harmful budget cuts.

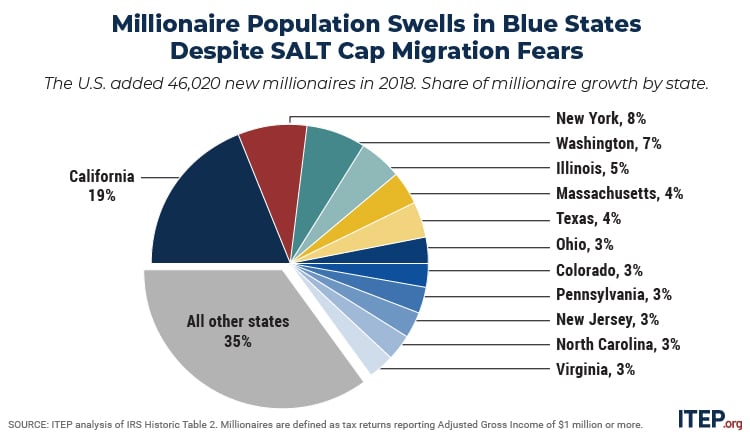

Yahoo! Finance: Salt Cap Isn’t Scaring Away Blue State Millionaires

September 15, 2020

The $10,000 cap on state and local tax deductions imposed as part of the 2017 Republican tax law is not causing high-income taxpayers to flee high-tax blue states, according to Carl Davis, research director at the progressive Institute on Taxation and Economic Policy. In a blog post last week, Davis said that new IRS data […]

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2020

September 15, 2020 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been amplified as many states have enacted and expanded their own credits.

Millionaire Population Swells in Blue States Despite Migration Fearmongering

September 3, 2020 • By Carl Davis

Although the 2017 Tax Cuts and Jobs Act has created a slew of problems, it is now clear that a mass migration of top earners out of higher-tax blue states is not one of them.

The Rich Are Weathering the Pandemic Just Fine: Tax Them

September 3, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

Reductions in critical state and local investments, including health care and education, would only exacerbate the economic crisis brought on by COVID-19 and worsen racial and income inequality for years to come. Higher taxes on top earners are among the best options for addressing pandemic-related state revenue shortfalls in the coming months.

State Rundown 8/26: Progressive Revenue Ideas Featured in Many States’ Fiscal Debates

August 26, 2020 • By ITEP Staff

Voters could significantly change the tax landscape through ballot measures this November regarding oil taxes in Alaska and a high-income surcharge for education funding in Arizona. Legislators are doing their part to bring progressive tax ideas to the fore as well, including a possible wealth tax in California, a millionaires tax in New Jersey, and a pied-a-terre proposal in New York. And Nebraska lawmakers reached a property tax and business tax subsidy compromise before closing out their session, but did not identify progressive revenue sources to fund it and will likely be back at the bargaining table before long.

This week, voters in Missouri approved Medicaid expansion, Nevada lawmakers moved to amend their Constitution to raise taxes on the state’s mining industry, and leaders in California and New York continued to push for needed revenues through tax increases on their richest households.

As many of the country’s major professional sports leagues attempt to return to action amid concerns that the pandemic will find a way to ruin even the best-laid plans, state legislatures find themselves in a similar boat. Lawmakers would normally be enjoying their summer breaks at this time of year, but instead are returning to work in special sessions surrounded by plexiglass and uncertainty. Read on for information on ongoing sessions in states including California, Massachusetts, and Nebraska, as well as upcoming sessions in Missouri and Oregon.

Americans are demanding policy that meets the needs of this urgent moment. There are now competing proposals from the U.S. House and Senate: One is a reasonable response to the staggering crisis we’re in. One is not.

Temperatures and tensions are high right now across the country as Congress debates its next pandemic response and states continue to sweat through difficult decisions. Nevada lawmakers, for example, just wrapped up a special session during which they came within one vote of a proposed tax increase but ultimately chose to balance their shortfall through only funding cuts. But advocates in many states, including California, New Jersey, New York, and Rhode Island are trying to light a fire under lawmakers to encourage them to enact progressive tax increases on their wealthiest households.

Law 360: State And Local Tax Policy To Watch In The 2nd Half Of 2020

July 14, 2020

As states grapple with refilling their coffers in response to the COVID-19 pandemic, tax policy debates in the second half of 2020 could center on revisiting conformity to the federal code and a consideration of broad-based tax proposals. Additionally, some states are contemplating wading into untested legal waters by taxing digital advertising, while practitioners are […]

State Rundown 7/8: Many State Legislatures Reconvene for Special or Resumed Sessions

July 8, 2020 • By ITEP Staff

Local leaders in the District of Columbia and Seattle, Washington, approved progressive tax changes to raise needed funding this week for priorities such as coronavirus relief, affordable housing, and mental health. Arizona advocates submitted signatures to place a high-income surcharge on the ballot for November. And as a number of states made decisions on how to use federal Coronavirus Aid, Relief, and Economic Security (CARES) Act funds, North Carolina decoupled from costly business tax cuts contained in the act and Nebraska started discussing doing the same.

As ITEP analyst Kamolika Das wrote today, July 1 is typically the beginning of state fiscal years and “a point when one can take a step back and reflect on the wins and disappointments of the past state legislative sessions.” Not so in 2020, she writes, as uncertainty surrounding the virus, state revenues, and potential federal action give state lawmakers no such time to relax and reflect. Although most recent state actions, such as those covered below in California, Mississippi, and West Virginia, have focused on funding cuts and temporary measures to bring budgets into short-term balance, the need for…

New Fiscal Year Brings New Challenges and Opportunities in the States

July 1, 2020 • By Kamolika Das

July 1—the start of the new fiscal year in most states—typically marks a point when one can take a step back and reflect on the wins and disappointments of the past state legislative sessions. 2020 is markedly different. Nationwide business closures and stay-at-home orders in response to COVID-19 have led to unprecedented spikes in unemployment, decreased demand for consumer spending, and increased demand for vital public services. As a result, states face incredibly uncertain financial futures with little clarity regarding how their tax collections will fare over the next year.

State Rundown 6/26: States Take Varying Fiscal Approaches While Awaiting Federal Action

June 26, 2020 • By ITEP Staff

State policymakers this week took a variety of approaches to their fiscal situations amid the COVID-19 pandemic. Tennessee lawmakers chose to balance their budget through $1.5 billion in cuts to public services, but not before adding to those cuts by going forward with planned tax cuts. California legislators also passed a budget but relied on a number of temporary measures and delays to do so. Their counterparts in Massachusetts, New Jersey, and Rhode Island opted for interim budgets to tide them over for a few months while they continue to look for lasting solutions. Meanwhile, many states are debating whether…

Beyond SCOTUS: States Recognize Need for More Inclusive Immigrant Policy

June 26, 2020 • By Marco Guzman

The U.S. Supreme Court last week halted an effort by the Trump administration that would have stripped DACA (Deferred Action for Childhood Arrivals) recipients of their lawful status in the country. The 5-4 ruling is a significant victory for immigrant rights advocates and over 643,000 Dreamers—as they’re known—who were brought here as children and have […]

State Rundown 6/18: States Work to “Finalize” Budgets in Uncertain Times

June 18, 2020 • By ITEP Staff

Despite uncertainty all around the nation, a few states passed budgets this week and many more are negotiating to enact theirs before fiscal years close at the end of June. Colorado notably pared back some of its own tax breaks and limited the potential damage on its budget from new federal breaks. California also passed a budget but few in the state actually think the dealing is done. Iowa quietly enacted its budget too, though advocates in the state are making noise about non-fiscal bills that were added late in the game.

Crain’s New York Business: Legalizing Marijuana Can’t Cure Inequality, But It Will Ease Budget Crisis

June 14, 2020

My methodology is informed by the work of Carl Davis, research director at the Institute on Taxation and Economic Policy, who recently published a thoughtful blog post on per-capita cannabis excise tax collections. Davis found that last year more than $1.9 billion of tax revenue was collected across seven adult-use states (Alaska, California, Colorado, Massachusetts, Nevada, Oregon, […]

As calls to defund the police demonstrate, state and local decisions about funding priorities and how those funds are raised are deeply embedded in racial justice issues. Tax justice is also a key component in advancing racial justice. Racial wealth disparities are the result of countless historic inequities and tax policy choices are certainly among […]

Most people assume that the federal government is the main—if not only—agent for ensuring economic stability and recovery in response to COVID. Yet, the fight for tax fairness at the state level will have a dramatic impact on economic recovery.

State Rundown 5/27: Some States Finally Talking Revenue Solutions to Revenue Crisis

May 27, 2020 • By ITEP Staff

This week the immense scale and uneven distribution of economic and health damage from the COVID-19 pandemic continued to come into focus, hand in hand with greater clarity around pandemic-related revenue losses threatening state and local revenues and the priorities—such as health care, education, and public safety—they fund. Officials in many states, including Ohio and Tennessee, nonetheless rushed to declare their unwillingness to be part of any solution that includes raising the tax contributions of their highest-income residents. On the brighter side, some leaders are willing to do just that, for example through progressive tax increases proposed in New York…

State Rundown 5/20: State Revenue Crisis Getting Clearer…and Scarier

May 20, 2020 • By ITEP Staff

State policymakers are navigating incredibly uncertain waters these days as they attempt to get a firmer grasp on the scale of their revenue crises, identify painful budget cuts they may have to make in response, and look for ways to raise tax revenues coming from the households and corporations still bringing in large incomes and profits amid the pandemic—all while hoping that additional federal aid and greater flexibility in how they can use federal CARES Act funds will help relieve some of these difficult decisions.

Bloomberg: California Setting Rules for Finding Pot’s Napa Valley

May 19, 2020

The state also has a vested interest in protecting pot’s reputation. California cannabis, both recreational and medicinal, generated $395.4 million in taxes in 2018 and $629.2 million in 2019, the Institute on Taxation and Economic Policy said. California cannabis sales accounted for one-third of the $1.9 billion in tax revenue raised nationwide last year, according […]