Blog - State Policy

647 posts

State Rundown 11/13: States Tackle Impending Deficits, Pennsylvania Secures an EITC

November 13, 2025 • By ITEP Staff

Revenue forecasts look increasingly grim as states anticipate shortfalls due to the slowing economy and impacts of the new federal tax law.

State and Local Policymakers Can Resist Austerity Even Amid Historic Federal Retreat

November 6, 2025 • By Kamolika Das

The progressivity of the federal tax code has been waning. State and local policymakers should respond by protecting their revenue bases, promoting equity, and safeguarding vulnerable communities from harmful budget cuts.

In 2025, Voters Said Yes to Public Resources and Community Investments

November 6, 2025 • By Rita Jefferson

Important tax measures were on the ballot this week, and the outcomes are clear: many voters support new state and local spending to support critical services in their communities.

States Begin Decoupling from Flawed ‘QSBS’ Tax Break

November 6, 2025 • By Nick Johnson, Sarah Austin

A costly tax break for wealthy venture capitalists is drawing some critical attention from state policymakers.

Despite being an off-year election, voters made a call for shared public investments at the polls.

States across the nation are debating how best to respond to costly new federal tax cuts.

Why States Shouldn’t Go Along With OBBBA’s Corporate Tax Breaks: A Practical Guide

October 27, 2025 • By Nick Johnson, Michael Mazerov

States should immediately decouple from four costly corporate tax provisions in the new federal tax law.

State Rundown 10/1: State and Local Governments Doing the Opposite of Shutting Down

October 1, 2025 • By ITEP Staff

State and local officials are staying very busy by considering a dizzying amount of reversals.

State Rundown 9/18: Lawmakers Confront Revenue Loss from Federal Policy Changes

September 18, 2025 • By ITEP Staff

Some states are trying to avoid revenue loss while others are welcoming it and doubling down.

Child Poverty Remains Unacceptably High, New Federal Changes Unlikely to Move Needle

September 16, 2025 • By Neva Butkus

By not extending the 2021 temporary Child Tax Credit expansion, federal lawmakers have allowed the number of children and families in poverty to increase and remain unnecessarily high.

Making the Wealthy Pay their Fair Share is the Way to Preserve Vacation Towns

September 10, 2025 • By Rita Jefferson

Rhode Island lawmakers created a new surcharge on second homes worth more than $1 million as part of the budget enacted this spring.

State Rundown 9/4: Colorado Tackles Offshore Corporate Tax Avoidance, Paves Way for State Conformity Best Practices

September 4, 2025 • By ITEP Staff

Despite an increasingly bleak state revenue outlook, state lawmakers across the country continue to prioritize regressive tax cuts.

Colorado Lawmakers Help Fill Trump-Induced Shortfall by Tackling Offshore Corporate Tax Avoidance

August 26, 2025 • By Matthew Gardner, Marco Guzman

As the Trump megabill blows holes in state budgets, Colorado is leading with reforms to curb offshore tax avoidance and roll back wasteful corporate subsidies.

SALT in the Wound: New Tax Law’s Limit on State Tax Deductions Exempts Some of the Very Wealthiest

August 21, 2025 • By ITEP Staff

The new tax law enacted last month found a temporary compromise on the level of the cap, boosting it to $40,000 through 2029, but failed to fix a loophole that allows some rich taxpayers with good accountants to completely avoid the cap

State Rundown 8/20: States to Face Serious Conformity, Revenue Issues as Summer Ends

August 20, 2025 • By ITEP Staff

While tax news has slowed as summer comes to an end, there are rumblings beneath the surface that could be an inauspicious sign of the times ahead for states and state budgets.

Trump’s Tax Law Clobbers State Budgets. Now’s the Time to Prepare.

August 13, 2025 • By ITEP Staff

The Trump megabill hands the richest 1% a trillion-dollar windfall while gutting funding for health care, education, and disaster relief — leaving communities to pick up the pieces. State and local leaders must step up, tax the wealthiest fairly, and safeguard the essentials that keep America healthy, educated, and safe.

Mississippi’s Path to Income Tax Elimination Hinders Racial and Economic Equity

August 7, 2025 • By Vanessa Woods

Mississippi policymakers this year took a big step to worsen the state’s racial income and wealth divides by passing a radical plan to eventually eliminate the state’s income tax.

How Maryland’s Tax Reforms Advance Racial and Economic Equity

August 7, 2025 • By Vanessa Woods

Maryland is taking aim at income and racial disparities through a revised personal income tax. By raising taxes on high earners and cutting them for most households across racial and ethnic lines, the state is proving that progressive tax policy can drive both equity and revenue.

As states prepare for the revenue loss and disruption resulting from the federal tax bill, tax policy is being considered in legislatures across the country.

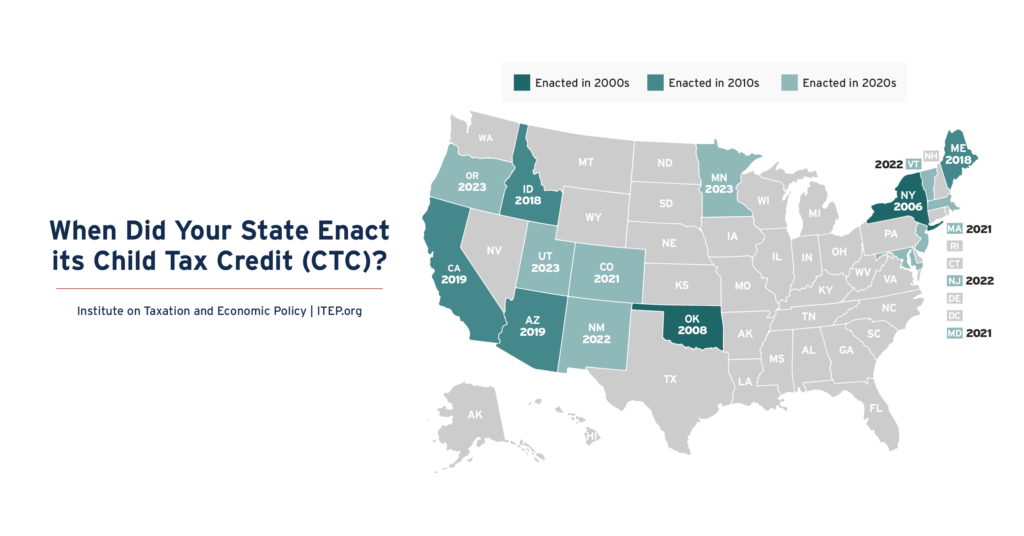

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

Refundable tax credits were a big part of state tax policy conversations this year. In 2025, nine states improved or created Child Tax Credits or Earned Income Tax Credits.

State Rundown 7/24: States Begin Preparing for Federal Megabill Fallout

July 24, 2025 • By ITEP Staff

All eyes in statehouses in recent weeks have been on federal budget negotiations, and now that the “megabill” has passed, they are focused in on their own budgets in search of ways to cope with the enormous consequences coming their way. All states will see fewer federal dollars flowing through their coffers, higher needs due […]

State Rundown 7/8: State Tax Cuts Continue Despite Federal Megabill Passing

July 8, 2025 • By ITEP Staff

The last states are wrapping up legislative sessions, and some are crossing the finish line with major income tax cuts.

With Fiscal Uncertainty Looming, Louisiana Senate Did the Right Thing on Tax Bills

June 27, 2025 • By Neva Butkus

If you find yourself in a hole, stop digging. This is exactly what Louisiana Senators did when they rejected two tax-cut bills that would have created a billion-dollar shortfall in the coming fiscal years.