Blog

1292 posts

State Rundown 9/27: Some States are Looking to Paint the Budgets Red

September 27, 2023 • By ITEP Staff

When it comes to investments, state lawmakers across the country are positioning their states to be in the red as they pass or debate further tax cuts that will overwhelmingly benefit the wealthy – and some states are now adding an additional coat of red paint...

Government Shutdown is Rooted in Hypocrisy, Dysfunction, and, As Always, Tax Cuts for the Rich

September 27, 2023 • By Joe Hughes

The priorities in this shutdown drama couldn’t be clearer. House Republicans once again threaten the financial security of the millions of Americans to exact cuts to programs like Head Start, the Social Security Administration, and the EPA – all while seeking unaffordable tax cuts for multinational corporations, the wealthy, and foreign investors.

Moore Case Could Enrich Tax-Avoiding Multinational Corporations – and the SCOTUS Justices Who Own Their Stock

September 27, 2023 • By Matthew Gardner

The Moore v. United States case that will soon be heard by the U.S. Supreme Court could jeopardize at least $270 billion if SCOTUS finds the entire transition tax to be unconstitutional. The decision could also invalidate other important parts of the current tax system while preempting progressive wealth tax proposals. Such an outcome would represent one of the costliest—and most ethically questionable - Supreme Court decisions in U.S. history.

Kyrsten Sinema’s Latest Fight to Protect Tax Breaks for Private Equity

September 15, 2023 • By Steve Wamhoff

Sen. Sinema's bill to stop a seemingly arcane business tax increase that was enacted as part of the 2017 Trump tax law would be hugely beneficial to the private equity industry.

The U.S. Census Bureau released its annual assessment of poverty in America this week...

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

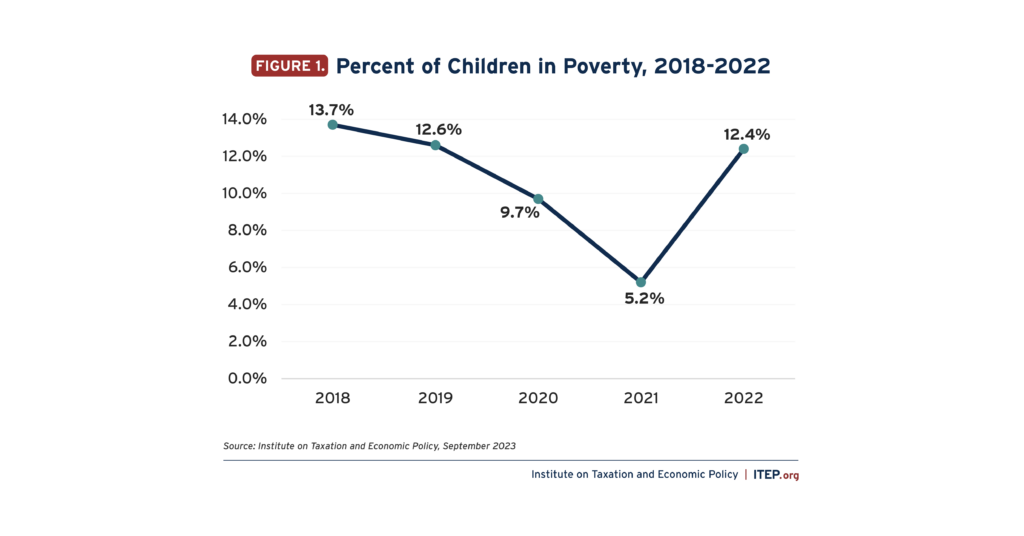

Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in Child Poverty

September 12, 2023 • By Joe Hughes

The new Census data should provide both concern and optimism for lawmakers. The steep rise in child poverty is an inexcusable tragedy. But it shows that child poverty is avoidable when Congress makes the decision to make tax policy for those who need the hand up rather than for the rich and powerful.

How to Better Tax the Rich Men North (and South) of Richmond

September 7, 2023 • By Amy Hanauer

When you examine tax policy through the lens of how much working (and poor) people are taxed compared to rich men north (and south) of Richmond, it’s hard not to take Oliver Anthony's runaway hit as a jumping off point to amplify some important facts.

While a number of state tax laws are debated, approved, and vetoed in any given year, many go unnoticed...

The Innovative Non-Tax Tax Parts of the Inflation Reduction Act

August 23, 2023 • By Michael Ettlinger

In the year since Congress enacted the Inflation Reduction Act (IRA), ITEP has written extensively on the law’s provisions to increase tax fairness and raise revenue for public investments. The IRA, however, also includes tax provisions that serve purposes other than ensuring that we raise adequate revenue and that we do so in a fair […]

Celebrating One Year Since the Landmark Inflation Reduction Act

August 14, 2023 • By Joe Hughes

The Inflation Reduction Act was a course correction from decades of tax cuts that primarily went to the richest Americans and left the rest of us with budget shortfalls that conservative lawmakers now seek to plug with cuts to Social Security and Medicare. For the first time in generations we are finally asking those who have benefited the most from our economy to contribute back.

State Rundown 8/10: Pump the ‘Breaks’ on Sales Tax Holiday Celebrations

August 10, 2023 • By ITEP Staff

August is here, school is starting, and with that comes back to school shopping...

A Lot for A Little: Gimmicky Sales Tax Holidays Are an Ineffective Substitute for Real Sales Tax Reform

August 3, 2023 • By Marco Guzman

This year, 19 states will forgo a combined $1.6 billion in tax revenue on sales tax holidays—politically popular, yet ultimately ineffective gimmicks with minimal benefits and significant downsides.

The Dog Days of summer are upon us, and with most states out of session and extreme heat waves making their way across the country, it’s a perfect time to sit back and catch up on all your favorite state tax happenings (ideally with a cool drink in hand)...

States and Localities are Making Progress on Curbing Unjust Fees and Fines

July 18, 2023 • By Andrew Boardman

Too many state and local governments tap legal-system collections, rather than adequate tax systems, to fund shared essentials like public safety and education. But a growing number of states and localities are choosing a better approach. Momentum for change has continued to build in 2023, with no fewer than seven states enacting substantial improvements.

Most state legislatures have adjourned for 2023, and that means it’s a perfect time to look at the tax policy trends that have formed thus far...

We can make modest reforms to better tax those who are taking a larger share of our wealth and income in order to reinforce a major pillar of our promise to Americans.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

State lawmakers continue to make groundbreaking progress on state tax credits, with 17 states creating or enhancing Child Tax Credits or Earned Income Tax Credits so far this year. These policies have the potential to boost family economic security and dramatically reduce the number of children living below the poverty line.

Minnesota’s Tax Battle of 2023 Signals a Turning of the Tide Against Corporate Tax Avoidance

July 7, 2023 • By Matthew Gardner

The qualified success of Minnesota’s GILTI conformity—to say nothing of the state’s serious dalliance with the game-changing worldwide combined reporting--sends a clear signal that the days may be coming to an end when big multinationals can scare state lawmakers into allowing them to game the tax system.

State Rundown 7/6: Tax Policy Keeping Governors Busy from Coast to Coast

July 6, 2023 • By ITEP Staff

From coast to coast, state governors have been busy inking their signature on a growing list of consequential budget and tax bills...

State Rundown 6/28: Movement on Refundable Credits Remains Hot Topic in 2023

June 28, 2023 • By ITEP Staff

The trend of state lawmakers taking big steps on important tax credits like the Child Tax Credit and Earned Income Tax Credit is coming out in full force this week...

Congressional Republicans Distort a New Report on the Global Minimum Tax

June 22, 2023 • By Steve Wamhoff

The notion that we are better off allowing our corporations to pretend their profits are earned in the Cayman Islands or Ireland simply defies logic and the facts. There is no scenario in which the U.S. would be better by ditching the international agreement that the government already negotiated.

Summer is here and many states nearing the end of their legislative sessions. Temperatures are rising in more ways than one in some state legislatures while others seem to be cooling off.

As the sweet days of summer pass, the scent of jasmine isn't the only thing blowing through the minds of state lawmakers, as tax policy discussions remain at the forefront...