On the Map - Sales, Gas and Excise Taxes

15 posts

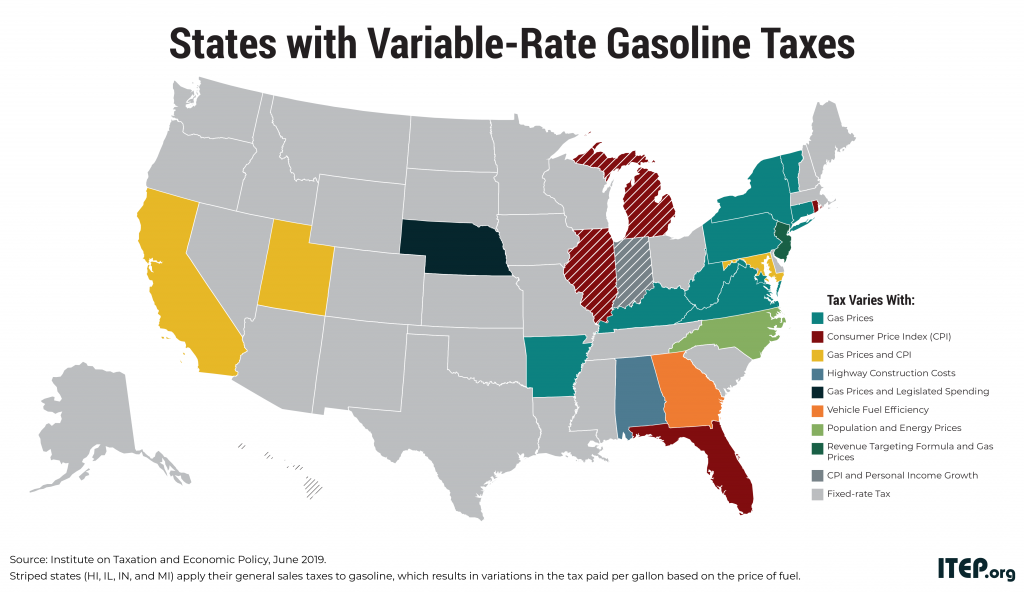

Two in Three Americans Live in States with Variable-Rate Gas Taxes

July 16, 2025 • By Carl Davis

As inflation and fuel efficiency undercut traditional gas tax revenue, many states are rethinking how they fund transportation. Lawmakers across the country are beginning to modernize outdated gas tax systems to keep pace with rising infrastructure costs and changing driving habits.

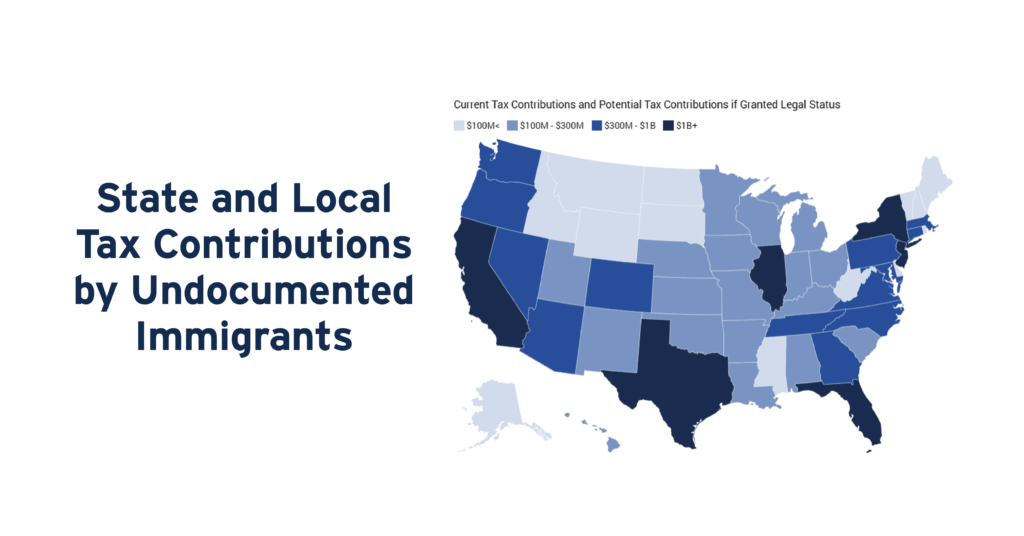

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

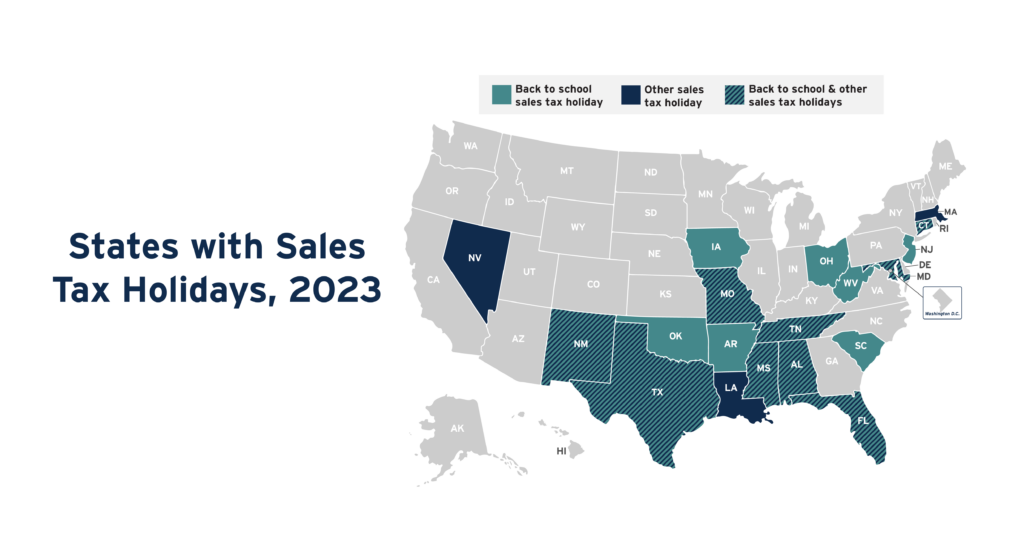

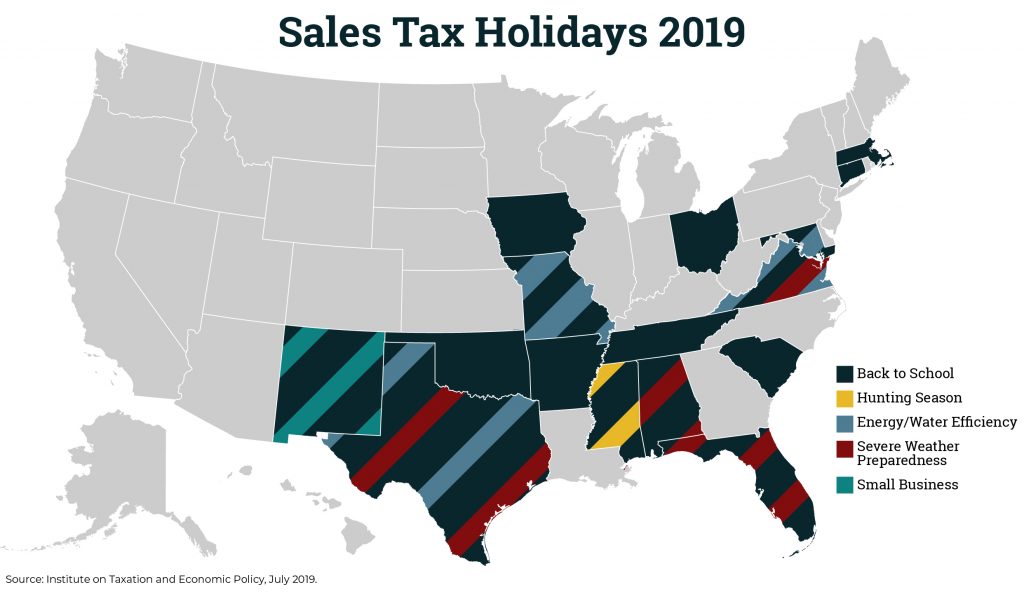

The number of states with sales tax holidays on the books fell to 19 in 2023 from 20 in 2022. Yet even as slightly fewer states have them, they are estimated to cost much more. In 2023, sales tax holidays will cost states and localities nearly $1.6 billion in lost revenue, up from an estimated $1 billion just a year ago.

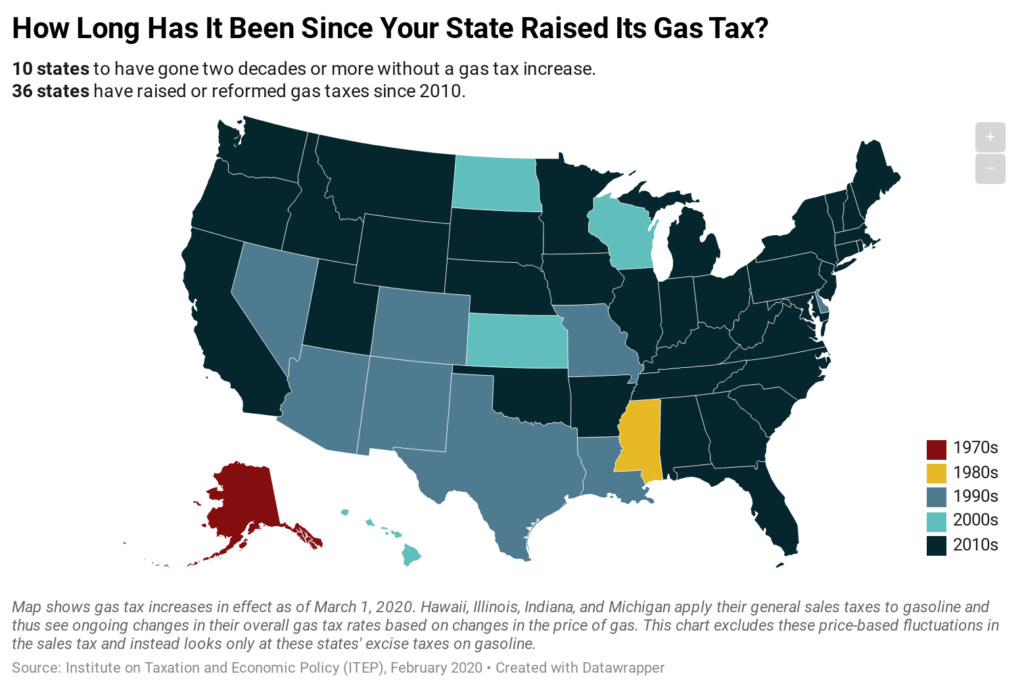

10 states to have gone two decades or more without a gas tax increase.

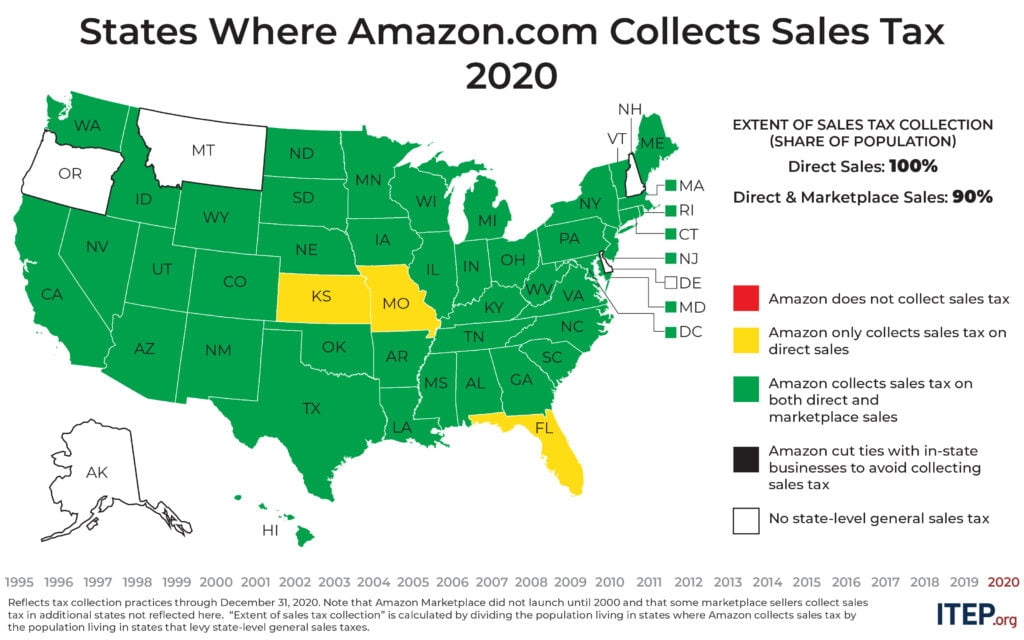

Today, Amazon is collecting state-level sales taxes on all its direct sales but it still usually fails to collect sales tax on the large volume of sales it makes through the Amazon Marketplace. This points to a broader problem in state tax enforcement that lawmakers in many states are moving quickly to address with laws and administrative action requiring tax collection by Amazon and other large online marketplaces such as Etsy and eBay.

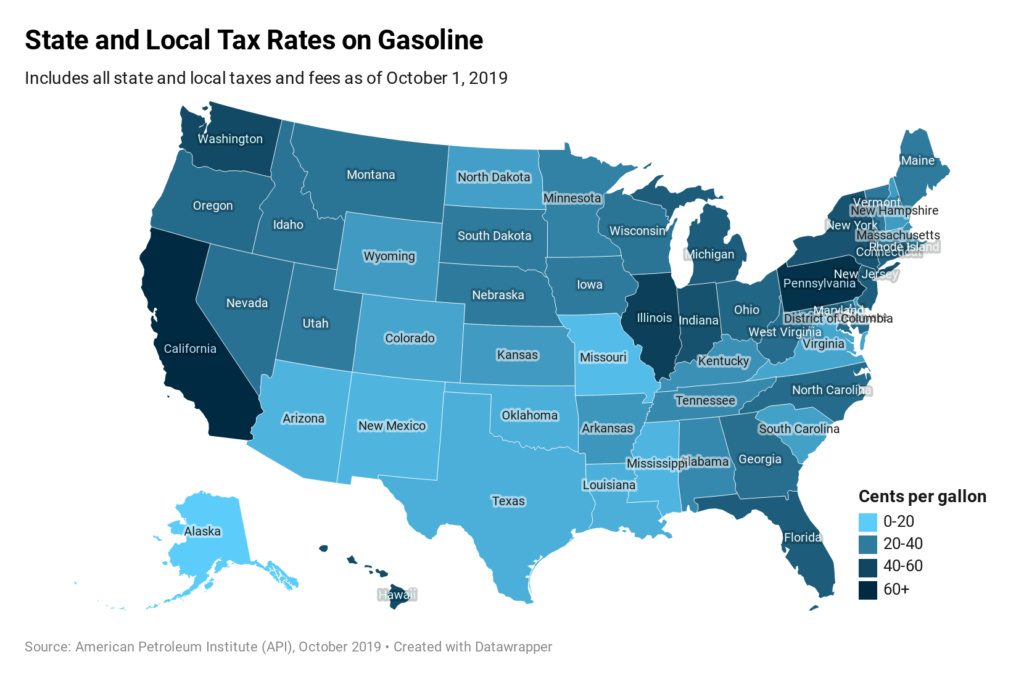

Every state levies excise taxes on motor fuel, including gasoline, to pay for transportation infrastructure. People who drive far distances or heavy vehicles tend to pay more tax, which helps offset the wear-and-tear they inflict on the roads.

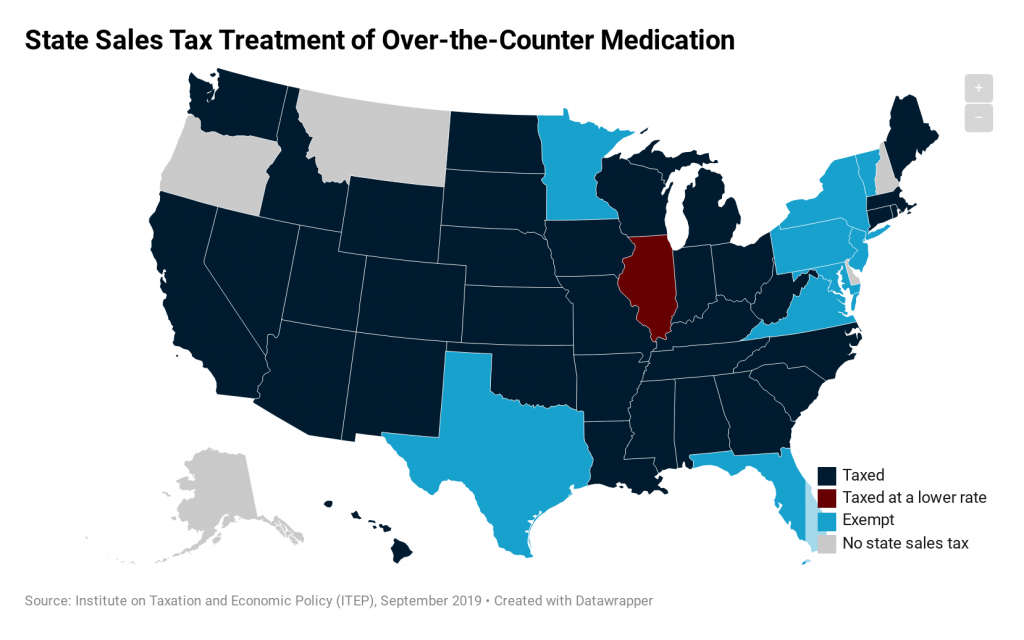

While most states levy general sales taxes on items that consumers purchase every day, those taxes often contain carveouts for some necessities such as rent, groceries, and medicine. Prescription drugs, for instance, are currently exempt from state sales tax in 44 of the 45 states levying such taxes (Illinois is the only exception, charging a […]

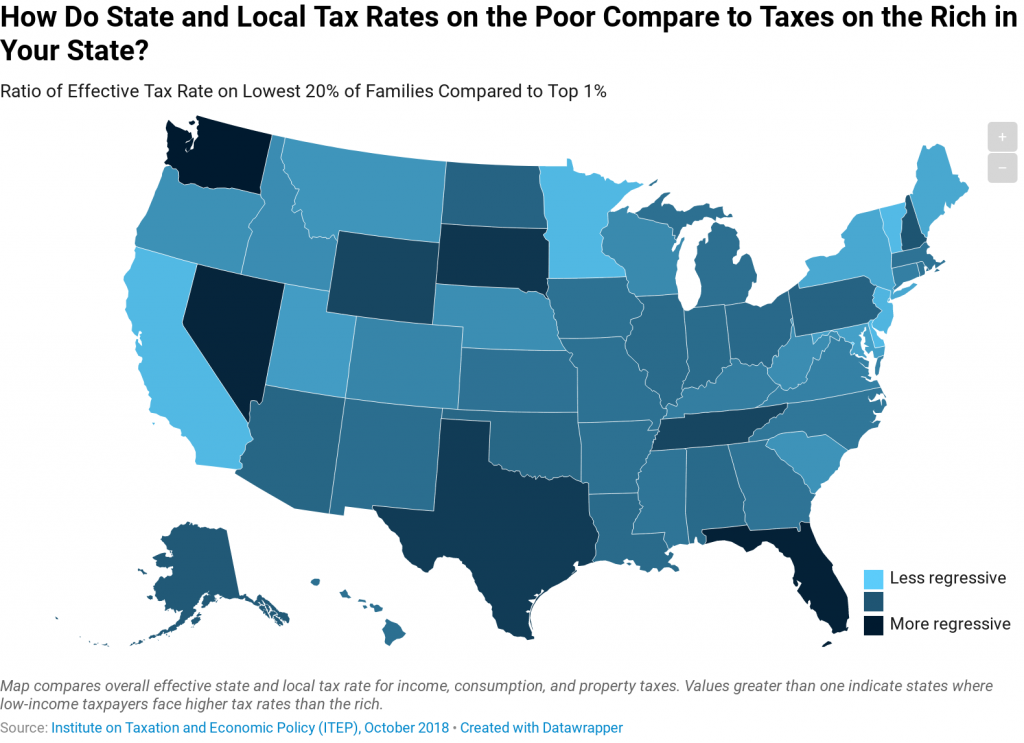

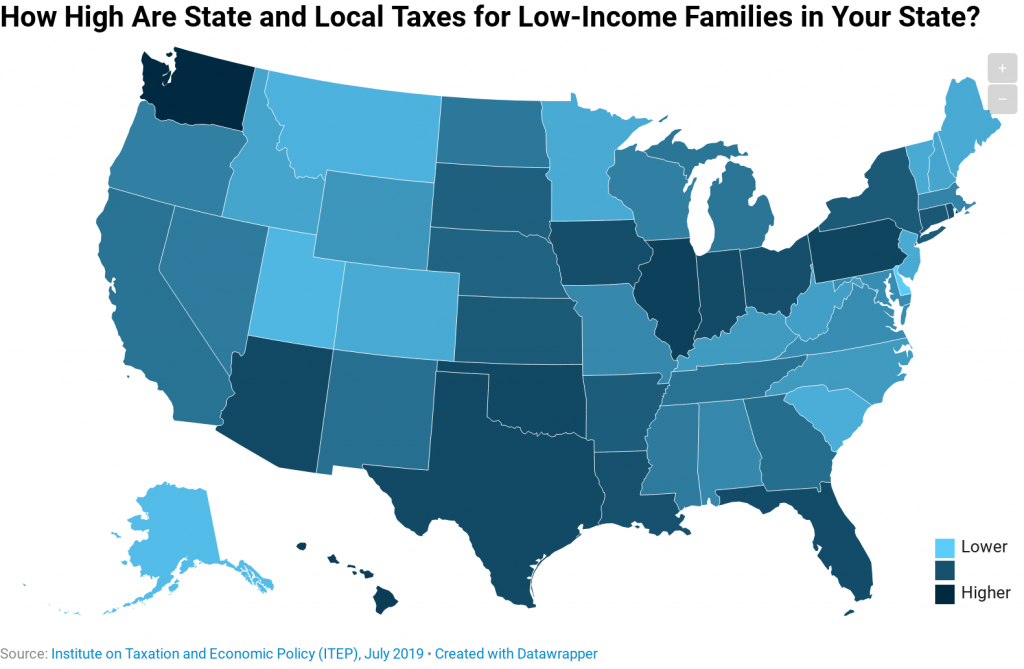

How Do Tax Rates on the Poor Compare to Taxes on the Rich in Your State?

August 1, 2019 • By ITEP Staff

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. Effective tax rates for the lowest 20 percent of families range from a high of 17.8 percent in Washington State to a low of 5.5 percent in Delaware.

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2019), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. ITEP’s policy brief […]

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. This map shows the effective tax rates for the lowest-income 20 percent in each state--ranging from a high of 17.8 percent in Washington to a low of 5.5 percent in Delaware.

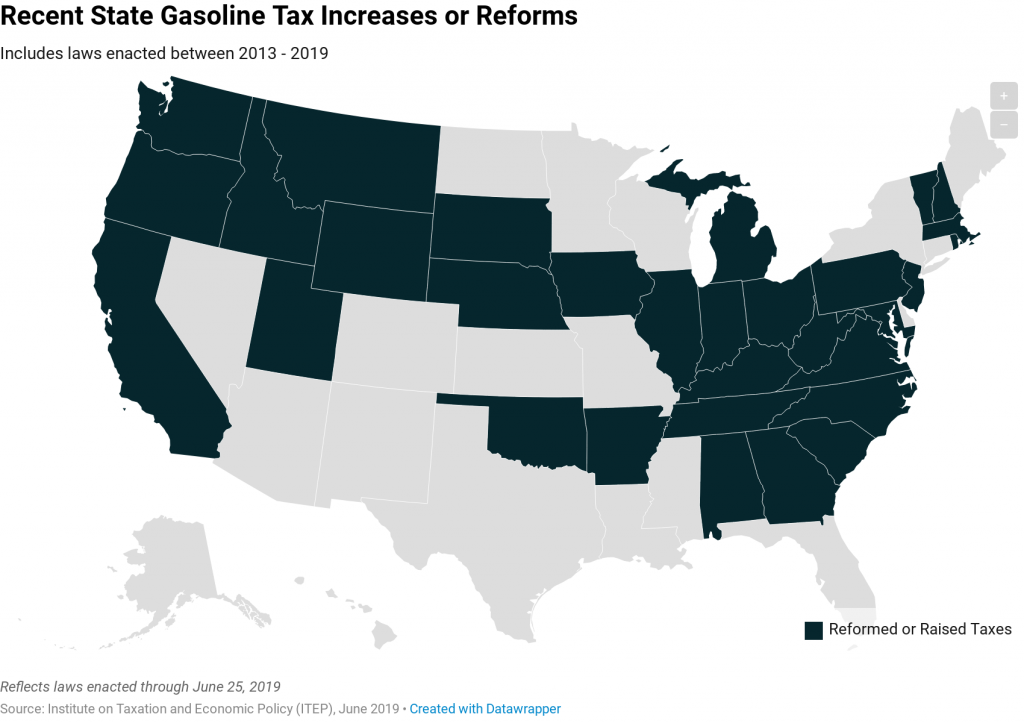

Gas taxes are the most important revenue source that states have available to pay for transportation infrastructure. In recent years, state lawmakers across the country have increasingly agreed that gas taxes must be increased to fund the maintenance and improvement of their infrastructure networks.

These States Abandoned Old Gas Tax Structures in Favor of More Sustainable Variable-Rate Gas Taxes

May 20, 2019 • By ITEP Staff

Because of these reforms, more than 193 million people (or 59 percent of the U.S. population) now live in places where the state gas tax rate automatically varies over time.

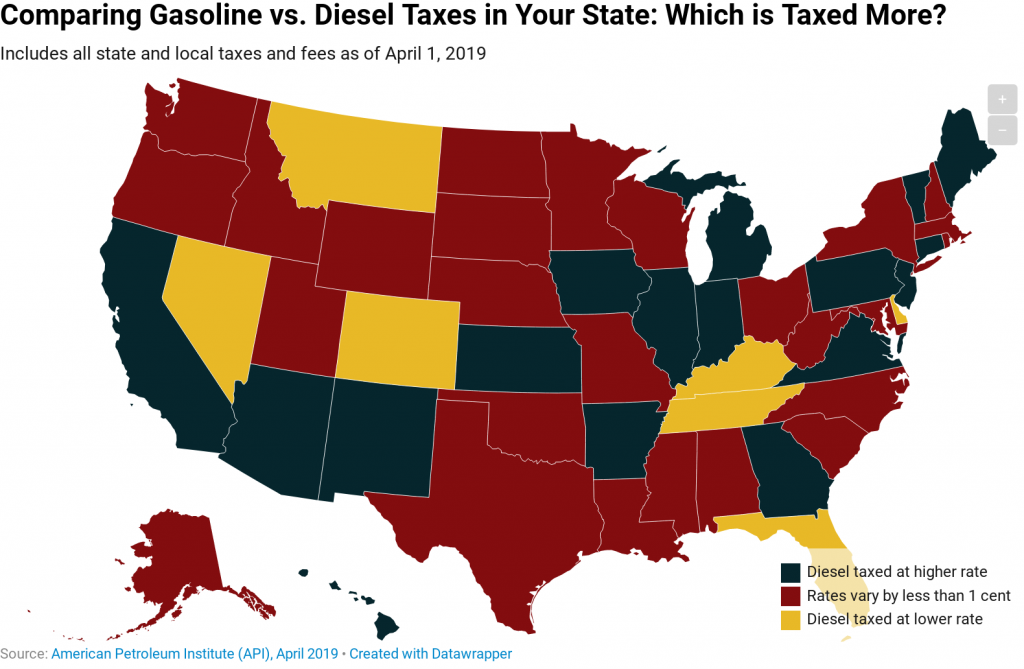

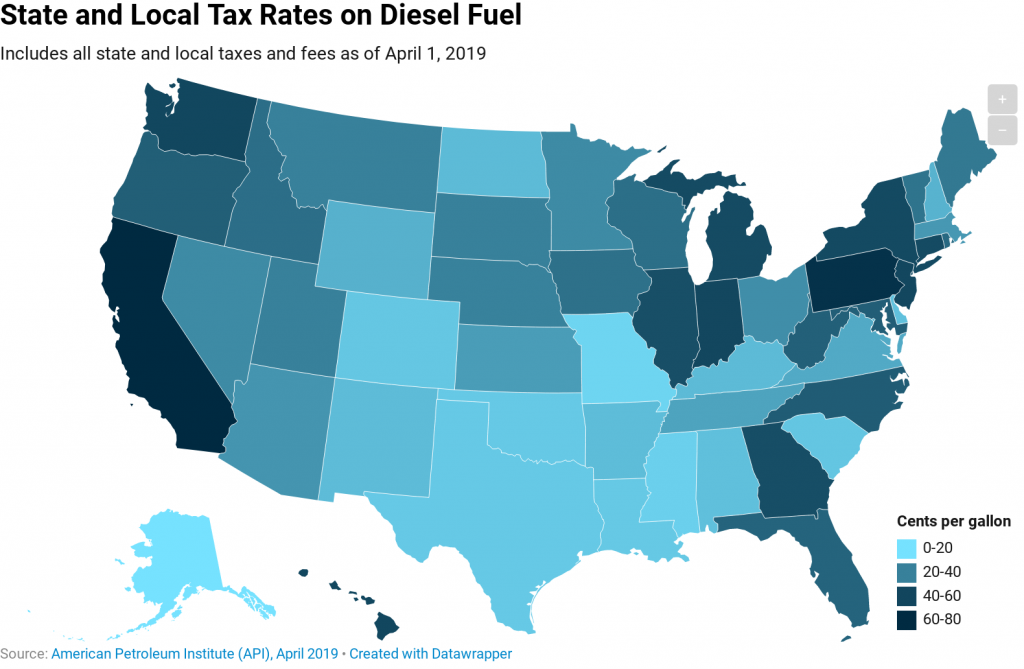

Twenty-six states and the District of Columbia tax these two fuel types at the same rate or very similar rates, as of April 2019, according to data from the American Petroleum Institute.

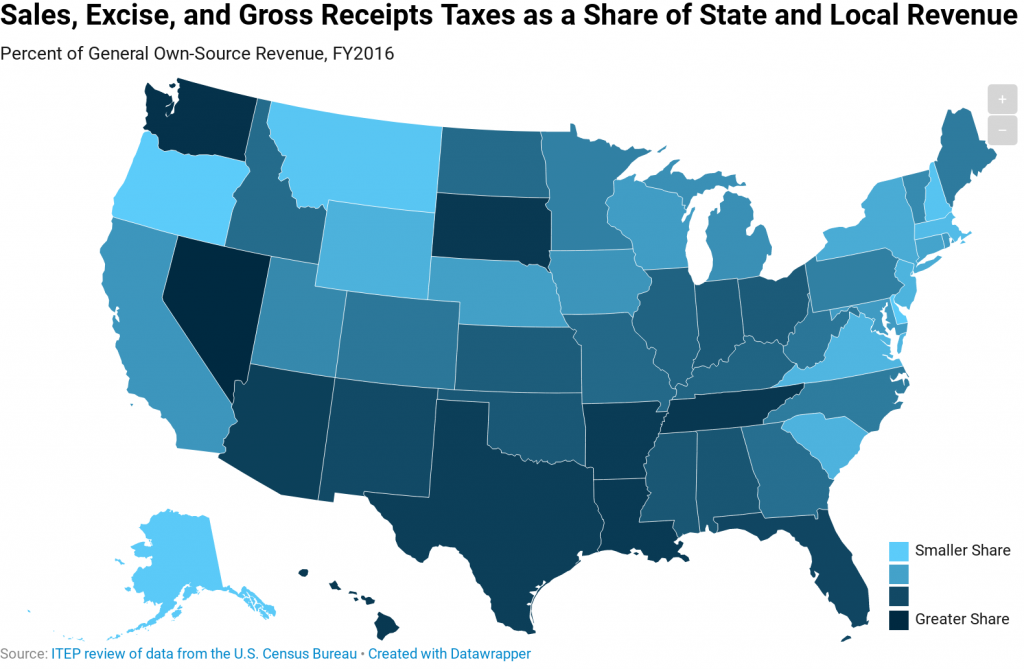

Consumption taxes (including general sales taxes, excise taxes on specific products, and gross receipts taxes) are an important revenue source for state and local governments. While five states lack state-level general sales taxes (Alaska, Delaware, Montana, New Hampshire, and Oregon), every state levies taxes on some types of consumption.

The tax rates identified in this map include state and local excise and sales taxes on diesel fuel, as well as various fees, as calculated by the American Petroleum Institute (API). These taxes are levied in addition to the federal government’s 24.4-cent-per-gallon diesel tax.