Tax Reform Options and Challenges

There Were Far Cheaper and Fairer Options Than the Trump Megabill

July 8, 2025 • By Steve Wamhoff, Joe Hughes, Jessica Vela

Congress and the president could have spent less than half that much money on a tax bill that does more for working-class and middle-class households.

Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates

July 7, 2025 • By Steve Wamhoff, Carl Davis, Joe Hughes, Jessica Vela

President Trump has signed into law the tax and spending “megabill” that largely favors the richest taxpayers and provides working-class Americans with relatively small tax cuts that will in many cases be more than offset by Trump's tariffs.

Our tax policies enable people like Elon Musk and Donald Trump to accumulate more wealth than anyone could ever use in a lifetime. They then use it to steer elections and shape public policy to further enrich themselves and others like them. We should defeat the enormously destructive tax bill in Congress and instead craft tax policy that taxes the rich, makes our democracy more fair, and returns resources to the rest of the country.

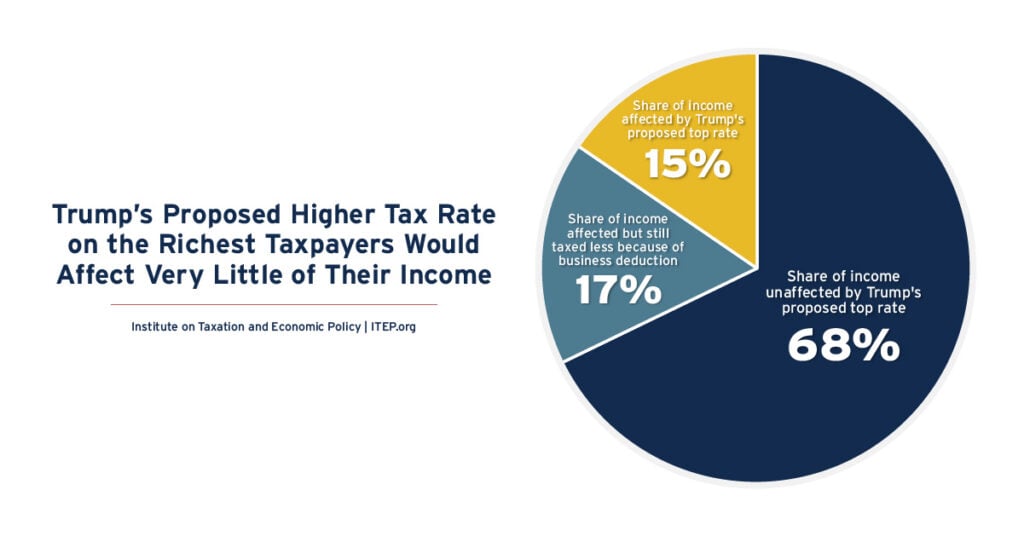

Trump’s Proposed Higher Tax Rate on the Richest Taxpayers Would Affect Very Little of Their Income

May 10, 2025 • By Carl Davis, Steve Wamhoff

President Donald Trump has proposed allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers. But many other special breaks in the tax code would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.

Senate Republicans Rig Congressional Rules to Make Their Tax Cuts Appear Cost-Free

April 4, 2025 • By Steve Wamhoff

This week, members of Congress are arguing about whether extending Trump’s 2017 tax cuts would cost trillions of dollars over a decade or cost nothing.

Different Approaches to the Trump Tax Law’s Cap on Deductions for State and Local Taxes (SALT)

January 17, 2025 • By Steve Wamhoff

President Trump and the Republican majorities in the House and Senate may not extend the $10,000 cap on federal income tax deductions for state and local taxes (SALT), the one part of the 2017 law that significantly limits tax breaks for the rich. And, depending on which proposal they settle on, leaving out the existing cap on SALT deductions could add between $10 billion and over $100 billion each year to the total cost of their tax plan.

Congress Could — But Won’t — Pass a Tax Package That Pays for Itself

January 17, 2025 • By Joe Hughes

If Republican lawmakers were serious about deficit-neutral tax reform, they would focus on increasing taxes for the ultra-wealthy and large corporations. The absence of such proposals in their plan reveals their true priority: delivering enormous tax cuts to the wealthiest Americans while average working families receive crumbs.

Billionaires and businesses have too much power in Washington. Tax revenue is needed to pay for things we all need. If we want economic justice, racial justice and climate justice, we must have tax justice.

The tax proposals from Vice President Kamala Harris would, on average, lead to a tax increase for the richest 1 percent of Americans and a tax cut for all other income groups.

The no tax on tips idea isn't a new one, but it's always been abandoned because it's practically impossible to do without creating new avenues for tax avoidance. Despite its embrace by the candidates from both major parties, this policy idea would do little to help the roughly 4 million people who work in tipped occupations while creating a host of problems.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2025 Budget Plan

March 12, 2024 • By Steve Wamhoff

President Biden’s most recent budget plan includes proposals that would raise more than $5 trillion from high-income individuals and corporations over a decade. Like the budget plan he submitted to Congress last year, it would partly reverse the Trump tax cuts for corporations and high-income individuals, clamp down on corporate tax avoidance, and require the wealthiest individuals to pay taxes on their capital gains income just as they are required to for other types of income, among other reforms.

Celebrating One Year Since the Landmark Inflation Reduction Act

August 14, 2023 • By Joe Hughes

The Inflation Reduction Act was a course correction from decades of tax cuts that primarily went to the richest Americans and left the rest of us with budget shortfalls that conservative lawmakers now seek to plug with cuts to Social Security and Medicare. For the first time in generations we are finally asking those who have benefited the most from our economy to contribute back.

The House’s Debt Ceiling Smoke Screen: The GOP Budget Plan Gives Cover for Tax Cuts for the Rich

May 9, 2023 • By Joe Hughes

While it isn’t reasonable in the first place for Congress to debate whether it will pay the bills it has already incurred, some of the same lawmakers who are holding the economy hostage to exact budget cuts have decided to make the conversation even more irrational by proposing to increase deficits with tax cuts that enrich the already rich.

Congress Should Raise Taxes on the Rich, But That’s a Totally Separate Issue from the Debt Ceiling

May 9, 2023 • By Steve Wamhoff

Congress absolutely should raise taxes on the rich and on corporations to generate revenue and improve the fairness of our tax code. President Biden has several proposals to do exactly that. But this is an entirely separate question from whether we should raise the debt ceiling to honor the debts the nation has already incurred and avoid an economic apocalypse.

The GOP is Finally Ready to Raise Taxes. (Or, When a Tax Hike is Not a Tax Hike.)

May 3, 2023 • By Joe Hughes

House Republicans recently voted to rescind the green energy and electric vehicle tax credits that were enacted last Congress as part of the Inflation Reduction Act. This newfound willingness to raise taxes stands in contrast to the recent position of almost the entire House Republican Caucus.

Lawmakers have repeatedly stepped on the same rake of slashing tax rates and expecting revenues to magically go up. Now they want middle-class Americans to be the ones who get hit in the face. The con is getting tired. If Congress wants to reel in the debt then it’s time to raise taxes on the wealthy.

As one of the most prosperous countries in human history, we have enough resources for our collective needs. By better taxing corporations and the wealthiest, we can generate revenue to improve family security, strengthen our communities, and reduce the debt too.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2024 Budget Plan

March 10, 2023 • By Steve Wamhoff

President Biden’s latest budget proposal includes trillions of dollars of new revenue that would be paid by the richest Americans, both directly through increases in personal income, Medicare and estate taxes, and indirectly through increases in corporate income taxes.

Politifalse: A Fact-Checker Does Biden an Injustice on Taxes Paid by Billionaires

March 9, 2023 • By Michael Ettlinger

Most Americans pay more in Social Security and Medicare payroll taxes than they pay in federal personal income tax. So just looking at the personal income tax for comparison misses most of the taxes middle-income Americans pay. That is not true for billionaires because a much, much smaller proportion of their income is subject to the federal payroll taxes.

State of the Union Likely to Continue Progress on Tax Justice

February 7, 2023 • By Amy Hanauer

After decades of Presidents who ran away from taxes, it’s a sea change to have a chief executive who understands that the rich should pay their fair share, extremely profitable corporations should pay their fair share, and the public sector should have revenue to invest in problems – like climate change and healthcare – that will only be solved with pathbreaking public action.

“Fair Tax” Plan Would Abolish the IRS and Shift Federal Taxes from the Wealthy to the Rest of Us

January 11, 2023 • By Steve Wamhoff

The "Fair Tax" bill would impose a 30 percent federal sales tax on everything we buy – groceries, cars, homes, health care - and lead to a giant tax shift from the well-off to everyone else.

New House Rules: Low Taxes for the Wealthy on Cruise Control, Tax Credits for Working People Face Roadblock

January 10, 2023 • By Joe Hughes

Two new rules will hamper the new Congress’s ability to pass tax legislation in the next two years. One requires a supermajority for legislation that increases income tax rates, and the other requires cuts to mandatory spending programs—like Medicare, Social Security, veterans’ benefits or unemployment insurance—in exchange for changes to the Child Tax Credit or Earned Income Tax Credit that would mostly help low-income families.

Congress should unite around a basic principle that Republican, Democratic, and independent voters support: the wealthiest, whether they are presidents, CEOs, or just rich heirs, should pay their fair share. Using Trump's tax maneuvering as a guidebook could make the tax code much fairer for all of us.

They Might Really Do It: The Senate Is About to Reform Our Tax Code

August 5, 2022 • By Steve Wamhoff

For now, the Senate is poised to reverse cuts to the IRS enforcement against wealthy tax evaders for the first time in a decade, crack down on tax-dodging by huge corporations for the first time since 1986, and finally address the method increasingly used by corporations to transfer income to shareholders to avoid federal taxes. The multi-decade winning streak of corporate lobbyists and special interests who have practically written many of our tax laws in recent years is about to come to an end.

The Tax Legislation Debated in Congress Would Reduce Inflation and Help Americans Deal with Rising Costs

July 19, 2022 • By Steve Wamhoff

Opposing a fully paid-for spending bill because of inflation concerns does not make any sense. Opposing a deficit-reducing bill because of inflation is absurd.

In addition to distributional analyses of existing and proposed tax law, ITEP provides policy recommendations for lawmakers to build a more equitable tax code, from progressive revenue-raising options to corporate tax reform to establishing a model for a wealth tax.