The ITEP Guide to State & Local Taxes

Tax Guide

ITEP's Tax Guide Research Priorities

How Do Real Property Taxes Work?

Property taxes on land and buildings are the oldest and still the largest major revenue source for state and local governments. They fund schools, health care, public safety, and other services. They are collected mostly by cities, counties, school districts, and other types of local government, but states typically make the rules for assessing the value of property and imposing the tax, with major implications for tax fairness and adequacy.

How Do Personal Income Taxes Work?

The personal income tax funds public education, health care, public safety, and other public services provided by state and local governments. If well-designed, it is the fairest major revenue source available to states.

What Principles Should Guide State and Local Tax Policy?

State and local taxes exist primarily to fund schools, roads, health care, and other services needed for communities to thrive. There are multiple ways to achieve this goal, so it can be helpful to evaluate different options based on a few core principles.

How Do State Corporate Income Taxes Work?

A robust corporate income tax ensures that profitable corporations help fund the public services they benefit from, just as working people do. It’s one of the few progressive taxes available to state policymakers.

How Do State and Local Tax Systems Affect Racial Justice?

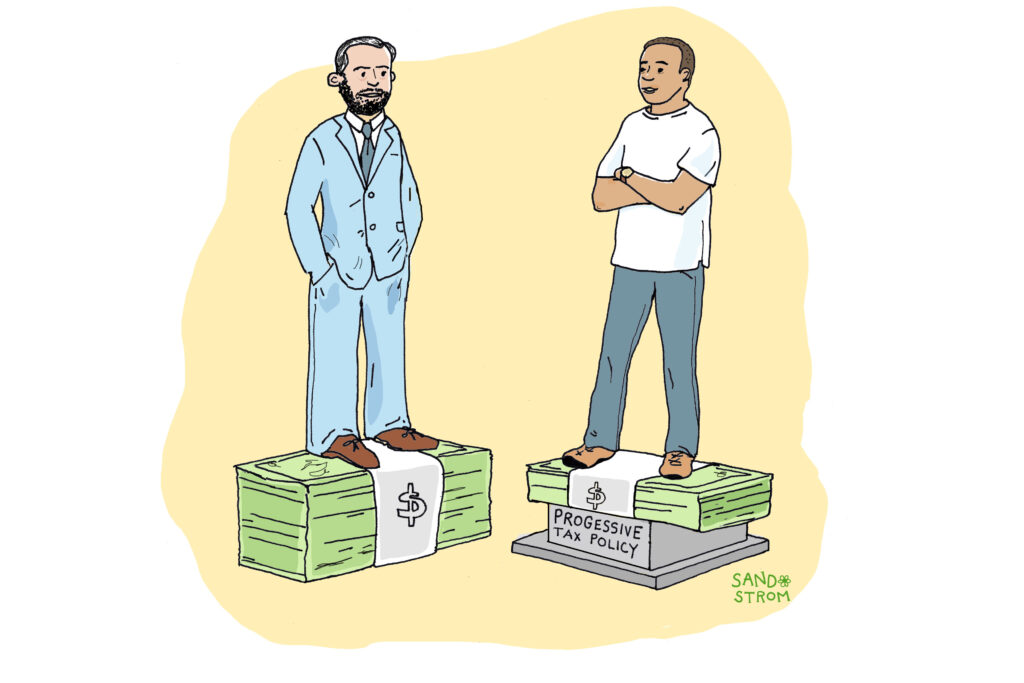

State and local tax codes have the potential to either narrow or widen racial inequality created by historical and current injustices in public policy and in broader society. In general, tax codes that are more progressive across the economic spectrum do more to narrow racial inequality, while regressive tax policies exacerbate it.

Do Tax Cuts Fuel Growth?

Tax policy is an important economic tool, but claims that tax changes will affect a state’s economy are often overstated. Such overstated claims are particularly common in discussions of taxes on wealthy individuals and profitable corporations, so careful assessment of such claims is an important part of shaping adequate and equitable revenue streams.

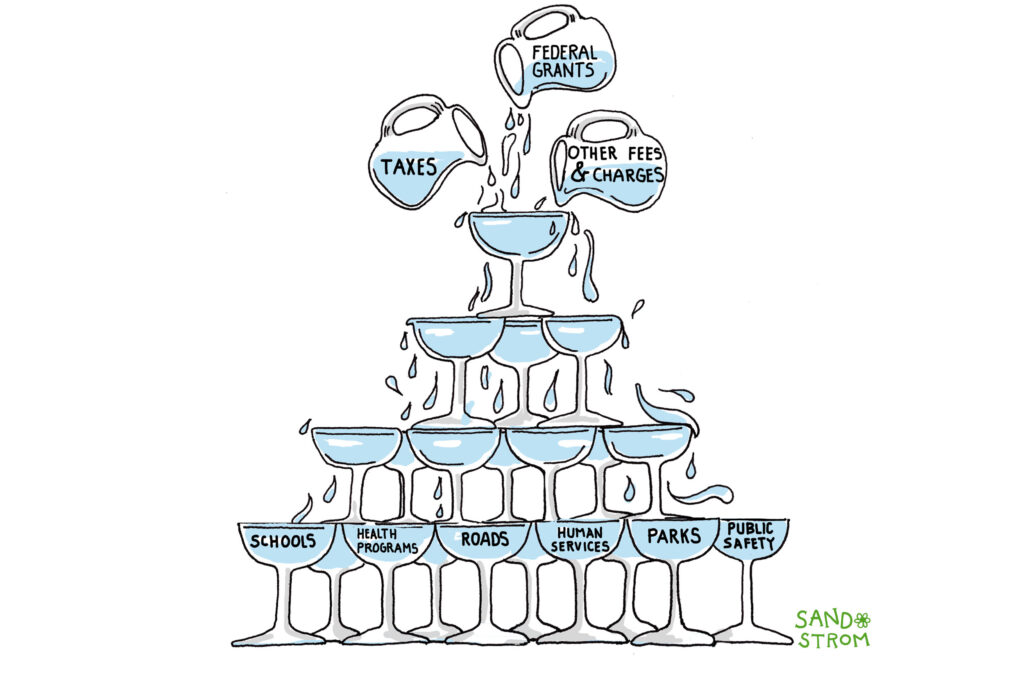

How Do State and Local Governments Raise Funds?

State and local governments play important roles in helping communities thrive. They fund and run schools, roads, parks, health programs, human services, public safety agencies, and other key services. To pay for these services, states and local areas receive money from multiple sources. The main source is taxes, but funds from the federal government and fees people pay to use services are also important contributors.

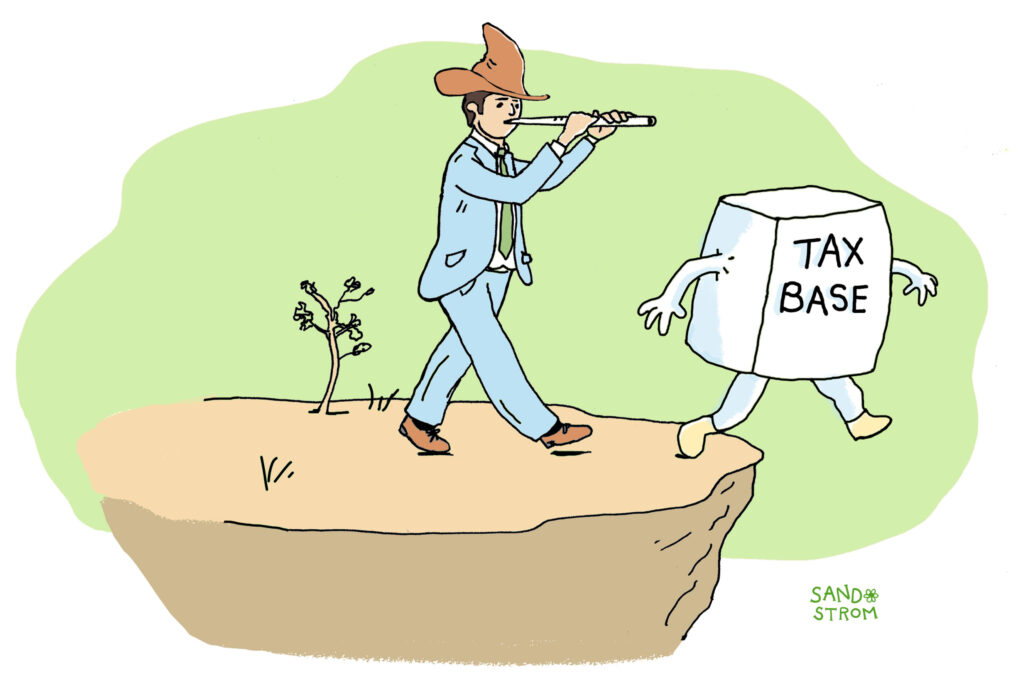

What Are Tax Bases and Tax Rates?

Taxes are calculated by multiplying a tax rate by a tax base (the things being taxed). Broader tax bases allow for lower tax rates while raising the same amount of revenue. It’s often helpful to differentiate nominal rates (the rate written into law) from effective tax rates (what people actually pay relative to their income).

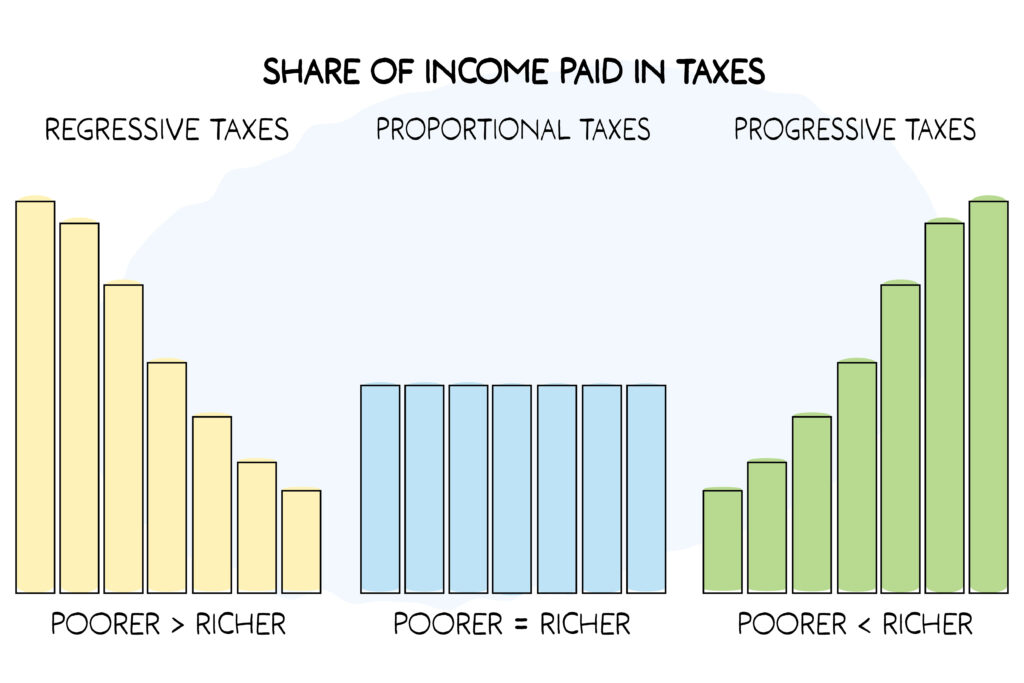

Why Should States and Localities Have Progressive Tax Systems?

A tax system cannot be described as fair unless it is progressive, but that’s not the only reason why states should tax upper-income people at higher rates than those with lower incomes. Progressive state tax codes raise more revenue for public services, improve the government’s relationship with residents, reduce poverty, and advance racial equity.

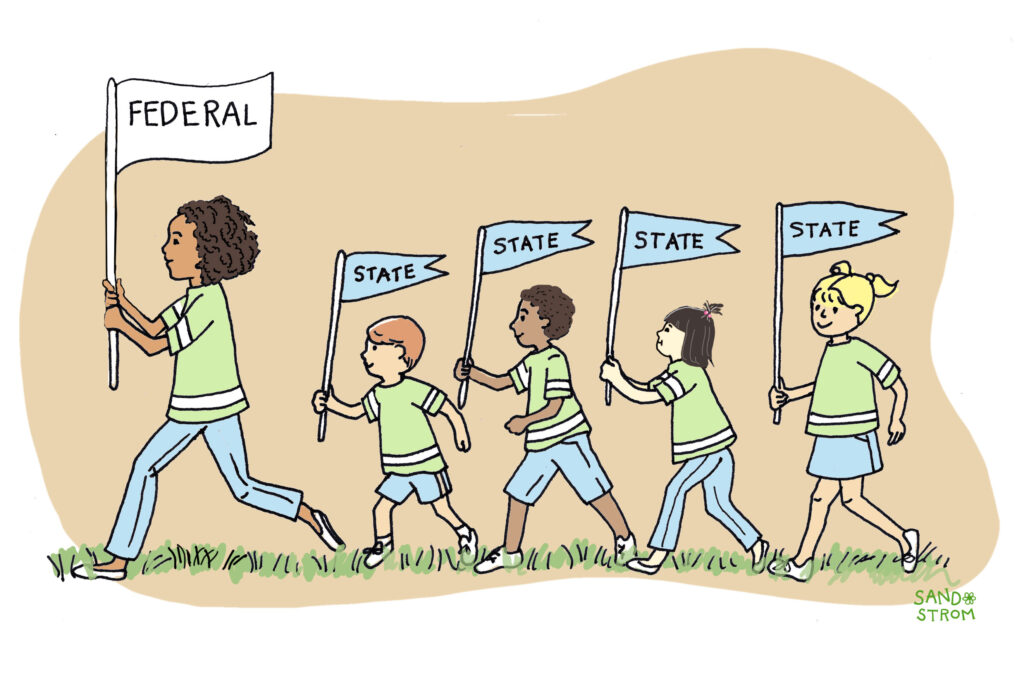

How Does Federal-State Tax Conformity Work?

Most states use the federal tax code as a starting point for their calculations of state personal income taxes, corporate income taxes, and estate taxes. Changes to the federal code and federal tax administration have the potential to affect state tax systems enormously, but to some extent states can pick and choose which of those federal changes to accept.

What Are Local Governments’ Taxing Authorities?

Tens of thousands of local governments in the United States, from big cities like Los Angeles and New York to rural counties, school districts, and small towns, operate schools, roads, parks, public safety, and other services. To pay for it, they collect roughly $1 trillion in taxes annually and receive another $800 billion in grants from states. But states, not just localities, set many of the rules for local taxes, and sometimes use that authority to undermine local democracy.

How Do State Tax and Expenditure Limits Work?

A Tax and Expenditure Limit (TEL) is a formula written into state law or into a state constitution that constrains government revenue and spending. These measures can undermine governmental accountability, degrade essential public services like health care and education, and create inequitable tax burdens.

Why Does Tax Incidence Matter and How Do We Measure It?

Tax incidence shows who pays taxes and how much they pay. In studying tax fairness, tax incidence specifically looks at how much people at different income levels pay. Tax incidence analysis is a critical tool for assessing the fairness of tax systems and in showing the equity or inequity of tax policy proposals.

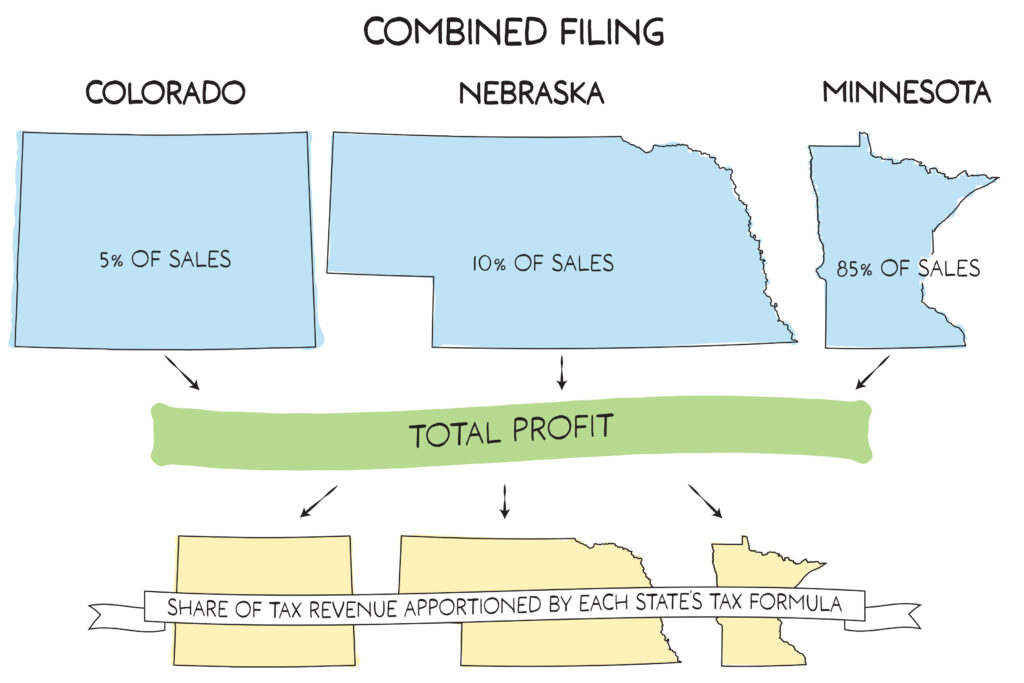

How Do States Use Combined Reporting to Tax Complex Multi-State Corporations?

Combined reporting requires corporations with multistate operations to report all their revenues and expenses together, making it harder for them to avoid state taxes by moving money around. This policy mainly affects very large companies, and it helps those states that use it to collect billions in tax revenue to fund services like education, public safety, and infrastructure that businesses and their employees rely on.

What State and Local Taxes Do Undocumented Immigrants Pay?

Like everyone else in America, immigrants pay taxes, whatever their legal status. The income taxes, property taxes, and sales and excise taxes paid by both documented and undocumented immigrants help sustain American public schools, services, and infrastructure. Undocumented immigrants paid more than $37 billion to states and localities in 2022, and they pay higher effective state and local tax rates as a share of their incomes than our wealthiest citizens.

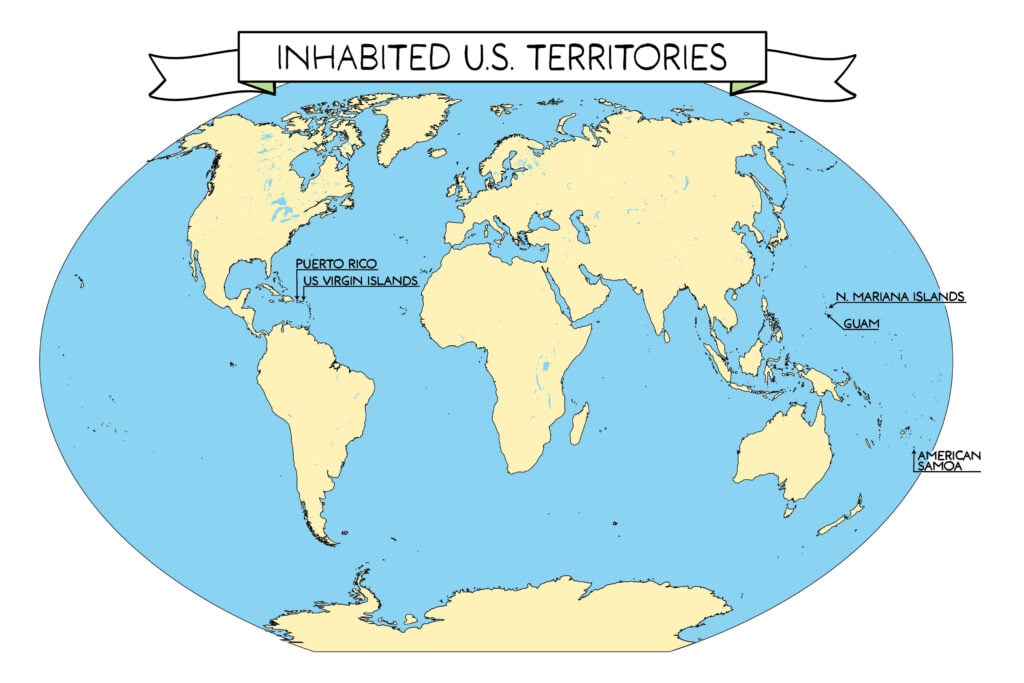

What Taxes Are Paid in Puerto Rico and Other U.S. Territories?

U.S. territories collect taxes to fund schools, roads, health care, and other services, somewhat like states do. They levy income taxes, sales taxes, property taxes, and other typical state and local taxes. These taxes can have important progressive elements, but territorial status poses unique challenges for fair and adequate taxation.

How Do State Itemized Deductions Work?

Most states that collect income taxes allow taxpayers to claim itemized deductions, which are tax breaks for items such as charitable donations, mortgage interest, medical expenses, and property taxes. These deductions reduce revenues that could otherwise be used for services like schools and health care, and they mostly benefit wealthy families. Because they are so skewed and ineffective, many states either limit itemized deductions or forgo them altogether.

How Do Legal Fines and Fees Work?

Local and state governments receive funds from fines and fees paid by people and businesses who have been charged with various offenses. These supplement tax revenues. Such financial penalties are intended to deter and punish bad behavior. But relying too heavily on fines and fees worsens economic and racial inequality, creates incentives for over-policing, and creates an unstable funding stream for crucial public services.

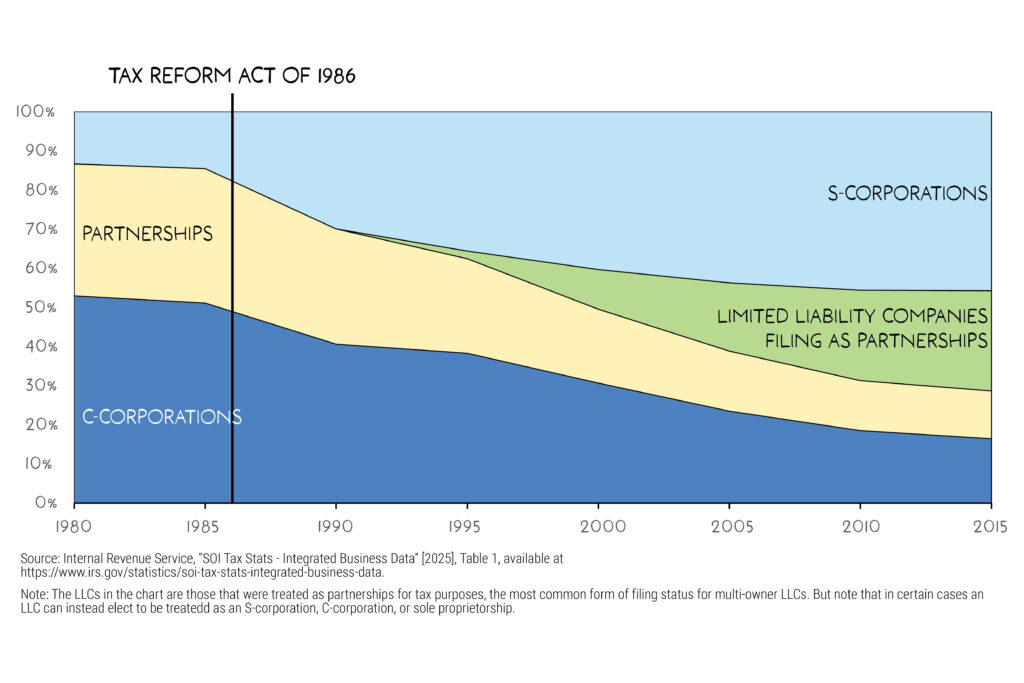

How Do States Tax the Profits of Pass-through Entities?

Most businesses are not liable for corporate income tax on their profits. Instead, federal and state tax laws allow them to choose a structure such as partnerships, sole proprietorships, and S-corporations under which their profits are passed through to their owners for taxation. These “pass-through entities” benefit from state-funded services like schools, infrastructure, and public safety, and their owners are generally wealthy, so taxing them fairly – at a minimum ensuring that pass-through income is taxed at the same rate as wages – is essential to a sound and equitable revenue system.

Glossary

Ability to pay The principle that those with greater financial resources should pay a larger share of their income in taxes than less-wealthy individuals. Adjusted gross income (AGI) The amount of income subject to tax after applying certain adjustments but before subtracting many types of deductions and exemptions. Federal AGI is typically the starting point […]

How Do Personal Property Taxes Work?

The great majority of property tax revenue is based on the value of land and buildings, but states also apply property taxes to certain business equipment, machinery, and supplies, and sometimes also to automobiles. Collectively these taxes are known as “personal property taxes.”

How Do States Tax Investment Income?

State personal income taxes apply not just to wages and salaries but also earnings on investments, like stocks and bonds. Most investments are held by wealthy people, so when states tax investment income at a lower rate than wages, high-income households pay tax at lower rates than middle-income households. By contrast, states that strengthen taxation of investment income can raise substantial revenue while improving economic and racial equity of their tax code.

How Do States Tax Cannabis?

A growing number of states are legalizing and taxing cannabis. Cannabis taxes are raising revenue for education, health care, and addressing substance abuse while encouraging consumers to moderate their use. But high cannabis taxes also mean that low-income communities previously targeted for enforcement now pay a disproportionate share of tax.

How Do State Tax Credits for Workers and Families Work?

State-level Earned Income Tax Credits (EITCs) and Child Tax Credits (CTCs) help workers and families make ends meet by reducing their taxes and providing refunds. Research shows these credits are very effective at reducing poverty and creating more equitable tax systems.

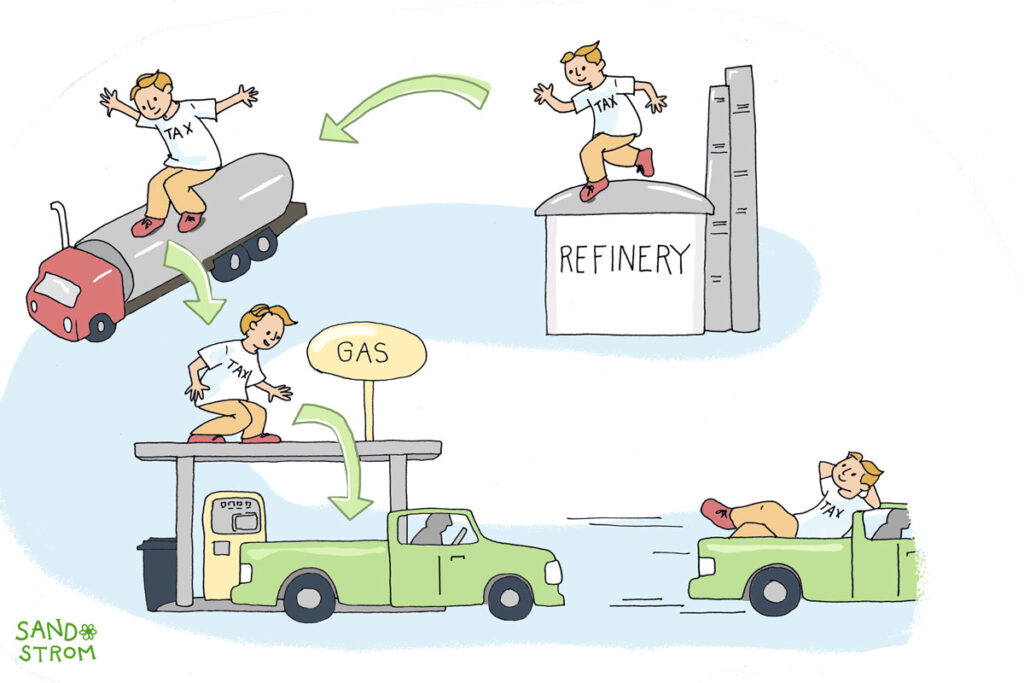

How Do State and Local Excise Taxes Work?

Excise taxes are sales taxes that apply to specific goods (such as gasoline, tobacco, or alcohol) or services (such as hotel and car rentals). Sometimes it’s appropriate to ask consumers of a particular item to pay an especially high tax for various reasons. But even in those circumstances, many excise taxes are highly regressive.

How Do State Estate and Inheritance Taxes Work?

Estate and inheritance taxes are taxes on wealth passed on after someone’s death. They are a common way for states to tax the inheritances of wealthy individuals. These taxes ensure that those very large estates help pay for public services like schools, hospitals, and parks.

How Can Communities Collect Property Taxes from Exempt Nonprofits?

Payment in Lieu of Taxes (PILT or PILOT) programs allow local governments to collect revenue from nonprofits that otherwise would not be contributing to the cost of providing local services.

How Can Cities and States Reduce Property Taxes for Homeowners and Renters?

To reduce the cost of property taxes for homeowners and renters, many places offer homestead exemptions, circuit breakers, and deferrals. Such provisions are more cost-effective alternatives to broad tax cuts or tax limitations.

What’s Exempt from State and Local Sales Taxes?

State and local sales taxes are typically conceived as broad-based consumption taxes – that is, taxes on most things consumers buy. In practice, many purchases are exempt from sales taxes.

How Do State and Local Sales Taxes Work?

Sales taxes are the second largest source of revenue for state and local governments. In nearly every state they are an important way we pay for public education, health care, public safety, and other services. But they are also typically the costliest tax for low-income families.

ITEP Guide to State & Local Taxes

The ITEP Guide to State & Local Taxes offers citizens, advocates, journalists, and policymakers a detailed primer on state and local tax policy. The guide explains a wide range of tax concepts and specific levies that states and localities use to fund public services - all in an easy-to-understand and accessible way.