Colorado

Tax Cuts 2.0 – Colorado

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

State Rundown 9/26: States Cleaning Up from Florence, Gearing Up for November

September 26, 2018 • By ITEP Staff

Affordable housing efforts made news in Minnesota and Virginia this week, as tax breaks for homeowners and other victims of Hurricane Florence were made available in multiple states. Meanwhile, New Jersey is still looking into legalizing and taxing cannabis, and Wyoming continues to consider a corporate income tax. And gubernatorial candidates and ballot initiative efforts will give voters in many states much to consider in the November elections.

State Tax Codes Can Help Mitigate Poverty and Impact of Federal Tax Cuts on Low- and Middle-Income Families

September 20, 2018 • By Misha Hill

The national poverty rate declined by 0.4 percentage points to 12.3 percent in 2017. According to the U.S. Census, this was not a statistically significant change from the previous year. 39.7 million Americans, including 12.8 million children, lived in poverty in 2017. Median household income also increased for the third consecutive year, but this was […]

The Rundown is back after a few-week hiatus, with lots of state fiscal news and quality research to share! Maine lawmakers found agreement on a response to the federal tax-cut bill, states continue to sort out how they’ll collect online sales taxes in the wake of the Wayfair decision, and policymakers in several states have been working on summer tax studies and other preparations for 2019 legislative sessions. Meanwhile, work on ballot measures and candidate tax plans to go before voters in November has been even more active, particularly in Arizona, California, Florida, Hawaii, and Missouri. Our “What We’re Reading” section has lots of great research and reading on inequalities, cities turning…

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

State Rundown 8/16: November Ballots and 2019 Debates Coming into Focus

August 16, 2018 • By ITEP Staff

Even as the haze from western wildfires reduced visibility across the nation this week, voters got more clarity on what to expect to see on their ballots this fall, particularly in California (commercial property taxes and corporate surcharges), Colorado (income taxes for education), Missouri (gas tax update), and North Dakota (recreational cannabis). Meanwhile, although Virginia lawmakers won’t return until 2019, they got a preview of a clear-headed federal conformity plan they should strongly consider. And look to our “What We’re Reading“ section for further enlightenment from researchers on the [in]effectiveness of charitable contribution credits, the [lack of] wage growth for…

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.

Although most state legislatures are out of session during the summer, the pursuit of better fiscal policy has no "off-season." Here at ITEP, we've been revamping the State Rundown to bring you your favorite summary of state budget and tax news in the new-and-improved format you see here. Meanwhile, leaders in Massachusetts and New Jersey have been hard at work in recent weeks and are already looking ahead their next round of budget and tax debates. Lawmakers in many states are using their summer break to prepare for next year's discussions over how to implement online sales tax legislation. And…

The Fight for Education Funding: State Revenue Needs and Responses in 2018

July 24, 2018 • By Aidan Davis

States’ need for revenue and increased investment in key public services is not unique to this legislative session. But the extent of disinvestment—particularly in education—has been a driving force behind policy discussion and state legislative action this year. In many cases ill-advised tax cuts coupled with persistent school funding cuts led states to this common fate, initiating a powerful and growing trend. Here’s how lawmakers in a handful of state responded:

State Rundown 7/19: Wayfair Fallout and Ballot Preparation Dominate State Tax Talk

July 19, 2018 • By ITEP Staff

In the wake of the U.S. Supreme Court's recent Wayfair decision authorizing states to collect taxes owed on online sales, Utah lawmakers held a one-day special session that included (among other tax topics) legislation to ensure the state will be ready to collect those taxes, and a Nebraska lawmaker began pushing for a special session for the same reason. Voters in Colorado and Montana got more clarity on tax-related items they'll see on the ballot in November. And Massachusetts moves closer toward becoming the final state to enact a budget for the new fiscal year that started July 1 in…

Building on Momentum from Recent Years, 2018 Delivers Strengthened Tax Credits for Workers and Families

July 10, 2018 • By Aidan Davis

Despite some challenging tax policy debates, a number of which hinged on states’ responses to federal conformity, 2018 brought some positive developments for workers and their families. This post updates a mid-session trends piece on this very subject. Here’s what we have been following:

With many state fiscal years beginning July 1, most states that will make decisions this year about federal tax conformity have now done so, so it is now time for an update on how well state policymakers have kept to, or veered from, the path we charted out earlier this year. Most states that have enacted laws in response to the federal changes have adhered to some but not all of the principles we laid out, with a few responding rather prudently and a handful charting a much more treacherous course of unfair, unsustainable policy based on unfounded promises of…

State Rundown 5/23: Special Sessions Abound Amid Budget Vetoes, Stalemates, Federal Tax Bill

May 23, 2018 • By ITEP Staff

This week the governors of Louisiana and Minnesota both vetoed budget bills, leading to another special session in Louisiana and unanswered questions in Minnesota, and Missouri legislators managed to push through a tax shift bill just before adjourning their regular session and heading right into a special session to impeach their governor. Wisconsin and Wyoming localities are both looking at ways to raise revenues as state funding drops. And our What We're Reading section contains helpful pieces on changing demographics, the effects of wealth inequality on families with children, and the impacts of the Supreme Court sports gambling and online…

SALT/Charitable Workaround Credits Require a Broad Fix, Not a Narrow One

May 23, 2018 • By Carl Davis

The federal Tax Cuts and Jobs Act (TCJA) enacted last year temporarily capped deductions for state and local tax (SALT) payments at $10,000 per year. The cap, which expires at the end of 2025, disproportionately impacts taxpayers in higher-income states and in states and localities more reliant on income or property taxes, as opposed to sales taxes. Increasingly, lawmakers in those states who feel their residents were unfairly targeted by the federal law are debating and enacting tax credits that can help some of their residents circumvent this cap.

State Rundown 5/17: Don’t Bet on Legal Sports Betting Solving State Budget Woes

May 17, 2018 • By ITEP Staff

This week the U.S. Supreme Court opened the door to legal sports gambling in the states (see our What We're Reading section), which will surely be a hot topic in state legislative chambers, but most states currently have more pressing matters before them. The teacher pay crisis made news in North Carolina, Alabama, and nationally. Louisiana, Oregon, and Vermont lawmakers are headed for special sessions over tax and budget issues. And several other states have recently reached or are very near the end of their legislative sessions.

NC Teachers’ March on Raleigh and the Tax Cuts that Led Them There

May 15, 2018 • By Aidan Davis

Once again, public school teachers are taking a stand for education and against irresponsible, top-heavy tax cuts that deprive states of the revenue they need to sufficiently fund public services, including education.

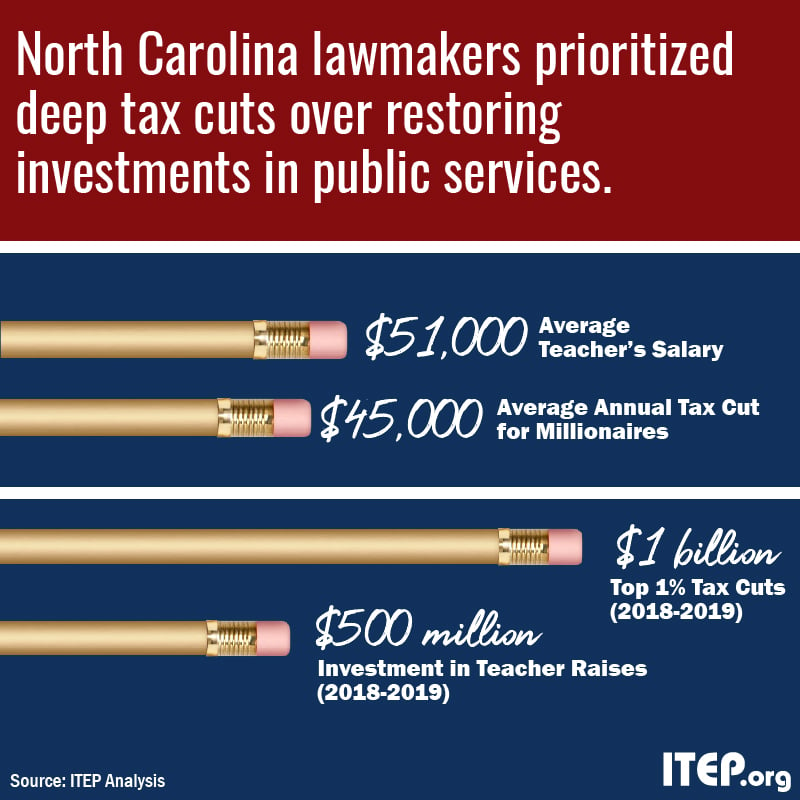

Millionaires Average Annual Tax Cut in North Carolina Is Comparable to Average Teacher’s Salary

May 11, 2018 • By Meg Wiehe

North Carolina lawmakers' misplaced priorities are evident: The recent rounds of tax cuts will provide the state’s millionaires with an average annual tax break of more than $45,000, which is nearly as much as the average teacher’s annual salary of about $50,000.

State Rundown 5/9: Iowa Digs a New Hole as Other States Try to Avoid or Climb Out of Theirs

May 9, 2018 • By ITEP Staff

This week we have news of a destructive tax cut plan finally approved in Iowa just as one was narrowly avoided in Kansas. Tax debates in Minnesota and Missouri will go down to the wire. And residents of Arizona and Colorado are considering progressive revenue solutions to their states' education funding crises.

State Rundown 5/3: Progressive Revenue Solutions to Fiscal Woes Gaining Traction

May 3, 2018 • By ITEP Staff

This week, Arizona teachers continued to strike over pay issues and advocates unveiled a progressive revenue solution they hope to put before voters, while a progressive income tax also gained support as part of a resolution to Illinois's budget troubles. Iowa and Missouri legislators continued to try to push through unsustainable tax cuts before their sessions end. And Minnesota and South Carolina focused on responding to the federal tax-cut bill.

State Rundown 4/27: Arbor Day Brings Some Fruitful Tax Developments, Some Shady Proposals

April 27, 2018 • By ITEP Staff

This Arbor Day week, the seeds of discontent with underfunded school systems and underpaid teachers continued to spread, with walkouts occurring in both Arizona and Colorado. And recognizing the need to see the forest as well as the trees, the Arizona teachers have presented revenue solutions to get to the true root of the problem. In the plains states, tax cut proposals continue to pop up like weeds in Kansas and threaten to spread to Iowa and Missouri, where lawmakers are running out of time but are still hoping their efforts to pass destructive tax cuts will bear fruit.

State Rundown 12/31/9999: IRS Glitch and Legislative Impasses Extend Tax Season

April 20, 2018 • By ITEP Staff

This week the IRS website asked some would-be tax filers to return after December 31, 9999. State legislators don't have quite that much time, but are struggling to wrap up their tax debates on schedule as well. Iowa legislators, for example, are ironically still debating tax cuts despite having run out of money to cover their daily expenses for the year. Nebraska's session wrapped up, but its tax debate continues in the form of a call for a special session and the threat of an unfunded tax cut going before voters in November. Mississippi's tax debate has been revived by…

Trends We’re Watching in 2018, Part 5: 21st Century Consumption Taxes

April 20, 2018 • By Misha Hill

We're highlighting the progress of a few newer trends in consumption taxation. This includes using the tax code to discourage consumption of everything from plastic bags to carbon and collecting revenue from emerging industries like ride sharing services and legalized cannabis sales.

What to Expect if the Supreme Court Allows for Online Sales Tax Collection

April 11, 2018 • By Carl Davis

Online shopping is hardly a new phenomenon. And yet states and localities still lack the authority to require many Internet retailers to collect the sales taxes that their locally based, brick and mortar competitors have been collecting for decades.

State Rundown 3/30: Several Major Tax Debates Will March on into April

March 30, 2018 • By ITEP Staff

This week, after the recent teacher strike in West Virginia, teacher pay crises brought on by years of irresponsible tax cuts also made headlines in Arizona and Oklahoma. Maine and New York lawmakers continue to hash out how they will respond to the federal tax bill. And their counterparts in Missouri and Nebraska attempt to push forward their tax cutting agendas.

Colorado Fiscal Institute: Pies & Charts: Mid-Session Briefing

March 29, 2018

Pies and Charts is the annual mid-session briefing hosted by Colorado Fiscal Institute.