Colorado

ITEP’s Marco Guzman: Making a More Robust Property Tax Circuit Breaker in Colorado

September 9, 2023

ITEP Senior State Policy Analyst Marco Guzman gave a presentation on property tax circuit breakers to the Colorado General Assembly’s Legislative Oversight Committee Concerning Tax Policy on September 7, 2023. Click here for the slide deck.

States and Localities are Making Progress on Curbing Unjust Fees and Fines

July 18, 2023 • By Andrew Boardman

Too many state and local governments tap legal-system collections, rather than adequate tax systems, to fund shared essentials like public safety and education. But a growing number of states and localities are choosing a better approach. Momentum for change has continued to build in 2023, with no fewer than seven states enacting substantial improvements.

State lawmakers continue to make groundbreaking progress on state tax credits, with 17 states creating or enhancing Child Tax Credits or Earned Income Tax Credits so far this year. These policies have the potential to boost family economic security and dramatically reduce the number of children living below the poverty line.

States Looking to Make Property Taxes Affordable Should Turn to ‘Circuit Breakers’

May 11, 2023 • By ITEP Staff

Many state legislatures this year have been considering property tax cuts – but too many are ignoring the solution that speaks more directly to questions of property tax affordability than any other policy option: the “circuit breaker."

States are Talking About the Wrong Kind of Property Tax Cuts

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Concerns over property tax affordability have been at the forefront this year as housing prices have climbed and property tax bills have often increased along with them. As lawmakers mull a range of property tax cuts, circuit breakers are the best possible approach—and these policies are receiving far too little attention in the states.

State Rundown 5/10: Momentum on State Tax Credits Continues to Build

May 10, 2023 • By ITEP Staff

This week, in states across the country the momentum to center improvements to family economic security remains strong...

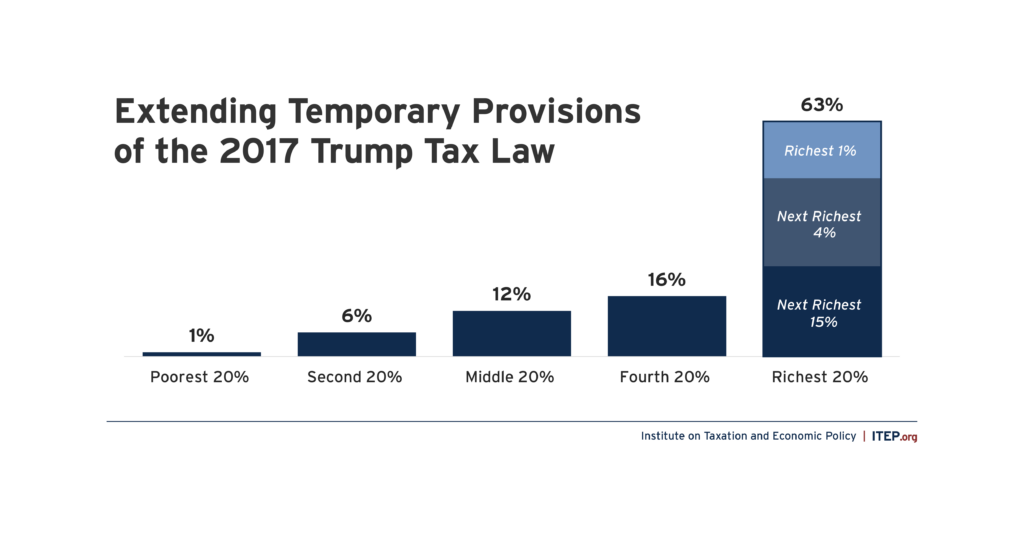

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

While the conversations on the debt ceiling heat up in the nation's capital, debates on state tax policy also continue to unfold in capitol buildings across the nation...

This week, a bill out of Arkansas that would cut the top personal income tax rate and the corporate income tax rate found its way to the governor’s desk...

State Rundown 2/23: Tax Dominos Take Shape, Begin to Fall as Session Heats Up

February 23, 2023 • By ITEP Staff

The 2023 legislative session is in full swing, and dominos continue to be set up as others fall...

State Rundown 2/1: February Brings New (and Some Old) Tax Policy Conversations

February 1, 2023 • By ITEP Staff

Tax bills across the U.S. are winding their way through state legislatures and governors continue to set the tone for this year’s legislative sessions...

State Rundown 1/19: ITEP Provides a Roadmap for Equitable Tax Goals in 2023

January 19, 2023 • By ITEP Staff

State legislatures are buzzing as leaders and lawmakers jockey to advance their 2023 goals...

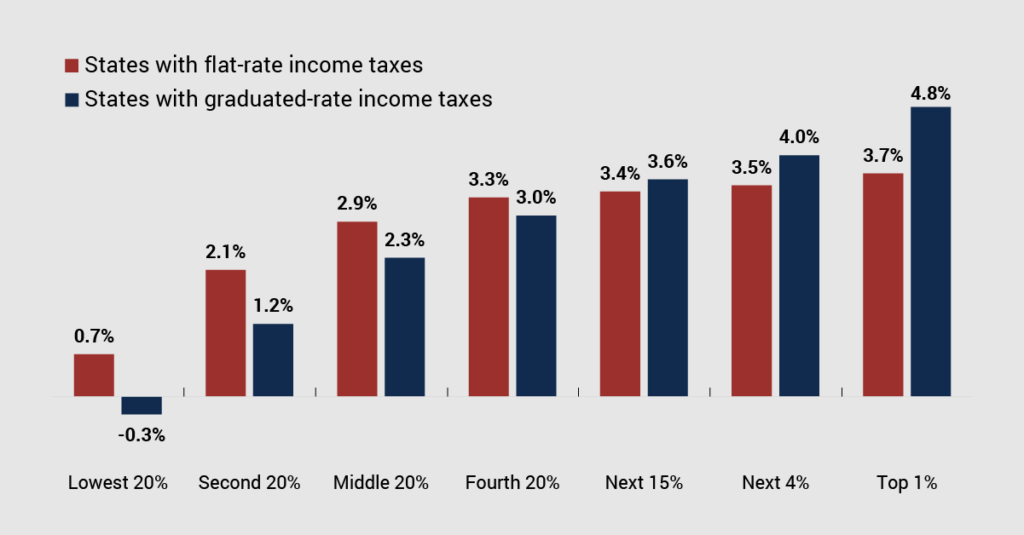

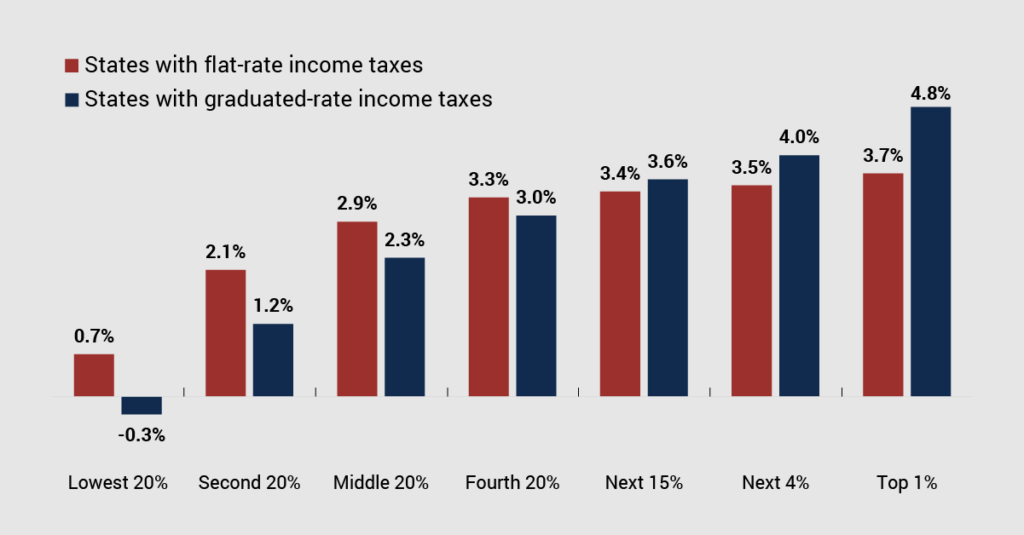

Two-thirds of states with broad-based personal income tax structures have a graduated rate, while one-third have flat taxes.

Flat taxes have some surface appeal but come with significant disadvantages. Critically, a flat tax guarantees that wealthy families’ total state and local tax bill will be a lower share of their income than that paid by families of more modest means.

State Rundown 1/11: Governors Ready to Talk Tax in 2023 State Addresses

January 11, 2023 • By ITEP Staff

Governors have begun their annual trek to the podium in statehouses across the U.S. to lay out their visions for 2023, and so far, taxes look like they will play a major role in debates throughout state legislative sessions...

State Rundown 12/15: State Priorities for 2023 Begin to Take Shape

December 15, 2022 • By ITEP Staff

State leaders have begun to release budget projections for 2023 and a familiar theme has emerged once again: big revenue surpluses, which have many state lawmakers pushing for another round of tax cuts despite the monumental challenges that we as a country face that call for sustainable revenues...

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

As states continue to tally the remaining votes and the news stories roll out at a breakneck pace, the unofficial results of the 2022 midterm elections have brought with it significant changes across the state tax policy landscape...

Election Day in the States: Voters Deliver Important Victories for Tax Justice

November 10, 2022 • By Jon Whiten

Voters in Massachusetts and Colorado raised taxes on their wealthiest residents to fund schools, public transportation and school lunches for kids while making their tax codes more equitable. And voters in West Virginia defeated a proposal to deeply cut taxes, mostly for businesses, and drain the coffers of county and local governments.

Next Tuesday, voters will head to the polls to not only elect local and national leaders, but also let their voices be heard on a range of tax policy issues that could improve or worsen their state tax codes...

Measures on the November Ballot Could Improve or Worsen State Tax Codes

October 26, 2022 • By Jon Whiten

In a couple of weeks, voters in a handful of states will weigh in on several tax-related ballot measures that could make state tax codes more equitable and raise money for public services, or take states in the opposite direction, making tax systems less fair and draining state coffers of dollars needed to maintain critical […]

Although the weather is beginning to cool down in parts of the country, the same cannot be said for many state economies, which are still running hot. That, however, doesn’t mean that the good times are guaranteed to last...

Do you remember/the big tax news innn September? Well, if not, we at ITEP got you covered...

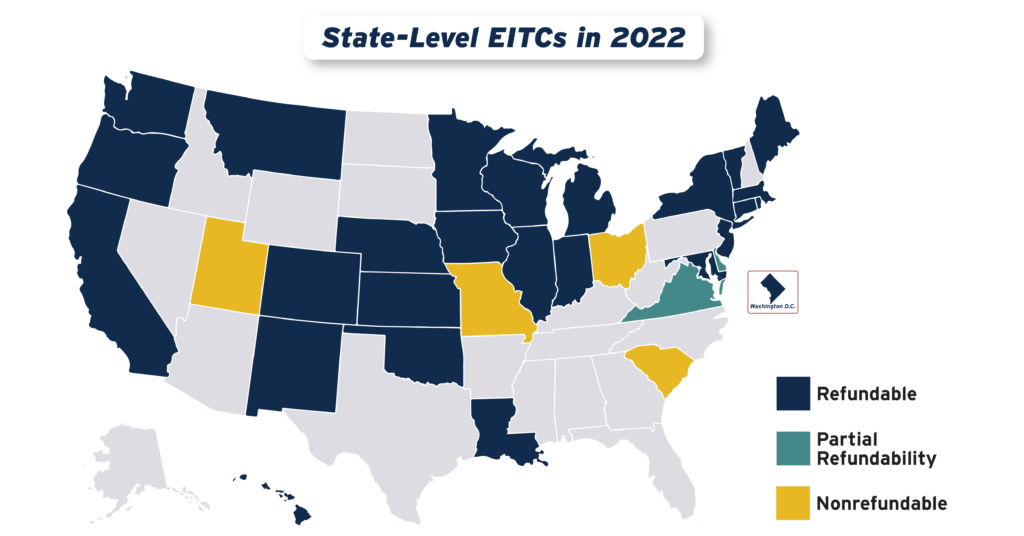

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.