District of Columbia

State Rundown 4/3: Some States Buck the Trend on Foolish Tax Policy

April 3, 2024 • By ITEP Staff

This week tax cuts were debated across the upper Midwest...

Local Mansion Taxes: Building Stronger Communities with Progressive Taxes on High-Value Real Estate

March 14, 2024 • By Andrew Boardman

More than one dozen cities and counties levy progressive taxes on high-price real estate transactions — sometimes called mansion taxes — and over a dozen more are considering such policies. By asking buyers and sellers with greater financial means to contribute more to the common good, these policies are equipping communities with resources to make progress on critical challenges of local and national concern.

Local Policy Analyst

March 7, 2024 • By ITEP Staff

ITEP seeks a Local Policy Analyst or Senior Policy Analyst to advance equitable and adequate tax policy in cities, towns, and counties across the country.

State Rundown 1/26: Wealth Taxes Drawing Interest Early in Legislative Sessions

January 26, 2024 • By ITEP Staff

Bills are moving and state legislative sessions are picking up across the country, giving elected officials the opportunity to consider two distinct paths when it comes to tax policy...

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

Worthwhile Ideas for a Stronger and Fairer D.C. Tax Code

January 17, 2024 • By Andrew Boardman, Kamolika Das, Marco Guzman

The nation’s capital has a once-in-a-decade opportunity to advance a stronger and fairer local tax code. New draft recommendations from a key advisory panel will help leaders make the most of the moment.

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. Yet a few states have made strides to buck that trend and have tax codes that are somewhat progressive and therefore do not worsen inequality.

Tax Systems in 44 States Exacerbate Inequality, In-Depth ‘Who Pays?’ Study Finds

January 9, 2024 • By ITEP Staff

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. That’s according to the latest edition of the Institute on Taxation and Economic Policy’s Who Pays?, the only distributional analysis of tax systems in all 50 states and the District of Columbia.

Vermont: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Vermont Download PDF All figures and charts show 2024 tax law in Vermont, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.7 percent) state and local tax revenue collected in Vermont. State and local tax shares of family income Top 20% Income Group […]

Oregon: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Oregon Download PDF All figures and charts show 2024 tax law in Oregon, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.5 percent) state and local tax revenue collected in Oregon. State and local tax shares of family income Top 20% Income Group […]

New York: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

New York Download PDF All figures and charts show 2024 tax law in New York, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.9 percent) state and local tax revenue collected in New York. State and local tax shares of family income Top […]

New Jersey: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

New Jersey Download PDF All figures and charts show 2024 tax law in New Jersey, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.9 percent) state and local tax revenue collected in New Jersey. State and local tax shares of family income Top […]

New Mexico: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

New Mexico Download PDF All figures and charts show 2024 tax law in New Mexico, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.6 percent) state and local tax revenue collected in New Mexico. As seen in Appendix D, recent tax policy changes […]

Minnesota: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Minnesota Download PDF All figures and charts show 2024 tax law in Minnesota, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.9 percent) state and local tax revenue collected in Minnesota. As seen in Appendix D, recent tax policy changes have added to […]

Massachusetts: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Massachusetts Download PDF All figures and charts show 2024 tax law in Massachusetts, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.8 percent) state and local tax revenue collected in Massachusetts. As seen in Appendix D, recent tax policy changes have significantly lessened […]

Maine: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Maine Download PDF All figures and charts show 2024 tax law in Maine, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.8 percent) state and local tax revenue collected in Maine. State and local tax shares of family income Top 20% Income Group […]

District of Columbia: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

District of Columbia Download PDF All figures and charts show 2024 tax law in the District of Columbia, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly 100 percent of DC’s tax revenue. These figures depict the District’s EITC for workers with children at its […]

California: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

California Download PDF All figures and charts show 2024 tax law in California, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.2 percent) state and local tax revenue collected in California. State and local tax shares of family income Top 20% Income Group […]

The Estate Tax is Irrelevant to More Than 99 Percent of Americans

December 7, 2023 • By Steve Wamhoff

The federal estate tax has reached historic lows. In 2019, only 8 of every 10,000 people who died left an estate large enough to trigger the tax. Legislative changes under presidents of both parties have increased the basic exemption from the estate tax over the past 20 years. This has cut the share of adults leaving behind taxable estates down from more than 2 percent to well under 1 percent.

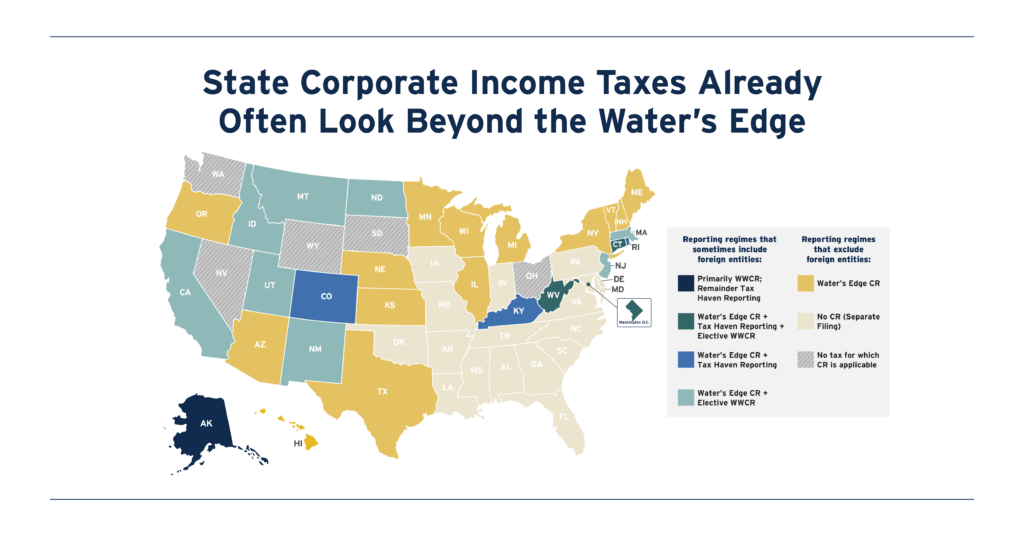

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

DC Fiscal Policy Institute: Taxing Capital Gains More Robustly Can Help Reduce DC’s Racial Wealth Gap

November 1, 2023

The federal and DC governments tax income from wealth more favorably than income from work. This preferential treatment means we under tax the most well-off, tax their wealth less often, and, in some cases, allow them to accumulate fortunes and pass vast sums of wealth to heirs tax-free. Read more.

Local Earned Income Tax Credits: How Localities Are Boosting Economic Security and Advancing Equity with EITCs

October 30, 2023 • By Andrew Boardman, Galen Hendricks, Kamolika Das

Leading localities are using refundable EITCs to boost incomes and reduce taxes for workers and families with low and moderate incomes. These local credits build on the success of EITCs at the federal and state levels, reduce economic hardship and improve the fairness of the tax code.

Testimony of Neva Butkus Before the Indiana State and Local Tax Review Task Force

October 20, 2023

Today ITEP State Policy Analyst Neva Butkus presented to the Indiana State and Local Tax Review Task Force. For a related blog from Neva, click here. For her slide deck, click here. Good morning members of the State and Local Tax Review Task Force, Thank you for providing me the opportunity to share ITEP’s findings […]

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.