Two recent Congressional Budget Office reports underscore why the nation needs progressive tax policies. The first, published in March, demonstrates that tax and other public policies have a measurable effect on income disparity. According to CBO data, tax policies (think Earned Income Tax Credit and Child Tax Credit) and means-tested programs (Children’s Health Insurance Program, Medicaid, food assistance, etc.) have helped alleviate growing income inequality. The second CBO report, released this week, reveals that the national debt will soar to untenable levels in the coming years due in part to the recent Trump-GOP tax cuts.

It’s important to think about both of these reports in the context of our current tax policies because the Trump-GOP tax law upended what we know about how sound tax policy can make a positive difference in the lives of working families. The law reserved the lion’s share of its tax cuts for corporations and the wealthy, redistributing our nation’s wealth to those who already have the most. [A new ITEP report provides a full analysis.] Further, immediately after passing the tax law, GOP leaders said they intend to “tackle entitlement spending next,” meaning they plan to maintain tax cuts that mostly benefit the rich while significantly curbing spending on programs that help provide economic security for the most vulnerable families. Data reveal their approach is a recipe for making income inequality worse.

For Tax Day, ITEP has released several new reports that tell a broader story about our nation’s federal, state and local tax systems, providing important details about taxes we all pay, comprehensive information about the new federal tax law, and research on the tax-paying habits of Fortune 500 corporations.

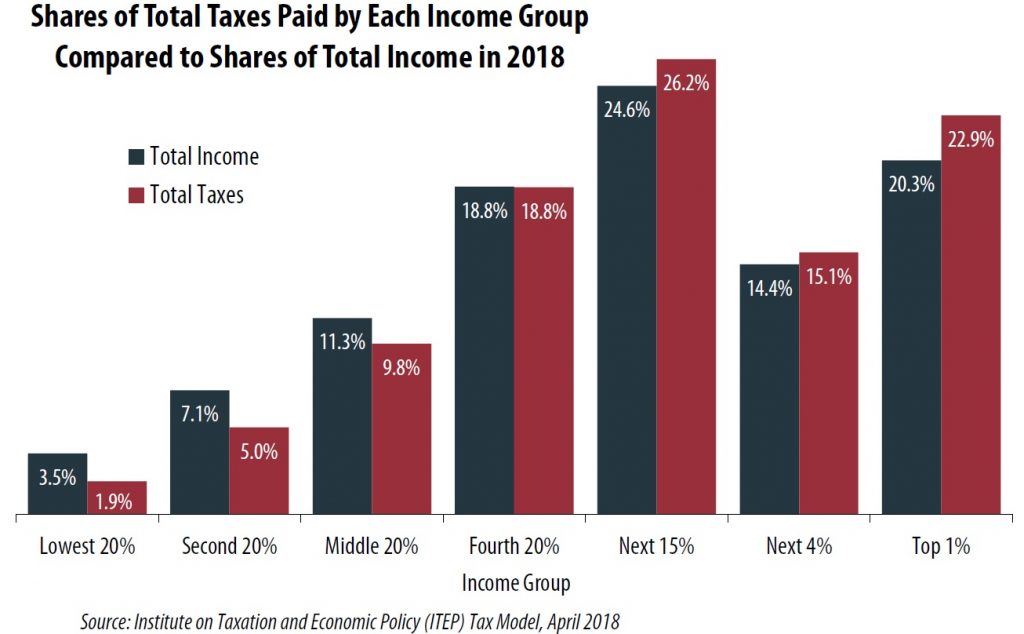

- Who Pays Taxes in America in 2018 is a distributional analysis of the combined federal, state, and local tax rates paid by people across the income spectrum. A key finding of the report is that the total federal, state and local effective tax rate paid by all income groups will decline in 2018 due to the new federal tax law. Notably, the rate will decline most for taxpayers in the top 5 percent.

- Extension of the New Tax Law’s Temporary Provisions Will Mostly Benefit the Wealthy is a new 50-state distributional analysis of the Trump-GOP tax law. It shows that 71 percent of the tax benefits in 2018 will flow to the richest 20 percent of taxpayers. Should Congress make permanent all of the law’s temporary provisions, the wealthy will still benefit most. View the report to get national numbers or data for each of the 50 states.

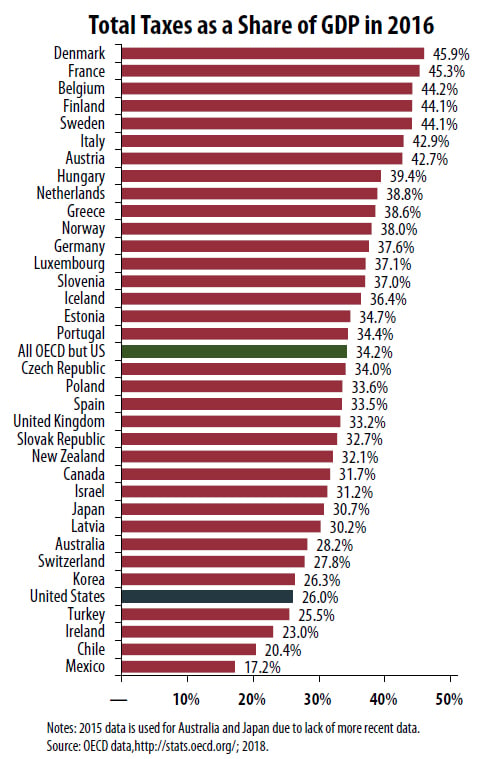

The Trump-GOP tax cuts were one of the most historically unpopular pieces of tax legislation to pass. Part of the public relations push behind this law was based on the demonstrably false claim that our taxes are too high. The truth is that compared to other economically advanced countries, our taxes on individuals and corporations are below average.

- View a report based on OECD data that shows the United States is one of the least taxed developed countries.

- View the latest OECD data that show the United States collects a substantially less in corporate taxes than average among 34 developed countries.

The new federal tax law slashed the corporate tax rate from 35 to 21 percent under the false premise that the nation’s corporations are taxed to the point where they cannot compete. The truth is that before the tax law passed, many profitable Fortune 500 companies paid nowhere near the statutory corporate tax rate.

- This new report (15 Reasons We Need Real Corporate Tax Reform) provides details about 15 profitable Fortune 500 companies that paid nothing in federal taxes for tax year 2017.

- In another report, ITEP examines the tax-paying habits of large corporations that claimed they gave employees one-time bonuses due to the new tax law. Many used various tax breaks to reduce their tax rates to below 21 percent year after year even before the new tax law passed. Their claims that they were unable to pay bonuses or higher wages in the past because of taxes are, at best, inconsistent with the facts.

A few other ITEP resources related to state tax policies that may interest you this Tax Day:

- ITEP Resources on Amazon and the Online Sales Tax Debate

- What to Expect if the Supreme Court Allows Online Sales Tax Collection

- Federal Tax Law Will Have Mixed Effect on Taxpayers’ State Tax Bills and States’ Revenue

- State and Local Tax Contributions of Young, Undocumented Immigrants

- Teachers’ Strikes Are Emblematic of Larger Tax Challenges in the States

- Trends We’re Watching in 2018, Tax Cuts and Tax Shifts