Kansas

Trump Budget Uses Unrealistic Economic Forecast to Tee Up Tax Cuts

June 29, 2017 • By Carl Davis

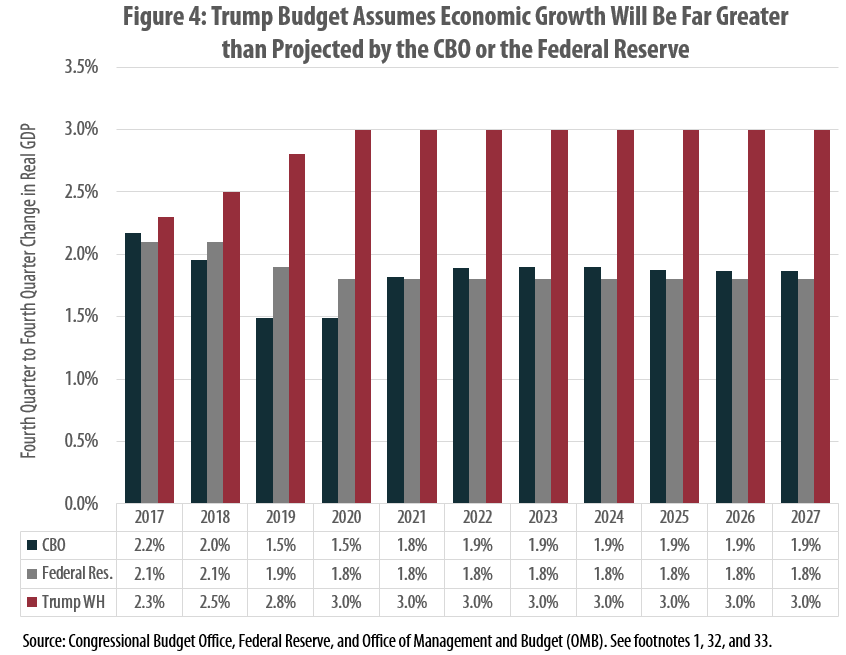

The Trump Administration recently released its proposed budget for Fiscal Year 2018. The administration claims that its proposals would reduce the deficit in nearly every year over the next decade before eventually achieving a balanced budget in 2027, but the assumptions it uses to reach this conclusion are deeply flawed. This report explains these flaws and their consequences for the debate over major federal tax changes.

State Rundown 6/28: States Scramble to Finish Budgets Before July Deadlines

June 28, 2017 • By ITEP Staff

This week, several states attempt to wrap up their budget debates before new fiscal years (and holiday vacations) begin in July. Lawmakers reached at least short-term agreement on budgets in Alaska, New Hampshire, Rhode Island, and Vermont, but such resolution remains elusive in Connecticut, Delaware, Illinois, Maine, Pennsylvania, Washington, and Wisconsin.

State Rundown 6/21: Crunch Time for Many States with New Fiscal Year on Horizon

June 21, 2017 • By Meg Wiehe

This week several states rush to finalize their budget and tax debates before the start of most state fiscal years on July 1. West Virginia lawmakers considered tax increases as part of a balanced approach to closing the state’s budget gap but took a funding-cuts-only approach in the end. Delaware legislators face a similar choice, […]

Gov. Sam Brownback’s tax experiment in Kansas was a failure. His radical tax cuts for the rich eventually had to be partly paid for through tax hikes on low- and middle-income families and also failed to deliver on promises of economic growth. Meanwhile, the tax cuts decimated the state’s budget, diminished its credit rating, and compromised its ability to meet the state’s constitutional standard of adequacy for public education.

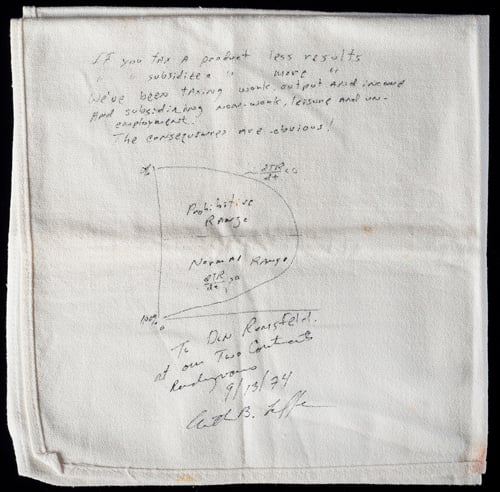

Sitting in the National Museum of American History in Washington, DC, hidden in the jumble of Americana like Thomas Jefferson’s desk, Michelle Obama’s inaugural gown and the ruby slippers worn in the Wizard of Oz, is a napkin with a drawing on it. Probably one of the least known exhibits in the museum, this napkin, quietly hiding behind glass lest some child wandering from a school group wipe his nose on it, has on several occasions destroyed the finances of the federal government and several state governments, most recently in Kansas.

Kansas City Star: Kansas Tax ‘Experiment’ Offers Lessons to the Nation, Analysts Say

June 7, 2017

“An analysis by the Institute on Taxation and Economic Policy found in 2015 that taxpayers in the bottom 40 percent saw an overall increase in their taxes under Brownback when the 2015 sales tax increase is included.” Read more

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

Chicago Magazine: What Can Illinois Learn from Other States’ Budget Disasters

June 1, 2017

In 2012, Kansas would go on to enact tax cuts that the Institute on Taxation and Economic Policy called ”among the largest” enacted by any state. Under the leadership of recently elected Governor Sam Brownback, the state dropped the top income tax rate by one-fourth, nixed taxes on “pass through” business profits (business profits passed directly to the […]

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

Besides Eviscerating the Safety Net, Trump Budget Would Put States in a Fiscal Bind

May 26, 2017 • By Misha Hill

There has been considerable discussion about the human impact of the Trump budget’s draconian cuts to what remains of the social safety net. A long-standing conservative talking point in response to such criticism is that states can pick up the tab when federal dollars disappear. But at a time when many states are facing budget shortfalls and the effect of federal tax reform is yet to be determined, it is outlandish to suggest that states are flush with cash to make up for federal spending reductions.

This week, Kansas lawmakers continued work on fixing the fiscal mess created by tax cuts in recent years, as legislators in Louisiana, Minnesota, Oklahoma, and West Virginia attempted to wrap up difficult budget negotiations before their sessions come to an end, and Delaware lawmakers advanced a corporate tax increase as one piece of a plan to close that state's budget shortfall. Our "what we're reading" section this week is also packed with articles about state and local effects of the Trump budget, new 50-state research on property taxes, and more.

ITEP’s Commitment to Being a Voice for Low-, Moderate- and Middle-Income People in Tax Policy Debates

May 22, 2017 • By Alan Essig

A strong voice for working people in federal and state tax policy debates is absolutely critical. Sound, progressive tax policies make all the difference between high-quality educational systems or crowded classrooms with limited resources. They account for the difference between structurally sound roads and bridges or potholes and other crumbling infrastructure. At the federal level, good tax policy means raising enough revenue so the nation can adequately fund child care and early education, health care, food inspection, national parks, and a clean, safe environment among other things.

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

Nebraska Vote Is Latest Defeat for Tax-Cut “Trigger” Gimmick

May 4, 2017 • By Dylan Grundman O'Neill

Nebraska lawmakers had a long and contentious tax-cut debate this session but ultimately chose the wise path and rejected attempts to give a massive tax cut to the wealthy at the expense of the state’s schools, other public services, low- and middle-income families, and property tax payers. Tax cut efforts in Nebraska last year ended […]

State Rundown 5/3: Lawmakers See Value in State EITCs, Danger in Tax Cut Triggers

May 3, 2017 • By ITEP Staff

This week, Kansas lawmakers found that they’ll have to roll back Gov. Brownback’s tax cuts and then some to adequately fund state needs. Nebraska legislators took notice of their southern neighbors’ predicament and rejected a major tax cut. Both Hawaii and Montana‘s legislatures sent new state EITCs to their governors, and West Virginia began an […]

Every year around Tax Day, ITEP updates some of its key reports to help put the nation's tax system in proper context. This year, as people around the country march to demand President Trump release his tax returns and as policymakers consider overhauling our federal tax system, these reports are especially critical. Read 10 Things You Should Know on Tax Day.

State Rundown 4/12: Season in Transition as Some States Close, Others Open Tax Debates

April 12, 2017 • By ITEP Staff

This week in state tax news we see Louisiana‘s session getting started, budgets passed in New York and West Virginia, Kansas lawmakers taking a rest after defeating a harmful flat tax proposal, and Nebraska legislators preparing for full debate on major tax cuts. Nevada lawmakers may make tax decisions related to tampons, diapers, marijuana, and […]

This week in state tax news we saw a destructive tax cut effort defeated in Georgia, a state shutdown avoided in New York, and lawmakers hone in on major tax debates in Massachusetts, Nebraska, South Carolina, and WestVirginia. State efforts to collect taxes owed on online purchases continue to heat up as well. — Meg […]

Testimony before the Alaska House Labor & Commerce Committee On House Bill 36

April 4, 2017 • By Matthew Gardner

Thank you for the opportunity to testify on the changes House Bill 36 would make to Alaska's tax treatment of pass-through income. The taxation of pass-through business entities has been a focal point of state and federal tax reform debates for over a quarter century, with a dual focus on minimizing the role of tax laws in determining the choice of business entity and on ensuring that the income of all business entities is subject to at least a minimal tax. My testimony makes two main points: 1. Alaska is one of a small number of states that do not…

In the Tax Justice Digest we recap the latest reports, blog posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Here’s a rundown of what we’ve been working on lately. Corporations Offshore Cash Hoard Grows to $2.6 Trillion U.S. corporations now hold a record $2.6 trillion offshore, a […]

State Rundown 3/29: More States Looking to Raise or Protect Revenues Amid Fiscal and Federal Uncertainty

March 29, 2017 • By ITEP Staff

This week we see West Virginia, Georgia, Minnesota, and Nebraska continue to deliberate regressive tax cut proposals, as the District of Columbia considers cancelling tax cut triggers it put in place in prior years, and lawmakers in Hawaii, Washington, Kansas, and Delaware ponder raising revenues to shore up their budgets. Meanwhile, gas tax debates continue […]

Kansas City Star: Who would argue taxes with H&R Block? This guy, but only a little

March 22, 2017

Who would argue taxes with H&R Block? Matt Gardner would, but only a little. Gardner was the lead author of a recent study by the Institute on Taxation and Economic Policy titled “The 35 Percent Corporate Tax Myth.” The study’s conclusion was that many big, profitable companies already pay far less than the 35 percent […]

Kansas Center for Economic Growth: A Flat Tax Would Only Worsen Kansas’ Budget Crisis

March 18, 2017

Governor Sam Brownback’s 2012 plan to phase out the state income tax created an unprecedented fiscal crisis for Kansas. Some options presented for addressing this crisis would “flatten” Kansas’ income tax and require all Kansans to pay the same income tax rate, regardless of how much they earn. Read more here

A growing number of Americans are getting rides or booking short-term accommodations through online platforms such as Uber and Airbnb. This is nothing new in concept; brokers have operated for hundreds of years as go-betweens for producers and consumers. The ease with which this can be done through the Internet, however, has led to millions of people using these services, and to some of the nation's fastest-growing, high-profile businesses. The rise of this on-demand sector, sometimes referred to as the "gig economy" or, by its promoters, the "sharing economy," has raised a host of questions. For state and local governments,…

Tax Justice Digest: New Eight-Year Data Reveals Corporations Aren’t Paying Their Fair Share

March 9, 2017 • By ITEP Staff

In the Tax Justice Digest we recap the latest reports, blog posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Here’s a rundown of what we’ve been working on lately. New Study Explores the 35 Percent Corporate Tax Myth A comprehensive, eight-year study of profitable Fortune 500 corporations […]