Kansas

This week as Americans celebrate Martin Luther King Jr.’s messages of resisting oppression and fighting for progress, state policymakers can look to some bright spots where tax and budget debates are bending toward justice. Among those highlights, Hawaii leaders are considering improvements to minimum wage policy, early childhood education, and affordable housing; Kansas Gov. Laura Kelly is seeking to reduce sales taxes applied to food and restore the state’s grocery tax credit; and advocates in Connecticut and Maryland are pushing for meaningful progressive tax reforms.

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

State Rundown 1/8: States Need Clear Tax and Budget Policy Vision in 2020

January 8, 2020 • By ITEP Staff

Happy New Year readers! The Rundown is back to our usual weekly schedule as state legislative sessions and governors’ budgets and State of the State Addresses begin in earnest. Here’s to clear-eyed 20-20 vision guiding state tax and budget decisions in 2020! So far this year, the harm of Colorado’s TABOR policy and Alaska’s lack of an income tax are coming into focus in big ways. Utah advocates are hoping the benefit of hindsight will help convince voters to overturn a recently enacted tax overhaul. Lawmakers in states including Iowa, Maryland, and Virginia can clearly see a need for revenues,…

State Rundown 12/18: Utah’s Tax Fight Wraps Up As Other States’ Ramp Up

December 18, 2019 • By ITEP Staff

With the new year and many state legislative sessions just around the corner, most state tax and budget debates are just getting started. Arkansas will be among the states working to improve their roads and other infrastructure. Massachusetts will have to deal with revenue losses due to a misguided tax-cut trigger put in place in prior years. Maryland and South Dakota will be two of many states facing teacher pay shortages and other education funding needs. And debates over the legalization and taxation of cannabis will likely continue in California, Kentucky, New Jersey, and beyond. Utah lawmakers, on the other…

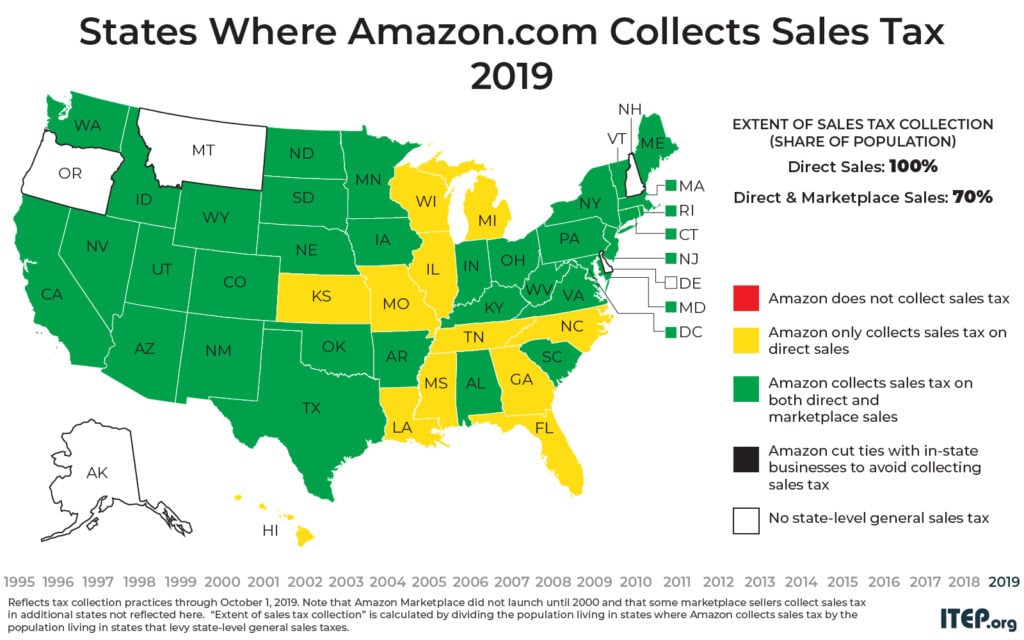

A Lump of Coal for 12 States Not Collecting Marketplace Sales Taxes this Holiday Season

November 25, 2019 • By Carl Davis

The last few years have brought major improvements in how states enforce their sales tax laws on purchases made over the Internet. Less than a decade ago, e-retailers almost never collected the sales taxes owed by their customers. The result was a multi-billion dollar drain on state coffers and a competitive disadvantage for local businesses. But this holiday season looks a bit different.

State Rundown 11/6: State Voters Show Readiness to Fix Broken Tax Codes

November 6, 2019 • By ITEP Staff

Many of yesterday’s Election Day votes came down to questions of whether or not to improve on upside-down and often inadequate state and local tax systems. The status quo was maintained in Colorado, where voters failed to approve a proposition to allow the state to invest tax revenue in education and other needs, and in Texas, where a constitutional amendment was approved to prohibit the state from creating an income tax. But voters supported important reforms in other states by approving needed funding for schools in Idaho, opting to legalize and tax recreational cannabis in California. And for more on…

State Rundown 10/24: State Tax Talk Makes Like a Tree and Gets Colorful

October 24, 2019 • By ITEP Staff

As autumn brings a colorful display of foliage to many states, so too are tax proposals taking on interesting hues as states move from the summer off-season toward 2020 legislative sessions. Ohio lawmakers are blue in the face from debating and re-debating tax and budget issues there. Maryland residents again showed they can’t be called yellow-bellied when it comes to footing the bill for needed education improvements, showing their broad support for higher taxes to fund those needs even despite a hefty price tag. Alaska, Michigan, and other states are giving the green light to laws implementing their new ability…

State Rundown 10/10: Always Something Old, Something New in State Tax Debates

October 10, 2019 • By ITEP Staff

Creative thinking from Pennsylvania lawmakers has helped them discover that the Wayfair ruling allowing states to collect sales tax from online retailers can also help them identify and tax corporate profits earned in their borders. Similarly, New York leaders had the vision to put bold environmental goals in place and identify a carbon price as a potential pay-for. Gubernatorial candidates in Mississippi and Kentucky showed less ingenuity, proposing tax cuts even though Mississippi is still phasing in a massive tax cut from a few years ago and Kentucky’s next election isn’t until 2020. Meanwhile, the old idea of eliminating income…

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…

Kansas City Star: Is There a Property Tax Fix for Next Year?

September 4, 2019

“Circuit breakers help offset the unfairness of a regressive property tax by identifying the individual taxpayers for whom property taxes are most burdensome and reducing their tax to a manageable level,” says the Institute on Taxation and Economic Policy. No homeowner should lose his or her residence because of an exorbitant property tax bill. Read […]

State Rundown 8/15: A Tax-Subsidy Cease-Fire in Kansas and Missouri

August 15, 2019 • By ITEP Staff

Over the last couple of weeks, leaders in Kansas and Missouri reached a historic agreement to stop giving away tax subsidies just to entice companies a couple of miles across their shared state line. Meanwhile, policymakers in Alaska resolved a stand-off over education funding...by cutting education funding slightly less. And California voters may be voting in 2020 on a stronger reform to the notoriously inequitable property tax effects of “Proposition 13.”

Many States Move Toward Higher Taxes on the Rich; Lower Taxes on Poor People

July 18, 2019 • By Meg Wiehe

Several states this year proposed or enacted tax policies that would require high-income households and/or businesses to pay more in taxes. After years of policymaking that slashed taxes for wealthy households and deprived states of revenue to adequately fund public services, this is a necessary and welcome reversal.

Missouri’s Creative Approach to Ending the “Race to the Bottom” in State Business Taxes

July 10, 2019 • By Matthew Gardner

Each year, state and local governments spend billions of dollars on targeted tax incentives—special tax breaks ostensibly designed to encourage businesses to relocate, expand or simply stay where they are. A law enacted by the Missouri legislature creates a template for states to work bilaterally to put the brakes on the “race to the bottom” in state business taxes.

State Rundown 6/27: States Look at Raising Incomes at the Bottom, Taxes at the Top

June 27, 2019 • By ITEP Staff

Low-income working families got good news and bad news this week, as Earned Income Tax Credit (EITC) enhancements passed in California and advanced in Oregon, while minimum wage increases failed in Pennsylvania, Rhode Island, and Wisconsin. Meanwhile, the momentum for taxing wealth and the very rich continued to grow, as more one-percenters called for enacting progressive taxes, and Inequality.org held a star-studded conference on why and how to do so.

State Rundown 6/12: Progress in Taxing the Rich, Expanding EITCs, and Taming Tax Subsidies

June 12, 2019 • By ITEP Staff

This week saw lawmakers in Ohio propose significant harmful tax cuts, leaders in California and Oregon work toward strengthening the state Earned Income Tax Credits (EITCs), and governors in Missouri and Kansas declare a truce to end the practice of bribing businesses in the Kansas City area with tax cuts to move from one side of the state line to the other. Meanwhile, Massachusetts leaders are discussing ways of raising taxes on their richest households, which our latest Just Taxes blog post notes is a promising trend this year across many states.

Like certain recent controversially concluded television shows, tax and budget debates can end in many ways and often receive mixed reviews. Illinois leaders, for example, ended on a cliffhanger by approving a historic constitutional amendment to create a graduated income tax in the state, whose ultimate conclusion will be crowdsourced by voters next November. Arizona’s fiscal finale fell flat with many observers due to corner-cutting on needed investments and a heavy focus on tax cuts. Texas legislators went for crowd-pleasing property tax cuts and school funding increases but left a gigantic “but how will we pay for this” plot hole…

State Rundown 5/22: (Some) State Lawmakers Can (Partly) Relax This Weekend

May 22, 2019 • By ITEP Staff

Lawmakers and advocates can enjoy their barbeques with only one eye on their work email this weekend in states that have essentially finished their budget debates such as Alaska, Minnesota, Nebraska, and Oklahoma, though both Alaska and Minnesota require special sessions to wrap things up. Getting to those barbeques may be a bumpy ride in Louisiana, Michigan, and other states still working to modernize outdated and inadequate gas taxes.

State Rundown 5/9: Illinois Moves Closer to a Progressive Income Tax

May 9, 2019 • By ITEP Staff

Lawmakers in Illinois and Ohio have advanced major tax proposals but cannot rest just yet, as they must still get past the other legislative chamber. Their counterparts in Michigan, Minnesota, Nebraska, and Oregon, meanwhile, are all at impasses over education funding, as those in Texas left their school funding disagreement unresolved at least until they reconvene...in 2021. And in an era of many states pre-empting smaller jurisdictions by revoking local decision-making powers, leaders in Colorado and Delaware made moves in the opposite direction, entrusting cities and school districts with more local control.

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.

More than three billion dollars could be raised under a major progressive tax plan proposed by Illinois Gov. J.B. Pritzker this week, the point being to simultaneously improve the state’s upside-down tax code and address its notorious budget gap issues. One state, Utah, may already be looking at a special session to revisit the sales tax reform debate that ended this week without resolution, in contrast to Alabama and Arkansas, where leaders finally resolved years-long debates over gas taxes and infrastructure funding. And lawmakers in four states – California, Florida, Minnesota, and North Carolina – introduced legislation to expand or…

State Rundown 2/27: Temperatures and Tax Fights Continue to Polarize

February 27, 2019 • By ITEP Staff

As another polar vortex heads for large swaths of the country, state tax debates this week were highly polarized in another way. Lawmakers and advocates in MICHIGAN, OHIO, OREGON, UTAH, and elsewhere fought to enact or improve state Earned Income Tax Credits to give a boost to low- and middle-income working families. But the opposite extreme was heavily represented as well, as others pushed for regressive tax cuts for wealthy individuals and corporations, including in KANSAS, NEBRASKA, NORTH DAKOTA, OHIO, UTAH, and WEST VIRGINIA. Even our “What We’re Reading” section has informative reading on how education funding policy continues to…

State Rundown 2/20: February and Regressive Tax Cuts, The “Meanest Moons of Winter”

February 20, 2019 • By ITEP Staff

Tom Robbins called February “the meanest moon of winter, all the more cruel because it will masquerade as spring, occasionally for hours at a time, only to rip off its mask with a sadistic laugh and spit icicles into every gullible face, behavior that grows quickly old.” Observers of state fiscal debates might think he was writing about similarly tiresome regressive tax cut proposals, which recently succeeded in Arkansas and advanced in North Dakota despite improved public understanding of the upside-down nature state tax systems, ineffectiveness of supply-side trickle-down tax cuts, and importance of investing in education. But like February…

Happy Valentine’s Day to all lovers of quality research, sound fiscal policy, and progressive tax reforms! This week, some leaders in ARKANSAS displayed their infatuation with the rich by advancing regressive tax cuts, but others in the state are trying to show some love to low- and middle-income families instead. WISCONSIN lawmakers are devoted to tax reductions for the middle class but have not yet decided how to express those feelings. NEBRASKA legislators are playing the field, flirting with several very different property tax and school funding proposals. And VIRGINIA’s legislators and governor just decided to settle for a flawed…