Montana

Independent Record: GOP Lawmaker Doubles Tax Cut Rate in Montana Senate Bill

March 12, 2021

Under the un-amended bill, a person earning from $40,000-$63,000 would see a reduction of about $14, according to an analysis of the proposal by the Institute on Taxation and Economic Policy. The House Taxation Committee delayed action on another bill that also aims to lower the state’s top income tax rate after hitting snags in […]

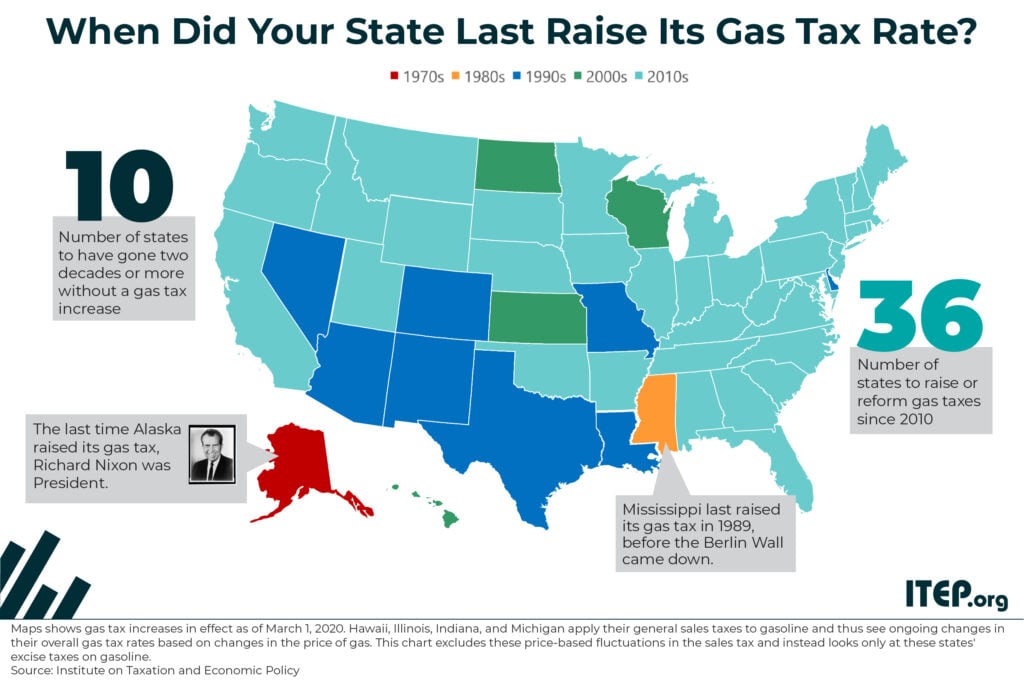

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

Montana Budget & Policy Center: Policy Basics: Who Pays Taxes in Montana

March 3, 2021

Our tax dollars serve as shared investments in the programs and services that make our state a great place to live, work, and play. Tax dollars enable Montanans to work together for things we cannot achieve alone like a quality education for our children, the development and maintenance of infrastructure, public safety through police and […]

State Rundown 2/24: State Tax Debates Quickly Thaw Out with Warmer Weather

February 24, 2021 • By ITEP Staff

Warming temperatures in many parts of the country this week seem to be thawing out state fiscal debates as well. Multiple states including California, Colorado, Maryland, and New Jersey saw movement on efforts to improve tax credits for low- and middle-income families. Mississippi House lawmakers suddenly rushed through a dangerous bill to eliminate the state’s income tax and shift those taxes onto lower-income households. Montana senators also approved regressive income tax cuts and South Dakota legislators advanced an anti-tax constitutional amendment, while lawmakers in Hawaii, Rhode Island, and Washington made progress on improving the progressivity of their tax codes. Gas…

State Rundown 2/17: Friction Over Tax Policy Still Generating Heat in Some Statehouses

February 17, 2021 • By ITEP Staff

Cold-hearted regressive tax proposals were pushed this week to cut income taxes on high-income households in states including Idaho, Montana, and West Virginia, while advocates for fair taxes and well-funded services continue to turn up the heat on taxing the richest residents in states like Connecticut and Pennsylvania.

State Rundown 2/4: Some Lawmakers, Governors Rising to Occasion with Progressive Tax Proposals

February 4, 2021 • By ITEP Staff

States face shifting landscapes as they attempt to deal with both emergent and longstanding issues in their tax codes and budget structures. This is particularly evident in Oklahoma, where lawmakers must adjust to a U.S. Supreme Court decision that literally redraws state boundaries by recognizing the rights of indigenous communities, but is true in every state, and lawmakers in many of them are rising to the challenge. Read below and see our blog posted today for more on bold proposals that increase tax fairness and solidify bottom lines with needed revenue in states including Connecticut, Minnesota, New York, Pennsylvania, Vermont,…

Montana Budget & Policy Center: What Proposed Tax Cuts Really Mean for Montanans

February 3, 2021

The 2021 Montana Legislature has the opportunity to address longstanding inequities in Montana’s tax code that have made life harder for many families. Previous legislatures have chosen to balance the budget by cutting needed services for our seniors, Montanans with disabilities, and those struggling with mental health instead of finding common-sense solutions to fairly increase […]

State Rundown 1/28: EITC Efforts a Welcome Contrast to State Tax Tug-of-War

January 28, 2021 • By ITEP Staff

Efforts to deliver and improve targeted tax credits to support low- and middle-income families proved to be unifying in Washington and Oregon, welcome developments in an otherwise divisive week in state tax debates. For example, Mississippi advocates hoping to end the state’s regressive grocery tax are up against a governor and many lawmakers pulling in the opposite direction by trying to eliminate its income tax. After Arizona residents approved an income tax increase to improve education funding, policymakers there are seeking to reverse course by slashing taxes instead. And North Dakota lawmakers are considering converting their graduated income tax into…

State Rundown 1/22: Somewhere Between a Flurry and a Blizzard of State Tax Activity So Far

January 22, 2021 • By ITEP Staff

You won’t find any images of Bernie Sanders and his mittens photoshopped into this week’s Rundown, but you will find the latest news on state fiscal debates, including proposals to generate needed funding by raising taxes on high-income households and profiting businesses in California, Delaware, Hawaii, Maryland, and Washington, as well as misguided efforts to slash taxes in Arizona, Iowa, South Carolina, Utah, and West Virginia. Also in the news are thoughtful improvements to targeted tax credits for families in need in Connecticut and Maryland, harmful obstacles to revenue generation proposed in Nebraska and Wyoming, and renewed hope on the…

State Rundown 1/7: State Work Continues in Shadow of National Events

January 7, 2021 • By ITEP Staff

Though most people’s attention is rightly focused on events unfolding in the nation’s capital this week, state legislative debates are also underway or soon to begin in many states, including proposals to tax the rich in New York and Rhode Island, provide a boost to low-income families in California, and legalize and tax cannabis in Missouri and Rhode Island.

After the Dust Has Settled: How Progressive Tax Policy Fared in the General Election

November 30, 2020 • By Marco Guzman

While the results of the 2020 presidential election are all but set in stone—and a sign of life for progressive policy—the results of state tax ballot initiatives are more of a mixed bag. However, the overall fight for tax equity and raising more revenue to invest in people and communities is trending in the right direction.

State Rundown 11/13: States Can Find Inspiration in Arizona Ballot Success; Must Look to Congress for More Immediate Help

November 13, 2020 • By ITEP Staff

Although progressive tax policy doesn’t always succeed in in statehouses or voting booths, Arizona voters showed once again that when offered a clear choice, most people resoundingly support requiring fairer tax contributions from rich individuals and highly profitable corporations over allowing their schools and other shared priorities to wither and decay. Still, a similar effort in Illinois and a more complicated measure in California were defeated, and anti-tax zealots in West Virginia and many other states will continue to push for tax cuts for the rich and defunding public investments, leaving much work to be done to advance tax justice.

Voters Have the Chance in 2020 to Increase Tax Equity in Arizona, Illinois, and California, And They Should

October 22, 2020 • By Marco Guzman

There’s a lot at stake in this election cycle: the nation and our economy are reeling from the effects brought on by the coronavirus pandemic and states remain in limbo as they weigh deep budget cuts and rush to address projected revenue shortfalls.

The biggest news for state and local fiscal debates this week was that federal fiscal relief to help with their pandemic-induced revenue crises is effectively off the table for at least another month. But if there is a silver lining to this federal inaction, it may be that it coincides with New Jersey’s success filling part of its own revenue shortfall through a millionaires tax, as well as with prominent wealth managers admitting that their rich clients don’t flee to other states in response to such taxes (see “What We’re Reading”). Combined, these three developments could encourage state leaders elsewhere…

It’s No Secret—To Save State Budgets End Preferential Treatment of Capital Gains

September 25, 2020 • By Marco Guzman

In an updated policy brief, ITEP explores the flaws in state capital gains tax breaks and highlights how ending special tax breaks provides one of the simplest ways to raise additional revenue and increase equity in the tax system.

State Taxation of Capital Gains: The Folly of Tax Cuts & Case for Proactive Reforms

September 25, 2020 • By Marco Guzman

The federal tax system and every state treat income from capital gains more favorably than income from work. Preferential capital gains tax treatment includes exclusions and seldom-discussed provisions like deferral and stepped-up basis, as well as more direct tax subsidies for profits realized from local investments and, in some instances, from investments around the world. This policy brief explains state capital gains taxation, examines the flaws in state capital gains tax breaks, and proposes reform options that will help make state tax systems more progressive and more equitable.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2020

September 15, 2020 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been amplified as many states have enacted and expanded their own credits.

State Rundown 8/26: Progressive Revenue Ideas Featured in Many States’ Fiscal Debates

August 26, 2020 • By ITEP Staff

Voters could significantly change the tax landscape through ballot measures this November regarding oil taxes in Alaska and a high-income surcharge for education funding in Arizona. Legislators are doing their part to bring progressive tax ideas to the fore as well, including a possible wealth tax in California, a millionaires tax in New Jersey, and a pied-a-terre proposal in New York. And Nebraska lawmakers reached a property tax and business tax subsidy compromise before closing out their session, but did not identify progressive revenue sources to fund it and will likely be back at the bargaining table before long.

State Rundown 8/12: States Find Themselves in New Unemployment Pickle

August 12, 2020 • By ITEP Staff

Even in statehouses, many eyes remained on Congress and President Trump this week as state lawmakers advocated for needed federal fiscal relief and debated whether they can afford to join in on the president’s executive order requiring states to partially fund a new version of enhanced unemployment benefits that have otherwise expired.

Temperatures and tensions are high right now across the country as Congress debates its next pandemic response and states continue to sweat through difficult decisions. Nevada lawmakers, for example, just wrapped up a special session during which they came within one vote of a proposed tax increase but ultimately chose to balance their shortfall through only funding cuts. But advocates in many states, including California, New Jersey, New York, and Rhode Island are trying to light a fire under lawmakers to encourage them to enact progressive tax increases on their wealthiest households.

As ITEP analyst Kamolika Das wrote today, July 1 is typically the beginning of state fiscal years and “a point when one can take a step back and reflect on the wins and disappointments of the past state legislative sessions.” Not so in 2020, she writes, as uncertainty surrounding the virus, state revenues, and potential federal action give state lawmakers no such time to relax and reflect. Although most recent state actions, such as those covered below in California, Mississippi, and West Virginia, have focused on funding cuts and temporary measures to bring budgets into short-term balance, the need for…

State Rundown 6/26: States Take Varying Fiscal Approaches While Awaiting Federal Action

June 26, 2020 • By ITEP Staff

State policymakers this week took a variety of approaches to their fiscal situations amid the COVID-19 pandemic. Tennessee lawmakers chose to balance their budget through $1.5 billion in cuts to public services, but not before adding to those cuts by going forward with planned tax cuts. California legislators also passed a budget but relied on a number of temporary measures and delays to do so. Their counterparts in Massachusetts, New Jersey, and Rhode Island opted for interim budgets to tide them over for a few months while they continue to look for lasting solutions. Meanwhile, many states are debating whether…

As calls to defund the police demonstrate, state and local decisions about funding priorities and how those funds are raised are deeply embedded in racial justice issues. Tax justice is also a key component in advancing racial justice. Racial wealth disparities are the result of countless historic inequities and tax policy choices are certainly among […]

This weekend’s Leap Day should be a welcome extra day for state lawmakers, advocates, and observers who care about tax and budget policy, as there is an overflow of proposals and information to digest. Most importantly, as emphasized in our “What We’re Reading” section, there are never enough days in a month to do justice to the importance of Black History Month and Black Futures Month. In state-specific debates, Oregon and Washington leaders are hoping to take a leap forward in raising funds for homelessness and housing affordability measures. Lawmakers in West Virginia and Wisconsin could use a day to…

State Itemized Deductions: Surveying the Landscape, Exploring Reforms

February 5, 2020 • By Carl Davis

State itemized deductions are generally patterned after federal law, though nearly every state makes significant changes to the menu of deductions available or the extent to which those deductions are allowed. This report summarizes the key details of each state’s itemized deduction policies and discusses various options for reforming those deductions with a focus on lessening their regressive impact and reducing their cost to state budgets.