A “Who Pays?” Follow-Up Report on Tax Policy Options for Advancing Equity and Addressing Income Inequality

Many new policymakers will join legislative bodies and take the reins of governorships this month in the wake of the 2018 elections. And many returning policymakers will come back to new leadership, new majorities, and fresh ideas. Yet much remains the same: inequality of income and wealth remains at extreme levels around the nation and continues to rise, while racial inequities continue to permeate our institutions, laws, and communities. Such disparities are barriers to the goal of equitable opportunities for people of all races and backgrounds.

Many new policymakers will join legislative bodies and take the reins of governorships this month in the wake of the 2018 elections. And many returning policymakers will come back to new leadership, new majorities, and fresh ideas. Yet much remains the same: inequality of income and wealth remains at extreme levels around the nation and continues to rise, while racial inequities continue to permeate our institutions, laws, and communities. Such disparities are barriers to the goal of equitable opportunities for people of all races and backgrounds.

As ITEP’s “Who Pays?” report shows, state and local tax policy choices often reinforce these barriers. As it is, our public policies are contributing to the widening income and wealth gap. Years of enacting public policies that prioritized top-heavy tax cuts have siphoned resources away from the public good while further enriching those who already have the most. Communities of color are disproportionately harmed by these policies while white, particularly more affluent white communities, receive outsize advantage.

In fact, while overall wealth continues to concentrate among the top 1 percent of Americans, tax systems of 45 states widen the income gap between their most affluent residents and lower- and middle-income families. The lowest-income families pay an overall state and local tax rate that is 50 percent higher on average than the rate paid by the top 1 percent.

But a broad look at recent trends in state tax policies, voter actions this year (e.g. teacher walkouts and strikes), and outcomes of elections across the country signals voters want their elected officials to make policy changes that will improve opportunities and economic security for all families and communities. And “Who Pays?” also shows that some states are doing far better than others when it comes to raising revenues for vital public services in ways that do not exacerbate those disparities, and that policy options exist that can help mitigate and reverse large and growing economic divides.

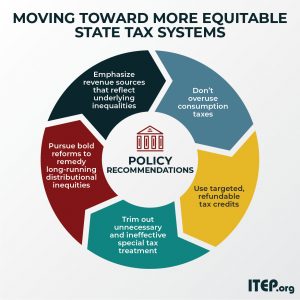

New and returning policymakers have a tremendous opportunity to improve their constituents’ lives and their states’ economies through tax policy. This report distills the findings of “Who Pays?” into policy recommendations that can serve as a guide to new lawmakers, advocates, and others seeking to improve their state’s tax codes.

It explains the importance of favoring taxes on income and wealth over taxes on consumption, the value of certain targeted tax benefits for families living in poverty, the need to abandon ineffective, unnecessary tax subsidies for high-income households, and the promise of bold new options for improving the regressive distributional outcomes of state and local tax policies.

1. Emphasize revenue sources that reflect underlying inequalities

To build a tax code that improves, or at least does not worsen, economic and racial inequalities, a first step is to focus on taxing income, corporate profits and inherited wealth. The distribution of these economic rewards is both severely unequal today and deeply rooted in historical legacies of racism and discrimination, making taxes on them key components of more equitable tax codes.

Enact or strengthen progressive personal income taxes

Policymakers can design personal income taxes to directly tie one’s tax rate to one’s income, so they are uniquely suited to a more progressive structure. ITEP’s Inequality Index featured in “Who Pays?” ranks states from the least regressive to most regressive. Every state in the 10 most equitable state and local tax systems has a personal income tax, while seven of the “Terrible Ten” most regressive systems have either no or an extremely limited income tax.

Simply having a personal income tax is not enough, however. To play a significant role in mitigating income inequality, the tax must be structured in a way that mirrors the extent of modern-day inequalities. There are significant differences in lower-, middle-, and upper-middle-income families’ ability to contribute to shared priorities through taxes, and an extremely large difference in that ability between households in the top 1 to 5 percent and the rest of their fellow residents. State policymakers can address this by designing systems that increase effective tax rates based on income and reserving the highest rates for the wealthiest households.

But many states, including the three “Terrible Ten” states that have income taxes, fail to make a significant dent in inequality because their income tax rates aren’t progressive enough to address mammoth income disparity. The average income in 2018 among the top 1 percent of households was about $1.7 million per year, which is more than 20 times the $70,000 average for the other 99 percent of households. Yet most states’ income tax brackets put these wealthy elites in the same group as average families. For example, most of the 42 states with broad-based personal income taxes have a top marginal rate that begins at less than $36,000 of taxable income, placing families with very modest incomes in the same bracket as multi-millionaires. Several of these states have flat rates that tax higher-income residents at the same rate as everyone else.

On the other end, state income taxes that are most effective at mitigating inequality, including those levied under seven of the 10 most equitable tax systems, apply their highest income tax rate only to truly high-income individuals. Several states have top rates that only apply to people with hundreds of thousands of dollars of taxable income, and some have top rates that begin at $1 million or more.

Policy Options to Pursue:

- Enact a personal income tax

- Adopt wider income tax brackets

- Adjust tax brackets and other parameters for inflation

- Raise upper-bracket tax rates

- Adopt a “millionaires’ tax” or surcharge

- Phase out lower-bracket benefits for higher-income households

Improve corporate income taxes

The benefits of corporate profits are predominantly enjoyed by high-income households, which are more likely to own stock or have business interests. Therefore, a tax on corporate profits is a helpful step toward making state tax systems more progressive, and even a flat-rate corporate tax will have a progressive influence on the overall tax structure. Some share of business taxes are ultimately passed on to customers of all income levels, but not enough to offset these progressive effects, leaving corporate income taxes as a relatively small but significantly progressive component of tax systems of states that use them.

Policy Options to Pursue:

- Follow these best practices, including:

- Enact a corporate income tax (on profits, not gross receipts)

- Adopt combined reporting to include at least all U.S. profits

- Adopt or expand to “global” or “complete” combined reporting to include profits shifted overseas

- Include “GILTI” (Global Intangible Low-Taxed Income) in combined reporting requirement

- Adopt or increase corporate minimum taxes

- Improve corporate tax disclosure

- Decouple from federal giveaways

- Improve tax subsidy oversight

Tax inherited fortunes

Another major source of inequity is the inequality of opportunity created by vastly different starting points for children born into wealthy families compared to those of more modest means. This wealth and opportunity gap is built upon and continues to reflect immense racial disparities. Although the federal estate tax has been greatly weakened, states can promote fairness by applying their own estate and/or inheritance taxes. Like corporate taxes, these do not tend to be major sources of revenue for states, but have a clear progressive impact, generally only applying to a very small share of the largest inherited fortunes. Seven of the 10 most equitable state tax systems levy such a tax.

Policy Options to Pursue:

- Enact an estate and/or inheritance tax

- Raise estate and inheritance tax rates

- Decouple from federal estate tax parameters (very high exemption levels have eroded the tax)

- Reduce exemption levels to apply estate taxes to more inherited wealth

2. Don’t overuse consumption taxes

Sales taxes that apply broadly to consumer purchases and excise taxes that apply to special categories like gasoline, alcohol, and tobacco have become vital sources of state and local revenue. But they also have the distinct disadvantage of being inherently regressive: Lower- and middle-income families spend much of their incomes on taxable purchases, so these taxes add up to a much higher level of sacrifice for them than for higher-income households who spend a much smaller share of their income on such purchases.

Lawmakers should take these weaknesses into account and rely less on consumption taxes than on income taxes to fund government. Seven of the 10 most equitable state tax systems rely less on these taxes than on income or property taxes, while eight of the “Terrible Ten” most regressive systems rely on them for the largest share of their revenue.

Refundable tax credits are another helpful tool to offset the regressive nature of consumption taxes, as explained below.

Policy Options to Pursue:

- Exempt groceries or offer a refundable tax credit to offset the taxes on food

- Enact refundable credits to offset consumption taxes

- Update tax bases to include services, online sales, and the “gig economy” and use new revenue to reduce sales tax rates

- Avoid Sales Tax Holidays

3. Use targeted, refundable tax credits

Tax credits that are appropriately targeted to families that need them the most–namely low- and middle-income families who are simultaneously benefitting the least from our current economy, are disproportionately people of color, and are affected the most by regressive consumption taxes–are one of the most important tools available to state lawmakers working to make their states’ tax codes more equitable.

The Earned Income Tax Credit (EITC) is a widespread and highly effective example of such a tax credit, which is also easy to administer because states can piggyback on the existing federal credit by simply setting the state credit at a percentage of the federal credit. Twenty-three states and the District of Columbia–including nine of the 10 most equitable tax systems and none of the “Terrible Ten” most regressive systems–currently have a refundable EITC. Another six states have non-refundable versions of the EITC, which can help working families with income tax liability but are much less effective at reaching the lowest-income families who often have little to no income tax liability but nonetheless are affected greatly by regressive sales and property taxes.

States also can design their own refundable credits to reach all types of families. Child tax credits, per-person credits, low-income credits, property tax “circuit breakers,” and renters’ credits are examples that multiple states currently use and are flexible enough to meet each state’s policy goals and budget constraints.

While these credits are most easily administered through a state income tax, even states without income taxes can implement them. For example, states can offer an EITC to residents through a separate form. And many states have targeted property tax reductions, often structured as “homestead exemptions” that insulate low-income and/or elderly homeowners from property taxes, that do not require a state income tax to implement.

Policy Options to Pursue:

- Enact a refundable state EITC

- Increase state percentage of federal EITC

- Improve upon federal EITC design by boosting credits for families without children

- Enact a refundable credit for families with children and/or child care expenses

- Enact refundable “circuit breaker” or other property tax credits

- Make existing nonrefundable credits refundable

4. Trim unnecessary and ineffective special tax treatment

Not all special tax provisions are as effective and efficient as the examples above. In fact, very few are. Lawmakers should take a close look at their states’ tax breaks–be they credits, deductions, exemptions, incentives, reduced rates, or other forms of special treatment–and ask whether they are effectively targeted to residents who need them most. In many cases, policies intended to help average families are unnecessarily also made available to wealthy individuals who need no such assistance. In fact, wealthy individuals, who are disproportionately white, often benefit the most from special treatment embedded in state and local tax codes.

Reform itemized deductions

Most states with personal income taxes allow residents to reduce their taxable income by either a set amount known as a standard deduction or a variable total based on their expenses, known as itemized deductions. Federal itemized deductions include mortgage interest, charitable contributions, extraordinary medical expenses, and state and local taxes, and most states with itemized deductions use a similar list.

But only a minority of taxpayers generally have enough of these expenses to lead them to itemize their deductions rather than take the standard deduction, and those are generally higher-income individuals. What is more, the 2017 Tax Cuts and Jobs Act (TCJA) increased the federal standard deduction, reducing the reach of itemized deductions to even fewer people with even higher incomes, a change that carried over to many state tax codes as well.

State policymakers can improve their tax codes by questioning and addressing this regressive arrangement. The TCJA also (temporarily) eliminated the “Pease” provision that reduces the value of itemized deductions for extremely high-income households; states can re-instate that provision or enact similar laws. Policymakers may also consider simply eliminating state itemized deductions, particularly in this new policy context in which they are now available to a smaller and wealthier subset of residents.

Policy Options to Pursue:

- Adopt one or more itemized deductions reforms:

- Repeal itemized deductions entirely

- Repeal specific deductions

- Cap total value of deductions

- Reduce total deductions by a percentage

- Convert deductions to credits

- Decouple from federal “Pease” elimination

- Enact stand-alone phase-down provisions

Revisit standard deductions, personal exemptions, and other similar provisions

Standard deductions, personal and dependent exemptions, and other similar tax provisions are generally available to all taxpayers regardless of income. But they too can be phased down for people with very high incomes, reducing their effect on state budgets and thus freeing up revenue that can be used for other purposes.

Moreover, within a progressive income tax structure, even deductions and exemptions that reduce everyone’s taxable income by a flat dollar amount provide more benefit to higher-income people who face higher marginal tax rates. Converting these provisions to credits that are applied after tax rates rather than before is one way states can reduce this inequity.

Policy Options to Pursue:

- Phase down deductions and exemptions at high incomes

- Convert deductions and exemptions to credits

Eliminate capital gains breaks and other tax breaks that primarily benefit the wealthy

State lawmakers can also reduce waste and improve progressivity by eliminating special tax carve-outs for types of income that are concentrated among people with high incomes. There is no need, for example, for states to grant special treatment to capital gains income, which is income realized only when (mostly wealthy) individuals sell off real estate and other investments at a profit. Special treatment of “pass-through” income (business profits taxed through the personal income tax) is another policy that is increasingly common but very regressive and fails to help small businesses as advertised. Like corporate profits, these sources of income are predominantly enjoyed by the wealthy.

Policy Options to Pursue:

- Eliminate tax breaks for capital gains income

- Eliminate breaks for pass-through income (including decoupling from federal pass-through break, if applicable)

- Eliminate state deductions for federal income taxes

5. Pursue bold reforms to remedy long-running distributional inequities

“Who Pays?” shows that even states using many of the best practices listed here are, at best, not making inequality much worse. But all states can aim much higher than this. To improve economic justice against a backdrop of racial inequities, widening pre-tax inequalities, and decreasing federal efforts to rein them in, states will need to go above and beyond these core recommendations, perhaps in some of the following ways.

Policy Options to Pursue:

- Strengthen even the most progressive components of state tax codes such as progressive rate structures and targeted refundable credits

Take existing progressive policies further

In light of historic levels of inequality, repeated federal income tax cuts for the richest Americans, and reduced federal investment in shared priorities like health care and education, a few states have now raised their top personal income rates beyond 10 percent. More states can and should follow suit, particularly when these highest rates are reserved for those with very high incomes as described above.

States are also having tremendous success fighting poverty and mitigating inequality by raising their EITCs to higher percentages of the federal credit, in some cases also expanding the credit to help more workers without children. States should continue to increase and enhance this well-targeted, proven policy and others like it.

Tax wealth and the fruits of wealth

While “Who Pays?” focuses primarily on income inequality, wealth remains even more unequally distributed than income, and state policymakers have tools at their disposal to reduce wealth inequalities as well.

States can, for example, consider progressive property tax features such as applying higher rates to higher-value homes, or identifying and taxing second homes and vacation homes.

Beyond real estate, property such as stocks, bonds, patents, copyrights, and other “intangibles” represent an enormous portion of private wealth and are incredibly unequally distributed, yet are usually exempted entirely from state and local property taxes. While these types of capital are mobile and administratively difficult to tax, states can do more to at least track, and potentially tax, these massive sources of wealth and inequality.

States can also certainly do more to tax income derived from these stores of wealth, which is in fact often taxed at lower rates than income from work. Rather than providing tax breaks for capital gains income, for example, states could tax this unearned income at higher rates, allowing for lower rates or more robust credits for working families.

Estate and inheritance taxes are yet another area where states can and should step up to enact strongly progressive policy where Congress has stepped back. Current rates and exemption levels at the federal and state levels do very little to stem the flow of inherited fortunes from one generation of multi-millionaires to the next, allowing the ideal of equality of opportunity to slip even further from reality. Much higher rates and lower exemption levels can be attained while still affecting only the truly wealthy.

Policy Options to Pursue:

- Create progressive property tax rate structures

- Enact “mansion taxes” and second-home taxes

- Apply property taxes to intangible assets

- Tax income from wealth higher than income from work

- Enhance taxation of inherited fortunes

Give local entities progressive options

While each state can choose the extent to which it funds its services through progressive or regressive revenue sources, very few states allow their cities, counties, and other local jurisdictions to choose any progressive revenue sources. Most of these jurisdictions can only choose between somewhat regressive property taxes, sharply regressive sales taxes, and fines and fees that are also generally regressive. Rather than ‘stacking the deck’ with these problematic options, state policymakers should expand local control and allow these jurisdictions to choose progressive revenue options such as local income taxes, which can even be structured as “surtaxes” that easily piggy-back on the state income tax structure. Extending such options would empower residents and local officials to choose policies that reduce inequalities in their own local communities as well as at the state and national levels.

Policy Options to Pursue:

- Allow local jurisdictions to tax income

- Extend local property tax bases to intangible assets

- Increase local aid funded through progressive state revenues