New York

New Jersey, New York, and Connecticut Should Keep Corporate Taxes Strong, Extend Surcharges

February 28, 2023 • By Marco Guzman

At a time when corporations are seeing record profits while not paying their fair share of federal taxes, state corporate income taxes can and should play a role in raising sustainable revenue and adding progressivity to state tax codes. Right now, lawmakers in New Jersey, New York, and Connecticut have a unique opportunity to extend targeted tax changes that have raised billions of dollars from profitable corporations for meaningful public investments.

New York Times: I.R.S. Decision Not to Tax Certain Payments Carries Fiscal Cost

February 27, 2023

More than 20 state governments, flush with cash from federal stimulus funds and a rebounding economy, shared their windfalls last year by sending residents one-time payments. This year, the Biden administration added a sweetener, telling tens of millions taxpayers they did not need to pay federal taxes on those payments. Read more.

State Rundown 2/23: Tax Dominos Take Shape, Begin to Fall as Session Heats Up

February 23, 2023 • By ITEP Staff

The 2023 legislative session is in full swing, and dominos continue to be set up as others fall...

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.

Michael Ettlinger

February 12, 2023 • By ITEP Staff

Michael is a senior fellow at the Institute on Taxation and Economic Policy. He is also a senior fellow with the Carsey School of Public Policy at the University of New Hampshire, where he was the founding director, and an independent author. This is Michael’s second tour at ITEP. He was previously the State Tax […]

The great women’s philosopher, Pat Benatar, once said “love is a battlefield,” and there’s no greater test of our love for state tax policy than following the ups and downs of state legislative sessions...

State Rundown 2/1: February Brings New (and Some Old) Tax Policy Conversations

February 1, 2023 • By ITEP Staff

Tax bills across the U.S. are winding their way through state legislatures and governors continue to set the tone for this year’s legislative sessions...

State Rundown 1/26: Tax Season Brings With it Reminder of EITC’s Impact

January 26, 2023 • By ITEP Staff

Tax season has officially kicked off and with Earned Income Tax Credit (EITC) Awareness Day right around the corner, it serves as another reminder for how important the EITC is...

Lawmakers in seven states will introduce legislation this week to tax wealth in a new coordinated effort to combat ever-increasing income and wealth inequality. The bills couldn’t come at a better time, as those at the very top continue to pull apart from the rest of us and far too many states contemplate piling on to this runaway inequality with seemingly endless tax cuts for those at the top.

State Rundown 1/11: Governors Ready to Talk Tax in 2023 State Addresses

January 11, 2023 • By ITEP Staff

Governors have begun their annual trek to the podium in statehouses across the U.S. to lay out their visions for 2023, and so far, taxes look like they will play a major role in debates throughout state legislative sessions...

Albany Times Union: Ending Poverty Will Take a New Look at Wealth, Too

January 2, 2023

We would do well to remember the millions of families in New York that were already experiencing the storms of poverty, inequality and policy violence, not to mention those who have nowhere safe to celebrate the holidays. Read more.

Pluribus News: States Advance Child Tax Credits as Congress Deliberates

December 15, 2022

Lawmakers in Connecticut, New York and several other states want to expand tax breaks for families with children next year, inspired by a 2021 federal tax credit that dramatically reduced child poverty. Read more.

State Rundown 12/15: State Priorities for 2023 Begin to Take Shape

December 15, 2022 • By ITEP Staff

State leaders have begun to release budget projections for 2023 and a familiar theme has emerged once again: big revenue surpluses, which have many state lawmakers pushing for another round of tax cuts despite the monumental challenges that we as a country face that call for sustainable revenues...

State Child Tax Credits Have Enormous Potential to Cut Child Poverty

November 16, 2022 • By ITEP Staff

CONTACT: Jon Whiten New state-by-state data charts a course for how states can make headway for the next generation As the dust settles on this year’s elections and state lawmakers look toward 2023’s legislative sessions, they should consider creating or improving their state Child Tax Credits. A new report released today by the Institute on […]

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

Fiscal Policy Institute: Inequality in New York & Options for Progressive Tax Reform

November 11, 2022

Income statistics have long shown that the top earners in New York State earn relatively more than their counterparts elsewhere in the U.S. Income inequality alone, however, provides an incomplete picture of the wealthiest households’ economic resources. In order to understand real economic power, we have to look at households’ wealth (their total net assets). […]

As states continue to tally the remaining votes and the news stories roll out at a breakneck pace, the unofficial results of the 2022 midterm elections have brought with it significant changes across the state tax policy landscape...

Next Tuesday, voters will head to the polls to not only elect local and national leaders, but also let their voices be heard on a range of tax policy issues that could improve or worsen their state tax codes...

New York Times: She’s Inheriting Millions of Euros. She Wants Her Wealth Taxed Away.

October 21, 2022

By the time her extraordinarily wealthy grandmother died last month, Marlene Engelhorn already knew who she wanted to be the ultimate beneficiary of the enormous inheritance coming her way: the tax man. Read more.

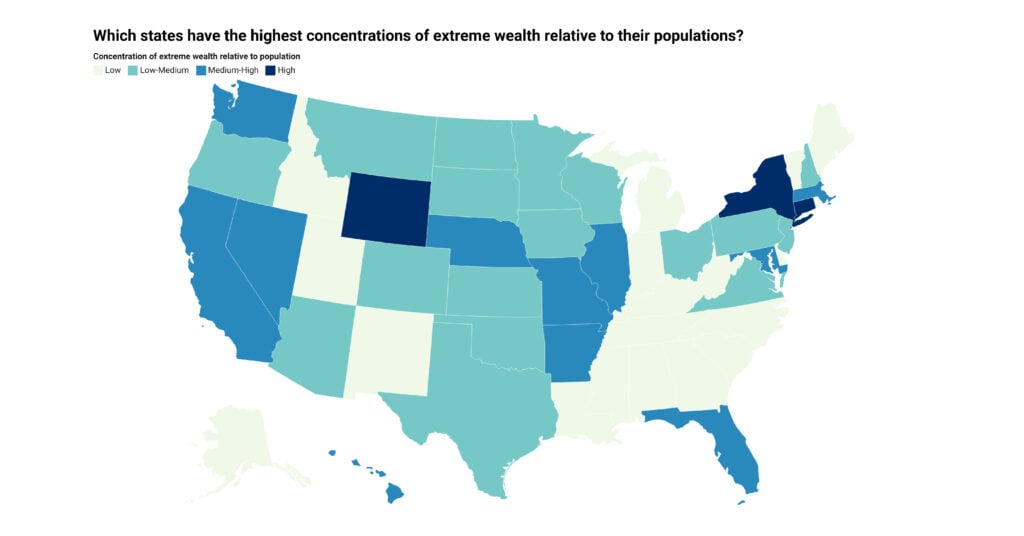

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. This extreme wealth is geographically concentrated, with the top 10 states accounting for more than 70 percent of nationwide extreme wealth and with New York and California alone accounting for nearly a third.

Report: Ten States Hold 71 Percent of America’s Extreme Wealth

October 13, 2022 • By ITEP Staff

Tackling wealth inequality through the tax code can boost economic opportunity Washington, DC: Wealth inequality is rampant in every state and particularly concentrated in a handful of states, according to a first-of-its-kind analysis released today by the Institute on Taxation and Economic Policy (ITEP). This extreme wealth hinders economic opportunities for all but the […]

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. Nationally, we estimate that wealth over $30 million per household will reach $26 trillion in 2022 with roughly one-fifth of that amount ($4.5 trillion) held by billionaires.

Although the weather is beginning to cool down in parts of the country, the same cannot be said for many state economies, which are still running hot. That, however, doesn’t mean that the good times are guaranteed to last...

Do you remember/the big tax news innn September? Well, if not, we at ITEP got you covered...

How the Inflation Reduction Act’s Tax Reforms Can Help Close the Racial Wealth Gap

September 20, 2022 • By Brakeyshia Samms, Joe Hughes

Lawmakers have many opportunities to pass reforms that will make our tax code fairer and further reduce racial inequity in our economy. The Inflation Reduction Act is a great step forward; better taxing wealth and income from wealth and expanding targeted refundable tax credits would build on this progress.