New York

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.

More than three billion dollars could be raised under a major progressive tax plan proposed by Illinois Gov. J.B. Pritzker this week, the point being to simultaneously improve the state’s upside-down tax code and address its notorious budget gap issues. One state, Utah, may already be looking at a special session to revisit the sales tax reform debate that ended this week without resolution, in contrast to Alabama and Arkansas, where leaders finally resolved years-long debates over gas taxes and infrastructure funding. And lawmakers in four states – California, Florida, Minnesota, and North Carolina – introduced legislation to expand or…

New York Daily News: Four Ways to Make New York Taxes More Fair

March 12, 2019

But Cuomo hasn’t talked about the benefits of the Trump tax law for ultra-millionaires — the very richest New Yorkers, mainly in Manhattan. Trump and his GOP minions cut taxes substantially for the richest 5%, who get an $8 billion-plus windfall, according to the Institute on Taxation and Economic Policy. Rich folks got lucrative tax […]

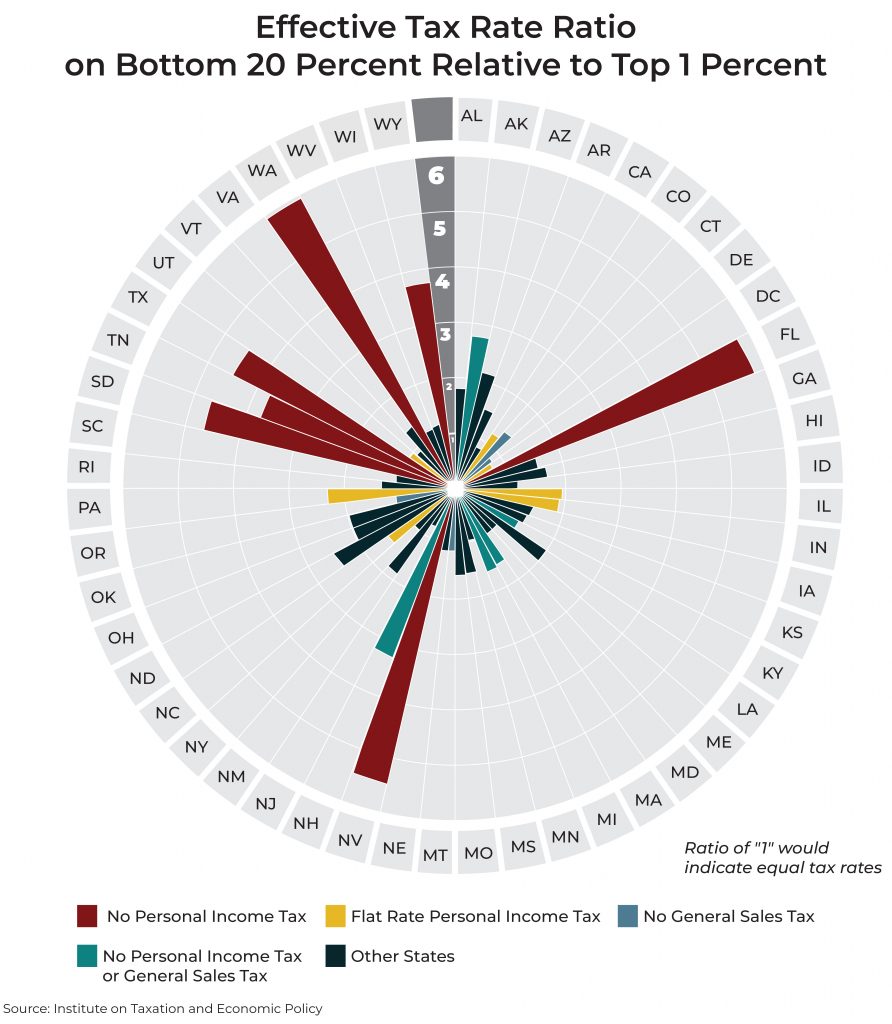

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

March 6, 2019 • By ITEP Staff

There is significant room for improvement in state and local tax codes. State tax codes are filled with top-heavy exemptions and deductions and often fail to tax higher incomes at higher rates. States and localities have come to rely too heavily on regressive sales taxes that fail to reflect the modern economy. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. These types of shortcomings provide compelling reason to pursue state and local tax reforms to make these systems more equitable, adequate, and sustainable.

New York Times: Betsy DeVos Backs $5 Billion in Tax Credits for School Choice

February 28, 2019

Carl Davis, the research director for the Institute on Taxation and Economic Policy, noted that the new tax credit would be extremely generous in providing a 100 percent tax break, especially because the new tax law eliminated some incentives for charitable giving. “Now they want to put a supersized one back into the code,” he […]

State Rundown 2/20: February and Regressive Tax Cuts, The “Meanest Moons of Winter”

February 20, 2019 • By ITEP Staff

Tom Robbins called February “the meanest moon of winter, all the more cruel because it will masquerade as spring, occasionally for hours at a time, only to rip off its mask with a sadistic laugh and spit icicles into every gullible face, behavior that grows quickly old.” Observers of state fiscal debates might think he was writing about similarly tiresome regressive tax cut proposals, which recently succeeded in Arkansas and advanced in North Dakota despite improved public understanding of the upside-down nature state tax systems, ineffectiveness of supply-side trickle-down tax cuts, and importance of investing in education. But like February…

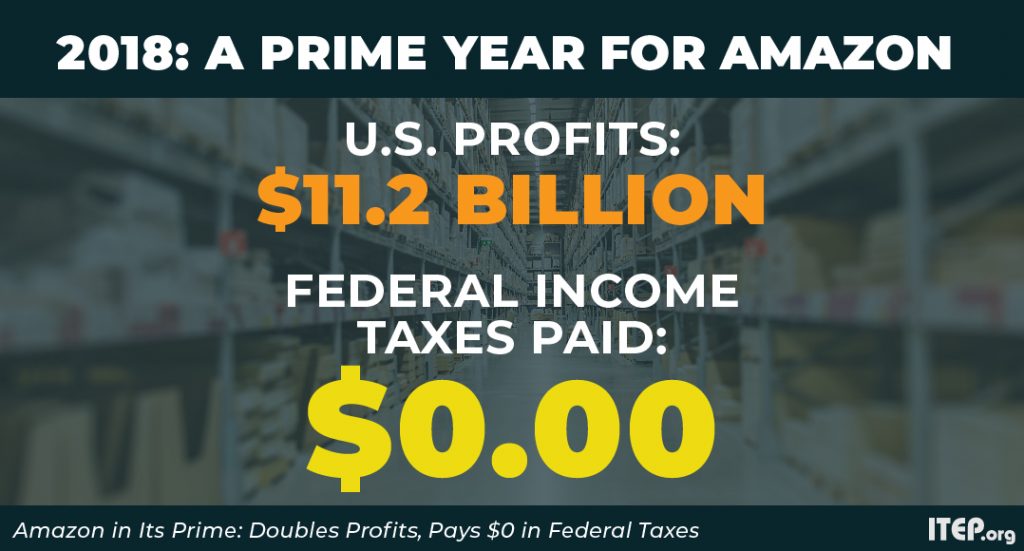

New York Observer: Amazon Paid $0 in Federal Taxes Despite Making $11 Billion in 2018—And No One Knows Why

February 20, 2019

You may feel like a champion financial planner after filing last year’s income taxes, even though you did pay a hefty fee to an accountant or some tax software. But don’t even think about beating Amazon, which paid a whopping $0 in federal taxes last year—despite earning $11.2 billion in U.S. profits—according to a report from the […]

Axios: 1 Big Thing: Filthy Rich, Owing No Tax

February 19, 2019

Amazon is not a passive player in tax law, says ITEP's Matthew Gardner, who researched and wrote the Amazon report. "Amazon in particular has shaped tax law in its own image. They made the laws by lobbying so persistently and effectively," Gardner tells Axios.

The Hill: Tech Looks for Lessons From Amazon HQ2 Fight

February 17, 2019

Amazon's decision to scrap its plans for a second headquarters in New York City, dubbed HQ2, stunned both the tech world and its critics this week, raising new questions about the industry's ambitious expansion plans and their dealings with state and local governments.

Inequality.org: Organizers Oust Amazon HQ2 from New York

February 16, 2019

As details of the incentives agreement came out, New Yorkers heard from Seattleites about the mass gentrification spurred by Amazon. Seattle and King County declared a state of emergency over the city’s homelessness crisis. Meanwhile, Amazon lobbied hard to repeal a head tax on the city’s richest businesses to deal with that very crisis just […]

Salon.com: Activist Defeat of Amazon is a Win for Democracy Over Technology

February 15, 2019

However, Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, told Salon it is impossible to know truly if New York missed out on an economic loss or not, and to think of it as a “good” or “bad” deal is a “one-dimensional” way to look at it. “From an opportunity-cost […]

The American Prospect: Amazon Is Giving Up on New York, and Activists in Nashville and Northern Virginia Are Energized

February 15, 2019

Amazon’s announcement to abandon their New York plans comes on the heels of a report from the Institute on Taxation and Economic Policy showing that Amazon made a profit of $11.2 billion in 2018, and, through its navigation of tax loopholes, did not pay any federal income taxes, instead gaining a tax rebate of $129 […]

The New Yorker: New York City Activists Drive Out Amazon

February 14, 2019

Two rhyming bits of Amazon news. The first is that Amazon, according to a report from the Institute on Taxation and Economic Policy, was taxed at an effective rate of negative-one percent in 2018, having paid a federal income tax of zero dollars and having received a rebate from the federal government of a hundred and twenty-nine million dollars. During that year, the company nearly doubled its profits, from $5.6 billion to $11.2 billion.

The Hill: Hillicon Valley: New York says goodbye to Amazon’s HQ2 …

February 14, 2019

Amazon will not pay any federal income taxes for the second year in a row, according to a report released Wednesday. The Institute on Taxation and Economic Policy found that the online retailer, which reported $11.2 billion in profits in 2018, did not pay income tax because of unnamed “tax credits” in their disclosure.

Governing: With Amazon Out of New York, Some Lawmakers Seek Multistate Ban on Corporate Tax Breaks

February 14, 2019

Opponents of such deals cite data that suggest that tax incentives often aren’t worth what they cost governments. An Institute on Taxation and Economic Policy study noted that most giveaways simply move pieces on a chessboard, rather than create actual growth.

Happy Valentine’s Day to all lovers of quality research, sound fiscal policy, and progressive tax reforms! This week, some leaders in ARKANSAS displayed their infatuation with the rich by advancing regressive tax cuts, but others in the state are trying to show some love to low- and middle-income families instead. WISCONSIN lawmakers are devoted to tax reductions for the middle class but have not yet decided how to express those feelings. NEBRASKA legislators are playing the field, flirting with several very different property tax and school funding proposals. And VIRGINIA’s legislators and governor just decided to settle for a flawed…

New York Post: Amazon Paid No Federal Taxes Again

February 14, 2019

Instead, as first reported by the Institute on Taxation and Economic Policy, Amazon received a federal income tax rebate of $129 million, essentially amounting to a tax rate of negative 1 percent.

The Illusion of Race-Neutral Tax Policy

February 14, 2019 • By Alan Essig, Carl Davis, Jenice Robinson, Meg Wiehe, Misha Hill, Steve Wamhoff

It is well known that the bulk of the federal tax cuts flowed to the highest-earning households, who received the largest tax cut both in terms of real dollars and also as a share of income. But as our analysis with Prosperity Now reveals, solely examining the tax law in the context of class misses a bigger-picture story about how the nation’s public policies not only perpetuate widening income and wealth inequality, they also preserve historic and current injustices that continue to allow white communities to build wealth while denying the same level of opportunity (and often suppressing it) to…

On Monday a group of Senators and Representatives from the Northeast announced their latest proposal to repeal the cap on deductions for state and local taxes (SALT), this time offsetting the costs by restoring the top personal income tax rate to 39.6 percent. This is an improvement over previous proposals to repeal the cap on SALT deductions without offsetting the costs at all. But the new approach does not improve our tax system overall. Instead, it trades one tax cut for the rich (a lower top income tax rate) for another (repeal of the cap on SALT deductions).

Amazon in Its Prime: Doubles Profits, Pays $0 in Federal Income Taxes

February 13, 2019 • By Matthew Gardner

Amazon, the ubiquitous purveyor of two-day delivery of just about everything, nearly doubled its profits to $11.2 billion in 2018 from $5.6 billion the previous year and, once again, didn’t pay a single cent of federal income taxes.

Trends We’re Watching in 2019: Cannabis Tax Implementation and Reform

February 7, 2019 • By Carl Davis

Few areas of state tax policy have evolved as rapidly as cannabis taxation over the last few years. The first legal, taxable sale of recreational cannabis in modern U.S. history did not occur until 2014. Now, just five years later, a new ITEP report estimates that recreational cannabis is generating more than $1 billion annually in excise tax revenues and $300 million more in general sales tax dollars.

Trends We’re Watching in 2019: Raising Revenue and Spending Surpluses to Prioritize Critical Public Investments

February 7, 2019 • By Lisa Christensen Gee

A second notable trend in 2019 is states raising revenue to address longstanding needs and states allocating their surpluses to invest in critical public priorities such as early childhood programs, education and other human services.

Trends We’re Watching in 2019: The Use of Targeted Tax Breaks to Help Address Poverty and Inequality

February 7, 2019 • By Aidan Davis

Continuing to build upon the momentum of previous years, states are taking steps to create and improve targeted tax breaks meant to lift their most in-need state residents up and out of poverty. Most notably, a range of states are exploring ways to restore, enhance or create state Earned Income Tax Credits (EITC). EITCs are an effective tool to help struggling families with low wages make ends meet and provide necessities for their children. The policy, designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, allows struggling families to move toward meaningful economic…

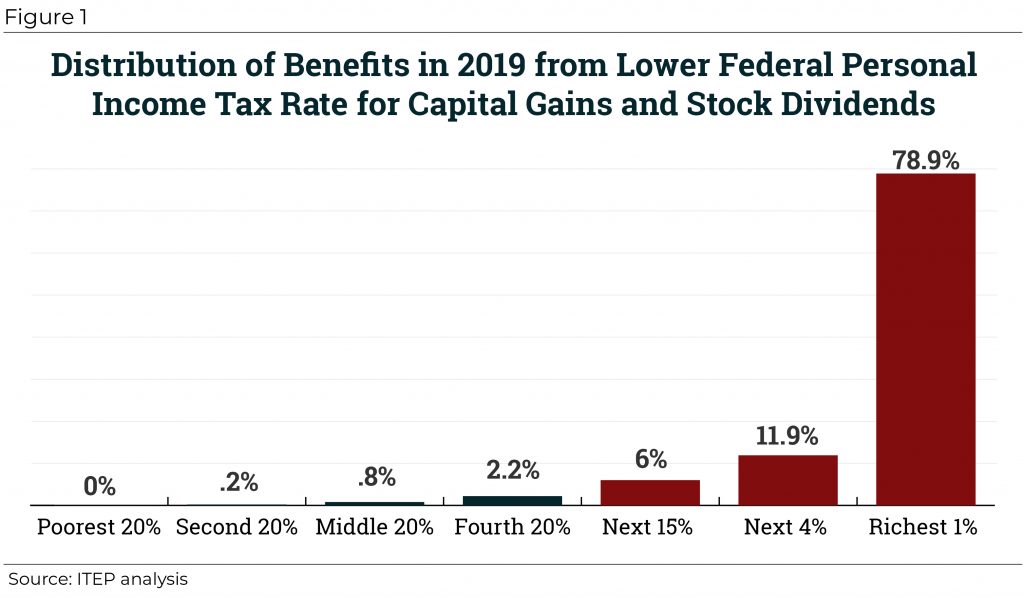

Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains

February 1, 2019 • By Steve Wamhoff

Even though income derived from capital gains receives a special lower tax rate and is therefore undertaxed, some proponents of lower taxes on the wealthy claim that capital gains are overtaxed due to the effects of inflation. But existing tax breaks for capital gains more than compensate for any problem related to inflation. Congress should repeal or restrict special tax provisions for capital gains rather than creating even more breaks.

Bloomberg: Warren’s Tax Proposal Aims at Assets of Wealthiest Americans

January 25, 2019

Her plan would do more to relieve inequality than New York Democratic Representative Alexandria Ocasio-Cortez’s idea to raise the top income tax rate to 70 percent, according to Steve Wamhoff, the director of federal tax policy at the left-leaning Institute on Taxation and Economic Policy. New research indicates that raising marginal income rates wouldn’t do […]