Recent Work by ITEP

The Trump-GOP tax plan is touted as plan for the middle-class but delivers a boon to the wealthy, throws a comparative pittance to everyone else and even includes a dose of tax increases for some middle- and upper-middle-income taxpayers. The data belie the rhetoric.

State Rundown 10/4: Wildfires in Montana and Tax Cuts in Kansas Wreak Budget Havoc

October 4, 2017 • By ITEP Staff

This week, Kansas's school funding was again ruled unconstitutionally low and unfair, while Montana lawmakers indicated they'd rather let historic wildfires burn a hole through their budget than raise revenues to meet their funding needs. Meanwhile, a struggling agricultural sector continues to cause problems for Iowa and Nebraska, but legalized recreational marijuana is bringing good economic news to both California and Nevada.

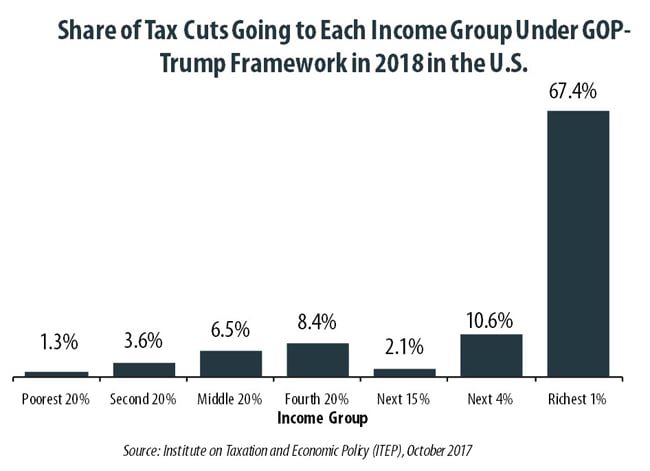

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

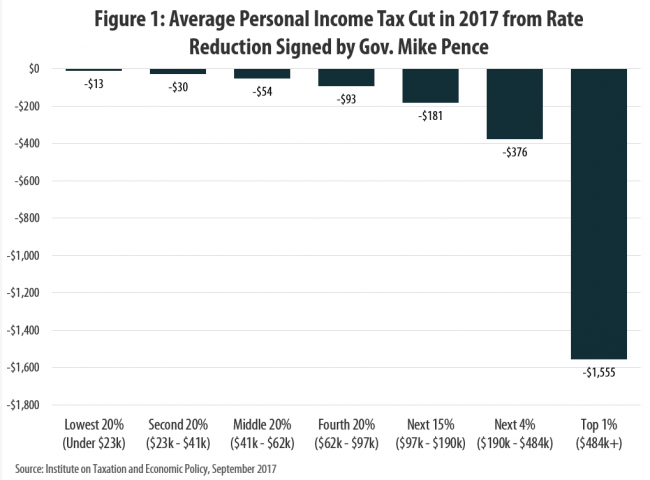

Indiana’s Tax Cuts Under Mike Pence Are Not a Model for the Nation

September 29, 2017 • By Carl Davis

In announcing a new tax cut framework this week in Indianapolis that was negotiated with House and Senate leaders, President Trump claimed that “Indiana is a tremendous example of the prosperity that is unleashed when we cut taxes and set free the dreams of our citizens …. In Indiana, you have seen firsthand that cutting taxes on businesses makes your state more competitive and leads to more jobs and higher paychecks for your workers.”

State Rundown 9/28: Wisconsin Budget Finalized, Oklahoma Special Session Underway

September 28, 2017 • By ITEP Staff

This week, Wisconsin's leaders finalized the state budget at last, while those in Oklahoma began a special session to close their state's revenue shortfall. Soda tax fights made news in Illinois and Pennsylvania. And New Jersey offered Amazon $5 billion in tax subsidies.

State Rundown 9/25: No Rest for the Weary as State Tax and Budget Debates Wind Down, Ramp Up

September 25, 2017 • By ITEP Staff

Last week, Wisconsin leaders finally came to agreement on a state budget, while their peers in Connecticut appear to be close behind them. Iowa lawmakers avoided a special session with a short-term fix and will have to return to their structural deficit issues next session, as will those in Louisiana who will face a $1 billion shortfall. Meanwhile, District of Columbia leaders have already resumed meeting and discussing tax and budget issues there.

Fact Sheet: The Consequences of Adopting a Territorial Tax System

September 18, 2017 • By Steve Wamhoff

President Trump and Republican leaders in Congress have proposed a “territorial” tax system, which would allow American corporations to pay no U.S. taxes on most profits they book offshore. This would worsen the already substantial problem of corporate tax avoidance and result in more jobs and investment leaving the U.S. Lawmakers should know some key facts about the territorial approach.

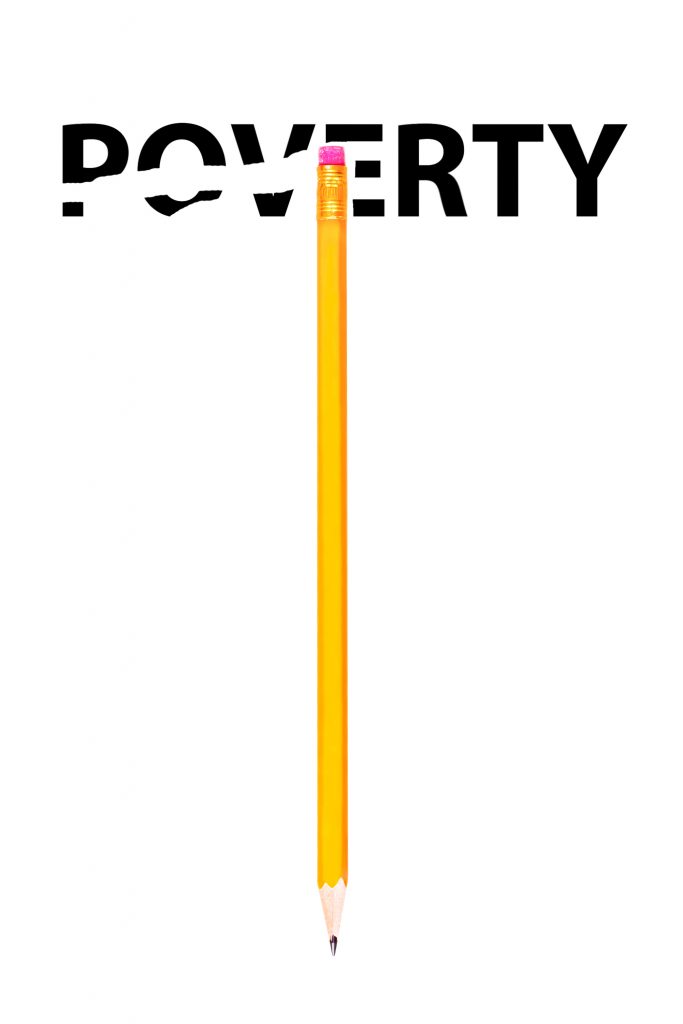

Poverty is Down, But State Tax Codes Could Bring It Even Lower

September 15, 2017 • By Misha Hill

The U.S. Census Bureau released its annual data on income, poverty and health insurance coverage this week. For the second consecutive year, the national poverty rate declined and the well-being of America’s most economically vulnerable has generally improved. In 2016, the year of the latest available data, 40.6 million (or nearly 1 in 8) Americans were living in poverty.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

Census Data Reveal Modest Gains for Working People; GOP Tax Overhaul Could Reverse These Gains

September 14, 2017 • By Jenice Robinson

On the surface, census poverty and income data released Tuesday reveal the nation’s economic conditions are improving for working families. The federal poverty rate declined for the second consecutive year and is now on par with the pre-recession rate. For the first time, median household income surpassed the peak it reached in 1999 and is […]