Recent Work by ITEP

State Rundown 5/11: Mid-Year Special Elections and Primary Season Kicks Off with Taxes in the Spotlight

May 11, 2022 • By ITEP Staff

As 2022 inches closer to its midpoint, important tax policy decisions are being put in the hands of voters, as special elections and the primary season begin...

Most Senate Democrats Join Republicans in Calling for Corporate Tax Break

May 6, 2022 • By Steve Wamhoff

The vast majority of Senate Democrats joined their Republican colleagues in approving a new corporate tax break related to research in legislation that contains no offsetting corporate tax increases.

While tax discussions among federal lawmakers continue in fits and starts, major tax news continues to make waves across the nation...

Revenue-Raising Proposals in President Biden’s Fiscal Year 2023 Budget Plan

April 26, 2022 • By Steve Wamhoff

President Biden's latest budget plan includes proposals that would raise $2.5 trillion in new revenue. While many of these reforms appeared in his previous budget, some of them are brand new, such as his proposal to prevent basis-shifting in partnerships and his Billionaires Minimum Income Tax.

Biden’s Proposals Would Fix a Tax Code that Coddles Billionaires

April 21, 2022 • By Steve Wamhoff

Billionaires can afford to pay a larger share of their income in taxes than teachers, nurses and firefighters. But our tax code often allows them to pay less, as demonstrated by the latest expose from reporters at ProPublica using IRS data. According to their calculations, Betsy DeVos, the Education Secretary under former President Donald Trump, […]

This Spring looks to be bringing a mix of showers and flowers as states around the nation continue to act on a range of tax proposals...

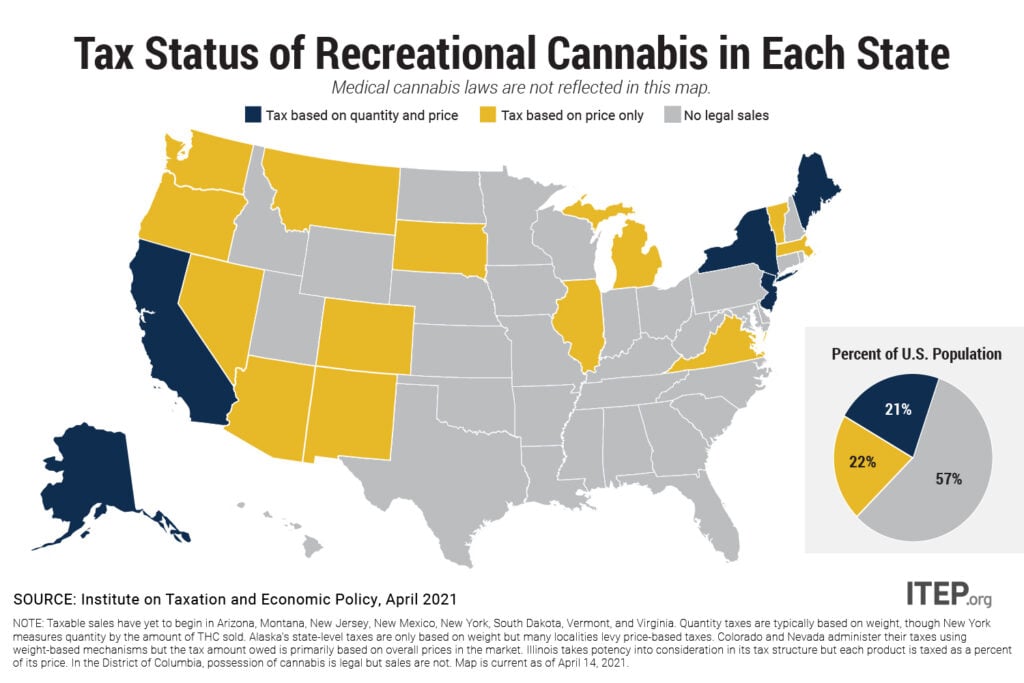

Eighteen states have legalized the sale of cannabis for general adult use and sales are already underway in 10 of those states. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes are typically based on weight, though New York measures quantity by the amount of THC sold. ITEP research indicates that taxes based on quantity will be more sustainable over time because prices are widely expected to fall as the cannabis industry matures. Most states allowing for legal cannabis sales apply their general sales taxes to the…

Some Lawmakers Continue to Mythologize Income Tax Elimination Despite Widespread Opposition

April 19, 2022 • By Kamolika Das

One of the most surprising trends this legislative session is that conservative leaders and the business community joined with progressive advocates to oppose income tax repeal plans. There is a general consensus that income tax repeal is a step too far.

Cannabis Taxes Outraised Alcohol by 20 Percent in States with Legal Sales Last Year

April 19, 2022 • By Carl Davis

In 2021, the 11 states that allowed legal sales within their borders raised nearly $3 billion in cannabis excise tax revenue, an increase of 33 percent compared to a year earlier. While the tax remains a small part of state budgets, it’s beginning to eclipse other “sin taxes” that states have long had on the books.

Long-term troubles for this country and this planet now demand our attention. Progressive tax policy would transform our ability to tackle them.