Recent Work by ITEP

As many of the country’s major professional sports leagues attempt to return to action amid concerns that the pandemic will find a way to ruin even the best-laid plans, state legislatures find themselves in a similar boat. Lawmakers would normally be enjoying their summer breaks at this time of year, but instead are returning to work in special sessions surrounded by plexiglass and uncertainty. Read on for information on ongoing sessions in states including California, Massachusetts, and Nebraska, as well as upcoming sessions in Missouri and Oregon.

Biden’s Minimum Corporate Tax Proposal: Yes, Please Limit Amazon’s Tax Breaks

July 29, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

A large majority of Americans want corporations to pay more taxes and Democratic presidential candidate Joe Biden has several proposals to achieve that. The newest idea is to require corporations to pay a minimum tax equal to 15 percent of profits they report to shareholders and to the public if this is less than what they pay under regular corporate tax rules. A recent article in the Wall Street Journal quotes several critics of the proposal, but none of their points are convincing.

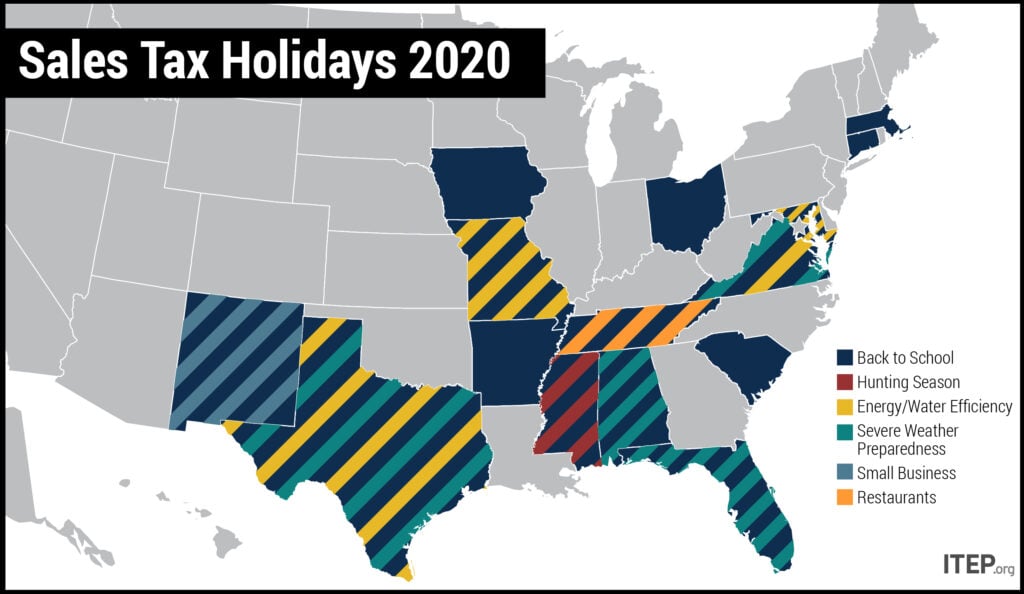

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 29, 2020 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2020) to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—and amplified in the context of the COVID-19 pandemic. This policy brief looks at sales tax holidays as a tax reduction device.

A Cautionary Tale on Sales Tax Holidays During a Pandemic

July 29, 2020 • By Dylan Grundman O'Neill

Sixteen U.S. states will hold “sales tax holidays” this year. As ITEP’s newly updated brief explains, these events offer dubious benefits at significant public expense even in normal years, problems which are only amplified in the context of the COVID-19 pandemic.

Americans are demanding policy that meets the needs of this urgent moment. There are now competing proposals from the U.S. House and Senate: One is a reasonable response to the staggering crisis we’re in. One is not.

A Tax Loophole You Could Drive a Food Truck Through: Senate GOP Proposes Full Deductibility of Business Meals

July 28, 2020 • By Matthew Gardner

After weeks of being in no particular hurry to assemble a new COVID-19 economic relief package, the Senate GOP has released its plan. It includes the “Supporting America’s Restaurant Workers Act,” which would allow business owners to write off 100 percent of the cost of their restaurant meals through the end of 2020. The two most obvious questions to ask about such a plan are “why” and “why now?” Republican lawmakers have not offered sensible responses to either because they have none.

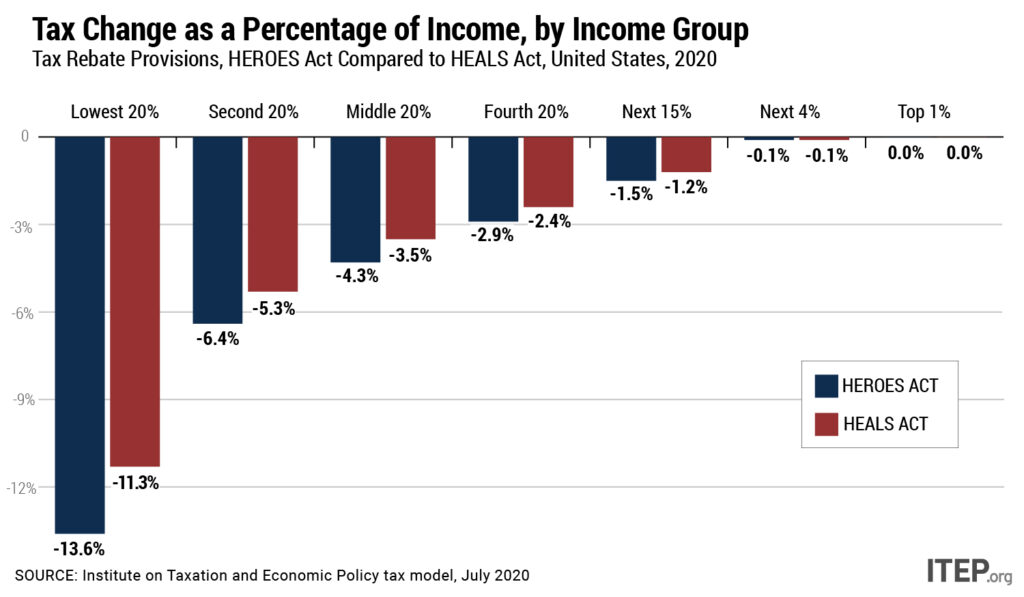

New Analysis Compares HEROES Act and HEALS Act, Disaggregates Data by Race and Income

July 28, 2020 • By ITEP Staff, Jessica Schieder, Meg Wiehe, Steve Wamhoff

The Health, Economic Assistance, Liability Protection and Schools (HEALS) Act released by Senate Republicans Monday includes a tax rebate that is slightly more generous than the one provided under the March CARES Act, but fails to correct most of the earlier act’s problems. House Democrats addressed these shortcomings in the May HEROES Act, a better starting place for negotiations over the next round of COVID-19 relief. ITEP has analyzed both acts to provide a detailed comparison of how the tax rebate provisions would affect families across the income spectrum and by race. Both measures would provide cash payments to a…

Treasury Secretary Mnuchin to Unemployed Workers: Don’t Worry, Get a Bank Loan

July 24, 2020 • By Jenice Robinson

In an explanation that can only be called richsplaining, Treasury Secretary Steve Mnuchin on Thursday suggested that Congress’s delay in approving expanded unemployment benefits was no problem because banks would extend loans to people in the meantime.

Temperatures and tensions are high right now across the country as Congress debates its next pandemic response and states continue to sweat through difficult decisions. Nevada lawmakers, for example, just wrapped up a special session during which they came within one vote of a proposed tax increase but ultimately chose to balance their shortfall through only funding cuts. But advocates in many states, including California, New Jersey, New York, and Rhode Island are trying to light a fire under lawmakers to encourage them to enact progressive tax increases on their wealthiest households.

Biden Proposes to Fund Child Care and Elder Care by Shutting Down Tax Breaks for Real Estate Investors

July 21, 2020 • By Steve Wamhoff

On Tuesday, Democratic presidential candidate Joe Biden announced a $775 billion proposal to expand care options for children and elderly people, suggesting that the cost would be at least partly offset by paring back tax breaks for real estate investors. Bigtime real estate investors are simply unaccustomed to operating without government subsidies provided through the tax code.