Pennsylvania

State Rundown 3/9: One State Stands Out Amid the Avalanche of Tax Cuts

March 9, 2022 • By ITEP Staff

The avalanche of regressive tax-cut proposals coming out of state legislatures has not slowed over the course of the winter months, but one state has provided a shot of hope to advocates of tax equity...

Pennsylvania Capital Star: GOP plan would be a tax hike for 35% of Pa. residents

March 9, 2022

The share of households facing tax hikes would vary across states, according to an analysis by the Institute on Taxation and Economic Policy, ranging from a low of about 24 percent in Washington State to high of roughly 50 percent in Mississippi, which is among the poorest states in the country. Read more

ITEP is happy to announce the launch of our new State Tax Watch page, where you can find out about the most up-to-date tax proposals and permanent legislative changes happening across the country...

While record state revenue surpluses have led to big pushes in red states to make unnecessary permanent income and corporate tax cuts, Democrats are also getting in on the tax-cut mania...

One-time payments have become a common theme around the country, as Idaho is one of roughly eleven states with plans to provide tax relief in a similar fashion...

State Rundown 1/26: States Offering Preview of Tax Themes and Trends for 2022

January 26, 2022 • By ITEP Staff

Governors and legislators are beginning to settle on and advance tax bills that could drastically shape the future of their states and several trends and themes are beginning to emerge...

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

One of the few industries to excel during the economic downturn brought on by the pandemic has been the marijuana business, and lawmakers around the country are taking notice as they try to ensure that sales in their state are both legal and subject to tax...

State Rundown 8/4: Tis the Season…for Unnecessary Sales Tax Holidays

August 4, 2021 • By ITEP Staff

It’s beginning to look a lot like that time of year again. That’s right, it’s sales tax holiday season and states across the country are doing their best to induce spending that would probably occur regardless...

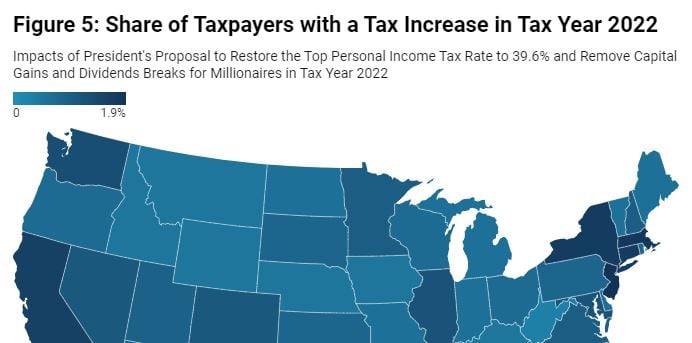

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

State Rundown 3/17: Momentum for Sound Progressive Tax Reforms Continues to Build

March 17, 2021 • By ITEP Staff

We wrote last week that the inclusion of fiscal relief for states and localities in Congress’s American Rescue Plan should free up state lawmakers’ time and attention to focus on the comprehensive reforms needed to address upside-down and inadequate tax codes, and some states are already doing just that.

Alaska lawmakers are facing an unprecedented fiscal crisis. The state is more dependent than any other on oil tax and royalty revenues but declines in oil prices and production levels have sapped much of the vitality of these revenue sources. One way of diversifying the state’s revenue stream and narrowing the yawning gap between state revenues and expenses would be to reinstitute a statewide personal income tax. Alaska previously levied such a tax until 1980. This report contains ITEP’s analysis of the distributional impact and revenue potential of a variety of flat-rate income tax options for Alaska, based on draft…

State Rundown 2/17: Friction Over Tax Policy Still Generating Heat in Some Statehouses

February 17, 2021 • By ITEP Staff

Cold-hearted regressive tax proposals were pushed this week to cut income taxes on high-income households in states including Idaho, Montana, and West Virginia, while advocates for fair taxes and well-funded services continue to turn up the heat on taxing the richest residents in states like Connecticut and Pennsylvania.

State Rundown 2/4: Some Lawmakers, Governors Rising to Occasion with Progressive Tax Proposals

February 4, 2021 • By ITEP Staff

States face shifting landscapes as they attempt to deal with both emergent and longstanding issues in their tax codes and budget structures. This is particularly evident in Oklahoma, where lawmakers must adjust to a U.S. Supreme Court decision that literally redraws state boundaries by recognizing the rights of indigenous communities, but is true in every state, and lawmakers in many of them are rising to the challenge. Read below and see our blog posted today for more on bold proposals that increase tax fairness and solidify bottom lines with needed revenue in states including Connecticut, Minnesota, New York, Pennsylvania, Vermont,…

States Are Finally Going Bold with Progressive Tax Efforts

February 4, 2021 • By Dylan Grundman O'Neill

Advocates, lawmakers, study commissions, and even governors in some states are proposing bold tax policy reforms that look beyond pandemic-induced budget shortfalls and the “K-shaped recovery” to address underlying inequities and underfunding that gave rise to them. These efforts include proposals to: end or reverse regressive tax policies like the preferential treatment of income derived from wealth over income earned through work; restore or strengthen estate and inheritance taxes to slow the concentration of wealth in ever-fewer hands; raise revenue and slow inequality with progressive income taxes; and many other ideas to right upside-down tax codes while raising the revenue…

State Rundown 11/24: Lawmakers and Families Thankful to Be Nearing End to 2020

November 24, 2020 • By ITEP Staff

Just as people will search their hearts to give thanks this week for the small and large things that got them through a difficult year, state lawmakers are also doing their best to count their blessings while keeping fingers crossed for badly needed federal relief to give them something to be truly grateful for.

Donald Trump and Taxes: Fast and Loose with Loopholes or Fraud?

September 30, 2020 • By Matthew Gardner

The president’s apparent abuse of everything from hair-care deductions to consulting fees for family members raises questions about whether Trump was fast and loose with tax loopholes or whether the IRS simply wasn’t enforcing the law. Either way, Trump successfully flouting or pushing the limits of the law shouldn’t come as a surprise: Congress has cut IRS funding, in real terms in each of the last 10 years.

State Rundown 8/26: Progressive Revenue Ideas Featured in Many States’ Fiscal Debates

August 26, 2020 • By ITEP Staff

Voters could significantly change the tax landscape through ballot measures this November regarding oil taxes in Alaska and a high-income surcharge for education funding in Arizona. Legislators are doing their part to bring progressive tax ideas to the fore as well, including a possible wealth tax in California, a millionaires tax in New Jersey, and a pied-a-terre proposal in New York. And Nebraska lawmakers reached a property tax and business tax subsidy compromise before closing out their session, but did not identify progressive revenue sources to fund it and will likely be back at the bargaining table before long.

Keystone Research Center: REPORT: Why Pennsylvania Needs a State Earned Income Tax Credit (EITC)

August 25, 2020

If one thing has become clear during the COVID-19 pandemic, it is that workers who do essential things like providing care for the sick, stocking shelves at grocery stores, and cleaning facilities to keep our buildings clean and safe are undervalued in our society. Despite their hard work, many Pennsylvanians earn such low wages that […]

With tax day finally coming at the federal level and in many states this week, policymakers in Nevada and New Jersey began to talk about revenue solutions to their revenue shortfalls, even if they fell well short of wholeheartedly backing needed reforms. Like their counterparts in most states, they remain primarily focused on temporary solutions to their short-term emergencies. Still, advocates in these and other states continue to push for more fundamental fixes to their inadequate and upside-down tax codes, including a new campaign for better tax policy in Massachusetts and efforts to rein in tax subsidies and loopholes in…

New Fiscal Year Brings New Challenges and Opportunities in the States

July 1, 2020 • By Kamolika Das

July 1—the start of the new fiscal year in most states—typically marks a point when one can take a step back and reflect on the wins and disappointments of the past state legislative sessions. 2020 is markedly different. Nationwide business closures and stay-at-home orders in response to COVID-19 have led to unprecedented spikes in unemployment, decreased demand for consumer spending, and increased demand for vital public services. As a result, states face incredibly uncertain financial futures with little clarity regarding how their tax collections will fare over the next year.

State Rundown 6/26: States Take Varying Fiscal Approaches While Awaiting Federal Action

June 26, 2020 • By ITEP Staff

State policymakers this week took a variety of approaches to their fiscal situations amid the COVID-19 pandemic. Tennessee lawmakers chose to balance their budget through $1.5 billion in cuts to public services, but not before adding to those cuts by going forward with planned tax cuts. California legislators also passed a budget but relied on a number of temporary measures and delays to do so. Their counterparts in Massachusetts, New Jersey, and Rhode Island opted for interim budgets to tide them over for a few months while they continue to look for lasting solutions. Meanwhile, many states are debating whether…

State Rundown 5/27: Some States Finally Talking Revenue Solutions to Revenue Crisis

May 27, 2020 • By ITEP Staff

This week the immense scale and uneven distribution of economic and health damage from the COVID-19 pandemic continued to come into focus, hand in hand with greater clarity around pandemic-related revenue losses threatening state and local revenues and the priorities—such as health care, education, and public safety—they fund. Officials in many states, including Ohio and Tennessee, nonetheless rushed to declare their unwillingness to be part of any solution that includes raising the tax contributions of their highest-income residents. On the brighter side, some leaders are willing to do just that, for example through progressive tax increases proposed in New York…

State Rundown 5/20: State Revenue Crisis Getting Clearer…and Scarier

May 20, 2020 • By ITEP Staff

State policymakers are navigating incredibly uncertain waters these days as they attempt to get a firmer grasp on the scale of their revenue crises, identify painful budget cuts they may have to make in response, and look for ways to raise tax revenues coming from the households and corporations still bringing in large incomes and profits amid the pandemic—all while hoping that additional federal aid and greater flexibility in how they can use federal CARES Act funds will help relieve some of these difficult decisions.

State Rundown 5/7: State Fiscal Responses to Pandemic Starting to Get Real

May 7, 2020 • By ITEP Staff

State lawmakers are starting to use fiscal policy levers to address the COVID-19 pandemic, but the actions vary greatly and are just a start. Mississippi, for example, is one state still clarifying who has authority to determine how federal aid dollars are spent. Colorado, Georgia, Missouri, and Ohio are among the many states identifying painful funding cuts they will likely make to shared priorities like health care. The Louisiana House and the Minnesota Senate each advanced tax cuts and credits that could dig their budget holes even deeper. Connecticut leaders are looking at one of the more comprehensive packages, which…