Puerto Rico

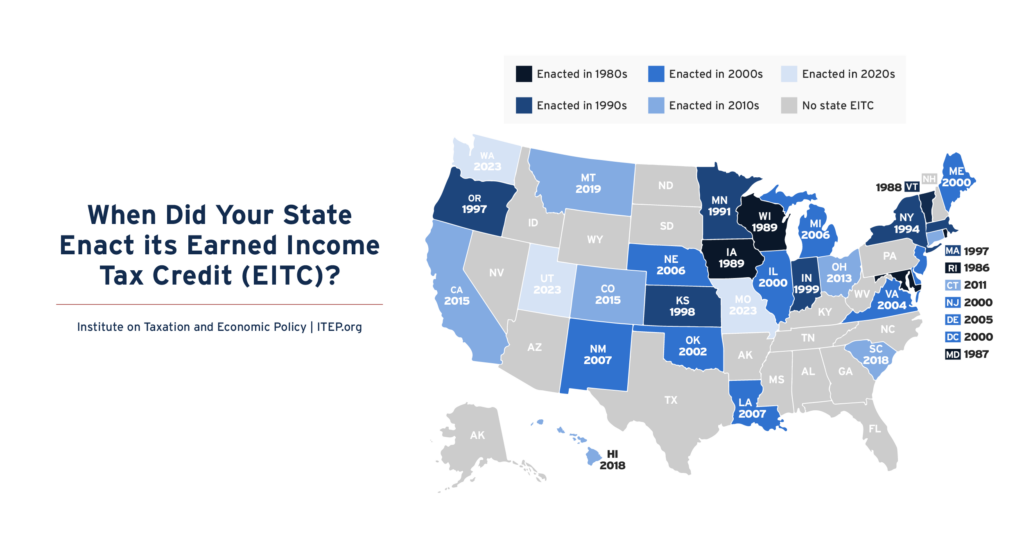

A pair of new briefs from the Institute on Taxation and Economic Policy (ITEP) illustrate the growing power of state Earned Income Tax Credits (EITCs) and Child Tax Credits (CTCs). In all, we find: Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit (EITC). These […]

State Earned Income Tax Credits Support Families and Workers in 2025

September 11, 2025 • By Neva Butkus

Nearly two-thirds of states now have an Earned Income Tax Credit (EITC). Momentum continues to build on these credits that boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

As states prepare for the revenue loss and disruption resulting from the federal tax bill, tax policy is being considered in legislatures across the country.

State Rundown 4/3: Amidst Tariff Uncertainty, State Lawmakers Talk Taxes

April 3, 2025 • By ITEP Staff

While all eyes are on the Trump administration’s tariffs on foreign imports, state lawmakers are moving forward with a mix of deep, regressive tax cuts and progressive revenue raisers.

The Earned Income Tax Credit (EITC) supports millions of workers and families and continues to grow in states and localities across the country. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco, where they benefited 700,000 households in 2023.

This week, we celebrate 50 years of the federal Earned Income Tax Credit (EITC) and the impact it's had on millions of workers and families. In 2023 alone, the latest year of available data, the federal EITC alongside the refundable portion of the Child Tax Credit lifted 6.4 million people and 3.4 million children out of poverty.

Tax policy results are mixed across the country as many voters weigh in on state and local ballot measures. For example, Washington state voted to maintain its new progressive tax on capital gains; Georgia voters capped growth in property tax assessments; Illinois voters approved a call for a millionaires’ tax; North Dakota voters rejected property […]

State Earned Income Tax Credits Support Families and Workers in 2024

September 12, 2024 • By Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit. These credits boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

States Should Opt Into IRS Direct File as the Program is Made Permanent

May 30, 2024 • By Jon Whiten

While there is plenty of room to expand Direct File at the federal level, states can take matters into their own hands and bring this benefit to their residents by opting into the program.

These Three Local EITCs Are Boosting Family Incomes at Tax Time

April 10, 2024 • By Andrew Boardman

This tax season more than 800,000 households in New York City, Maryland's Montgomery County, and San Francisco are set to receive a boost through local refundable EITCs. These credits put dollars directly into the pockets of low-income households, equipping families with resources to better make ends meet and invest in their futures. In turn, they can help build stronger, fairer, and more resilient communities.

Local Earned Income Tax Credits: How Localities Are Boosting Economic Security and Advancing Equity with EITCs

October 30, 2023 • By Andrew Boardman, Galen Hendricks, Kamolika Das

Leading localities are using refundable EITCs to boost incomes and reduce taxes for workers and families with low and moderate incomes. These local credits build on the success of EITCs at the federal and state levels, reduce economic hardship and improve the fairness of the tax code.

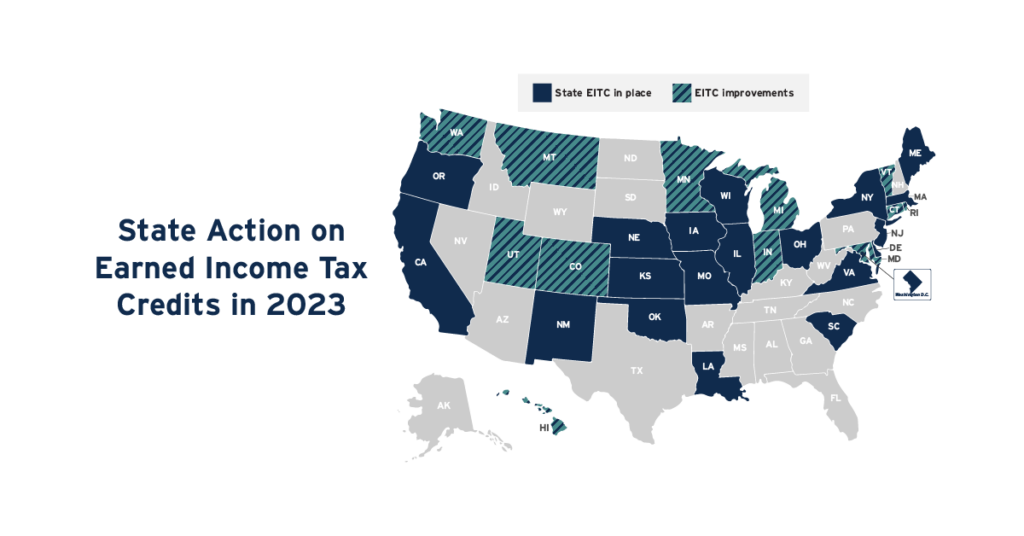

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

State Rundown 8/10: Pump the ‘Breaks’ on Sales Tax Holiday Celebrations

August 10, 2023 • By ITEP Staff

August is here, school is starting, and with that comes back to school shopping...

State Action on Child Tax Credits and Earned Income Tax Credits in 2023

June 28, 2023 • By ITEP Staff

In 2023 so far, 17 states have either adopted or expanded a Child Tax Credit or Earned Income Tax Credit. Both these policies can help bolster the economic security of low- and middle-income families and position the next generation for success.

The great women’s philosopher, Pat Benatar, once said “love is a battlefield,” and there’s no greater test of our love for state tax policy than following the ups and downs of state legislative sessions...

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

While the Inflation Reduction Act's corporate minimum tax is a huge improvement in our tax system, implementing the global corporate minimum tax would improve it much more. And if other governments implement the global minimum tax, the United States will have an even stronger interest in joining them to ensure that new revenue collected from American corporations flows to the U.S. rather than to other countries.

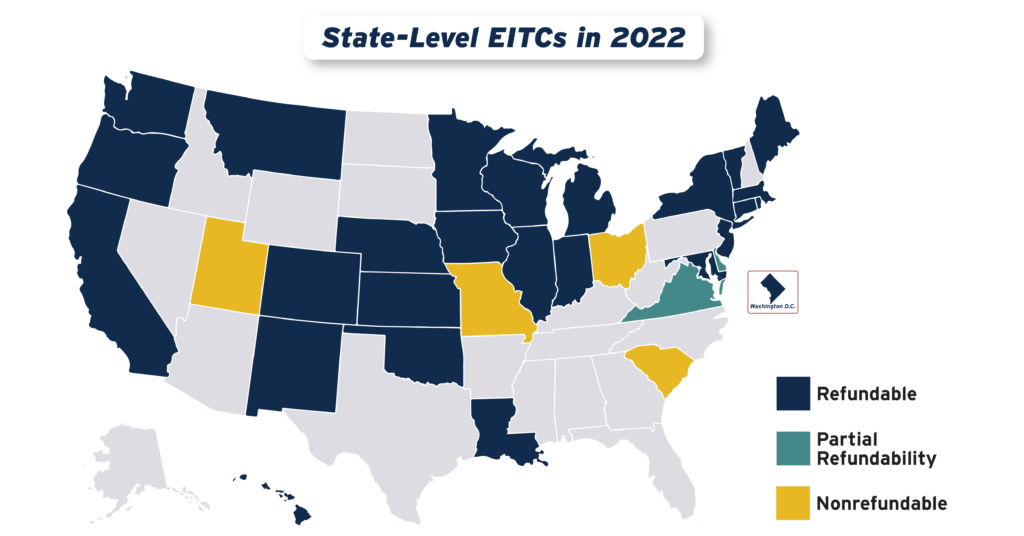

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

National and State-by-State Estimates of Two Approaches to Expanding the Child Tax Credit

September 7, 2022 • By Emma Sifre, Joe Hughes, Steve Wamhoff

The Romney Child Tax Credit plan would leave a quarter of children worse off compared to current law and help half as many low-income children as the 2021 expansion of the credit.

Opponents of Inflation Reduction Act Call for Continued Tax Avoidance by Large Manufacturers

August 2, 2022 • By Steve Wamhoff

The biggest revenue-raising provision in the Inflation Reduction Act, the 15 percent minimum tax for corporations that have more than a billion dollars in profits, is under attack from members of Congress who argue that manufacturing companies should not be required to pay any minimum amount of tax. Sen. Mike Crapo, the top Republican on […]

Creating Racially and Economically Equitable Tax Policy in the South

June 21, 2022 • By Kamolika Das

The South's negative outcomes on measures of wellbeing are the result of a century and a half of policy choices. Lawmakers have many options available to make concrete improvements to tax policy that would raise more revenue, do so equitably, and generate resources that could improve schools, healthcare, social services, infrastructure, and other public resources.

With inflation dominating headlines both nationally and locally, state lawmakers around the U.S. are searching for ways to put their revenues to good use, and not surprisingly, some options are better than others...

State Rundown 3/16: The Scramble to Curb Rising Gas Prices is On

March 16, 2022 • By ITEP Staff

Rising gas prices have lawmakers around the country searching for ways to ease the pressure on consumers and almost half the states are considering reducing or temporarily repealing their gas tax, but another idea is taking hold...

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2021

October 21, 2021 • By Aidan Davis

The EITC benefits low-income people of all races and ethnicities. But it is particularly impactful in historically excluded Black and Hispanic communities where discrimination in the labor market, inequitable educational systems, and countless other inequities have relegated a disproportionate share of people to low-wage jobs.