Recent Work

2146 items

State Rundown 4/12: Tax Day 2023 – A Good Reminder of the Impact of Our Collective Investments

April 12, 2023 • By ITEP Staff

With Tax Day quickly approaching it’s worth taking some time to reflect not just on tax forms (though those are important!), but also on the current state of state tax policy...

Deep Public Investment Changes Lives, Yet Too Many States Continue to Seek Tax Cuts

April 12, 2023 • By Aidan Davis

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

As Tax Day approaches, it’s worth thinking about not only the taxes that we individually pay but the overall condition of our tax code as well. State tax codes, while perhaps less discussed than the federal system, are critically important. Depending on how they are designed, state taxes can improve or worsen economic and racial […]

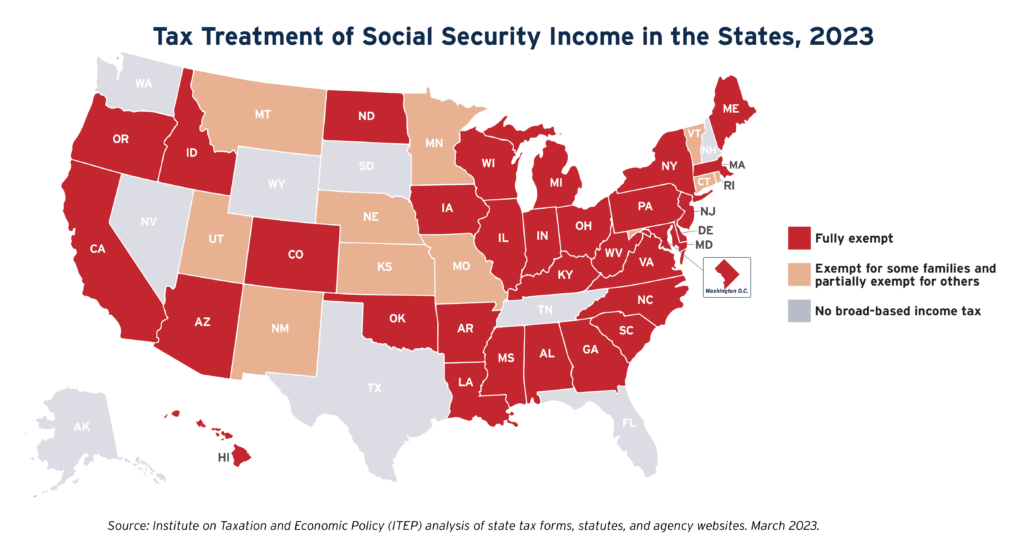

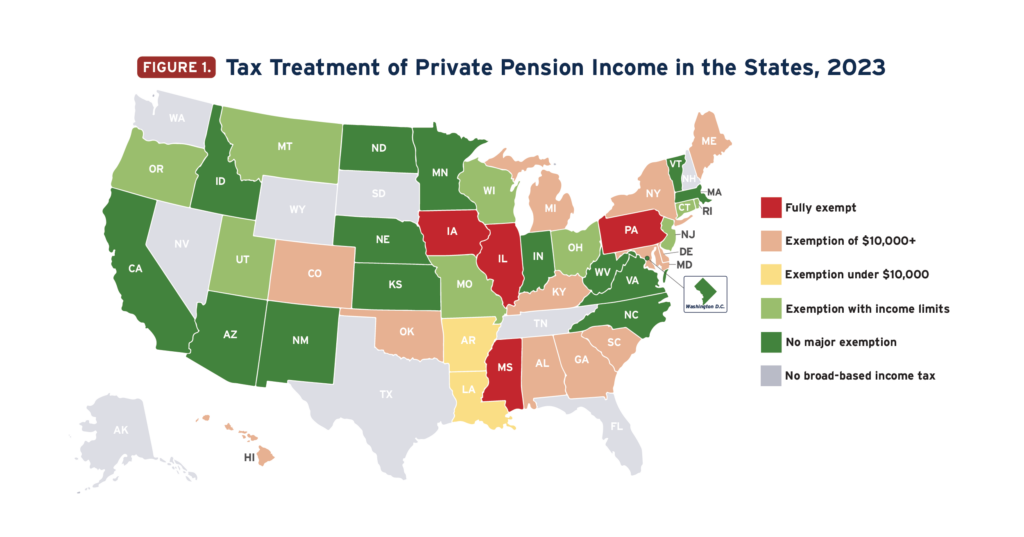

Every state with a personal income tax offers tax subsidies for seniors that are unavailable to younger taxpayers. The best academic research suggests that the median state asks senior citizens to pay about one-third less in personal income tax than younger families with similar incomes. The majority of these subsidies are costly and poorly targeted. […]

This week, a bill out of Arkansas that would cut the top personal income tax rate and the corporate income tax rate found its way to the governor’s desk...

Lawmakers have repeatedly stepped on the same rake of slashing tax rates and expecting revenues to magically go up. Now they want middle-class Americans to be the ones who get hit in the face. The con is getting tired. If Congress wants to reel in the debt then it’s time to raise taxes on the wealthy.

Minnesota’s Tax Code Should Be Based on Ability to Pay, Not Year of Birth

March 31, 2023 • By Carl Davis, Eli Byerly-Duke

Minnesota lawmakers are considering a carveout that would treat seniors much more favorably than young families. The proposal would fully exempt all Social Security income from state income tax, even for seniors with exceptionally high incomes.

Over the past week Washington state saw a major victory for tax fairness after the state Supreme Court held the state’s capital gains tax—passed in 2021—constitutional...

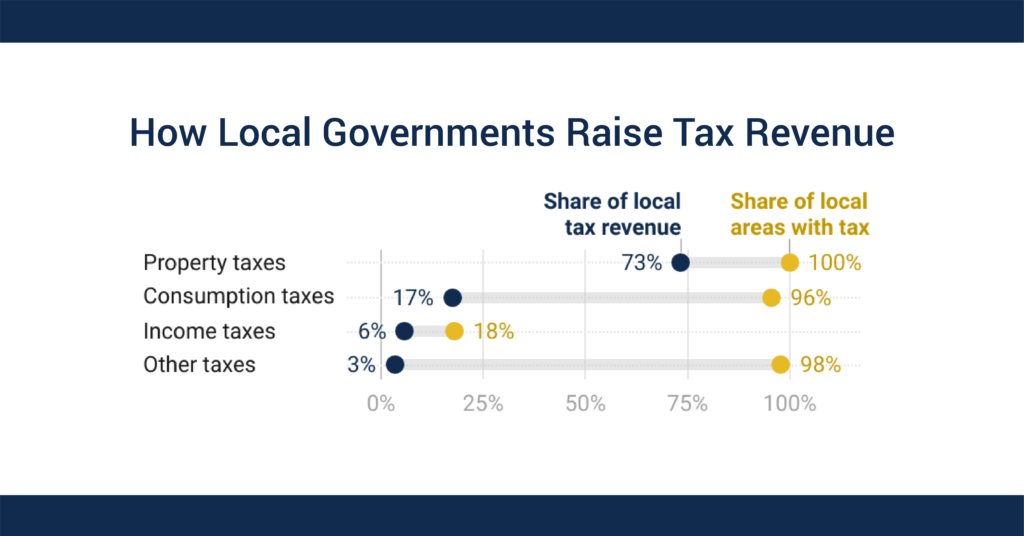

How Local Governments Raise Revenue—and What it Means for Tax Equity

March 30, 2023 • By Andrew Boardman, Kamolika Das

Most local tax systems are falling short of their potential. Well-structured local tax policies support communities by facilitating important investments and advancing fairness, but the tax revenue sources most utilized by local governments tend to disproportionately weigh on households with fewer resources. Learning from these realities can inform the path to improved tax policies and stronger communities.

From dedicating new taxes to fund climate action and public health to vacancy and “mansion” taxes, many local leaders are already exploring ways to make their tax systems more progressive and sustainable. ITEP is committed to helping local leaders and advocates build on this work by advancing knowledge about local tax solutions.

Race-Conscious Tax Policy Discourse is Shifting the Conversation About the Tax Code

March 27, 2023 • By Brakeyshia Samms

As we look ahead to what comes next in our journey to a more race-conscious tax policy debate, it’s worth reflecting on how we got here and what we’ve learned along the way.

As nature bursts into life and color with the arrival of spring, state tax proposals are doing the same as the legislative seeds planted by lawmakers earlier this year start to grow, blossom, and in some cases rot. However, some governors are not entirely happy with what state lawmakers have produced.

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

State governments provide a wide array of tax subsidies to their older residents. But too many of these carveouts focus on predominately wealthy and white seniors, all while the cost climbs.

Effects of President Biden’s Proposal to Expand the Child Tax Credit

March 16, 2023 • By Joe Hughes

In his latest budget proposal, President Biden proposes enhancing the Child Tax Credit (CTC) based on the temporary credit that was in effect for 2021 as part of the American Rescue Plan Act. In this report we analyze how that proposal would help children and families.