Recent Work

2146 items

This Spring looks to be bringing a mix of showers and flowers as states around the nation continue to act on a range of tax proposals...

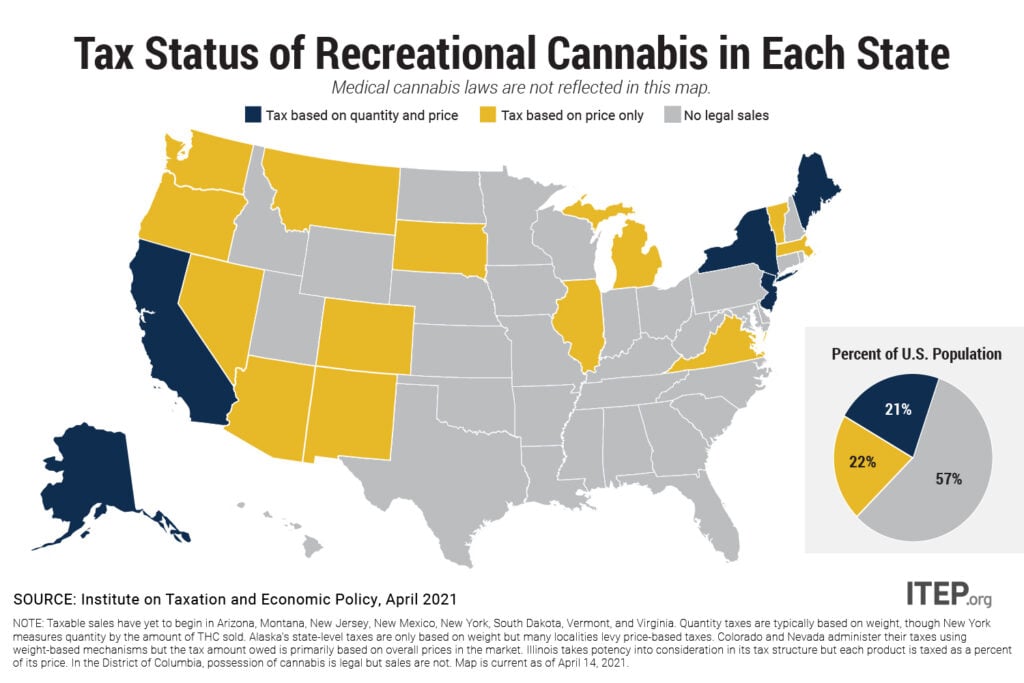

Eighteen states have legalized the sale of cannabis for general adult use and sales are already underway in 10 of those states. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes are typically based on weight, though New York measures quantity by the amount of THC sold. ITEP research indicates that taxes based on quantity will be more sustainable over time because prices are widely expected to fall as the cannabis industry matures. Most states allowing for legal cannabis sales apply their general sales taxes to the…

Some Lawmakers Continue to Mythologize Income Tax Elimination Despite Widespread Opposition

April 19, 2022 • By Kamolika Das

One of the most surprising trends this legislative session is that conservative leaders and the business community joined with progressive advocates to oppose income tax repeal plans. There is a general consensus that income tax repeal is a step too far.

Cannabis Taxes Outraised Alcohol by 20 Percent in States with Legal Sales Last Year

April 19, 2022 • By Carl Davis

In 2021, the 11 states that allowed legal sales within their borders raised nearly $3 billion in cannabis excise tax revenue, an increase of 33 percent compared to a year earlier. While the tax remains a small part of state budgets, it’s beginning to eclipse other “sin taxes” that states have long had on the books.

Long-term troubles for this country and this planet now demand our attention. Progressive tax policy would transform our ability to tackle them.

State Rundown 4/13: Recent State Budgets Prove Not All Tax Cuts are the Same

April 13, 2022 • By ITEP Staff

Two prominent blue states made headlines this past week when they passed budget agreements that include relief for taxpayers, and fortunately, the budget plans don’t include costly tax cuts that primarily benefit the wealthy...

Last week we highlighted how several states were pushing through regressive tax cuts as their legislative sessions are coming to a close. Well, this week many of those same states took further actions on those bills and it’s safe to say we’re even less impressed than before...

President Biden’s Proposed Billionaires’ Minimum Income Tax Would Ensure the Wealthiest Pay a Reasonable Amount of Income Tax

April 6, 2022 • By Steve Wamhoff

The Billionaires’ Minimum Income Tax included in President Biden's budget plan would limit an unfair tax break for capital gains income and complement proposals the president has offered previously to limit other tax breaks for capital gains.

Frequently Asked Questions and Concerns About the President Billionaires’ Minimum Income Tax

April 6, 2022 • By Steve Wamhoff

Find the answers to some frequently asked questions about President Biden's Billionaires’ Minimum Income Tax, which would limit very wealthy individuals’ ability to put off paying income taxes on capital gains until they sell assets.

Punitive Fines and Fees Are an Invisible Cost of State Tax Cuts

April 4, 2022 • By Jenice Robinson

The deck is stacked against those who have the least, and ongoing racism makes it even more difficult for people of color to avoid punitive systems that are intentionally structured to extract what, for poor people, can be usurious penalties. The nation collectively shrugs about such injustices because they are either invisible or we chalk up entanglements in any legal morass to personal behavior. But the truth is that, indirectly, we are all part of the fines-and-fees matrix that entraps poor people in debt or keeps them tethered to the criminal justice system. None of us should look away.

Racial Discrimination in Home Appraisals Is a Problem That’s Now Getting Federal Attention

March 31, 2022 • By Brakeyshia Samms

With both assessments and appraisals being unfair, homeowners of color are stuck between a rock and a hard place when it comes to determining the worth of what is, for most homeowners, their most valuable asset.

Several states have dropped a few late-session surprises, and from the looks of it, they’re not the good kind...

New ITEP Report Explains How the Biden Administration Can Act on Its Own to Fix Our Tax Code

March 25, 2022 • By Steve Wamhoff

The Biden administration should revise regulations from the TCJA to enforce the law as it was written and passed by Congress, not as big banks and multinational corporations have lobbied for it to be enforced.

Excess Profits Tax Proposals Meet the Moment, But Lawmakers Should Keep Their Eye on Fundamentally Fixing Our Corporate Tax

March 25, 2022 • By Steve Wamhoff

New corporate tax proposals address the current situation, but ultimately leaders in Washington must fix federal law to tax all corporate profits and stop the tax dodging that is rampant today.

What the Biden Administration Can Do on Its Own, Without Congress, to Fix the Tax Code

March 25, 2022 • By Steve Wamhoff

The Biden administration has several options to address tax reform even when Congress is unable or unwilling to help.