Recent Work

2146 items

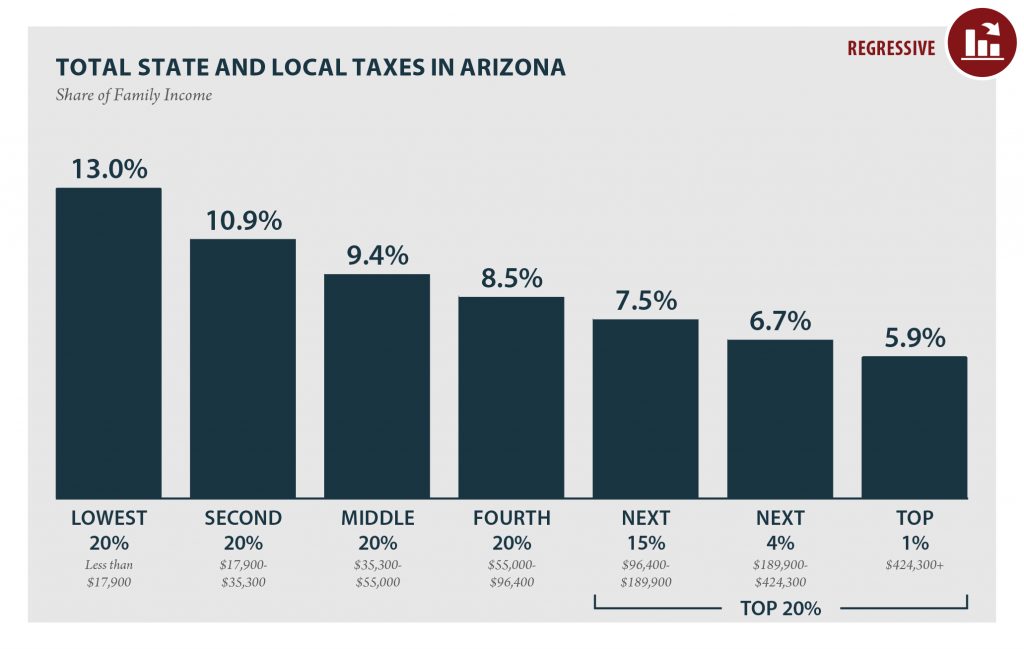

Arizona: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

ARIZONA Read as PDF ARIZONA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,900 $17,900 to $35,300 $35,300 to $55,000 $55,000 to $96,400 $96,400 to $189,900 $189,900 to $424,300 over $424,300 […]

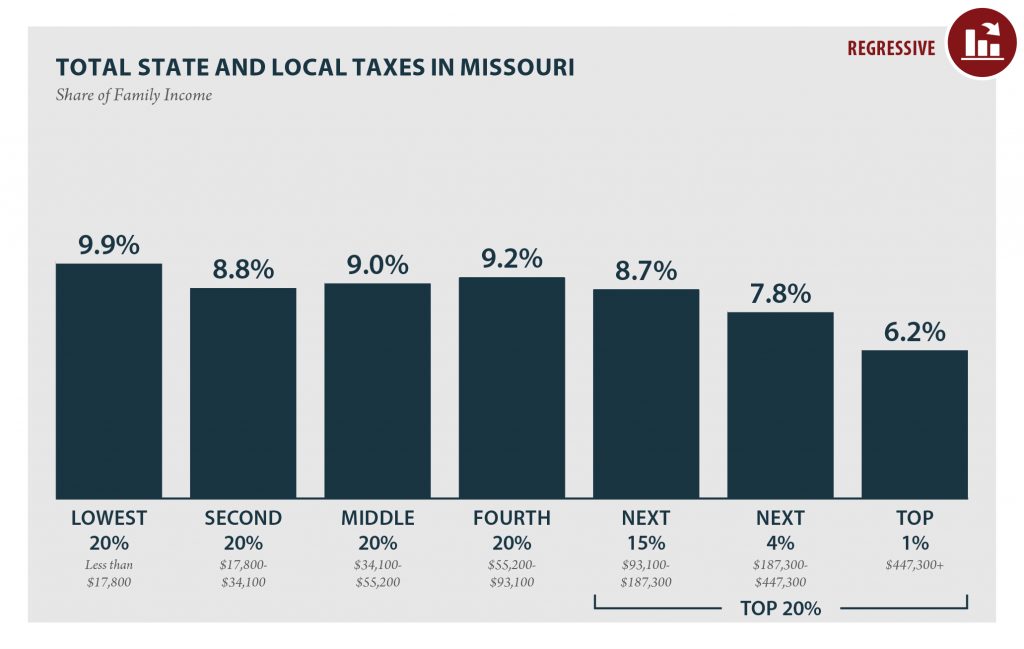

Missouri: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

MISSOURI Read as PDF MISSOURI STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,800 $17,800 to $34,100 $34,100 to $55,200 $55,200 to $93,100 $93,100 to $187,300 $187,300 to $447,300 over $447,300 […]

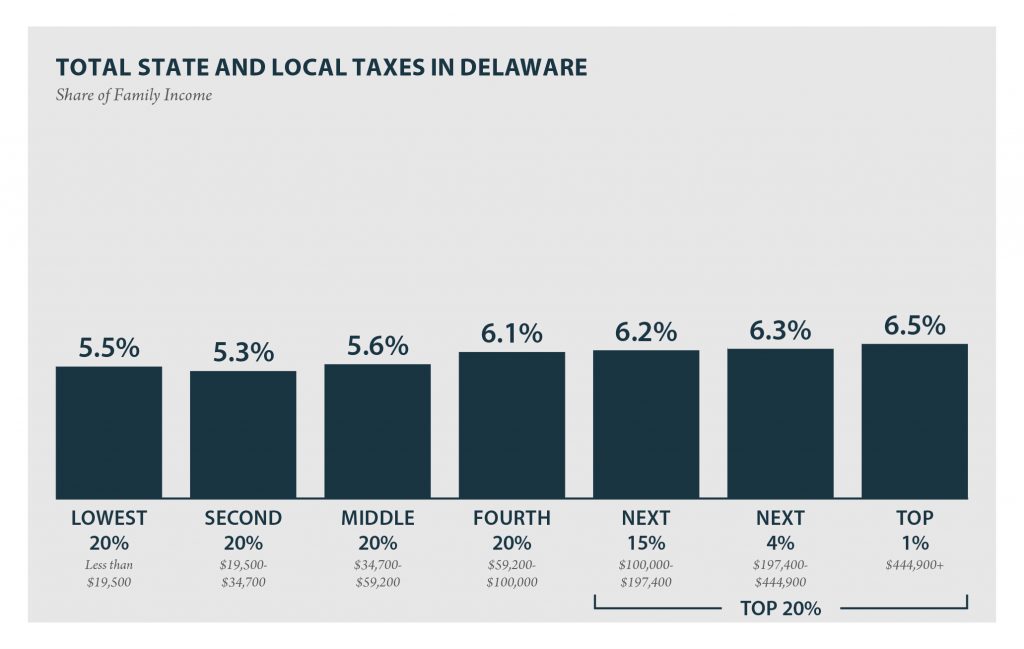

Delaware: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

DELAWARE Read as PDF DELAWARE STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,500 $19,500 to $34,700 $34,700 to $59,200 $59,200 to $100,000 $100,000 to $197,400 $197,400 to $444,900 over $444,900 […]

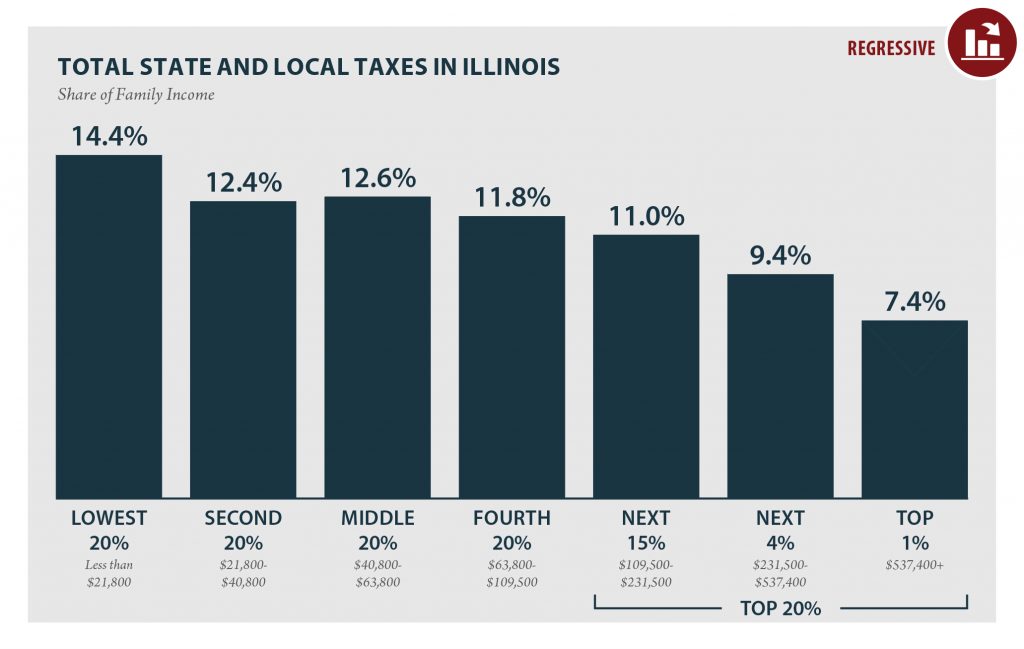

Illinois: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

ILLINOIS Read as PDF ILLINOIS STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $21,800 $21,800 to $40,800 $40,800 to $63,800 $63,800 to $109,500 $109,500 to $231,500 $231,500 to $537,400 over $537,400 […]

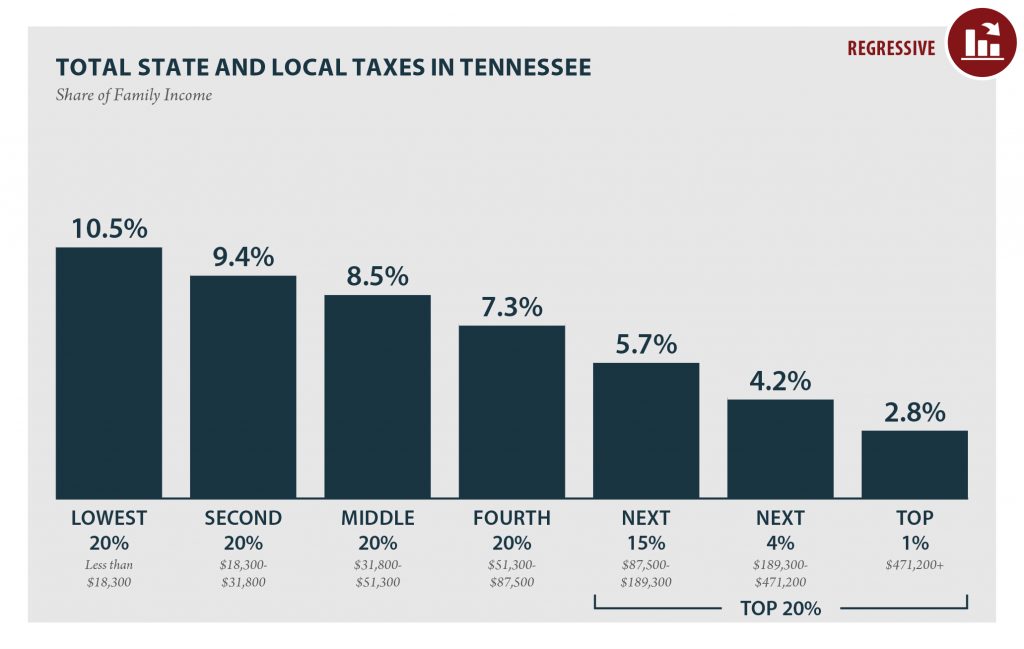

Tennessee: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

TENNESSEE Read as PDF TENNESSEE STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,300 $18,300 to $31,800 $31,800 to $51,300 $51,300 to $87,500 $87,500 to $189,300 $189,300 to $471,200 over $471,200 […]

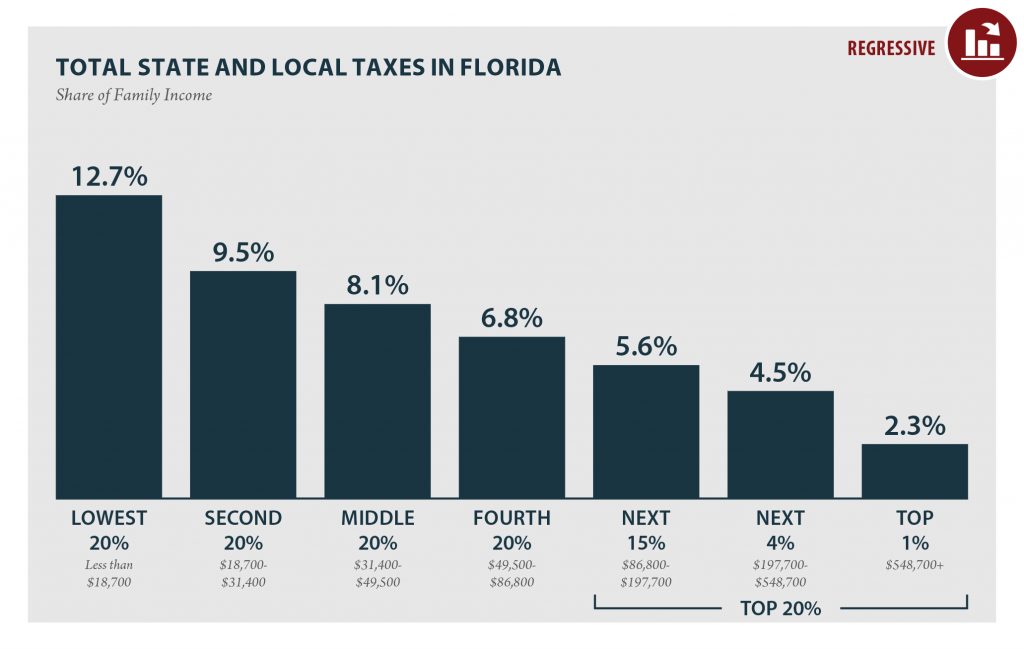

Florida: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

FLORIDA Read as PDF FLORIDA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,700 $18,700 to $31,400 $31,400 to $49,500 $49,500 to $86,800 $86,800 to $197,700 $197,700 to $548,700 over $548,700 […]

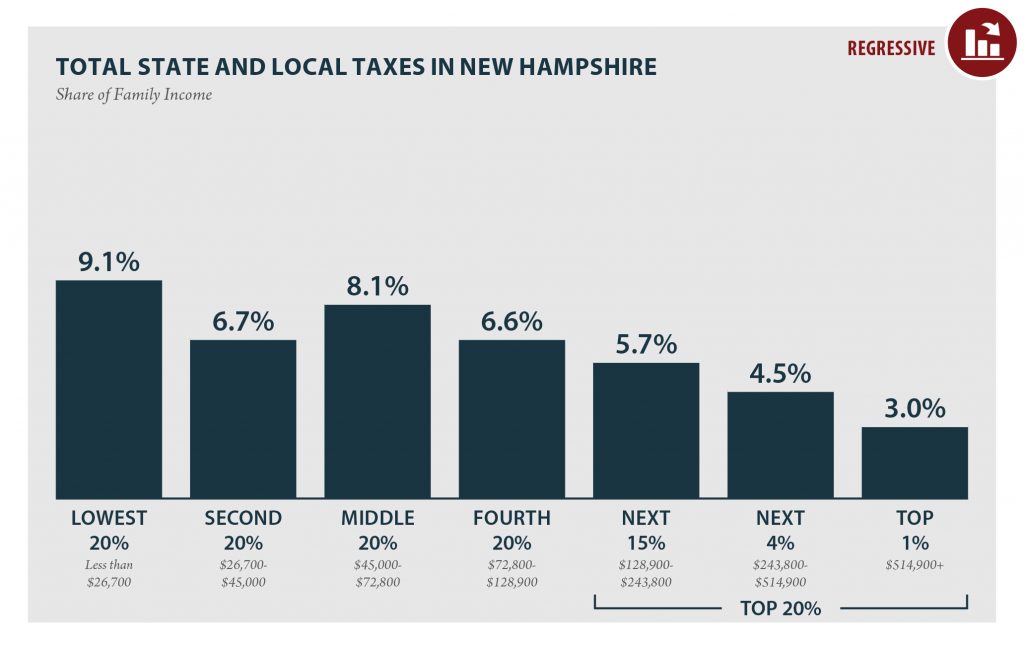

New Hampshire: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, New Hampshire has the 16th most unfair state and local tax system in the country. Incomes are more unequal in New Hampshire after state and local taxes are collected than before.

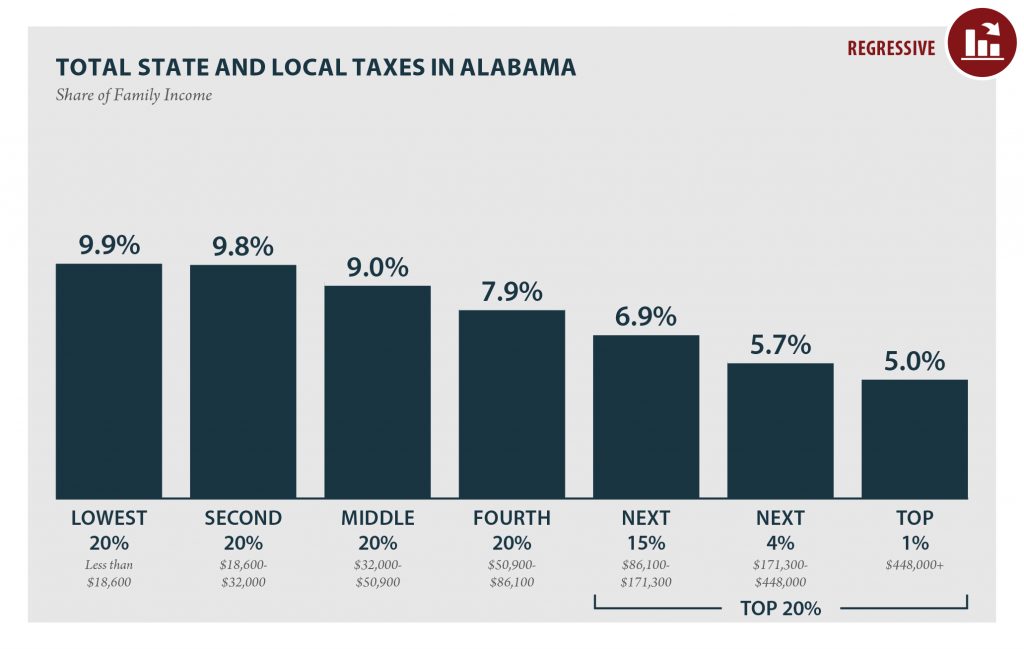

Alabama: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

ALABAMA Read as PDF ALABAMA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,600 $18,600 – $32,000 $32,000 – $50,900 $50,900 – $86,100 $86,100 – $171,300 $171,300 – $448,000 More than […]

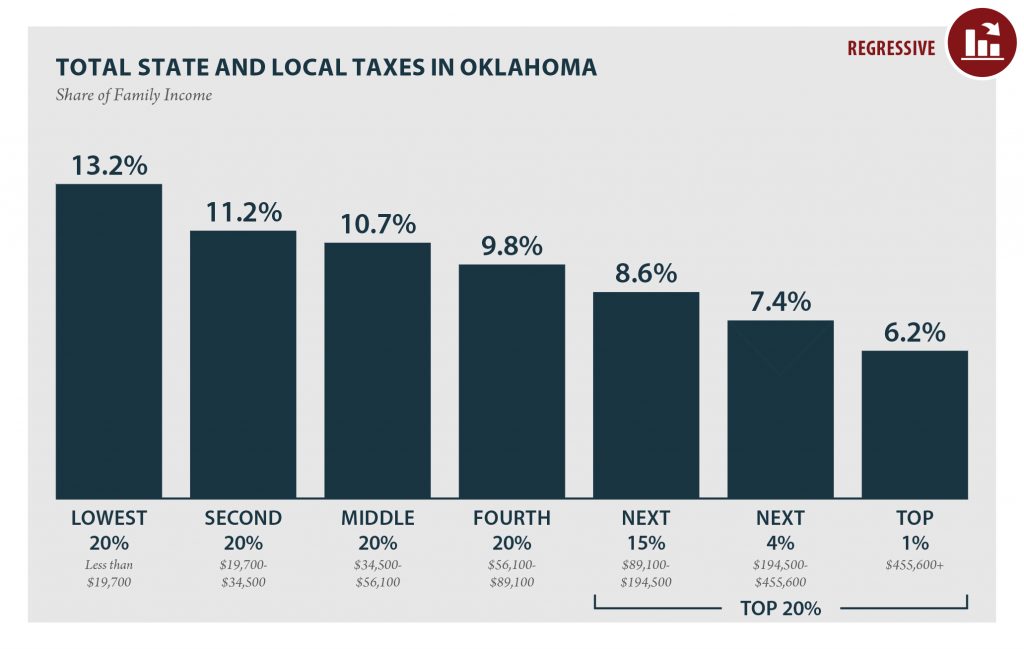

Oklahoma: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, which measures the impact of each state’s tax system on income inequality, Oklahoma has the 9th most unfair state and local tax system in the country. Incomes are more unequal in Oklahoma after state and local taxes are collected than before.

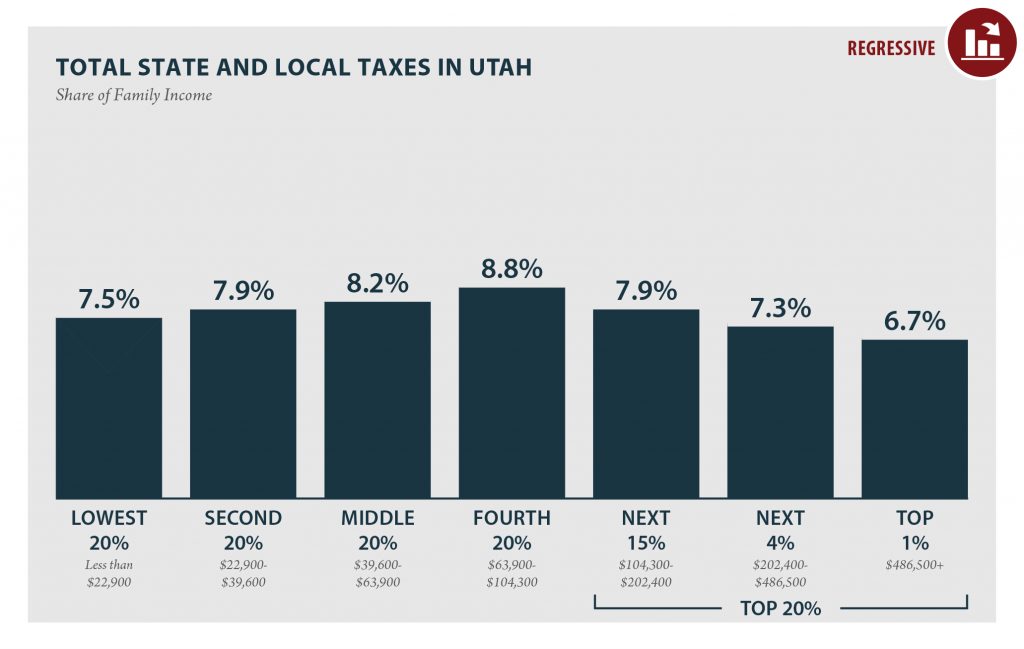

Utah: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

UTAH Read as PDF UTAH STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $22,900 $22,900 to $39,600 $39,600 to $63,900 $63,900 to $104,300 $104,300 to $202,400 $202,400 to $486,500 over $486,500 […]

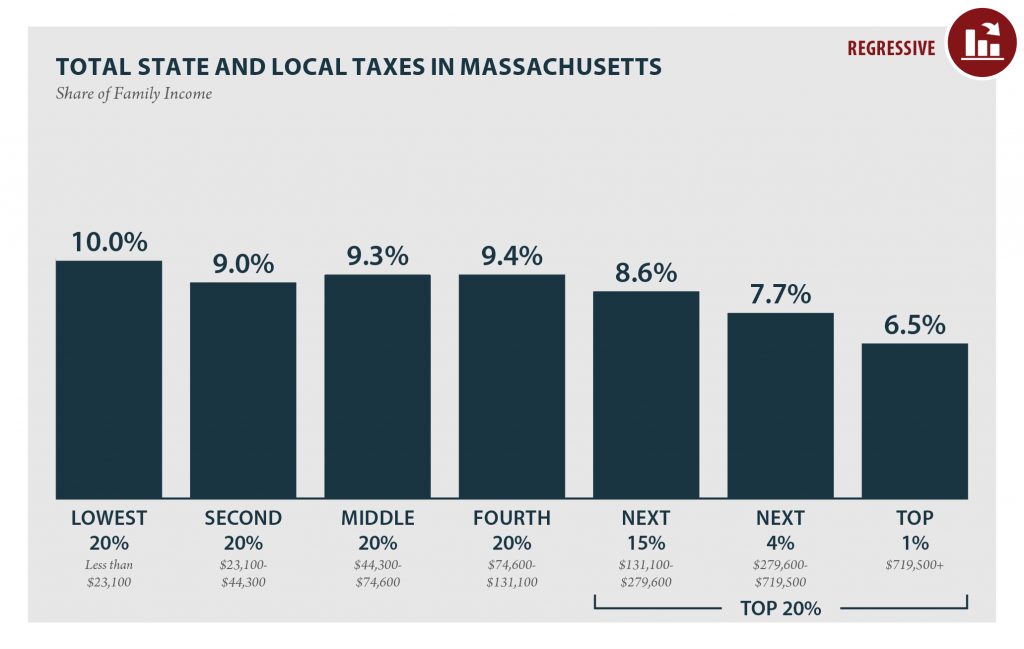

Massachusetts: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

MASSACHUSETTS Read as PDF MASSACHUSETTS STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $23,100 $23,100 to $44,300 $44,300 to $74,600 $74,600 to $131,100 $131,100 to $279,600 $279,600 to $719,500 over $719,500 […]

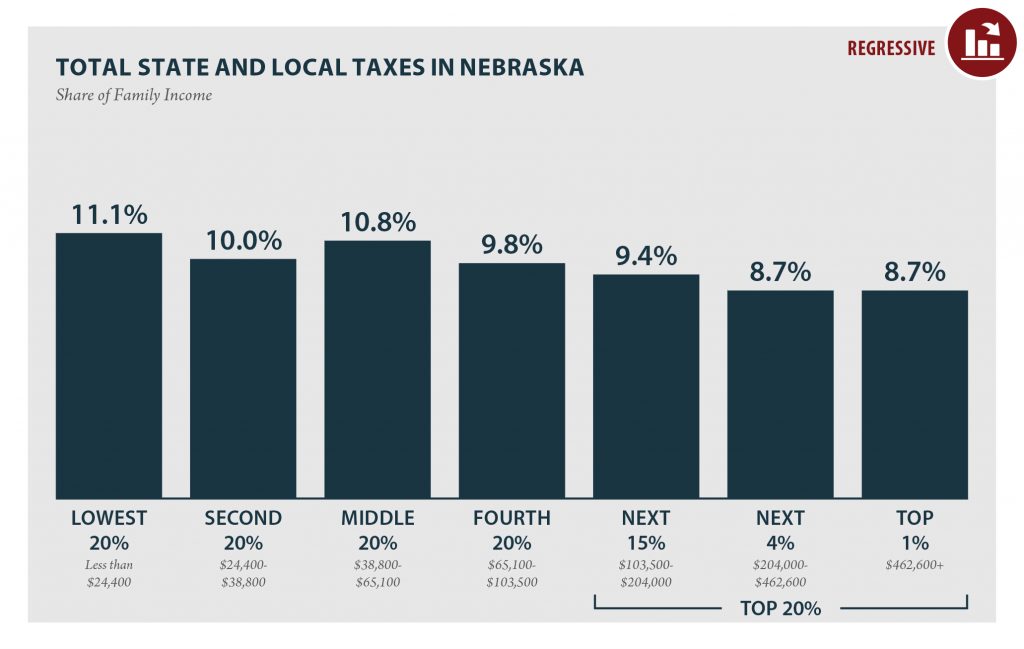

Nebraska: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

NEBRASKA Read as PDF NEBRASKA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $24,400 $24,400 to $38,800 $38,800 to $65,100 $65,100 to $103,500 $103,500 to $204,000 $204,000 to $462,600 over $462,600 […]

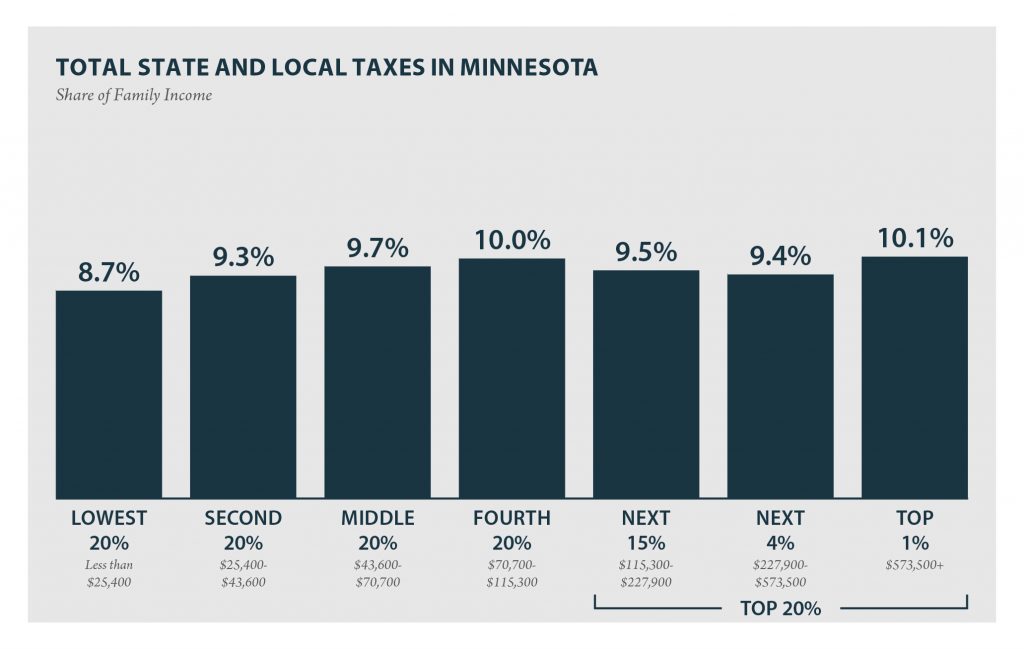

Minnesota: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

MINNESOTA Read as PDF MINNESOTA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $25,400 $25,400 to $43,600 $43,600 to $70,700 $70,700 to $115,300 $115,300 to $227,900 $227,900 to $573,500 over $573,500 […]

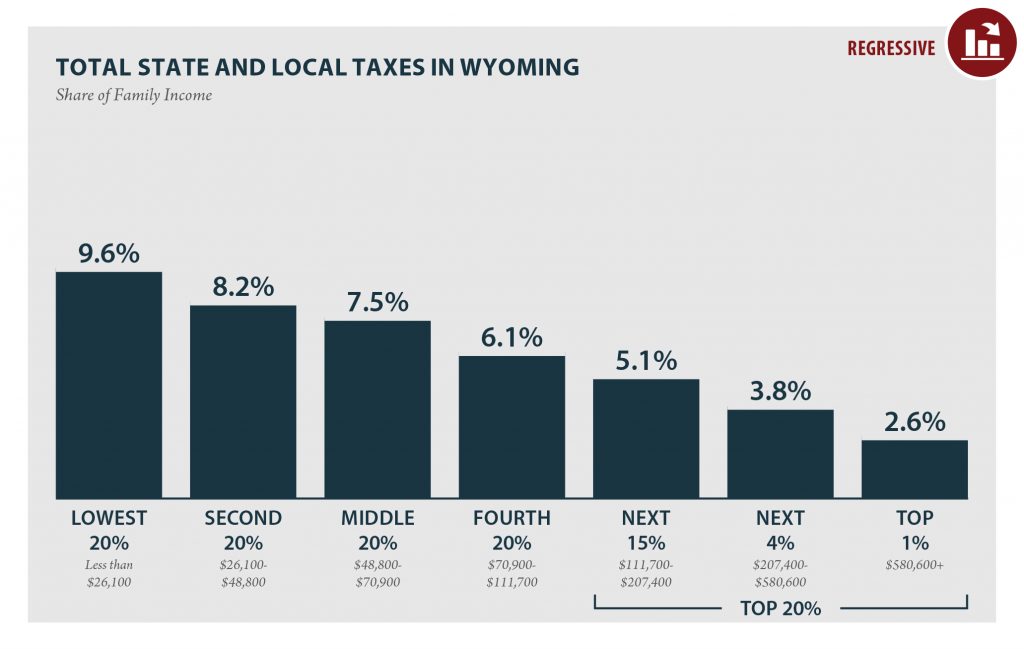

Wyoming: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

WYOMING Read as PDF WYOMING STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $26,100 $26,100 to $48,800 $48,800 to $70,900 $70,900 to $111,700 $111,700 to $207,400 $207,400 to $580,600 over $580,600 […]

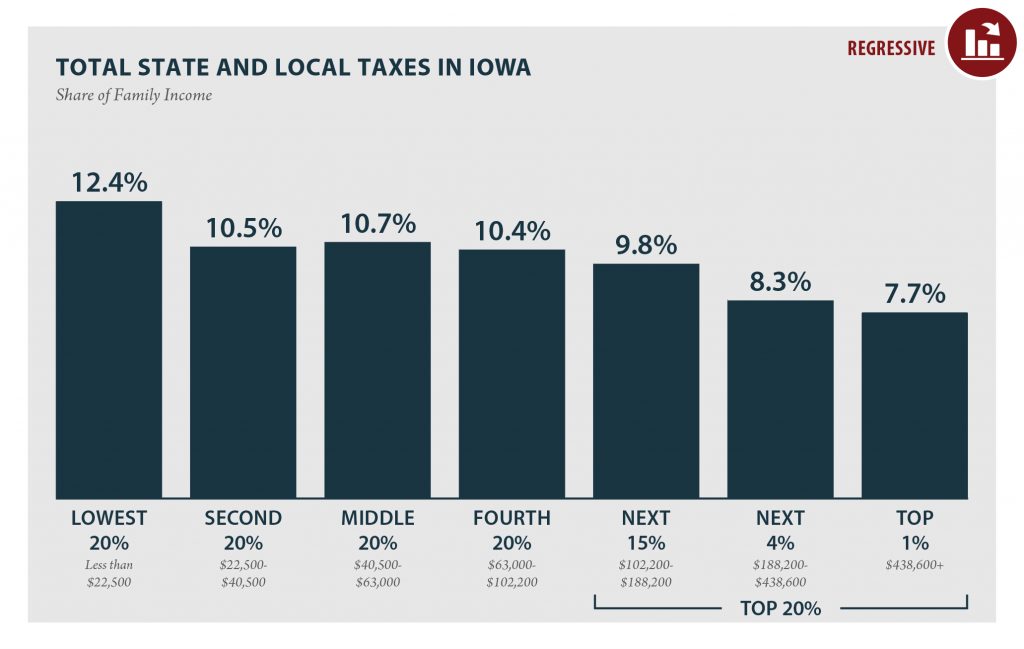

Iowa: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

IOWA Read as PDF IOWA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $22,500 $22,500 to $40,500 $40,500 to $63,000 $63,000 to $102,200 $102,200 to $188,200 $188,200 to $438,600 over $438,600 […]