State lawmakers continue to make groundbreaking progress on state tax credits, with 17 states creating or enhancing Child Tax Credits or Earned Income Tax Credits so far this year. These policies have the potential to boost family economic security and dramatically reduce the number of children living below the poverty line, as seen during the temporary boost to the federal credits in 2021. As Congress continues to debate the future of the federal Child Tax Credit, states are choosing to invest – sometimes in a rare demonstration of bipartisanship – in their people by creating and expanding refundable tax credits.

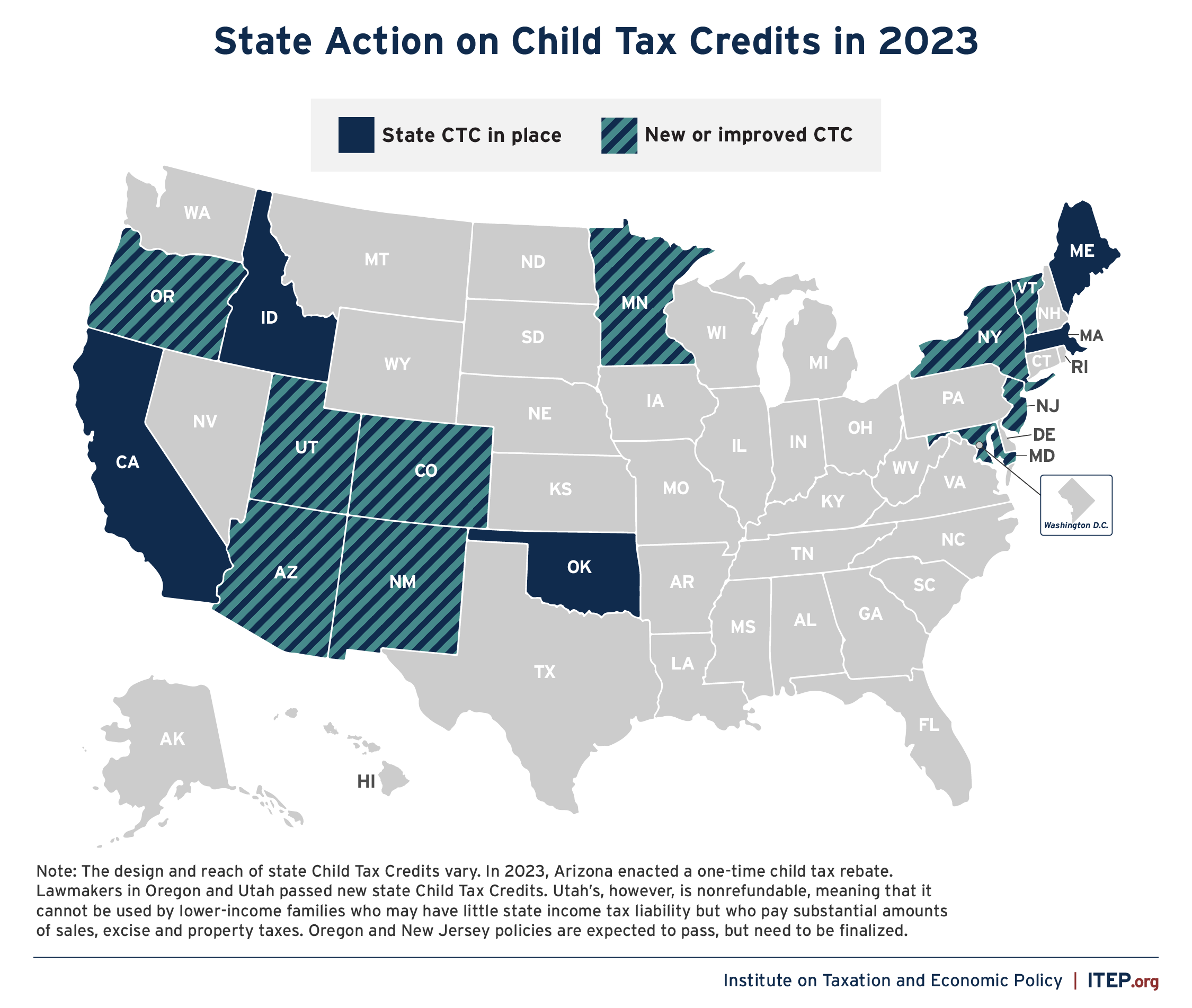

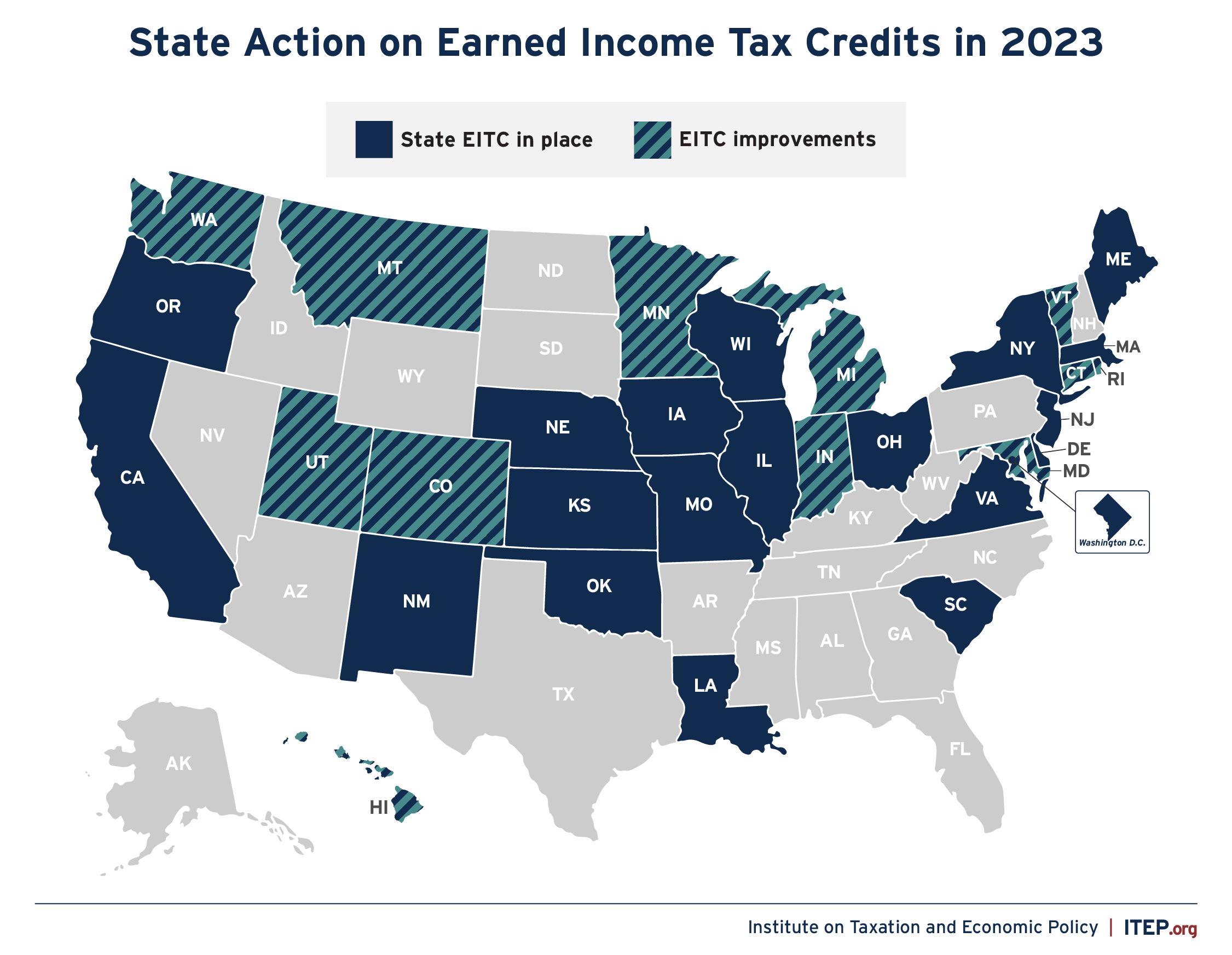

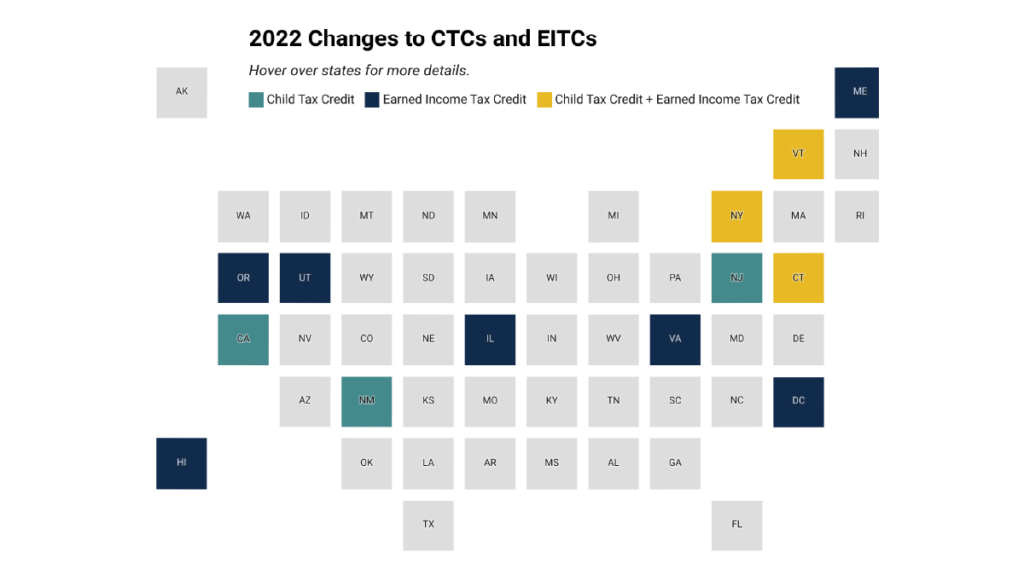

Ten states have created or expanded Child Tax Credits and 12 states have enhanced Earned Income Tax Credits in 2023. Most of these are fully refundable, meaning the lowest income families will receive the full credit regardless of how much they owe in state income tax. These credits, particularly those with full refundability, will help families make ends meet while injecting more dollars into underserved communities and local economies.

Efforts to build on these credits are ongoing: Maine and Massachusetts continue to discuss enhancements to their Child Tax Credits as they hammer out their final budgets.

Many states that passed temporary credit expansions during the COVID-19 pandemic came back to the table to make permanent improvements in 2023. Connecticut permanently increased its EITC from 30.5 to 40 percent this year after enacting a temporary bump to 41.5 percent in 2022. New York expanded its Empire State Child Credit to children under four after temporary boosts in 2022. And Maryland made permanent its temporary EITC boost from 2020, which made the credit fully refundable and increased the credit from 28 to 35 percent, instead of letting it expire.

The credits being passed are also larger than ever. Prior to 2023, the maximum state Child Tax Credit, available only to qualifying families with young children in Vermont, was $1,000 per child. Four states met or exceeded that amount this year, with Oregon creating a $1,000 credit per child under six, New Jersey doubling its maximum credit to $1,000 per child under six, Colorado increasing its maximum credit to $1,200 per child under six and Minnesota creating a credit of $1,750 per child under 17.

Immigrant families and others who file taxes with Individual Tax Identification Numbers (ITIN) are too often left behind by key state and federal policies. But several states made moves this year to ensure that access to a Social Security number was not a barrier to receiving these credits. In Vermont and Minnesota, eligible families who file taxes with an ITIN will now receive state EITCs and CTCs. Colorado and Oregon, which already allowed ITIN filers to claim their state EITCs, extended their CTCs to include these families as well. ITIN filers were also included in the Maryland EITC expansion.

States also made progress on tax credits that make housing more affordable. Minnesota expanded its Renter’s Property Tax Refund Program and made administrative changes to boost take-up rates. North Dakota increased property tax credits for senior homeowners and renters. Maine is considering boosting its Property Tax Fairness Credit and deferment program and Massachusetts is proposing increases to its senior circuit breaker credit as lawmakers finalize their budgets.

Too many families in every state are forced to live on the margins due to unlivable minimum wages, astronomical childcare expenses, skyrocketing housing costs, and other policy failures. Boosting the incomes of these families through the tax code pays enormous dividends. Families and workers who receive refundable credits such as the CTC and EITC have better health outcomes, particularly in areas of maternal and infant health. Their children do better in school and are more likely to seek postsecondary education. And families report less stress as they struggle less to make ends meet. The income boost that refundable credits provide is spent at local grocery stores and mechanic shops and on utility bills and other necessities, supporting local jobs in the process.

The states that prioritized refundable credits, particularly the ones that did so while rejecting expensive tax cuts for the wealthy altogether, are following recommendations from decades of research that show refundable tax credits make our communities stronger. These credits are proven to make state tax systems more equitable while reducing poverty and unnecessary hardship. State lawmakers should continue to build on the momentum behind refundable credits.