Much like every day is Mother’s Day or Father’s Day, when you’re a tax institute, every day is truly Tax Day. But for the rest of America, with Tax Day landing in the middle of May this year, it feels more like the last day of school providing one last opportunity to get yearbooks signed, celebrate school pride, and make plans for the summer vacation on the other side. So, as we close the books on another tax season, we thought it appropriate to provide some A+ summer reading from the ITEP archives for your upcoming road trips.

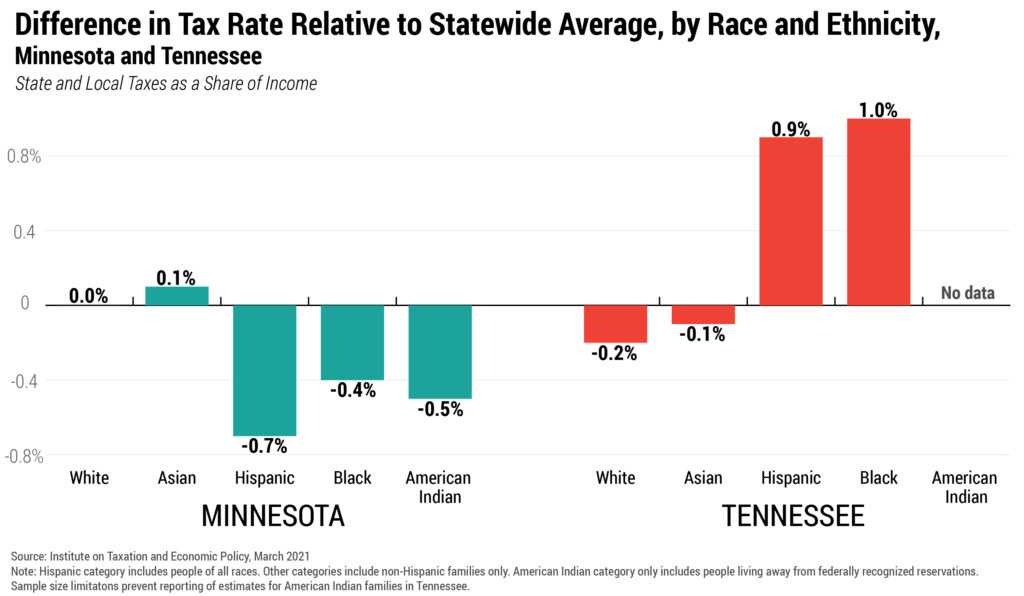

With a number of school districts and states moving to ban the inclusion of critical race theory in their curricula, this chart may soon go the way of The Color Purple and To Kill a Mockingbird. In A New Look at Taxes and Race at the State and Local Levels, comparing the effects of Tennessee’s tax code to that of Minnesota’s provides a stark contrast that reveals how tax policy is not race-neutral.

This tale of two states is not isolated to Minnesota and Tennessee, however. The video illustration below of New Jersey and Texas, which have similar levels of income inequality before taxes, is a gold star example of how policymakers’ decisions affect the economic wellbeing of their constituents and can exacerbate inequality.

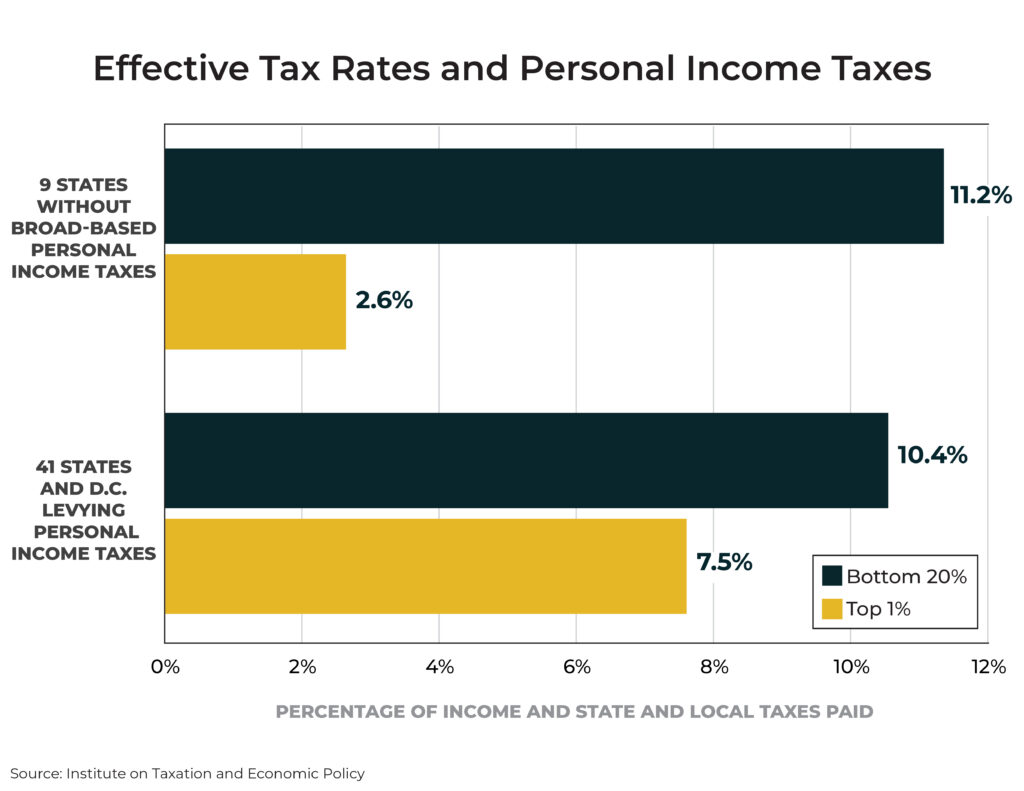

The experiment that is the United States is essentially one big group project, and sadly in many states, there are some who contribute relatively little to the project and expect the same grades as everyone else. In sharp contrast to the myth that lower-income families don’t pay taxes, it turns out that the rich are the most likely to get by paying very little in state and local taxes. In the nine states without broad-based personal income taxes, the richest 1 percent pay a dramatically lower effective tax rate as a percentage of income than the poorest 20 percent.

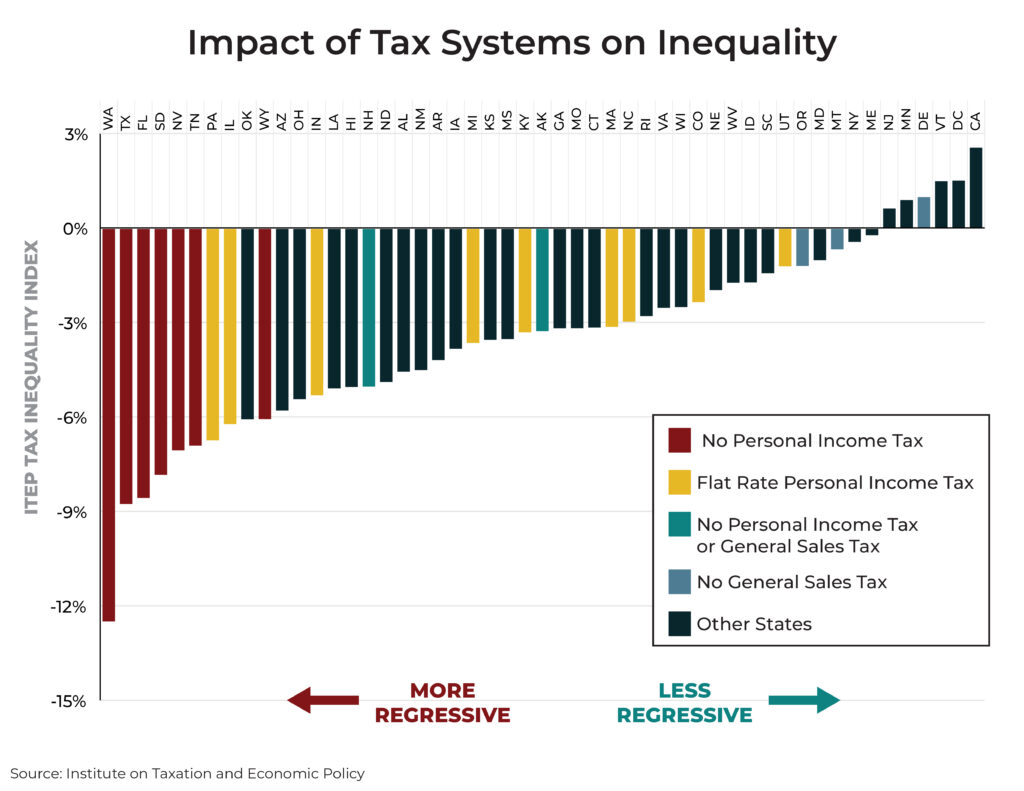

When looking at the 45 states with regressive tax codes that worsen income inequality after taxes, the worst offenders are those with a flat rate personal income tax or no personal income tax at all. This is textbook misguided tax policy that holds back residents by failing to raise the necessary revenue to support government services at the state and local level.

While the past school year has been lamented as a year of learning loss for students challenged by distance learning, several states have absorbed valuable lessons from the past that have been translated into bold progressive state tax victories.

One of the biggest lessons was that states with high top tax rates have been doing as well, if not better, than states without income taxes. But Mississippi and West Virginia must have been playing hooky that day as they continue to answer incorrectly on the question of trickle-down economics.

How can states like Mississippi and West Virginia make up for such poor results? Every struggling student’s favorite two words—extra credit. These two words are also a gamechanger for those struggling to make ends meet, and Earned Income Tax Credit enhancements can make a significant difference at the state level. But as states offer these extra credit opportunities as part of a more comprehensive approach moving toward a more equitable tax system, it is important that the policies are inclusive of all taxpayers, including the undocumented.

Now that you have your summer reading assignments, you are free to go enjoy your summer. But before you do, take just one more minute on this Tax Day to reflect on all that you survived, accomplished, and contributed to the collective good this past year, and be proud. There is always more work to be done to build the communities we desire, and paying your share is what allows that work to continue.