Arizona

State Rundown 5/27: State Legislatures Step Back, Advocates Push Forward

May 27, 2021 • By ITEP Staff

As more and more state legislatures wrap up their sessions and we reflect on the whirlwind that is this past year, it’s easy to focus on the steps back that states like Oklahoma have taken and Nebraska, North Carolina, and Arizona are trying to take. We have had some significant wins in states over the course of the year, but not every development will be a good one. However, we know advocates are on the ground, working tirelessly to help states maintain equity and progressivity in their tax codes. And for that, we have many of you—our intrepid readers of…

The Arizona Center for Economic Progress: Flat Tax Exacerbates Inequalities for Households of Color

May 26, 2021

Arizona’s elected leaders have created a tax code that is upside down and regressive– meaning that those with low incomes pay a much higher share of their income in taxes compared to Arizona’s highest income earners. Our state’s tax code is both a product of and perpetrator of stark racial inequities. The cumulation of Arizona’s […]

Phoenix Business Journal: Arizona flat tax proponents point to survey showing residents’ support

May 22, 2021

The Republic also reported that an Institute on Taxation and Economic Policy analysis found that 20% of Arizona taxpayers would get 91% of the reductions. The report said the switch would cut state revenues by $1.5 billion per year. The plan has drawn opposition from cities in the state. They say the reduced revenue will […]

“Tax Day” was earlier this week but the debates, research, and advocacy that determine our taxes and how they are used take place every day of the year...

AZ Central: Flat tax plan could decimate Arizona revenue, benefit a few. Don’t buy it

May 17, 2021

This is not a tax plan that will benefit most Arizonans. According to an analysis of the plan by the Institute on Taxation and Economic Policy, 53% of the tax cuts would go to the wealthiest 1% of taxpayers, while the bottom 80% would receive only 8% of the tax cuts. Read more

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

Attacks on Voting Rights, Secret Tax-Cut Negotiations in Arizona Reflect Broader Trend to Undermine Democracy

May 13, 2021 • By Carl Davis, ITEP Staff, Jenice Robinson

The onslaught of news about multiple states introducing or passing legislation to make it harder to vote is a clear signal that our democracy is in crisis. Decades of policymaking and judicial rulings have created a system in which the voices of the wealthy and powerful have more weight, and some lawmakers are determined to further rig the system and keep it that way.

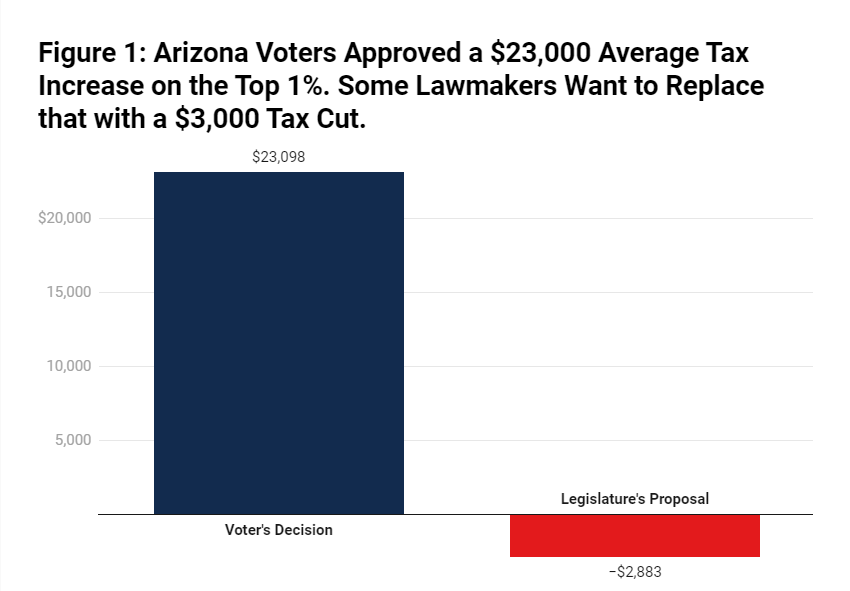

Arizonans Voted to Tax the Rich. Now Lawmakers Want to Undo Most of That.

May 12, 2021 • By Carl Davis

In 2018, Arizona teachers took part in a national wave of teacher walkouts, protesting inadequate education funding and some of the lowest teacher pay in the nation—direct results of the state’s penchant for deep tax cuts and its decision to levy some of the lowest tax rates in the country on high-income families.

North Carolina lawmakers may have approved a massive tax subsidy giveaway to Apple, but we won’t let that news spoil our barrel this week. Nor will we be discouraged by Connecticut Gov. Ned Lamont’s threats to upset the apple cart full of positive progressive tax reforms state lawmakers recently came together to approve...Why all the optimism? Because the apple of our eye this week is Washington State, where advocates and lawmakers succeeded in a decade-long fight...

Arizona Center for Economic Progress: The flat tax falls flat for most Arizonans

April 28, 2021

The Arizona legislature is poised to permanently cut over a billion dollars in state revenues, the largest tax cut in the last three decades. This cut will make Arizona’s tax system more regressive than it is today with 91 percent of the tax cuts going to people in the top 20 percent of incomes. Read […]

Bold Progressive State Tax Victories Provide Bright Spots in Difficult Year

April 27, 2021 • By Dylan Grundman O'Neill

“Bold progressive victories” is probably not the first phrase that comes to mind when thinking about state laws enacted so far in 2021...But progressive advocates, lawmakers, and voters have won some tremendous victories in states recently...We should celebrate them for the achievements they are—and closely study them for lessons they can teach about how to bring about positive progressive change in these and other states.

Just as a recent cold snap reminded us that spring has not fully sprung yet, this week’s news has been full of reminders that state fiscal debates aren’t quite finished either...

State Rundown 4/14: More Progressive Wins in the Headlines this Week, but Mind the Fine Print

April 14, 2021 • By ITEP Staff

Two significant victories headlined state tax debates in the past week, as New Mexico leaders improved existing targeted tax credits to give bigger boosts and reach more families in need, and West Virginia lawmakers unanimously shut down a destructive effort to eliminate the state’s progressive income tax. These developments follow last week’s major wins for progressive taxation and targeted assistance in New York, and more good news is likely soon as Washington legislators continue to advance their own targeted credit for working families. Not all the news is positive though, as costly and/or regressive tax cuts remain on the table…

Arizona Center for Economic Progress: Arizona’s regressive tax policy contributes significantly to economic and racial injustice

April 13, 2021

Tax policy plays a role in the fight for economic and racial justice. The type of tax and how it is structured matters. A new report issued by the Institute for Taxation and Economic Policy (ITEP), Taxes and Racial Equity , explains how historical and contemporary policy choices have resulted in tax codes that maintain […]

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

The Street: New York Inches Closer to Legalizing Recreational Cannabis

March 24, 2021

Last November, voters in New Jersey and Arizona voted to legalize marijuana. And in December, New Jersey placed a social equity excise tax on cannabis sales in order to address the disparate effect of anti-marijuana laws on communities of color. About one in three Americans live in a state with legal sales of recreational cannabis, […]

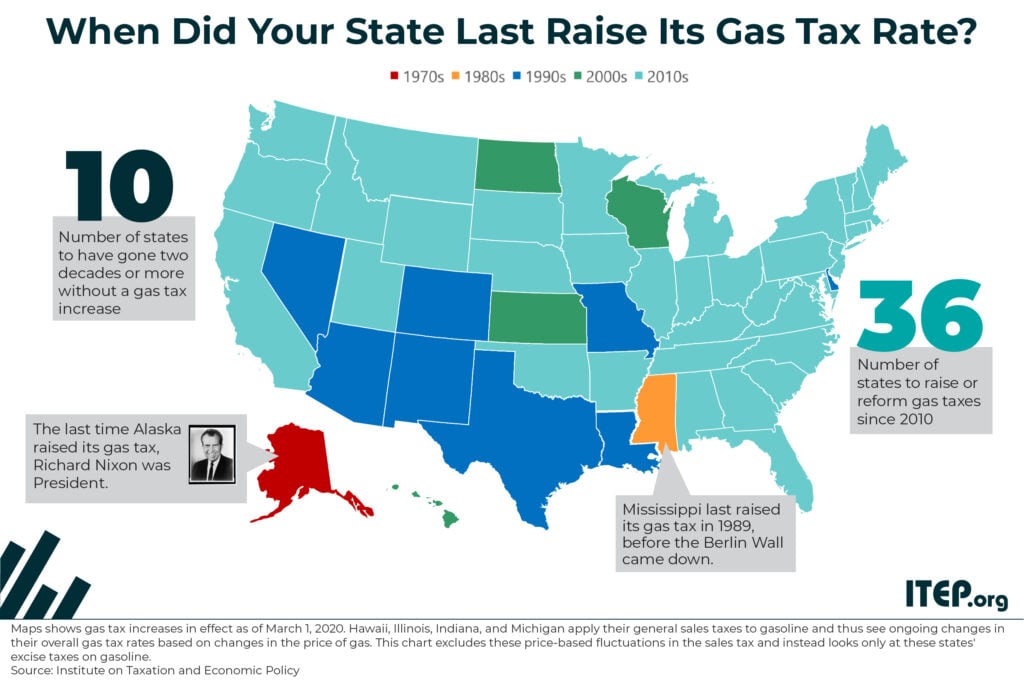

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

Alaska lawmakers are facing an unprecedented fiscal crisis. The state is more dependent than any other on oil tax and royalty revenues but declines in oil prices and production levels have sapped much of the vitality of these revenue sources. One way of diversifying the state’s revenue stream and narrowing the yawning gap between state revenues and expenses would be to reinstitute a statewide personal income tax. Alaska previously levied such a tax until 1980. This report contains ITEP’s analysis of the distributional impact and revenue potential of a variety of flat-rate income tax options for Alaska, based on draft…

State Rundown 2/11: Legalizing and Taxing Cannabis Becoming Increasingly Mainstream

February 11, 2021 • By ITEP Staff

This week, the governors of New Hampshire and West Virginia proposed to eliminate their states’ most progressive revenue sources and shift taxes even more heavily onto the middle- and low-income families who already pay the highest rates in both states. It was also a big week for proponents of legalizing recreational cannabis, as that movement made progress in Hawaii, Virginia, and Wisconsin.

State Rundown 2/4: Some Lawmakers, Governors Rising to Occasion with Progressive Tax Proposals

February 4, 2021 • By ITEP Staff

States face shifting landscapes as they attempt to deal with both emergent and longstanding issues in their tax codes and budget structures. This is particularly evident in Oklahoma, where lawmakers must adjust to a U.S. Supreme Court decision that literally redraws state boundaries by recognizing the rights of indigenous communities, but is true in every state, and lawmakers in many of them are rising to the challenge. Read below and see our blog posted today for more on bold proposals that increase tax fairness and solidify bottom lines with needed revenue in states including Connecticut, Minnesota, New York, Pennsylvania, Vermont,…

States Are Finally Going Bold with Progressive Tax Efforts

February 4, 2021 • By Dylan Grundman O'Neill

Advocates, lawmakers, study commissions, and even governors in some states are proposing bold tax policy reforms that look beyond pandemic-induced budget shortfalls and the “K-shaped recovery” to address underlying inequities and underfunding that gave rise to them. These efforts include proposals to: end or reverse regressive tax policies like the preferential treatment of income derived from wealth over income earned through work; restore or strengthen estate and inheritance taxes to slow the concentration of wealth in ever-fewer hands; raise revenue and slow inequality with progressive income taxes; and many other ideas to right upside-down tax codes while raising the revenue…

State Rundown 1/28: EITC Efforts a Welcome Contrast to State Tax Tug-of-War

January 28, 2021 • By ITEP Staff

Efforts to deliver and improve targeted tax credits to support low- and middle-income families proved to be unifying in Washington and Oregon, welcome developments in an otherwise divisive week in state tax debates. For example, Mississippi advocates hoping to end the state’s regressive grocery tax are up against a governor and many lawmakers pulling in the opposite direction by trying to eliminate its income tax. After Arizona residents approved an income tax increase to improve education funding, policymakers there are seeking to reverse course by slashing taxes instead. And North Dakota lawmakers are considering converting their graduated income tax into…

State Rundown 1/22: Somewhere Between a Flurry and a Blizzard of State Tax Activity So Far

January 22, 2021 • By ITEP Staff

You won’t find any images of Bernie Sanders and his mittens photoshopped into this week’s Rundown, but you will find the latest news on state fiscal debates, including proposals to generate needed funding by raising taxes on high-income households and profiting businesses in California, Delaware, Hawaii, Maryland, and Washington, as well as misguided efforts to slash taxes in Arizona, Iowa, South Carolina, Utah, and West Virginia. Also in the news are thoughtful improvements to targeted tax credits for families in need in Connecticut and Maryland, harmful obstacles to revenue generation proposed in Nebraska and Wyoming, and renewed hope on the…

As states kick off their 2021 legislative sessions, it’s clear that many governors and lawmakers are attempting to “take a mulligan” on the last year and recycle tax-slashing ideas that were already bad in 2020 and are even worse now as states try to recover from the Covid-19 pandemic and accompanying downturn...On a brighter note, Illinois leaders showed they did learn from the events of 2020, passing a major criminal justice reform bill and payday loan protections intended to reduce racial inequities.