California

It doesn’t matter if someone with a family income of $800,000 per year thinks they aren’t rich because they can’t quit their jobs and retire to a luxury home on the beach in Malibu. They can call themselves what they want. The point is that they are richer than 99 percent of the population and can afford to pay more.

The IRS Direct File pilot is currently open to eligible taxpayers here. Millions of American families have now received their W-2s for 2023, signaling the start to a new tax filing season. The IRS has set January 29 as the first date that people can file their tax returns for the previous year, and the […]

State Rundown 1/26: Wealth Taxes Drawing Interest Early in Legislative Sessions

January 26, 2024 • By ITEP Staff

Bills are moving and state legislative sessions are picking up across the country, giving elected officials the opportunity to consider two distinct paths when it comes to tax policy...

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

The findings of Who Pays? go a long way toward explaining why so many states are failing to raise the amount of revenue needed to provide full and robust support for our public schools.

Worthwhile Ideas for a Stronger and Fairer D.C. Tax Code

January 17, 2024 • By Andrew Boardman, Kamolika Das, Marco Guzman

The nation’s capital has a once-in-a-decade opportunity to advance a stronger and fairer local tax code. New draft recommendations from a key advisory panel will help leaders make the most of the moment.

State Rundown 1/11: Sounding the Alarm on Regressive State & Local Tax Codes

January 11, 2024 • By ITEP Staff

States got a wake-up call this week as ITEP released the latest edition of our flagship Who Pays? report...

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. Yet a few states have made strides to buck that trend and have tax codes that are somewhat progressive and therefore do not worsen inequality.

Tax Systems in 44 States Exacerbate Inequality, In-Depth ‘Who Pays?’ Study Finds

January 9, 2024 • By ITEP Staff

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. That’s according to the latest edition of the Institute on Taxation and Economic Policy’s Who Pays?, the only distributional analysis of tax systems in all 50 states and the District of Columbia.

California: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

California Download PDF All figures and charts show 2024 tax law in California, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.2 percent) state and local tax revenue collected in California. State and local tax shares of family income Top 20% Income Group […]

Even as revenue collections slow in many states, some are starting the push for 2024 tax cuts early. For instance, policymakers in Georgia and Utah are already making the case for deeper income tax cuts. Meanwhile, Arizona lawmakers are now facing a significant deficit, the consequence of their recent top-heavy tax cuts. There is another […]

The Reach of the Ever-Shrinking Estate Tax is at a Historic Low

December 7, 2023 • By ITEP Staff

Contact: Jon Whiten ([email protected]) Last month when the IRS announced the inflation-adjusted 2024 tax brackets, it also adjusted the basic exemption to the federal estate tax. Next year, an individual can leave behind an estate of $13.61 million without triggering the tax (for a married couple, that doubles to $27.22 million). Clearly, the estate tax […]

The Estate Tax is Irrelevant to More Than 99 Percent of Americans

December 7, 2023 • By Steve Wamhoff

The federal estate tax has reached historic lows. In 2019, only 8 of every 10,000 people who died left an estate large enough to trigger the tax. Legislative changes under presidents of both parties have increased the basic exemption from the estate tax over the past 20 years. This has cut the share of adults leaving behind taxable estates down from more than 2 percent to well under 1 percent.

South Florida Sun Sentinel: Editorial: America’s Deep Divide on Display in So-Called Debate

December 3, 2023

The staged TV confrontation on Fox News Thursday between Gov. Ron DeSantis and his California counterpart, Gavin Newsom, didn’t live up to the hype. You knew it wouldn’t. Read more.

TIME: Who Really Won in the DeSantis-Newsom Debate

December 3, 2023

If hurling insults, distorting facts, and pandering to Americans’ worst instincts are the hallmarks of leadership, then Florida Gov. Ron DeSantis emerged the winner in the debate with California Gov. Gavin Newsom. Read more.

Though Turkey Day has passed, lawmakers in states across the U.S. have yet to get their fill of delicious tax policy goodness...

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

State Rundown 11/8: Election Results Bring Victories, Opportunities for More Common-Sense Tax Reform

November 8, 2023 • By ITEP Staff

Voters had the chance to impact tax policy across the country on election day, and some chose to enact common-sense reforms to raise revenue...

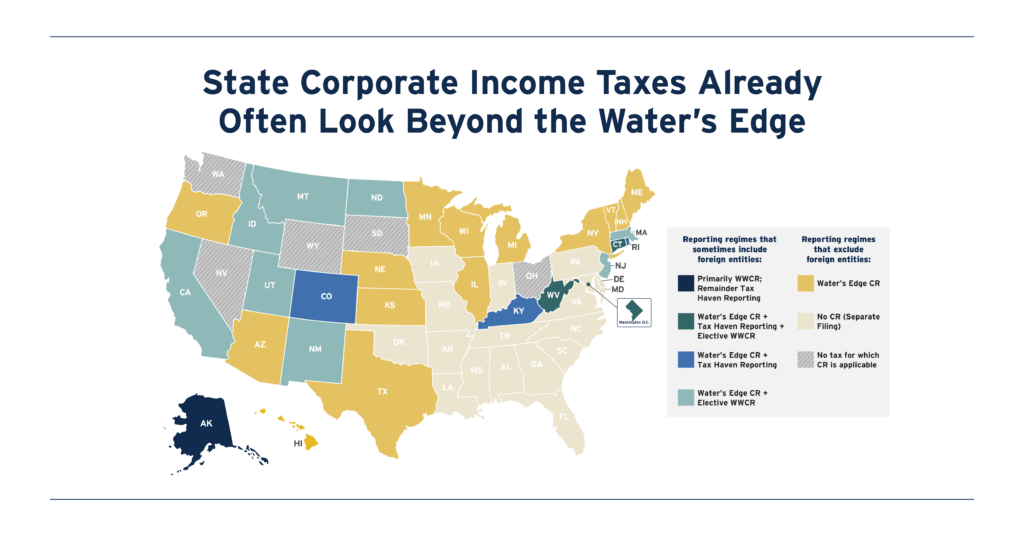

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

Free Tax Filing Option from the IRS Would Benefit People of Color, Contrary to Corporate Warnings

October 30, 2023 • By Brakeyshia Samms

There's a patchwork of programs and preparers for people of color to turn to when filing taxes, and most come from corporations that profit from providing a service that the government could provide more effectively and efficiently for free. The Direct File program can change that and is a great step forward in the IRS’ work addressing racism in the tax code.

Local Earned Income Tax Credits: How Localities Are Boosting Economic Security and Advancing Equity with EITCs

October 30, 2023 • By Andrew Boardman, Galen Hendricks, Kamolika Das

Leading localities are using refundable EITCs to boost incomes and reduce taxes for workers and families with low and moderate incomes. These local credits build on the success of EITCs at the federal and state levels, reduce economic hardship and improve the fairness of the tax code.

State Rundown 10/26: Off-Year Ballot Measures and State & Local Tax Policy

October 26, 2023 • By ITEP Staff

November elections are creeping closer and closer and while that typically means a new batch of lawmakers are elected, it also means voters have another chance to help shape state and local tax policy...

State Rundown 10/12: Tax Policy Debates Don’t Just Happen in the Statehouse

October 12, 2023 • By ITEP Staff

It may be the off-season for state legislatures, but tax policy changes could soon emerge from the ballot box or the courts. Advocates in Arkansas want voters to decide the future of taxing diapers and feminine hygiene products, and supporters of public education in Nebraska are working to make sure voters have a say on the state’s school choice tax credit. Meanwhile, cannabis firms in Missouri are suing the state over cities and counties stacking sales tax on marijuana.

Kyrsten Sinema’s Latest Fight to Protect Tax Breaks for Private Equity

September 15, 2023 • By Steve Wamhoff

Sen. Sinema's bill to stop a seemingly arcane business tax increase that was enacted as part of the 2017 Trump tax law would be hugely beneficial to the private equity industry.

The U.S. Census Bureau released its annual assessment of poverty in America this week...