Florida

As many of you may know, we love taxes, along with the many great things they provide for our communities...

State Rundown 1/26: Wealth Taxes Drawing Interest Early in Legislative Sessions

January 26, 2024 • By ITEP Staff

Bills are moving and state legislative sessions are picking up across the country, giving elected officials the opportunity to consider two distinct paths when it comes to tax policy...

Editorial: Florida Shines at Favoring the Rich, Punishing the Poor

January 23, 2024

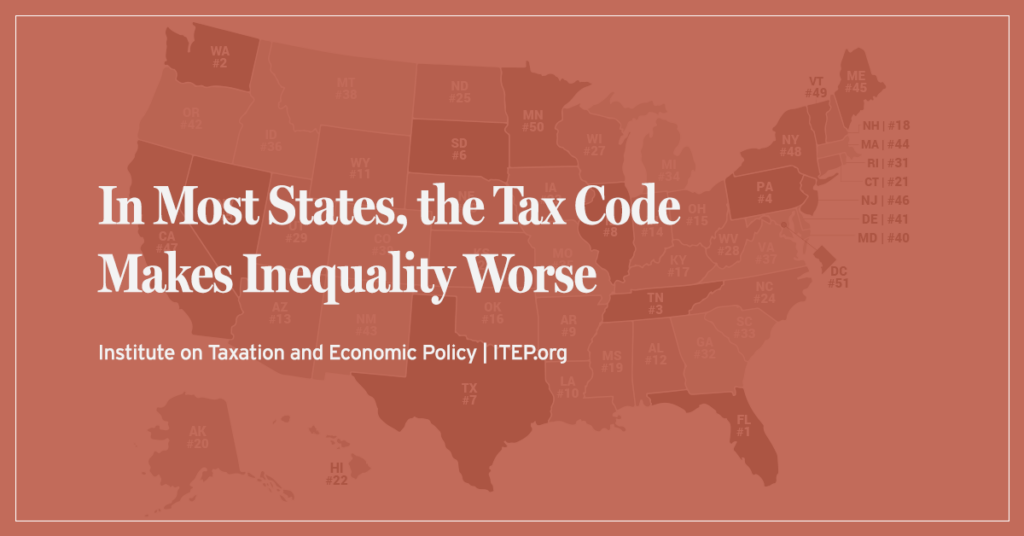

But there’s one category in which Florida is unarguably first — first of the worst. The state has the nation’s most regressive state and local tax structure. That’s the judgment of ITEP, the progressive Institute on Taxation and Economic Policy, which ranks states every five years

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

The findings of Who Pays? go a long way toward explaining why so many states are failing to raise the amount of revenue needed to provide full and robust support for our public schools.

MarketWatch: Moving to Florida Might Not Be the Tax Play It’s Cracked Up to Be — Unless You’re Loaded

January 12, 2024

Florida, Texas and Tennessee have become hot real-estate markets in recent years, in part because they offer the allure of low taxes and cheap living costs. But a new analysis of how much state and local taxes cost rich and poor residents in those states throws cold water on the assumption that moving to states like Florida […]

Newsweek: Florida’s Tax System Most Unfair on Poor in US, Study Shows

January 10, 2024

The Florida tax system is the most unfair on the poor in the entire country, according to a new study, with the lowest-income 20 percent in the state paying much more of their income in taxes than the wealthiest 1 percent. Read more.

Fast Company: Florida Can’t Get Enough of Tax Holidays. But They’re Not the Magic Bullet Ron DeSantis Claims

January 10, 2024

Floridians saved more than $475 million on tax-free holidays—but it comes at the expense of the state’s schools and infrastructure. Read more.

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. Yet a few states have made strides to buck that trend and have tax codes that are somewhat progressive and therefore do not worsen inequality.

Tax Systems in 44 States Exacerbate Inequality, In-Depth ‘Who Pays?’ Study Finds

January 9, 2024 • By ITEP Staff

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. That’s according to the latest edition of the Institute on Taxation and Economic Policy’s Who Pays?, the only distributional analysis of tax systems in all 50 states and the District of Columbia.

Florida: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Florida Download PDF All figures and charts show 2024 tax law in Florida, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.9 percent) state and local tax revenue collected in Florida. State and local tax shares of family income Top 20% Income Group […]

The Reach of the Ever-Shrinking Estate Tax is at a Historic Low

December 7, 2023 • By ITEP Staff

Contact: Jon Whiten ([email protected]) Last month when the IRS announced the inflation-adjusted 2024 tax brackets, it also adjusted the basic exemption to the federal estate tax. Next year, an individual can leave behind an estate of $13.61 million without triggering the tax (for a married couple, that doubles to $27.22 million). Clearly, the estate tax […]

The Estate Tax is Irrelevant to More Than 99 Percent of Americans

December 7, 2023 • By Steve Wamhoff

The federal estate tax has reached historic lows. In 2019, only 8 of every 10,000 people who died left an estate large enough to trigger the tax. Legislative changes under presidents of both parties have increased the basic exemption from the estate tax over the past 20 years. This has cut the share of adults leaving behind taxable estates down from more than 2 percent to well under 1 percent.

South Florida Sun Sentinel: Editorial: America’s Deep Divide on Display in So-Called Debate

December 3, 2023

The staged TV confrontation on Fox News Thursday between Gov. Ron DeSantis and his California counterpart, Gavin Newsom, didn’t live up to the hype. You knew it wouldn’t. Read more.

TIME: Who Really Won in the DeSantis-Newsom Debate

December 3, 2023

If hurling insults, distorting facts, and pandering to Americans’ worst instincts are the hallmarks of leadership, then Florida Gov. Ron DeSantis emerged the winner in the debate with California Gov. Gavin Newsom. Read more.

America Used to Have a Wealth Tax: The Forgotten History of the General Property Tax

November 2, 2023 • By Carl Davis, Eli Byerly-Duke

Over time, broad wealth taxes were whittled away to become the narrower property taxes we have today. These selective wealth taxes apply to the kinds of wealth that make up a large share of middle-class families’ net worth (like homes and cars), but usually exempt most of the net worth of the wealthy (like business equity, bonds, and pooled investment funds).The rationale for this pared-back approach to wealth taxation has grown weaker in recent decades as inequality has worsened, the share of wealth held outside of real estate has increased, and the tools needed to administer a broad wealth tax…

State Rundown 8/10: Pump the ‘Breaks’ on Sales Tax Holiday Celebrations

August 10, 2023 • By ITEP Staff

August is here, school is starting, and with that comes back to school shopping...

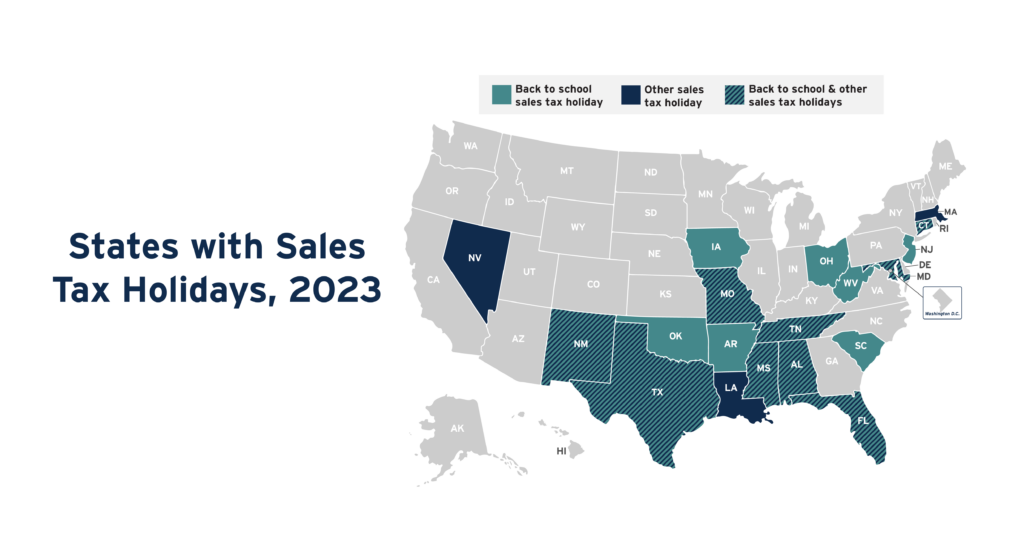

The number of states with sales tax holidays on the books fell to 19 in 2023 from 20 in 2022. Yet even as slightly fewer states have them, they are estimated to cost much more. In 2023, sales tax holidays will cost states and localities nearly $1.6 billion in lost revenue, up from an estimated $1 billion just a year ago.

New York Times: What’s the Matter With Miami?

August 4, 2023

For a couple of years after the pandemic struck, there was considerable buzz to the effect that much of the financial industry might leave New York for Miami. After all, state and local taxes on the richest one percent are much lower in Florida than in New York — about nine points lower as a percentage of income, according […]

Gimmicky Sales Tax Holidays to Cost States & Localities $1.6 Billion This Year

August 3, 2023 • By ITEP Staff

Sales tax holidays are bad policies that have too often been used as a substitute for more meaningful, permanent reform.

A Lot for A Little: Gimmicky Sales Tax Holidays Are an Ineffective Substitute for Real Sales Tax Reform

August 3, 2023 • By Marco Guzman

This year, 19 states will forgo a combined $1.6 billion in tax revenue on sales tax holidays—politically popular, yet ultimately ineffective gimmicks with minimal benefits and significant downsides.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 2, 2023 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2023, and these suspensions will cost nearly $1.6 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Overall, the benefits of sales tax holidays are minimal while their downsides are significant.

We can make modest reforms to better tax those who are taking a larger share of our wealth and income in order to reinforce a major pillar of our promise to Americans.

Illinois Voucher Tax Credits Don’t ‘Invest in Kids,’ They Invest in Inequality

June 12, 2023 • By Carl Davis

By allowing their school privatization tax credit to expire at the end of the year, Illinois lawmakers can take a meaningful step toward better tax and education policy, and a clear show of support for our nation’s public education system.

South Florida Sun Sentinel: Editorial: Short-Sighted Debt Deal Protects Tax Evaders

June 7, 2023

Not much in the debt ceiling extension deal will have lasting impact. But one significant aspect cuts $21 billion out of the $80 billion the IRS received in new money from Congress last year. Read more.