Maryland

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

Tax policy themes have begun to crop up in states as governors give their yearly addresses and legislators lay out their plans for the 2024 legislative season...

Maryland: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Maryland Download PDF All figures and charts show 2024 tax law in Maryland, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.2 percent) state and local tax revenue collected in Maryland. State and local tax shares of family income Top 20% Income Group […]

State Rundown 1/4: New Year, New Opportunities, Same Tax Cut Proposals

January 4, 2024 • By ITEP Staff

The year may be new, but state lawmakers seem to have the same old resolution: slashing state income taxes...

Even as revenue collections slow in many states, some are starting the push for 2024 tax cuts early. For instance, policymakers in Georgia and Utah are already making the case for deeper income tax cuts. Meanwhile, Arizona lawmakers are now facing a significant deficit, the consequence of their recent top-heavy tax cuts. There is another […]

The Estate Tax is Irrelevant to More Than 99 Percent of Americans

December 7, 2023 • By Steve Wamhoff

The federal estate tax has reached historic lows. In 2019, only 8 of every 10,000 people who died left an estate large enough to trigger the tax. Legislative changes under presidents of both parties have increased the basic exemption from the estate tax over the past 20 years. This has cut the share of adults leaving behind taxable estates down from more than 2 percent to well under 1 percent.

Hidden in Plain Sight: Race and Tax Policy in 2023 State Legislative Sessions

November 21, 2023 • By Brakeyshia Samms

Race was front and center in a lot of state policy debates this year, from battles over what’s being taught in schools to disagreements over new voting laws. Less visible, but also extremely important, were the racial implications of tax policy changes. What states accomplished this year – both good and bad – will acutely affect people and families of color.

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

State Rundown 11/8: Election Results Bring Victories, Opportunities for More Common-Sense Tax Reform

November 8, 2023 • By ITEP Staff

Voters had the chance to impact tax policy across the country on election day, and some chose to enact common-sense reforms to raise revenue...

New from ITEP: Three Localities Are Leading the Way on Local EITCs

October 30, 2023 • By ITEP Staff

Refundable local EITCs improve the economic security of workers, families, and children. These credits put dollars directly into the pockets of financially vulnerable households, helping them afford the basics and achieve better health and economic outcomes.

Three Localities are Boosting Communities with Refundable EITCs; Others Should Follow Suit

October 30, 2023 • By Kamolika Das

Most states already offer their own Earned Income Tax Credits, typically matching a certain percentage of residents’ federal EITC, but this is still a rarity among localities.

Local Earned Income Tax Credits: How Localities Are Boosting Economic Security and Advancing Equity with EITCs

October 30, 2023 • By Andrew Boardman, Galen Hendricks, Kamolika Das

Leading localities are using refundable EITCs to boost incomes and reduce taxes for workers and families with low and moderate incomes. These local credits build on the success of EITCs at the federal and state levels, reduce economic hardship and improve the fairness of the tax code.

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

States are Boosting Economic Security with Child Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Fourteen states now provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states created new Child Tax Credits while lawmakers in seven states expanded existing credits. To maximize impact, lawmakers should consider making their credits fully refundable, not including an earnings requirement, setting a maximum amount per child instead of per household, setting state-specific phase-out ranges that target low- and middle-income families, indexing to inflation, and offering the option of advanced payments.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

Gimmicky Sales Tax Holidays to Cost States & Localities $1.6 Billion This Year

August 3, 2023 • By ITEP Staff

Sales tax holidays are bad policies that have too often been used as a substitute for more meaningful, permanent reform.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 2, 2023 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2023, and these suspensions will cost nearly $1.6 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Overall, the benefits of sales tax holidays are minimal while their downsides are significant.

State lawmakers continue to make groundbreaking progress on state tax credits, with 17 states creating or enhancing Child Tax Credits or Earned Income Tax Credits so far this year. These policies have the potential to boost family economic security and dramatically reduce the number of children living below the poverty line.

This past week, in statehouses around the country, tax policy decisions are moving fast as budgets were signed and budget plans were released and passed...

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

State Rundown 5/10: Momentum on State Tax Credits Continues to Build

May 10, 2023 • By ITEP Staff

This week, in states across the country the momentum to center improvements to family economic security remains strong...

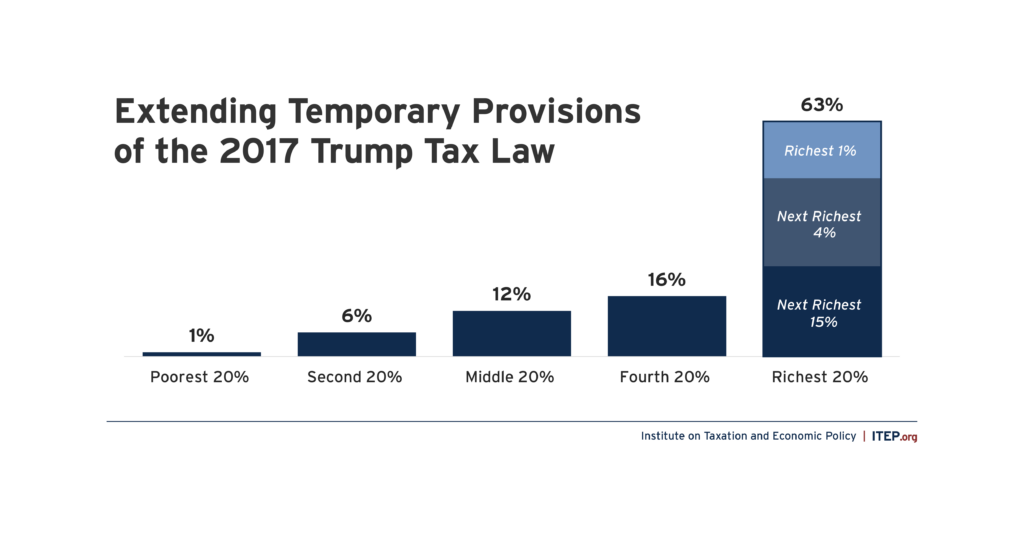

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

State Rundown 4/12: Tax Day 2023 – A Good Reminder of the Impact of Our Collective Investments

April 12, 2023 • By ITEP Staff

With Tax Day quickly approaching it’s worth taking some time to reflect not just on tax forms (though those are important!), but also on the current state of state tax policy...

From dedicating new taxes to fund climate action and public health to vacancy and “mansion” taxes, many local leaders are already exploring ways to make their tax systems more progressive and sustainable. ITEP is committed to helping local leaders and advocates build on this work by advancing knowledge about local tax solutions.

Contact: Jon Whiten ([email protected]) For decades, the Institute on Taxation and Economic Policy (ITEP) has played a role in shaping equitable and sustainable tax systems at the federal and state level. From the beginning, we have collaborated with advocates, policymakers, and others to advance policies that can foster expansive, inclusionary, and racially equitable tax systems. […]