Nebraska

State Rundown 1/31: Low-Income Families’ Taxes Getting Some Much-Needed Attention

January 31, 2018 • By ITEP Staff

This week was promising for advocates of Earned Income Tax Credits (EITCs) and other tax breaks for workers and their families, which are making headway in Alabama, Maine, Massachusetts, Missouri, Utah, and Wisconsin. The week also saw the unveiling of a tax cut plan in Missouri, a budget-balancing tax increase package in Oklahoma, the end of an unproductive film tax credit in West Virginia, and a very busy week for tax policy in Utah.

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

January 26, 2018 • By ITEP Staff

The recently enacted Tax Cuts and Jobs Act (TCJA) has major implications for budgets and taxes in every state, ranging from immediate to long-term, from automatic to optional, from straightforward to indirect, from certain to unknown, and from revenue positive to negative. And every state can expect reduced federal investments in shared public priorities like health care, education, public safety, and basic infrastructure, as well as a reduced federal commitment to reducing economic inequality and slowing the concentration of wealth. This report provides detail that state residents and lawmakers can use to better understand the implications of the TCJA for…

State Rundown 1/12: Tax Cut Tunnel Vision Threatens to Bore State Budget Holes Even Deeper

January 12, 2018 • By ITEP Staff

As states continue to sift through wreckage of the federal tax cut bill to try to determine how they will be affected, two things should be clear to everyone: the richest people in every state just got a massive federal tax cut, and federal funding for shared priorities like education and health care is certain to continue to decline. State leaders who care about those priorities should consider asking those wealthy beneficiaries of the federal cuts to pay more to the state in order to minimize the damage of the looming federal funding cuts, but so far policymakers in Idaho,…

State Rundown 1/4: Will States Show Resolve in a Challenging Year?

January 4, 2018 • By ITEP Staff

This week marks the beginning of what is bound to be a wild year for state tax and budget debates. Essentially every state is already working to sort through the complicated ramifications of the federal tax cuts passed in December, including Kansas, Michigan, Montana, and New Jersey highlighted below. These and other states will have important decisions to make about how to incorporate, reject, or mitigate various aspects of the new federal law, and will need considerable resolve to improve state tax policy to be more fair and more adequate – even as federal taxes become less so.

How the Final GOP-Trump Tax Bill Would Affect Nebraska Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

State Rundown 12/13: Supermajority Laws Considered in Some States Even as They Confound Others

December 13, 2017 • By ITEP Staff

Supermajority requirements for tax increases are proving a major obstacle to responsible budgeting in Oklahoma, while ballot initiatives are being filed to alter or abolish Oregon‘s similar requirement, but a similar requirement is slowly advancing toward the ballot in Florida nonetheless. Displeasure with agricultural property taxes are spawning both a ballot initiative drive and a […]

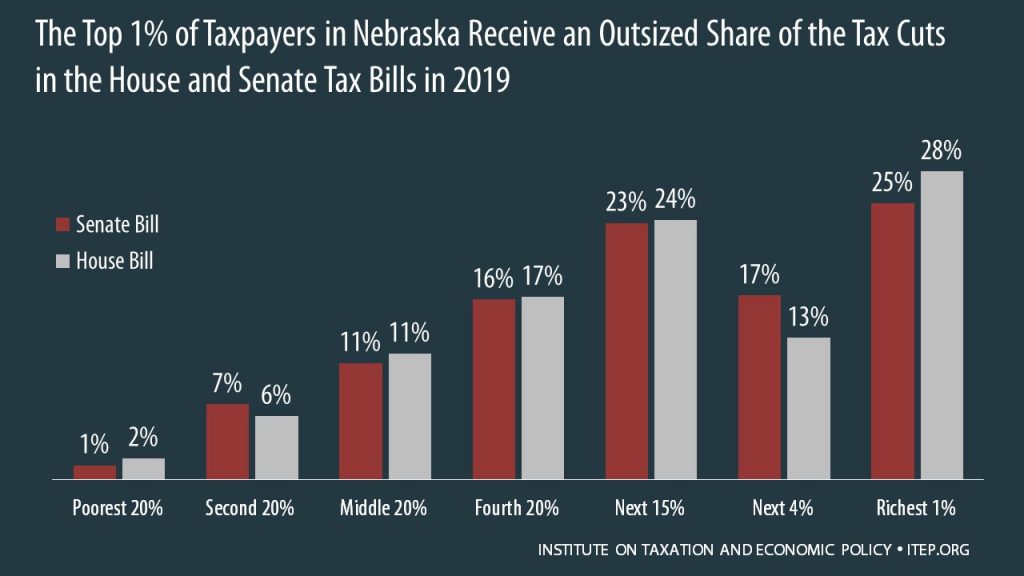

How the House and Senate Tax Bills Would Affect Nebraska Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Nebraska residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

The State Rundown is back from Thanksgiving break with a heaping helping of leftover state tax news, but beware, some of it may be rotten.

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Senate Tax Bill Would Affect Nebraska Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Nebraska, 40 percent of the federal tax cuts would go to the richest 5 percent of residents, and 9 percent of households would face a tax increase, once the bill is fully implemented.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

How the House Tax Proposal Would Affect Nebraska Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

State Rundown 11/1: Connecticut Balances Budget, Leaves Tax Code Out of Whack

November 1, 2017 • By ITEP Staff

This week a "historic" but highly problematic budget agreement was finally reached in Connecticut, Michigan lawmakers banned localities from taxing any food or beverages, and Nebraska and North Dakota both got unpleasant news about future revenues. Also see our "what we're reading" section for news on 11 states that have run up long-term fiscal deficits since 2002 and the impacts of flooding on local tax bases.

State Rundown 10/18: Ballot Initiative Efforts Being Finalized

October 18, 2017 • By ITEP Staff

Ballot initiatives relating to taxes made news around the country this week, with Oregon voters to consider reversing new health care taxes, Washingtonians to vote on improving education funding, and Nebraskans to potentially vote on a state tax credit for school property taxes. Meanwhile, multiple states are finalizing their proposals to lure Amazon to build a new headquarters in their state, often through the use of massive tax subsidies. And in our "What We're Reading" section we have sobering news from Moody's Investors Service on states' struggles to fund their infrastructure and save for the next recession.

State Rundown 10/4: Wildfires in Montana and Tax Cuts in Kansas Wreak Budget Havoc

October 4, 2017 • By ITEP Staff

This week, Kansas's school funding was again ruled unconstitutionally low and unfair, while Montana lawmakers indicated they'd rather let historic wildfires burn a hole through their budget than raise revenues to meet their funding needs. Meanwhile, a struggling agricultural sector continues to cause problems for Iowa and Nebraska, but legalized recreational marijuana is bringing good economic news to both California and Nevada.

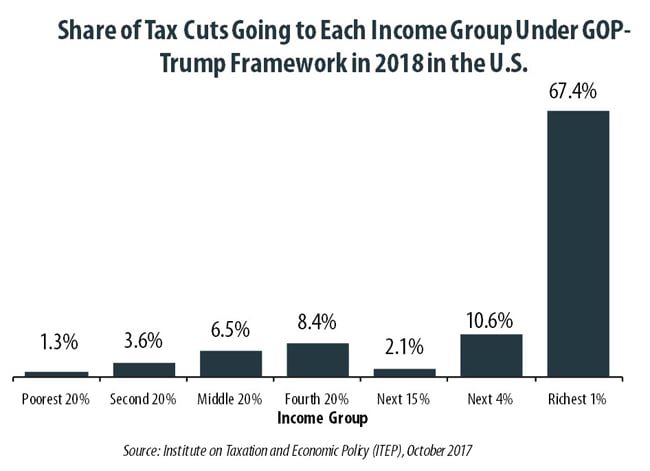

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

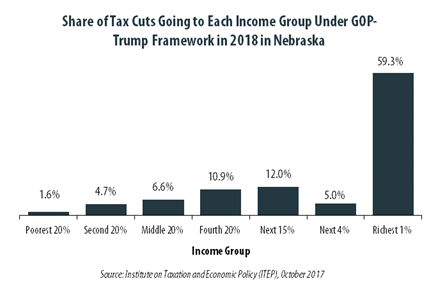

GOP-Trump Tax Framework Would Provide Richest One Percent in Nebraska with 59.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Nebraska equally. The richest one percent of Nebraska residents would receive 59.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $521,300 next year. The framework would provide them an average tax cut of $80,910 in 2018, which would increase their income by an average of 5.1 percent.

State Rundown 9/28: Wisconsin Budget Finalized, Oklahoma Special Session Underway

September 28, 2017 • By ITEP Staff

This week, Wisconsin's leaders finalized the state budget at last, while those in Oklahoma began a special session to close their state's revenue shortfall. Soda tax fights made news in Illinois and Pennsylvania. And New Jersey offered Amazon $5 billion in tax subsidies.

State Rundown 9/25: No Rest for the Weary as State Tax and Budget Debates Wind Down, Ramp Up

September 25, 2017 • By ITEP Staff

Last week, Wisconsin leaders finally came to agreement on a state budget, while their peers in Connecticut appear to be close behind them. Iowa lawmakers avoided a special session with a short-term fix and will have to return to their structural deficit issues next session, as will those in Louisiana who will face a $1 billion shortfall. Meanwhile, District of Columbia leaders have already resumed meeting and discussing tax and budget issues there.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

Reducing the Cost of Child Care Through State Tax Codes in 2017

September 11, 2017 • By ITEP Staff

Low- and middle-income working parents spend a significant portion of their income on child care. As the number of parents working outside of the home continues to rise, child care expenses have become an unavoidable and increasingly unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

State Rundown 8/31: Modernizing Taxes is Sometimes a Sprint, Sometimes a Marathon

August 31, 2017 • By ITEP Staff

Tax and budget debates are progressing at different paces in different parts of the country this week. In Connecticut and Wisconsin, lawmakers hope to finally settle their budget and tax differences soon. In South Dakota, a court case that could finally enable states to enforce their sales taxes on online retailers inches slowly closer to the U.S. Supreme Court.

In Nebraska 38.4 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Nebraska population (0.5 percent) earns more than $1 million annually. But this elite group would receive 38.4 percent of the tax cuts that go to Nebraska residents under the tax proposals from the Trump administration. A much larger group, 41.8 percent of the state, earns less than $45,000, but would receive just 5.0 percent of the tax cuts.