Nevada

Policymakers and residents in all 50 states and the District of Columbia got new ITEP data this week on how their tax structures and decisions affect their high-, middle-, and low-income residents. As our “Who Pays?” report outlines, most state and local tax codes exacerbate economic inequalities and all states have room to improve. The data can serve as an important informative backdrop to all state and local tax policy debates, such as whether to change the valuation of commercial property in California, how to improve funding for early childhood education in Indiana, and how to evaluate tax-related ballot measures…

Politico Morning Tax: Desperately Seeking Clarity

October 17, 2018

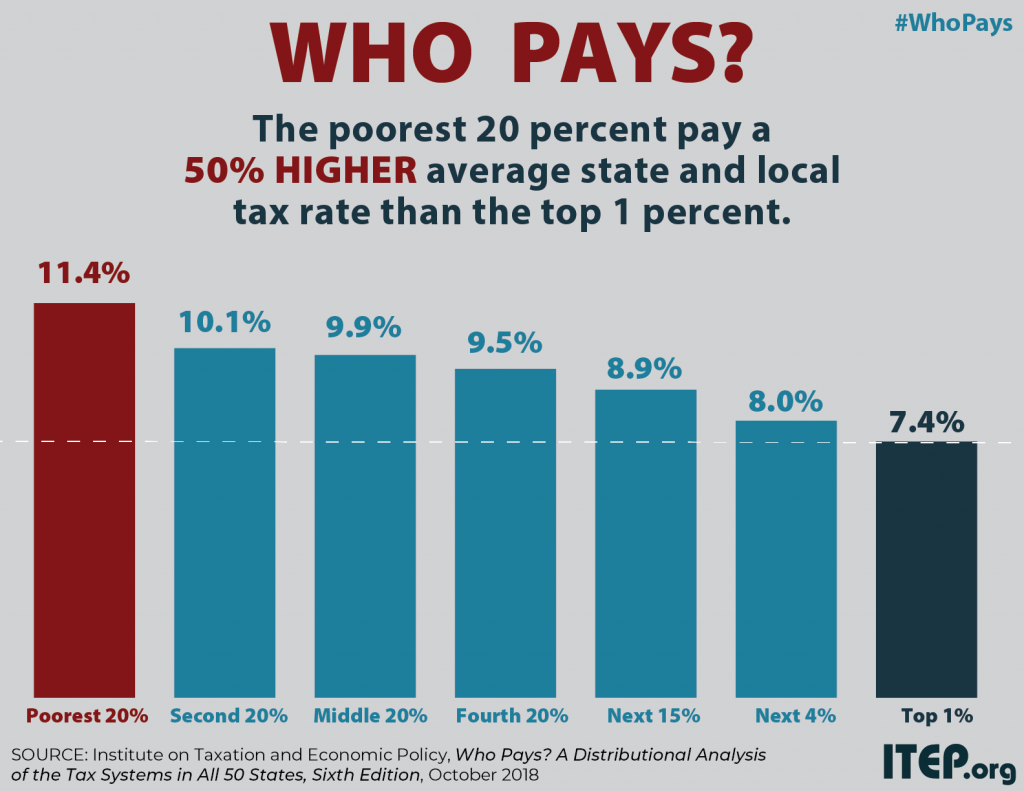

MOST STATE TAX SYSTEMS REGRESSIVE: No state has more regressive taxes on its citizens than Washington, followed by Texas, Florida, South Dakota and Nevada, according to a distributional analysis of state tax systems that will be released today by the Institute on Taxation and Economic Policy. Most states take a larger share of income from low- and middle-income families than from wealthy families, it said. The 10 most regressive in the rankings tax their residents in the bottom 20 percent of the income scale at rates up to six times higher than the wealthy, while their middle-income families pay a rate up to…

Poorest 20 Percent Pays a 50 Percent Higher Effective State and Local Tax Rate than the Top 1 Percent

October 17, 2018 • By ITEP Staff

A comprehensive 50-state study released today by the Institute on Taxation and Economic Policy (ITEP) finds that most state and local tax systems tax low- and middle-income households at significantly higher rates than wealthy taxpayers, with the lowest-income households paying an average of 50 percent more of their income in taxes than the very rich.

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

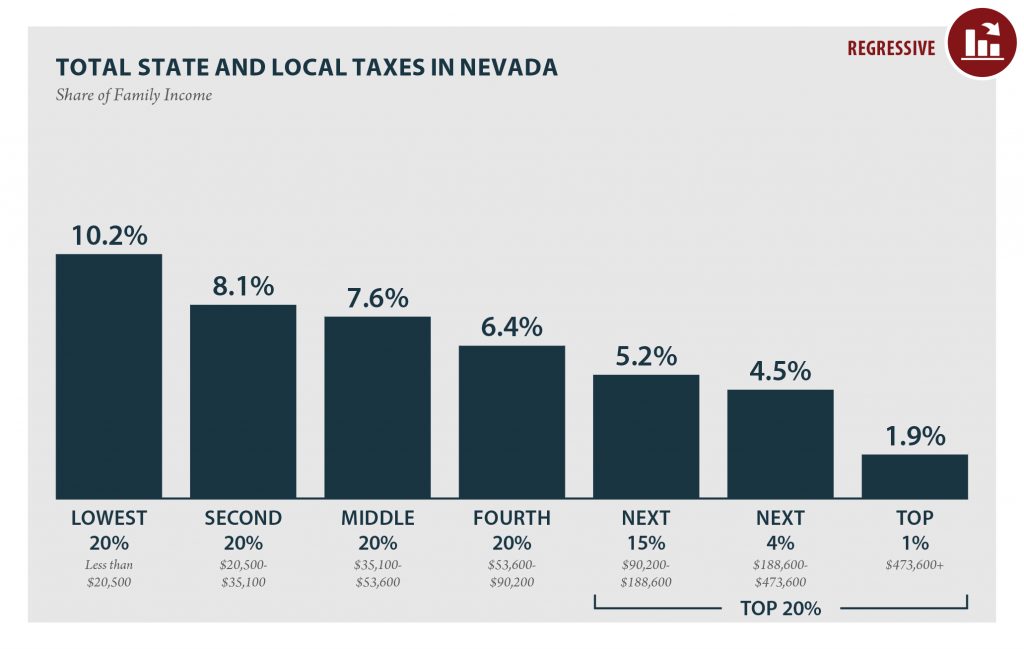

Nevada: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

NEVADA Read as PDF NEVADA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $20,500 $20,500 to $35,100 $35,100 to $53,600 $53,600 to $90,200 $90,200 to $188,600 $188,600 to $473,600 over $473,600 […]

State Rundown 10/12: Local Jurisdictions Fighting for Revenues, Independence

October 12, 2018 • By ITEP Staff

Voters all around the country are educating themselves for the upcoming elections, notably this week around ballot initiatives in Arizona and Colorado and competing gubernatorial tax proposals in Georgia and Illinois. But not all eyes are on the elections, as the relationship between state and local policy made news in Delaware, Idaho, North Dakota, and Ohio.

South Carolina lawmakers have finally passed a federal conformity bill in response to last year’s federal tax-cut legislation. Voters in many states are hearing a lot about tax-related questions they’ll see on the ballot in November, particularly residents of Florida, Montana, and Oregon, where corporate donors and other anti-tax interests are spending major sums to alter policy in their states. And states continue to work on ensuring they can collect online sales taxes and, in some states, online sports betting taxes.

Tax Cuts 2.0 – Nevada

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.

Although most state legislatures are out of session during the summer, the pursuit of better fiscal policy has no "off-season." Here at ITEP, we've been revamping the State Rundown to bring you your favorite summary of state budget and tax news in the new-and-improved format you see here. Meanwhile, leaders in Massachusetts and New Jersey have been hard at work in recent weeks and are already looking ahead their next round of budget and tax debates. Lawmakers in many states are using their summer break to prepare for next year's discussions over how to implement online sales tax legislation. And…

New Jersey avoided a second consecutive shutdown and proved that even against staunch opposition, progressive solutions to states' fiscal issues are attainable, and Arizona voters will likely have a chance to solve their education funding crisis in a similar way. Budget and tax debates remain to be resolved, however, in Maine and Massachusetts. Meanwhile, voters are gaining a clearer picture of what questions they will be asked on ballots this fall as signature drives conclude in several states.

All Bets are Off: State-Sponsored Sports Betting Isn’t Worth the Risk

June 13, 2018 • By Misha Hill

Many state legislators and regulators are considering expanding state-sponsored gambling by allowing betting on major league sports games. But the revenue states could bring in isn’t worth the risk.

State Rundown 6/1: Time Is Ripe for Closer Look at Intergovernmental Relations

June 1, 2018 • By ITEP Staff

This week, Virginia lawmakers overcame their budget impasse and approved an expansion of Medicaid, North Carolina's behind closed doors budget debate appears to be wrapping up, and Vermont's special session continues in the wake of the governor's vetoes of the state budget and accompanying tax bills. New research highlighted in our What We're Reading section shows that both corporate income tax cuts and business tax subsidies contribute to wider economic inequality. And the possible reconstitution of a federal commission on intergovernmental relations could not come soon enough, as other headlines this week include a state-to-local shift in school funding, governments…

Reno News and Review: Tax Hike?

May 31, 2018

According to the Institute on Taxation and Economic Policy, the poorest 20 percent of Nevada families pay 6.1 percent of their income in sales tax. The wealthiest one percent of Nevada families pays six-tenths of one percent. That fund has generated from nine to six million dollars annually. With 20 years of sales tax payments […]

Tax Wars: 3 Lessons about Tax Policy from the Star Wars Universe

May 4, 2018 • By Richard Phillips

Even in the universe of Jedi, Death Stars and Ewoks, tax policy plays a surprisingly important role in driving the events of the day. In celebration of Star Wars Day, we just wanted to share some of the little-known tax policy lessons from the Star Wars universe.

State Rundown 4/27: Arbor Day Brings Some Fruitful Tax Developments, Some Shady Proposals

April 27, 2018 • By ITEP Staff

This Arbor Day week, the seeds of discontent with underfunded school systems and underpaid teachers continued to spread, with walkouts occurring in both Arizona and Colorado. And recognizing the need to see the forest as well as the trees, the Arizona teachers have presented revenue solutions to get to the true root of the problem. In the plains states, tax cut proposals continue to pop up like weeds in Kansas and threaten to spread to Iowa and Missouri, where lawmakers are running out of time but are still hoping their efforts to pass destructive tax cuts will bear fruit.

Trends We’re Watching in 2018, Part 5: 21st Century Consumption Taxes

April 20, 2018 • By Misha Hill

We're highlighting the progress of a few newer trends in consumption taxation. This includes using the tax code to discourage consumption of everything from plastic bags to carbon and collecting revenue from emerging industries like ride sharing services and legalized cannabis sales.

State Rundown 2/28: February a Long Month for State Tax Debates

February 28, 2018 • By ITEP Staff

February may be the shortest month but it has been a long one for state lawmakers. This week saw Arizona, Idaho, Oregon, and Utah seemingly approaching final decisions on how to respond to the federal tax-cut bill, while a bill that appeared cleared for take-off in Georgia hit some unexpected turbulence. Other states are still studying what the federal bill means for them, and many more continue to debate tax and budget proposals independently of the federal changes. And be sure to check our "What We're Reading" section for news on corporate tax credits from multiple states.

How the Final GOP-Trump Tax Bill Would Affect Nevada Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

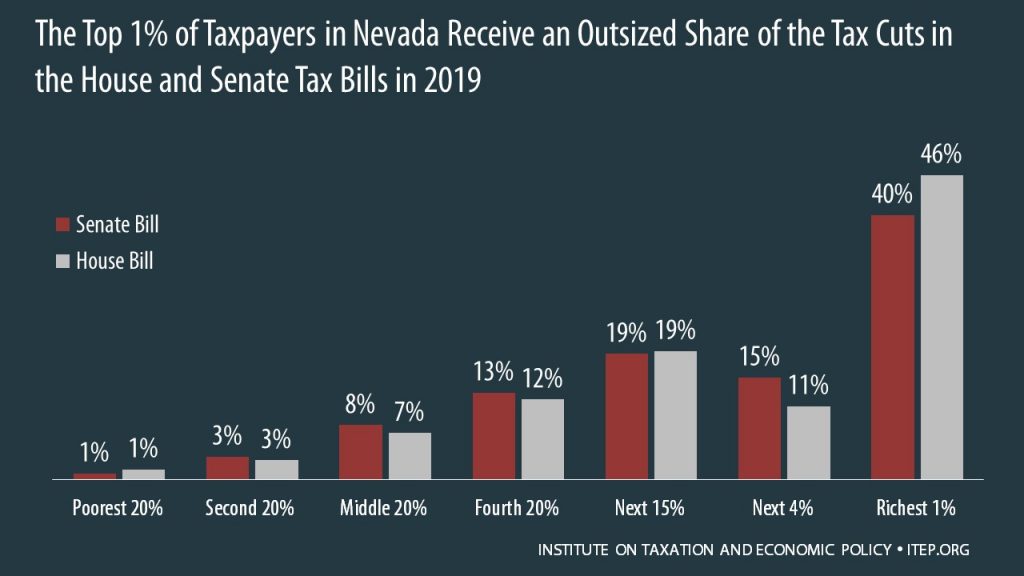

How the House and Senate Tax Bills Would Affect Nevada Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Nevada residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Revised Senate Tax Bill Would Affect Nevada Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Nevada, 57 percent of the federal tax cuts would go to the richest 5 percent of residents, and 9 percent of households would face a tax increase, once the bill is fully implemented.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.