North Carolina

Failed Tax-Cut Experiment (in North Carolina) Will Continue Under Final Budget Agreement, Pushes Fiscal Reckoning Down the Line

June 21, 2017

The final budget agreement from leaders of the House and Senate puts North Carolina on precarious fiscal footing, The tax changes that leaders agreed to—which were less a compromise and more of a decision to combine the tax cuts in both chambers’ proposals—make the cost of these tax cuts bigger than what either chamber proposed. Including the new tax cuts,approximately 80 percent of the net tax cut since 2013 will have gone to the top 20 percent. More than half of the net tax cut will go to the top 1 percent.

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

The Cost Of Trickle-Down Economics For North Carolina

May 26, 2017

Since 2013, state lawmakers have passed significant income tax cuts that largely benefit the state’s highest income earners and profitable corporations. These costly tax cuts have made the state’s tax system more upside-down by delivering the greatest income tax cuts to the state’s highest income taxpayers, while maintaining a heavier tax load on low- and […]

State Rundown 5/10: Spring Tax Debates at Different Stages in Different States

May 10, 2017 • By Meg Wiehe

This week saw a springtime mix of state tax debates in all stages of life. In West Virginia and Louisiana, debates over income tax reductions and comprehensive tax reform are full of vigor. Other debates that bloomed earlier are now settled, such as Florida‘s now-complete budget debate and the more florid debates over gas taxes […]

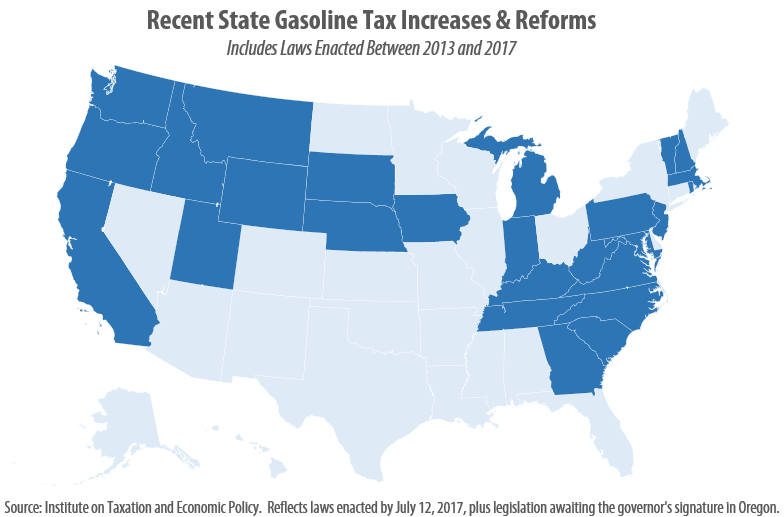

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

The Progressive Pulse: Young Undocumented Immigrants’ Tax Contributions Would Drop by Nearly Half Without the Protection of the DACA Program

May 3, 2017

Young immigrants eligible for DACA (Deferred Action for Childhood Arrivals) annually contribute $2 billion in state and local taxes, according to new analysis from the Institute on Taxation and Economic Policy. The ITEP report finds that this number would drop by nearly half without DACA protection at a time when the Trump Administration has sent mixed signals on whether it intends to honor the DACA executive order in the long term.

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

States are experiencing a rapid decline in state corporate income tax revenue, and the downward trend has become increasingly pronounced in recent years. Despite rebounding bottom lines for many corporations, a new ITEP report, 3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015,finds that effective tax rates paid by […]

State Rundown 4/19: Alaska’s Long Income Tax Freeze May Be Thawing

April 19, 2017 • By ITEP Staff

This week Alaska‘s House advanced a historic bill to reinstate an income tax in the state, Oklahoma‘s House voted to cancel a misguided tax cut “trigger,” West Virginia‘s governor colorfully vetoed his state’s budget, tax reform debate kicked off in Louisiana, and gas tax updates were considered in South Carolina and Tennessee, among other tax-related news […]

North Carolina Justice Center: Prosperity Watch (Issue 72, No 3): Tax cuts since 2013 reinforce racial and ethnic exclusion

April 18, 2017

Changes to North Carolina’s tax system in recent years have had an impact on the level of available revenue for public investments and shifted tax responsibility among taxpayers. BTC analysis has already noted how the tax chances since 2013 have delivered a significant share of the net tax cut to the state’s highest income earners […]

The Progressive Pulse: Undocumented immigrants pay their fair share of taxes, too

April 12, 2017

Tax Day is just around the corner, and this year is no different than any other for countless undocumented immigrants filling tax forms in North Carolina. Current rhetoric on immigration often overlooks the important contributions undocumented immigrants make to our communities as neighbors, workers, and taxpayers. The Institute on Taxation and Economic Policy recently released […]

NC Policy Watch: What you need to know as the state Senate moves to cut taxes yet again

April 3, 2017

The North Carolina Senate is moving ahead yet again – perhaps as early as this afternoon – with a new proposal to further reduce state taxes and the revenues they generate to fund essential public structures and services. While the plan is billed as “a billion dollar middle class tax cut,” a closer look at […]

The Progressive Pulse: New analysis: Most of NC senate’s “middle class” tax cut would actually flow to the wealthy

April 3, 2017

BTC’s analysis of SB 325 uses a more robust model developed by the Institute on Taxation and Economic Policy (ITEP), a non-profit, non-partisan organization. ITEP’s microsimulation tax model calculates tax revenue yield and incidence, by income group, of federal, state and local taxes. The model is used in states across the country to analyze state […]

The Progressive Pulse: Why cutting taxes for business again makes no sense

March 31, 2017

When businesses pay their share of taxes, North Carolina is able to invest in the things that build thriving communities and a prosperous economy – things like good schools, roads, public health and a clean environment. The Senate’s tax plan, Senate Bill 325, includes a tax cut for businesses that goes against this proven principle. […]

Tax Justice Digest: 50-State Analysis of GOP Health Care Plan, Ensuring State Sales Taxes Keep Pace with Our Changing Economy

March 23, 2017 • By ITEP Staff

In the Tax Justice Digest we recap the latest reports, blog posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Here’s a rundown of what we’ve been working on lately. State-by-State Analysis of GOP Health Care Plan By now, it’s widely known that the GOP health care plan […]

GOP Healthcare Bill Cuts Insurance Coverage for Millions to Pay for Tax Cuts for the Wealthy; ITEP State-By-State Estimates

March 22, 2017 • By Richard Phillips

The House GOP’s American Health Care Act is being pushed quickly through the legislative process, with a vote on the House floor scheduled for as early as Thursday. The Republican legislation seeks to pay for the cost of repealing highly progressive taxes enacted as part of the Affordable Care Act by making substantial cuts to […]

This week in state tax news saw major changes debated in Hawaii and West Virginia and proposed in North Carolina, a harmful flat tax proposal in Georgia, new ideas for ignoring revenue shortfalls in Mississippi and Nebraska, an unexpected corporate tax proposal from the governor of Louisiana, gas tax bills advance in South Carolina and […]

North Carolina Justice Center: BTC POLICY BASIC: Marginal versus Effective Personal Income Tax Rates

March 19, 2017

A great deal of confusion abounds in discussions about state personal income tax rates and how they apply to income. This policy basic clarifies the difference between marginal and effective tax rates, and gives a North Carolina-specific example of how these rates work in action. Read more here

North Carolina Justice Center: Still walking the path to zero: The Senate tax plan will harm North Carolina’s goal of building a stronger, inclusive economy

March 19, 2017

Senate leaders continue to pursue reductions to the income tax rate for wealthy taxpayers and profitable corporations even as they claim to be focused on helping low- and moderate-income taxpayers. This year they will do so without proposing immediate replacement of the revenue with sales-tax base expansions. The result is a loss of nearly $1 […]

This week brings more news of states considering reforms to their consumption taxes, on everything from gasoline in South Carolina and Tennessee, to marijuana in Pennsylvania, to groceries in Idaho and Utah, and to practically everything in West Virginia. Meanwhile, the fiscal fallout of Kansas’s failed ‘tax experiment’ has new consequences as the state’s Supreme […]

State Rundown 3/1: Will Tax Cut Proposals Be “In Like a Lion, Out Like A Lamb”?

March 1, 2017 • By ITEP Staff

Tax cuts have been proposed in many states already this year, but amid so much uncertainty, it remains to be seen how successful those efforts will be. This week saw one dangerous, largely regressive tax cut proposal move in Georgia, new budget proposals in Louisiana and New Jersey, a new plan to close West Virginia‘s […]

This week saw a nearly successful attempt to right the fiscal ship in Kansas; regressive tax proposals introduced in WestVirginia, Georgia, and Missouri; ongoing gas tax fights in Indiana, South Carolina, and Tennessee; and further tax and budget wrangling in Illinois, New Mexico, Oklahoma, and beyond. — Meg Wiehe, ITEP State Policy Director, @megwiehe Both […]

North Carolina Budget and Tax Center: The Road to Nowhere Good for North Carolina

February 22, 2017

Tax changes passed in the 2016 legislative session reduced the income tax rate and increased reliance on the sales tax. This continued flawed approach to taxation that policymakers have followed since 2013 has proven disastrous to other states’ fiscal and economic outlook. Such an approach delivers the greatest reduction in the tax load to the […]

Lawmakers Should Not Use Disproven Trickle-Down Myth to Ramrod Tax Cuts for the Rich

February 8, 2017 • By Misha Hill

For more than four decades, supply-side ideologues have promoted the myth that tax cuts for the wealthy are self-financing and the benefits eventually trickle down to everyone else, despite real-life evidence that tax cuts for the rich benefit the rich. Not even the reality of 40 years of widening income inequality or the current economic […]

This is the second installment of our six part series on 2017 state tax trends. The introduction to this series is available here. State tax policy can be a divisive issue, but no area has generated more agreement among lawmakers across the country than the need to raise new revenues to fund infrastructure improvements. The […]