Oregon

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

States are Boosting Economic Security with Child Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Fourteen states now provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states created new Child Tax Credits while lawmakers in seven states expanded existing credits. To maximize impact, lawmakers should consider making their credits fully refundable, not including an earnings requirement, setting a maximum amount per child instead of per household, setting state-specific phase-out ranges that target low- and middle-income families, indexing to inflation, and offering the option of advanced payments.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

State lawmakers continue to make groundbreaking progress on state tax credits, with 17 states creating or enhancing Child Tax Credits or Earned Income Tax Credits so far this year. These policies have the potential to boost family economic security and dramatically reduce the number of children living below the poverty line.

State Rundown 6/28: Movement on Refundable Credits Remains Hot Topic in 2023

June 28, 2023 • By ITEP Staff

The trend of state lawmakers taking big steps on important tax credits like the Child Tax Credit and Earned Income Tax Credit is coming out in full force this week...

Summer is here and many states nearing the end of their legislative sessions. Temperatures are rising in more ways than one in some state legislatures while others seem to be cooling off.

States Looking to Make Property Taxes Affordable Should Turn to ‘Circuit Breakers’

May 11, 2023 • By ITEP Staff

Many state legislatures this year have been considering property tax cuts – but too many are ignoring the solution that speaks more directly to questions of property tax affordability than any other policy option: the “circuit breaker."

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

At nearly every turn, Oregon’s tax policies widen inequality; as a result, the top 1 percent pay less state and local taxes as a share of income than the poorest residents. Taxing capital gains at the local level is an important and exciting move in the other direction – to tax income from wealth and use it to address crucial needs.

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Oregon Center for Public Policy: Beyond the Water’s Edge: Oregon Can Make it Harder for Corporations to Hide Profits Overseas

April 6, 2023

Oregon can clamp down on multinational corporations shifting profits overseas, create a more level playing field for Oregon businesses, and raise millions in revenue by enacting “complete reporting” by large corporations. Read more.

Oregon Center for Public Policy: How to Pay (PAE) for It? Enact Complete Reporting

March 29, 2023

Making Oregonians more economically secure requires investing in our well-being: housing, education, child care, and more. One fair way to pay for these investments is to fight corporate tax avoidance by enacting complete reporting. Read more.

As nature bursts into life and color with the arrival of spring, state tax proposals are doing the same as the legislative seeds planted by lawmakers earlier this year start to grow, blossom, and in some cases rot. However, some governors are not entirely happy with what state lawmakers have produced.

State Rundown 2/23: Tax Dominos Take Shape, Begin to Fall as Session Heats Up

February 23, 2023 • By ITEP Staff

The 2023 legislative session is in full swing, and dominos continue to be set up as others fall...

The great women’s philosopher, Pat Benatar, once said “love is a battlefield,” and there’s no greater test of our love for state tax policy than following the ups and downs of state legislative sessions...

Why the States Have a Major Role to Play If We Want Tax Justice

February 9, 2023 • By Amy Hanauer

With fears of gridlock in a divided Washington, tax justice champions are building momentum in other places where there's dire need for better tax policy: the states. We can upgrade communities across the country by making 2023 a year to win tax improvements in statehouses.

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

Policy for the People Podcast: Our Labor, Their Fortunes: Billionaires Capture Oregon’s Wealth

November 11, 2022

Wealth inequality is at mind-boggling levels in Oregon and elsewhere. Listen to Research Director Carl Davis talk about the trends here.

Oregon Center for Public Policy: Wealth Inequality in Oregon Is Extreme

November 3, 2022

How extreme is wealth inequality in Oregon? So extreme that, together, three billionaires residing in the state have about twice the wealth as that of the entire bottom half of Oregonians. Read more.

Miles Trinidad

October 19, 2022 • By ITEP Staff

Miles provides research and monitors state tax policy to support state researchers and advocates. Before joining ITEP in 2022, Miles worked in the office of Rep. Peter DeFazio for more than three years. As a legislative assistant, his work included drafting a windfall profits tax on oil companies to prevent corporate profiteering from global crises […]

Do you remember/the big tax news innn September? Well, if not, we at ITEP got you covered...

ITEP Policy Briefs: More and More States Are Helping Low-Income Families with New and Expanded Tax Credits

September 15, 2022 • By ITEP Staff

13 states plus D.C. created or expanded state CTCs or EITCs this year, helping create more equitable state tax systems WASHINGTON, D.C.: In 2022’s state legislative sessions, lawmakers across the country advanced tax policies that will bolster the economic security of millions of low- and moderate-income working families through new and enhanced Child Tax Credits […]

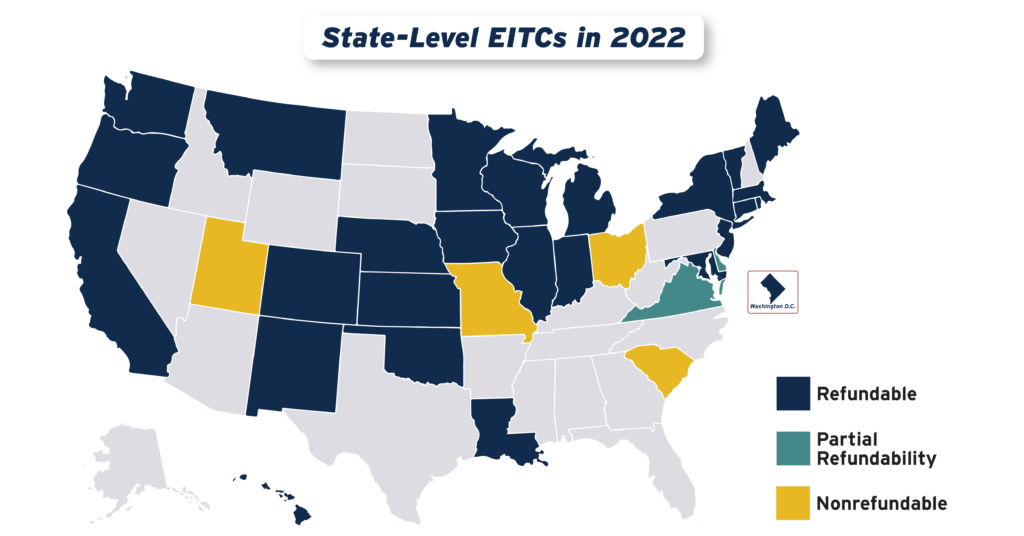

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

Census Data Shows Need to Make 2021 Child Tax Credit Expansion Permanent

September 14, 2022 • By Joe Hughes

The Child Tax Credit expansion led to a 46 percent decline in childhood poverty. That it could be accomplished during the largest economic disruption in most of our lifetimes underscores a basic fact: thoughtful, decisive government action to combat poverty works.

State Rundown 8/10: States Still Talking Taxes as IRA Dominates Headlines

August 10, 2022 • By ITEP Staff

While federal tax policy has dominated the headlines with the Senate’s recent approval of the Inflation Reduction Act, lawmakers in statehouses across the country...