Rhode Island

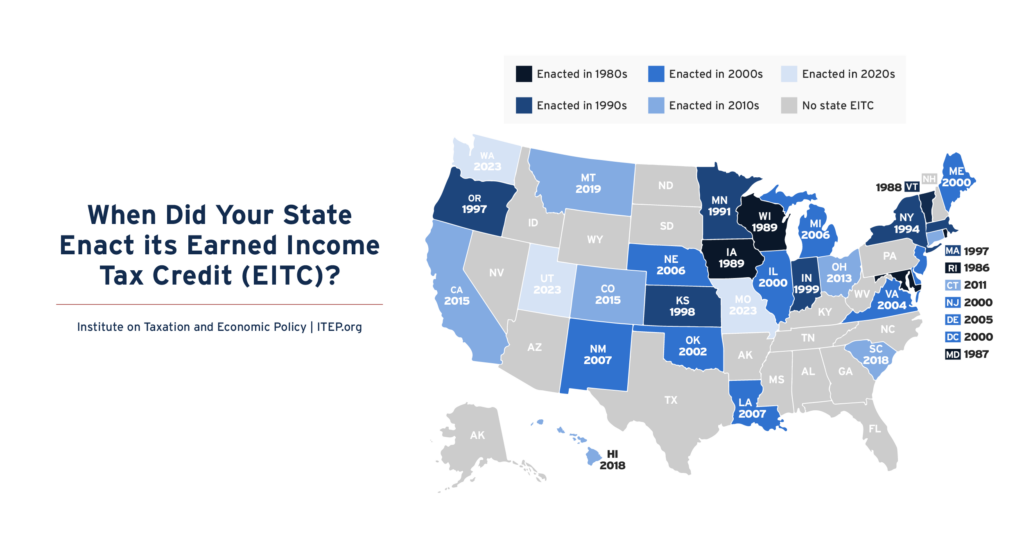

The Earned Income Tax Credit (EITC) supports millions of workers and families and continues to grow in states and localities across the country. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco, where they benefited 700,000 households in 2023.

This week, we celebrate 50 years of the federal Earned Income Tax Credit (EITC) and the impact it's had on millions of workers and families. In 2023 alone, the latest year of available data, the federal EITC alongside the refundable portion of the Child Tax Credit lifted 6.4 million people and 3.4 million children out of poverty.

Below is a list of tax expenditure reports published in the states.

In the face of immense uncertainty around looming federal tax and budget decisions, many of which could threaten state budgets, state lawmakers have an opportunity to show up for their constituents by raising and protecting the revenue needed to fund shared priorities. Lawmakers have a choice: advance tax policies that improve equity and help communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for most families to get ahead.

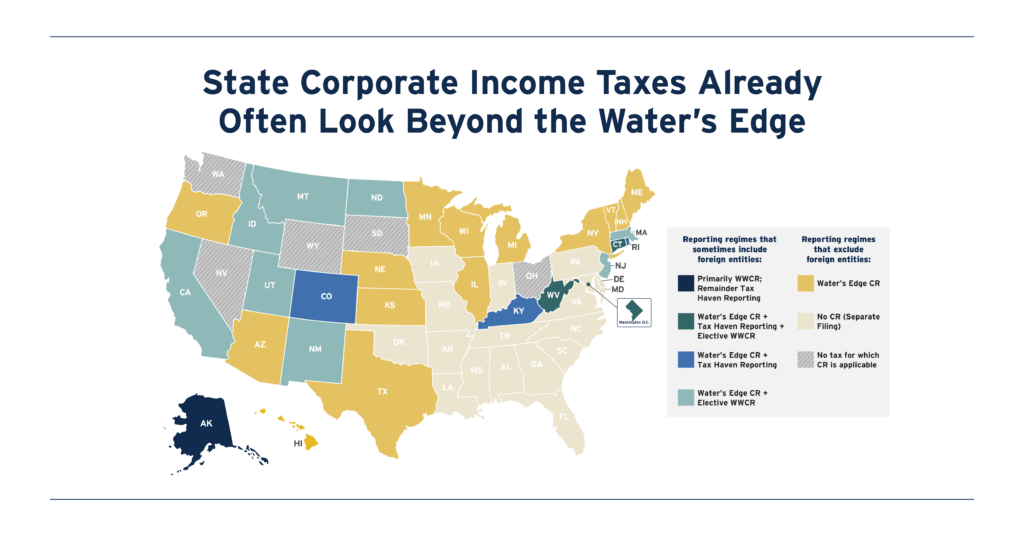

A Revenue Analysis of Worldwide Combined Reporting in the States

February 20, 2025 • By Carl Davis, Matthew Gardner, Michael Mazerov

Universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion.

Turning IRS Agents to Deportation Will Reduce Public Revenues

February 11, 2025 • By Carl Davis, Jon Whiten

The Trump Administration’s plan to turn IRS agents into deportation agents will result in lower tax collections in addition to the harm done to the families and communities directly affected by deportations.

Local income taxes can be an important progressive revenue raiser, as they ask more of higher-income households and are connected to ability to pay. They can raise substantial revenue to fund key public services to make cities and regions better off.

State Rundown 1/22: Tax Policy, Affordability, and Where It Misses the Mark

January 22, 2025 • By ITEP Staff

As state legislative sessions ramp up many lawmakers discuss their prioritization of affordability of necessities like food and housing as they craft their legislative agendas. Arkansas, Mississippi and Utah are looking to reduce or fully exempt groceries from their state sales taxes. Meanwhile, multiple proposals to reduce property taxes are making their way around state […]

State Rundown 1/15: Tax Debates Heat Up Despite Winter Weather

January 15, 2025 • By ITEP Staff

While frigid temperatures expected across a large swath of the country, major tax proposals are heating up in the states. Governors are giving their State of the State addresses and state lawmakers have begun to convene for 2025. New York Gov. Kathy Hochul announced plans to expand the state’s Child Tax Credit earlier this year and has since announced nearly $1 billion in income tax cuts. Maryland Gov. Wes Moore unveiled a new tax proposal aimed at helping close the state’s looming revenue shortfall. The plan would increase taxes on the wealthy and cut taxes for many low- and middle-income…

Trump’s Plan to Extend His 2017 Tax Provisions: Updated National and State-by-State Estimates

January 8, 2025 • By Steve Wamhoff

Trump’s plan to make most of the temporary provisions of his 2017 tax law permanent would disproportionately benefit the richest Americans. This includes all major provisions except the $10,000 cap on deductions for state and local taxes (SALT) paid.

On Election Day, Voters Across the Country Chose to Invest in Their States & Communities

November 19, 2024 • By Kamolika Das

On election day, voters across the country — in states red and blue and communities rural and urban — approved a wide range of state and local ballot measures on taxation and public investment. The success of these measures clearly shows that voters are willing to invest in public priorities that feel tangible and close to home.

Extending Temporary Provisions of the 2017 Trump Tax Law: Updated National and State-by-State Estimates

September 13, 2024 • By Steve Wamhoff

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans. Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s […]

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

States Should Enact, Expand Mansion Taxes to Advance Fairness and Shared Prosperity

June 26, 2024 • By Carl Davis, Erika Frankel

The report was produced in partnership with the Center on Budget and Policy Priorities and co-authored by CBPP’s Deputy Director of State Policy Research Samantha Waxman.[1] Click here to use our State Mansion Tax Estimator A historically large share of the nation’s wealth is concentrated in the hands of a few, a reality glaring in […]

State Rundown 6/13: Decisions are falling into place, but some states will come back for more

June 13, 2024 • By ITEP Staff

State budgets are falling into place as lawmakers near the end of their legislative sessions...

Local Mansion Taxes: Building Stronger Communities with Progressive Taxes on High-Value Real Estate

March 14, 2024 • By Andrew Boardman

More than one dozen cities and counties levy progressive taxes on high-price real estate transactions — sometimes called mansion taxes — and over a dozen more are considering such policies. By asking buyers and sellers with greater financial means to contribute more to the common good, these policies are equipping communities with resources to make progress on critical challenges of local and national concern.

Anti-tax interests finally found the end of the tax cutting appetite in a few states this week...

Video: ITEP’s Carl Davis Discusses ‘Who Pays?’ at Rhode Island Revenue Roundtable

February 5, 2024

ITEP researcher Carl Davis joins the Economic Progress Institute (EPI) for Rhode Island's Revenue Roundtable.

State Rundown 2/1: Black History Month Begins as Tax Debates Heat Up Nationwide

February 1, 2024 • By ITEP Staff

This week the showdown between the Kansas legislature and governor continued as Gov. Kelly vetoed the legislature’s latest attempt to pass a flat personal income tax. Elsewhere, the focus is on doing more for working families through proposals to expand refundable credits in Maryland and adding a millionaire tax bracket in Rhode Island. Meanwhile, there’s […]

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

Tax policy themes have begun to crop up in states as governors give their yearly addresses and legislators lay out their plans for the 2024 legislative season...

Rhode Island: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Rhode Island Download PDF All figures and charts show 2024 tax law in Rhode Island, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly 100 percent of state and local tax revenue collected in Rhode Island. State and local tax shares of family income Top […]

Hidden in Plain Sight: Race and Tax Policy in 2023 State Legislative Sessions

November 21, 2023 • By Brakeyshia Samms

Race was front and center in a lot of state policy debates this year, from battles over what’s being taught in schools to disagreements over new voting laws. Less visible, but also extremely important, were the racial implications of tax policy changes. What states accomplished this year – both good and bad – will acutely affect people and families of color.

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.