Texas

Sales Tax Holidays Are Outdated Gimmicks That Have Run Their Course

July 17, 2019 • By ITEP Staff

Just as the very first sales tax holiday for car sales did not fix the auto industry’s challenges, providing consumers a temporary reprieve on sales tax will not address families’ pocketbook concerns.

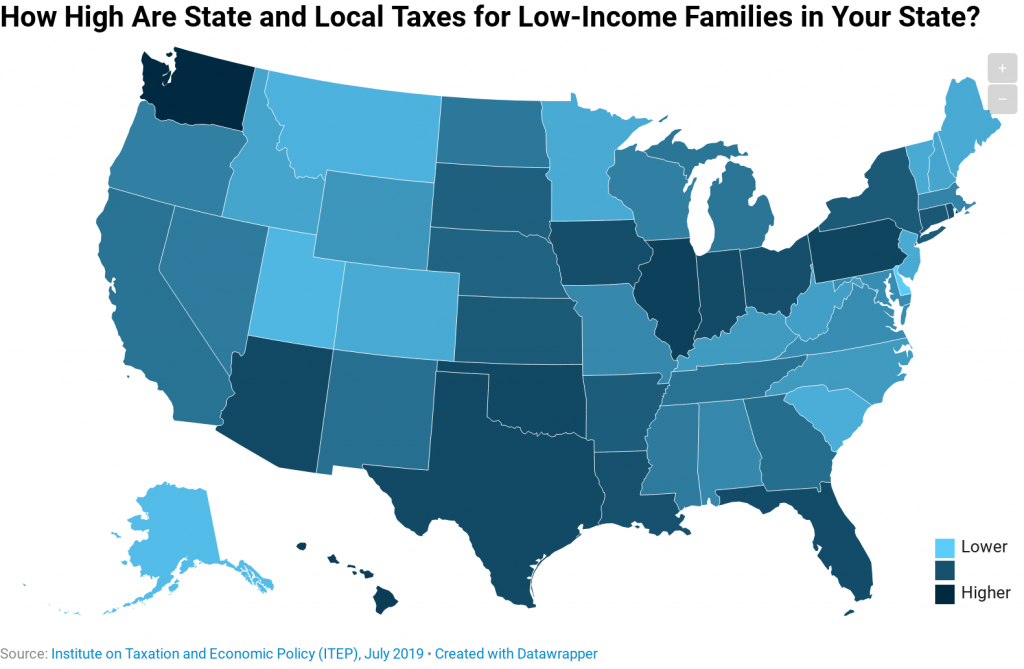

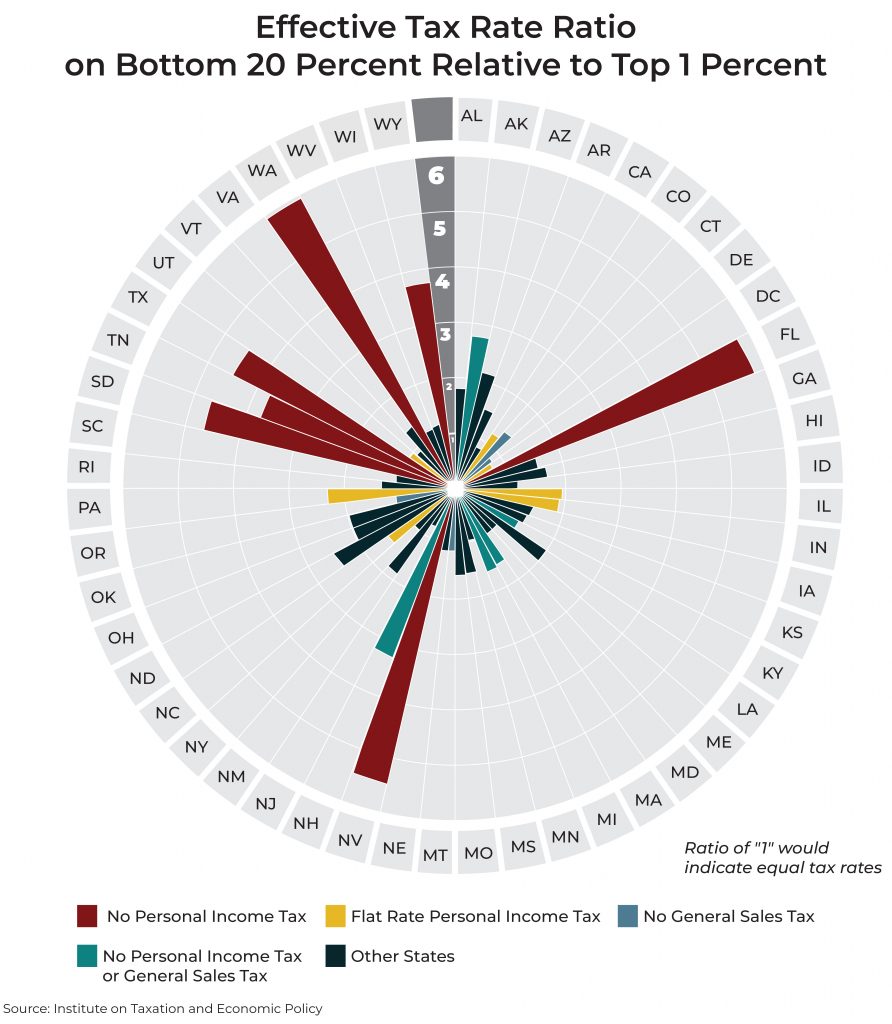

No two state tax systems are the same, but 45 states have one thing in common: Low-income residents are taxed at a higher rate than the top 1 percent. This map shows the effective tax rates for the lowest-income 20 percent in each state--ranging from a high of 17.8 percent in Washington to a low of 5.5 percent in Delaware.

State Rundown 6/19: Juneteenth Highlights Role of State Policy in Racial Equity Fight

June 19, 2019 • By ITEP Staff

As Americans observe Juneteenth today–the day two years after the Emancipation Proclamation on which news of the end of the Civil War and slavery reached some of the last slaves in Texas—most people’s attention should be on celebrating victories, remembering losses, gathering strength to continue the fight for racial justice, and the accompanying Congressional reparations hearings. In comparison, state tax debates over matters such as reluctance to invest in infrastructure in Michigan and Missouri, approval of income tax cuts in Wisconsin, and a budget standoff in New Jersey may seem unimportant and irrelevant. But we encourage our readers to think about how state policies often serve to enrich and empower white and wealthy households, and…

Like certain recent controversially concluded television shows, tax and budget debates can end in many ways and often receive mixed reviews. Illinois leaders, for example, ended on a cliffhanger by approving a historic constitutional amendment to create a graduated income tax in the state, whose ultimate conclusion will be crowdsourced by voters next November. Arizona’s fiscal finale fell flat with many observers due to corner-cutting on needed investments and a heavy focus on tax cuts. Texas legislators went for crowd-pleasing property tax cuts and school funding increases but left a gigantic “but how will we pay for this” plot hole…

State Rundown 5/22: (Some) State Lawmakers Can (Partly) Relax This Weekend

May 22, 2019 • By ITEP Staff

Lawmakers and advocates can enjoy their barbeques with only one eye on their work email this weekend in states that have essentially finished their budget debates such as Alaska, Minnesota, Nebraska, and Oklahoma, though both Alaska and Minnesota require special sessions to wrap things up. Getting to those barbeques may be a bumpy ride in Louisiana, Michigan, and other states still working to modernize outdated and inadequate gas taxes.

State Rundown 5/16: Tensions Remain High Over Budgets and School Finances in Several States

May 16, 2019 • By ITEP Staff

Tax and budget negotiations remain at standstills in Louisiana and Minnesota, as school funding debates and teacher protests again captured headlines in several states. Oregon lawmakers, for example, finally passed a mixed-bag tax package that won’t improve tax equity but will raise much-needed revenue for education. Meanwhile their counterparts in Nebraska continue to debate highly […]

State Rundown 5/9: Illinois Moves Closer to a Progressive Income Tax

May 9, 2019 • By ITEP Staff

Lawmakers in Illinois and Ohio have advanced major tax proposals but cannot rest just yet, as they must still get past the other legislative chamber. Their counterparts in Michigan, Minnesota, Nebraska, and Oregon, meanwhile, are all at impasses over education funding, as those in Texas left their school funding disagreement unresolved at least until they reconvene...in 2021. And in an era of many states pre-empting smaller jurisdictions by revoking local decision-making powers, leaders in Colorado and Delaware made moves in the opposite direction, entrusting cities and school districts with more local control.

New York Times: Apple Plans to Buy $75 Billion More of Its Own Stock

April 30, 2019

When it repatriated its cash under the new tax law, Apple paid $43 billion less than it would have under previous rates, bigger savings than any other American company, according to the Institute on Taxation and Economic Policy, a research group in Washington. Apple has also saved billions of dollars under the lower corporate tax rate. Apple says it is spending billions in the United States, hiring new workers, building data centers, expanding offices in Texas and investing in some outside manufacturers.

Tax and budget debates are now mostly complete in Alabama, Arkansas, and Colorado, but just starting or just getting interesting in several other states. Delaware and Massachusetts lawmakers, for example, are looking at progressive income tax increases on wealthy households, and New Hampshire may use a progressive tax on capital gains to simultaneously improve its upside-down tax code and invest in education. Nebraska and Texas, on the other hand, are also looking to improve school funding but plan to do so on the backs of low- and middle-income families through regressive sales tax increases. Fiscal debates are heating up in…

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

Texas Monthly:The Governor Wants to Replace Property Taxes With ‘Consumption’ Taxes. That’s a Terrible Idea.

April 16, 2019

The trick, of course, is that consumption taxes are regressive, and property taxes are not. Again, because there’s no state income tax, the burden of funding state government falls disproportionately on poor and middle-class folks. The poorest half of Texans pay more than 10 percent of their annual income on state and local taxes, according […]

Newark Star-Ledger: Tax Day 2019 More Taxing for 400k NJ Households

April 16, 2019

Only California, New York, Texas and Florida saw a greater number of households paying more in taxes, according to the report, based on data from the Institute on Taxation and Economic Policy. Read more

State Rundown 4/4: Ohio Gas Tax and Maryland Minimum Wage Get Needed Updates

April 4, 2019 • By ITEP Staff

Transportation funding was a hot topic this week, as OHIO lawmakers responsibly voted to update their gas tax and offset some of its impact on lower-income families with an Earned Income Tax Credit (EITC) boost, while NEW YORK enacted the nation’s first “congestion pricing” charge, and LOUISIANA and VIRGINIA leaders looked at gas tax updates as well—a trend ITEP’s Carl Davis explored in depth today here. Broad tax packages are also being hashed out in LOUISIANA, NEBRASKA, OREGON, and TEXAS. And MARYLAND became the sixth state with a $15 minimum wage on the horizon.

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.

KUOW: Why Washington Ranks as the Worst State for Poor Residents

March 12, 2019

Washington ranks as the worst state for low-income earners to live, and it’s notably worse than any other state. The Institute on Taxation and Economic Policy (ITEP) places Washington, Texas and Florida at the top of the “terrible 10” list in its annual report. The institute says these have the most regressive tax systems, in […]

Philadelphia Inquirer: Why It’s Not as Simple as ‘New Jersey Is a High-Tax State’ or ‘Texas Is a Low-Tax State’

March 10, 2019

A recent study by the Institute on Taxation and Economic Policy analyzed the burdens of state and local taxes across the nation. The results were eye opening, though hardly surprising. Nationally, households in the lowest 20 percent income group spent 11.4 percent of their income on state and local taxes. In comparison, the top 1 […]

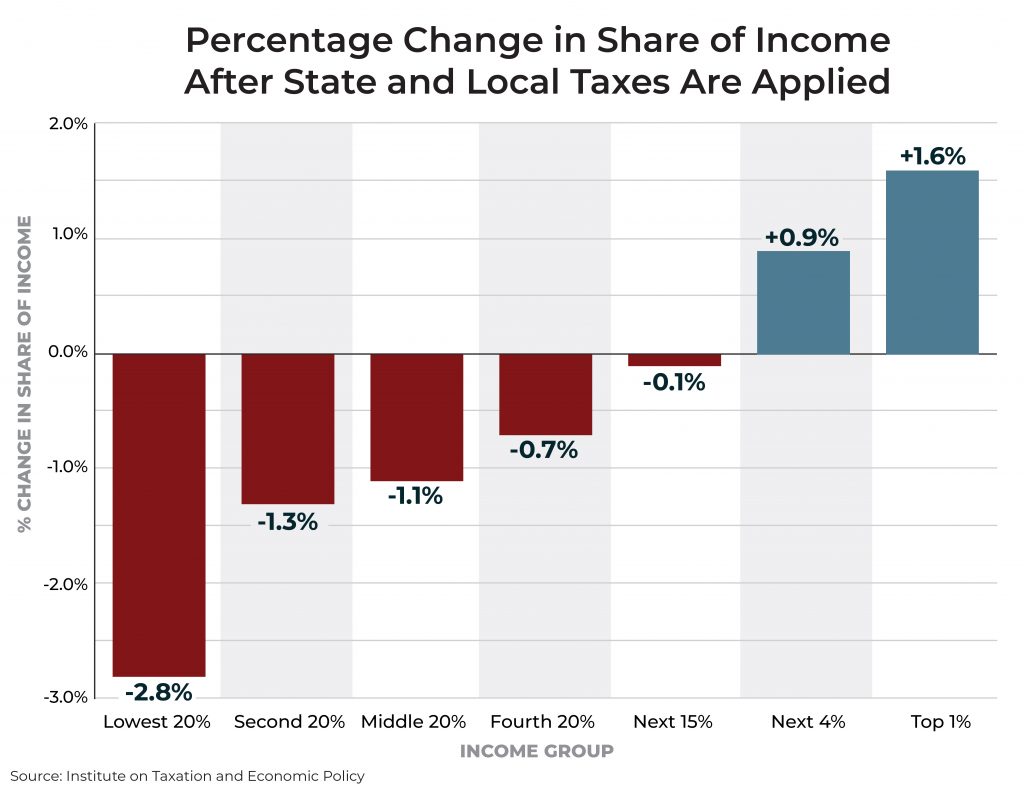

The nation is currently engaging in serious discourse about how to expand economic opportunity and remedy income inequality via the federal tax code. State tax systems are also important and have a dismal effect on the growing economic divide. In a new report, Fairness Matters: A Chart Book on Who Pays State and Local Taxes, we further parse our Who Pays? data.

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

March 6, 2019 • By ITEP Staff

There is significant room for improvement in state and local tax codes. State tax codes are filled with top-heavy exemptions and deductions and often fail to tax higher incomes at higher rates. States and localities have come to rely too heavily on regressive sales taxes that fail to reflect the modern economy. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. These types of shortcomings provide compelling reason to pursue state and local tax reforms to make these systems more equitable, adequate, and sustainable.

State Rundown 2/27: Temperatures and Tax Fights Continue to Polarize

February 27, 2019 • By ITEP Staff

As another polar vortex heads for large swaths of the country, state tax debates this week were highly polarized in another way. Lawmakers and advocates in MICHIGAN, OHIO, OREGON, UTAH, and elsewhere fought to enact or improve state Earned Income Tax Credits to give a boost to low- and middle-income working families. But the opposite extreme was heavily represented as well, as others pushed for regressive tax cuts for wealthy individuals and corporations, including in KANSAS, NEBRASKA, NORTH DAKOTA, OHIO, UTAH, and WEST VIRGINIA. Even our “What We’re Reading” section has informative reading on how education funding policy continues to…

Happy Valentine’s Day to all lovers of quality research, sound fiscal policy, and progressive tax reforms! This week, some leaders in ARKANSAS displayed their infatuation with the rich by advancing regressive tax cuts, but others in the state are trying to show some love to low- and middle-income families instead. WISCONSIN lawmakers are devoted to tax reductions for the middle class but have not yet decided how to express those feelings. NEBRASKA legislators are playing the field, flirting with several very different property tax and school funding proposals. And VIRGINIA’s legislators and governor just decided to settle for a flawed…

A Tale of Two States: How State Tax Systems Perpetuate Income Inequality

February 11, 2019 • By ITEP Staff

To explain how state tax systems make income inequality worse, we compared tax systems in New Jersey and Texas which, before taxes, have similar levels of income inequality. This comparison provides an example of how policymakers’ decisions affect the economic wellbeing of their constituents.

State Rundown 1/31: Governors and Teachers Dominate Headlines, Much More in Fine Print

January 31, 2019 • By ITEP Staff

Gubernatorial addresses and the prospect of teacher strikes continued to take center stage in state fiscal news this week, as governors of Connecticut, Maryland, and Utah gave speeches that all included significant tax proposals. Meanwhile, teachers walked out in Virginia, and many other states debated school funding increases to avoid similar results. State policymakers have many other debates on their hands as well, including what to do with online sales tax revenue, how to cut property taxes without undermining schools, whether and how to legalize and tax cannabis, and whether to update gas taxes for infrastructure investments.

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

Who Pays and Why It Matters | MECEP Policy Insights Conference Keynote Address

January 16, 2019 • By Aidan Davis

States have broad discretion in how they secure the resources to fund education, health care, infrastructure, and other priorities important to communities and families. Aidan Davis with the Institute on Taxation and Economic Policy will offer a national perspective on state-level approaches to funding public investments and the implications of those approaches on tax fairness and revenue adequacy, and their economic outcomes. She’ll also provide insight on what’s in store for 2019 among the states.

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…