Virginia

Trends We’re Watching in 2019: Addressing Lingering Federal Conformity Questions and Opportunities

February 7, 2019 • By Dylan Grundman O'Neill

In our last update on state responses to the federal tax cut (Tax Cuts and Jobs Act, or TCJA), we noted that several states were waiting until 2019 to make their final decisions, giving them additional time to (hopefully) respond in ways that improve their fiscal situations and upside-down tax codes. The TCJA is affecting the 2018 federal taxes people are filing now, in some cases adding urgency and/or confusion to these debates.

Trends We’re Watching in 2019: The Use of Targeted Tax Breaks to Help Address Poverty and Inequality

February 7, 2019 • By Aidan Davis

Continuing to build upon the momentum of previous years, states are taking steps to create and improve targeted tax breaks meant to lift their most in-need state residents up and out of poverty. Most notably, a range of states are exploring ways to restore, enhance or create state Earned Income Tax Credits (EITC). EITCs are an effective tool to help struggling families with low wages make ends meet and provide necessities for their children. The policy, designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, allows struggling families to move toward meaningful economic…

State Rundown 1/31: Governors and Teachers Dominate Headlines, Much More in Fine Print

January 31, 2019 • By ITEP Staff

Gubernatorial addresses and the prospect of teacher strikes continued to take center stage in state fiscal news this week, as governors of Connecticut, Maryland, and Utah gave speeches that all included significant tax proposals. Meanwhile, teachers walked out in Virginia, and many other states debated school funding increases to avoid similar results. State policymakers have many other debates on their hands as well, including what to do with online sales tax revenue, how to cut property taxes without undermining schools, whether and how to legalize and tax cannabis, and whether to update gas taxes for infrastructure investments.

Data for the Win: Advocating for Equitable State and Local Tax Policy (Webinar)

January 30, 2019 • By Aidan Davis, Dylan Grundman O'Neill, ITEP Staff, Meg Wiehe

Watch the video recording below for discussion on how ITEP’s distributional data can be part of an advocacy and communications strategy for securing state tax policies that raise enough revenue to fund various priorities. Outline includes a brief overview of findings from the sixth edition of Who Pays? A Distributional Analysis of the Tax Systems in All 50 States as well as insight from state advocates who use Who Pays? and other tax policy analyses research to pursue their legislative agendas.

State Rundown 1/24: States Reflect on MLK’s Dream and Teacher Uprisings

January 24, 2019 • By ITEP Staff

This week, as Americans in every state celebrated Martin Luther King Jr. Day and reflected on his dream of peaceful protest and racial and economic justice, many eyes were on the teachers’ strike pressing for parts of this dream amid the “curvaceous slopes of California.” Governors and lawmakers in many states—including Arizona, Georgia, Indiana, Louisiana, Nevada, New Mexico, South Carolina, and Wisconsin—discussed ways to raise pay for teachers and/or enhance education investments generally.

West Virginia Center on Budget & Policy: Fixing the Social Security Tax Bill with a Bottom-Up Tax Cut for Working Families

January 24, 2019

The fact that so few West Virginians pay income tax on their Social Security benefits should tell us that this is not a middle-class tax cut. As the graph and analysis by the Institute on Taxation and Economic Policy (ITEP) below shows, the average tax change from eliminating the state income tax on Social Security […]

State policy toward cannabis is evolving rapidly. While much of the debate around legalization has rightly focused on potential health and criminal justice impacts, legalization also has revenue implications for state and local governments that choose to regulate and tax cannabis sales. This report describes the various options for structuring state and local taxes on cannabis and identifies approaches currently in use. It also undertakes an in-depth exploration of state cannabis tax revenue performance and offers a glimpse into what may lie ahead for these taxes.

State Rundown 1/18: Governors’ Speeches Kick Off State Fiscal Debates

January 18, 2019 • By ITEP Staff

Gubernatorial speeches and budget proposals dominated state fiscal news this week, as governors proposed a wide array of policies including positive reforms such as Earned Income Tax Credit (EITC) enhancements in CALIFORNIA, a capital gains tax on wealthy households in WASHINGTON, and investments in education in several states. Proposals to exempt more retirement income from tax, particularly for veterans, are a common theme so far this year, having been raised in multiple states including MARYLAND, MICHIGAN, and SOUTH CAROLINA. And NEW JERSEY became the fourth state with a $15 minimum hourly wage. Those wishing to better understand and influence important debates about equitable tax policy should mark their…

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

State Rundown 12/19: Time to Rest and Recharge for Big Year Ahead

December 19, 2018 • By ITEP Staff

With many people enjoying time off over the next couple weeks, and the longest nights of the year coming over the weekend, now is a good time to get plenty of rest and relaxation in advance of what is likely to be a very busy 2019 for state fiscal policy and other debates. Among those debates, Kentucky lawmakers will be returning to topics they could not resolve in a brief special session held this week, New Jersey and New York will both be deciding how to legalize and tax cannabis, and gas tax updates will be on the agenda in…

State Rundown 12/5: Familiar Questions Returning to Fore as 2019 Approaches

December 5, 2018 • By ITEP Staff

State lawmakers are preparing their agendas for 2019 and looking at all sorts of tax and budget policies in the process, raising many familiar questions. Oregon legislators, for example, will try to fill in the blanks in a proposal to boost investments in education that left out detail on how to fund them, while their counterparts in Texas face the inverse problem of a proposed property tax cut that fails to clarify how schools could be protected from cuts. Similar school finance debates will play out in many other states. Alabama, Kansas, and Louisiana will look at gas tax updates,…

The EITC Boosts Opportunities for Communities of Color

November 28, 2018

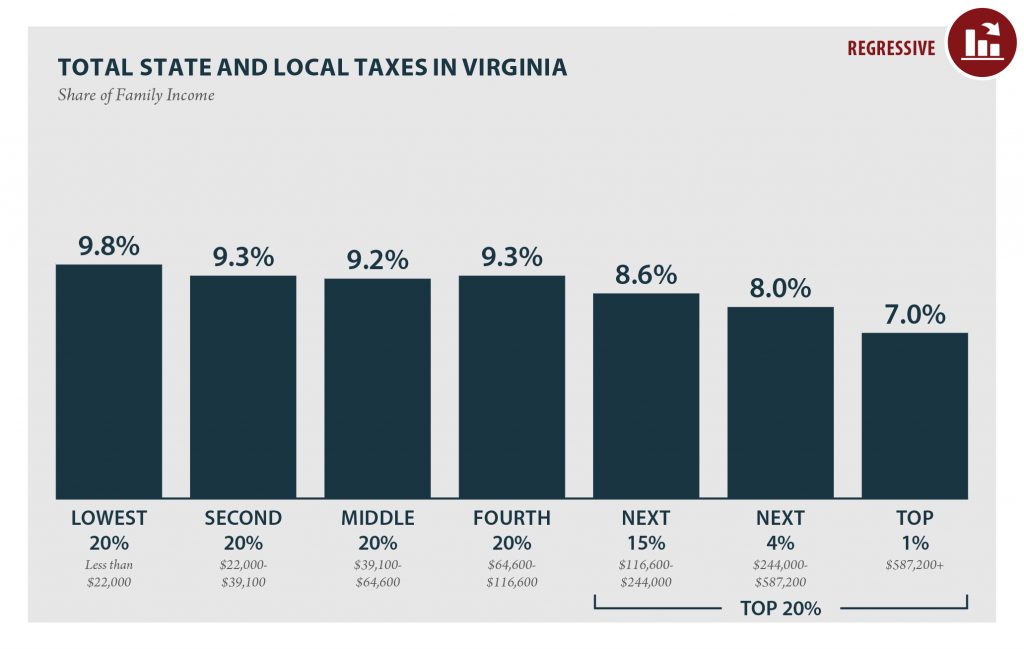

State and local taxes play an important role in shaping economic opportunity. These tax revenues pay for the schools, roads, parks, and libraries that create a foundation for thriving communities. Yet we know that Virginia’s state and local tax system is upside down. In Virginia, households with low and modest incomes pay a higher share of their incomes toward state and local taxes than the highest-income households. In tax policy terms, this is known as a regressive system. And since historical and present-day barriers for communities of color have resulted in stark differences in income by race, this means these…

State Rundown 11/16: Election Results Clarify Agendas as Real Work Begins

November 16, 2018 • By ITEP Staff

State policymakers, voters, and observers have been reflecting on this year’s campaigns and looking ahead to how the policy opportunities in their states have shifted as a result. For example, Arkansas’s governor sees a fresh chance to slash income taxes on the state’s wealthiest residents, while the governor-elect of Illinois will be doing just the opposite, launching into a promised effort to shore up the state’s budget by asking the wealthy to pay more. New York and Virginia residents may end up with buyers’ remorse after Amazon accepted their combined $2 billion tax subsidy offers for its HQ2 project. And…

Today Amazon announced major expansions in New York and Virginia, where it intends to hire up to 50,000 full-time employees. The announcement marks the culmination of a highly publicized search that lasted more than a year and involved aggressive courting of the company by cities across the nation. The following are three tax-related observations on the announcement.

WVTF: Study: State Taxes Have Disproportionate Impact On Lower Income Virginians

October 19, 2018

Virginians who make the least amount of money pay 40 percent more taxes as a percent of their income than the wealthiest Virginians. That’s according to a new report from the Institute on Taxation and Economic Policy, which says Virginia’s tax code is upside down.

WOWK TV: Tax Issues in West Virginia

October 19, 2018

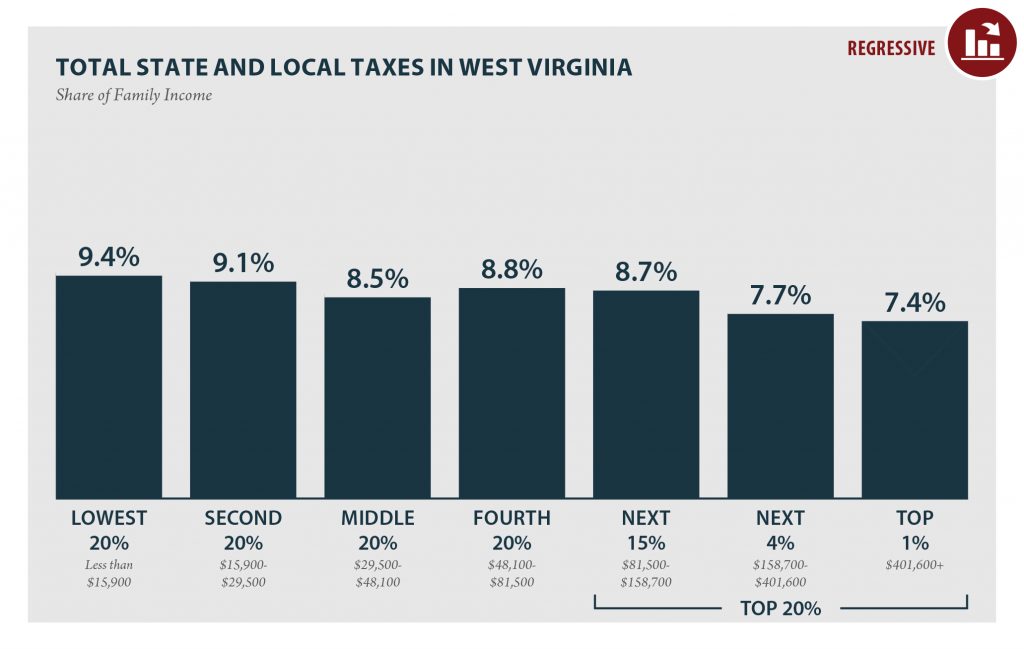

WOWK TV - Sean O'Leary, of the West Virginia Center on Budget and Policy, talks to Mark Curtis about a new report that shows there's room improve West Virginia's upside-down tax system.

West Virginia Center on Budget & Policy: West Virginia’s Upside Down Tax System Grows Inequality

October 18, 2018

State and local tax systems can be effectively used to boost economic opportunity, create broadly shared prosperity and build equitable state economies. But in most states, including West Virginia, tax systems are upside down and are making inequality worse, as a new report from the Institute on Taxation and Economic Policy (ITEP) shows.

West Virginia Center on Budget & Policy: Low-Income West Virginians Pay Far More in Taxes as a Percent of Income Than Wealthiest West Virginians

October 17, 2018

West Virginia's tax system is regarded as regressive because the lower one's income, the higher one's effective tax rate. While West Virginia has a progressive personal income (meaning the higher one's income, the higher one's effective personal income tax rate), it also, like most other states, relies heavily on the more regressive sales and excise taxes to raise revenue. Low-income West Virginians pay up to 6.6 percent of their income on sales and excise taxes, while the wealthiest in the state pay less than one percent of income in state and local sales taxes.

The Half Sheet: Virginia’s Tax System Is Upside Down

October 17, 2018

Virginia’s state and local taxes help to shape economic opportunity across the state. That’s because state and local revenues pay for the building blocks of thriving communities: schools, roads, libraries, and other public services. Unfortunately, the current state and local tax system is upside down. Families in Virginia have taxes withheld from their paychecks, and they also pay taxes when they shop at local businesses, buy groceries, or fill their gas tanks. But updated analysis from the Institute on Taxation and Economic Policy (ITEP) shows that Virginia’s low- and moderate-income households pay a higher share of their incomes toward state…

West Virginia: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, which measures the impact of each state’s tax system on income inequality, West Virginia has the 37th most unfair state and local tax system in the country. Incomes are more unequal in West Virginia after state and local taxes are collected than before.

Virginia: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

VIRGINIA Read as PDF VIRGINIA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $22,000 $22,000 to $39,100 $39,100 to $64,600 $64,600 to $116,600 $116,600 to $244,000 $244,000 to $587,200 over $587,200 […]

State Rundown 10/12: Local Jurisdictions Fighting for Revenues, Independence

October 12, 2018 • By ITEP Staff

Voters all around the country are educating themselves for the upcoming elections, notably this week around ballot initiatives in Arizona and Colorado and competing gubernatorial tax proposals in Georgia and Illinois. But not all eyes are on the elections, as the relationship between state and local policy made news in Delaware, Idaho, North Dakota, and Ohio.

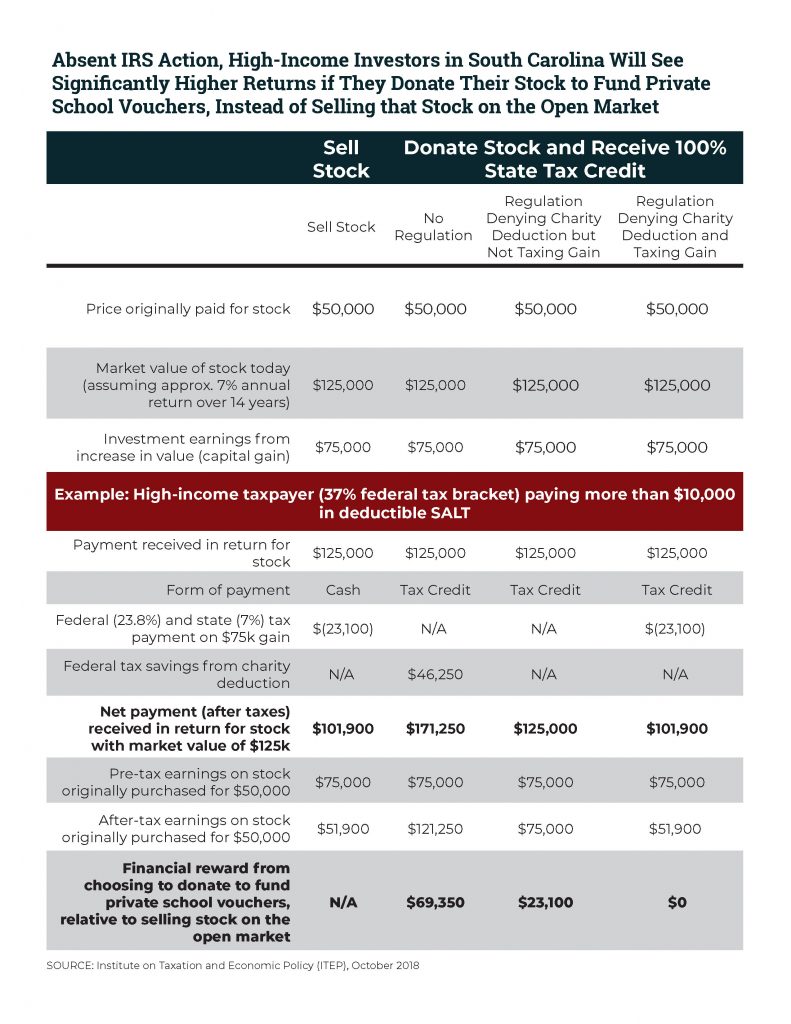

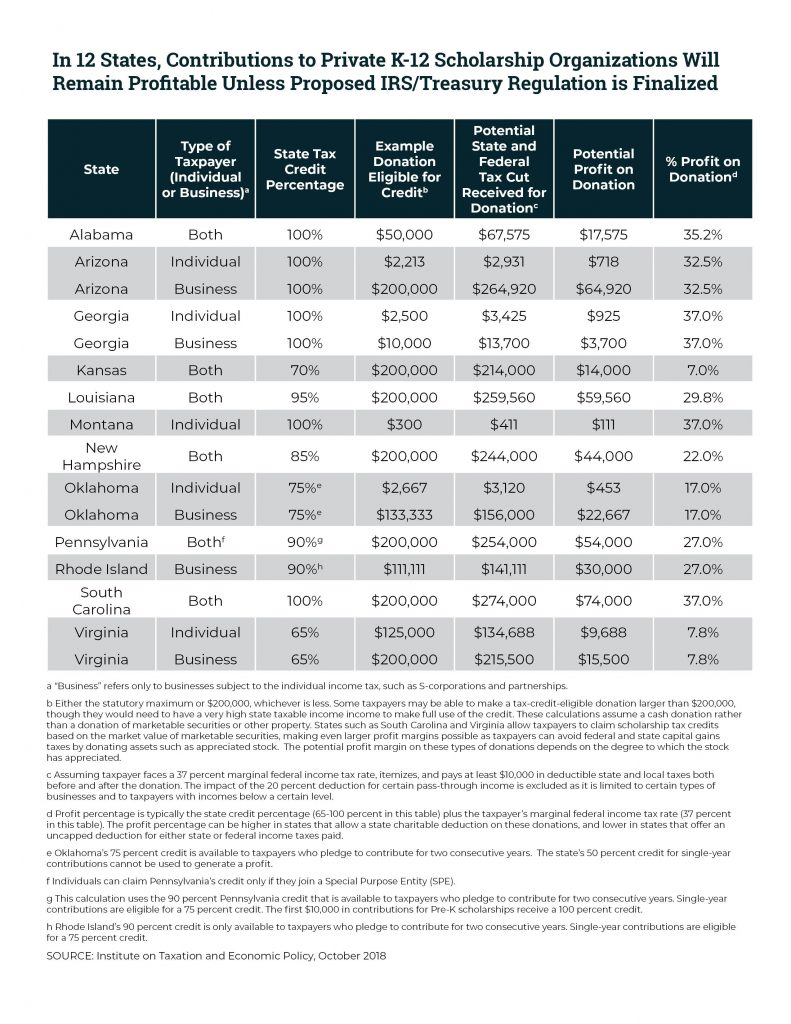

ITEP Comments and Recommendations on Proposed Section 170 Regulation (REG-112176-18)

October 11, 2018 • By Carl Davis

The IRS recently proposed a commonsense improvement to the federal charitable deduction. If finalized, the regulation would prevent not just the newest workarounds to the $10,000 deduction for state and local taxes (SALT), but also a longer-running tax shelter abused by wealthy donors to private K-12 school voucher programs. ITEP has submitted official comments outlining four key recommendations related to the proposed regulation.

Twelve States Offer Profitable Tax Shelter to Private School Voucher Donors; IRS Proposal Could Fix This

October 2, 2018 • By Carl Davis

A proposed IRS regulation would eliminate a tax shelter for private school donors in twelve states by making a commonsense improvement to the federal tax deduction for charitable gifts. For years, some affluent taxpayers who donate to private K-12 school voucher programs have managed to turn a profit by claiming state tax credits and federal tax deductions that, taken together, are worth more than the amount donated. This practice could soon come to an end under the IRS’s broader goal of ending misuse of the charitable deduction by people seeking to dodge the federal SALT deduction cap.